Essentially, he sees the past 50 years of economic prosperity fueled by globalization and easy credit in serious danger of being unwound, as the doomed monetary policies currently being pursued by the word’s central banks result in a massive multi-decade depression that spans the globe.

The first version of The Dollar Crisis, the hardback, came out in 2003, so I wrote it in 2002. And at that time, the dollar against gold was $300. So the dollar has lost more than 75% of its value since The Dollar Crisis was written, and I don’t think it’s going to stop here. I expect it to continue to lose value over the years and decades ahead.

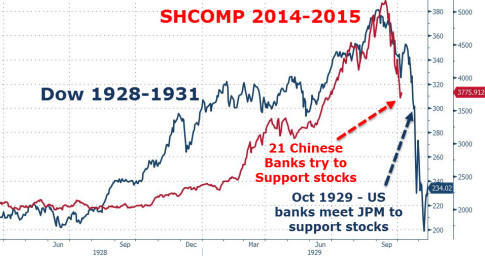

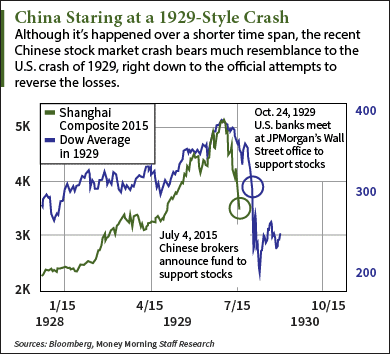

But what we’re seeing is that the real theme of The Dollar Crisis was that the post-Bretton Woods international monetary system was fundamentally flawed because it couldn’t prevent trade imbalances between countries. And the US had developed an enormous trade deficit with the rest of the world and this blew the trade surplus countries like Japan and China into bubbles. And then, the dollars boomeranged back into the United States and blew it into a bubble, as well. I didn’t know when the housing bubble was going to pop in the US but I knew it would. And I wrote in The Dollar Crisis that when it did, we would have a severe global economic recession/depression that would involve a systemic banking sector crisis in the United States and necessitate trillion-dollar budget deficits and unorthodox monetary policy to prevent a Great Depression from occurring.

Read moreRichard Duncan: The Real Risk Of A Coming MULTI-DECADE GLOBAL DEPRESSION (Video)