– Futures Tumble, Bunds Soar To Record, Gold Surges As Europe Is Broken Again; Espirito Santo Halted (ZeroHedge, July 10, 2014):

But… but… the VIX said everything is ok, and European rates were the lowest they have been in centuries… How can something possibly go wrong?

It just did.

The scandal which we first reported yesterday, after observing the record collapse in the bonds of troubled Portuguese lender Espirito Santo International following the failure to make a bond payment, has quickly escalated and overnight went nuclear.

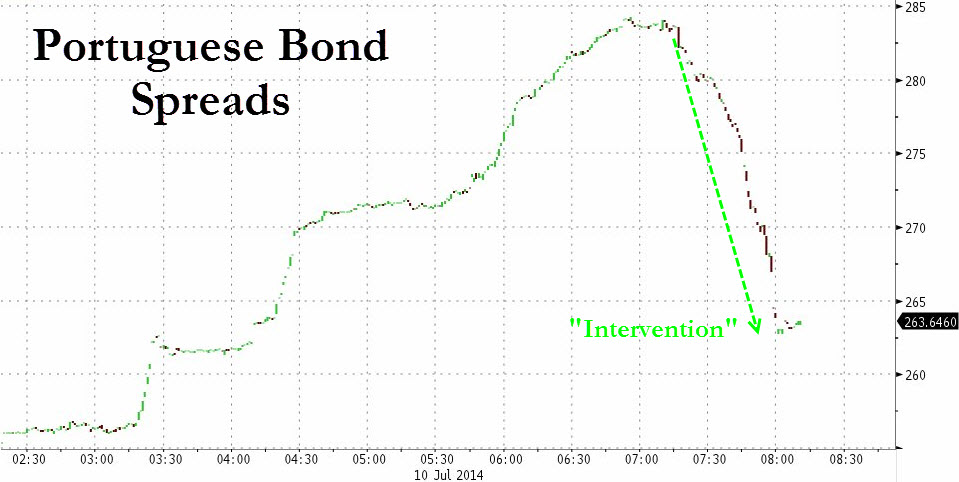

It seems someone is intervening in Portuguese bonds…

Early on in the European trading session, following a report in Diario that E.S. International is considering an insolvency request, Espirito Santo Financial Group, which holds 25% of Banco Espirito Santo, fell as much as 16.15% to EU1.09 and traded over 15% lower at EU1.10, at the same time as Banco Espirito Santo fell as much as 7.15% to EU0.571.This was aggravated by creditors concerns that anything was contained after yesterday’s failed damage control attempt by the parent.

Then things went from bad to worse after Espirito Santo Financial announced it has suspended trading in its shares and bonds due to its exposure to ESI, adding the decision was taken due to “ongoing material difficulties” at its largest shareholder Espirito Santo International, according to regulatory filing. ESFG says it “is currently assessing the financial impact of its exposure to ESI”. ESFG also suspends bond issued by fully owned subsidiary Espirito Santo Financiere. We will have the full, convoluted, org chart of Espirito Santo shortly.

At that point the genie was out of the bottle and thanks to Europe’s still completely insolvent banking system, linked intimately to the sovereign as the ECB has done absolutely nothing to break the bank-sovereign link, promptly hit the sovereign sector, leading to a blow out in the Portuguese 5Y yield +16bps to 2.616%, sending the 10Y yield pushing wider +12bps to 3.896%, and the 10Y spread vs bunds +15bps to 270bps, highest since May 21. And not only in Portugal but other peripheral spreads widened also, with Greece (which is supposed to sell 3Y bonds today – good luck) and Ireland expanding most in 10Y.

Then the safe haven trade came back with a vengeance and the September German Bund future rose as much as 46 ticks to a contract high 147.79, and sending 10 Year yields to all-time lows of 1.17%.

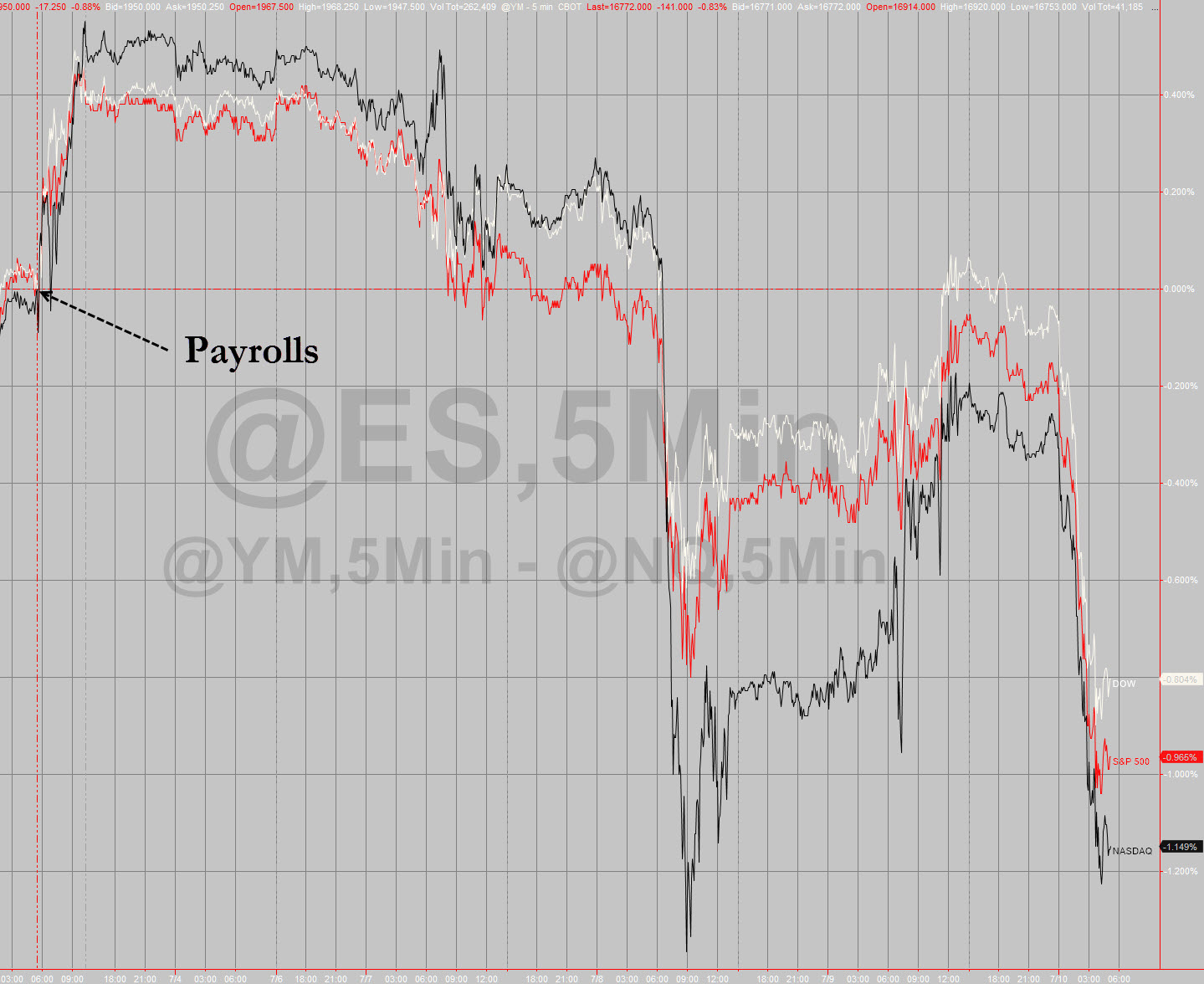

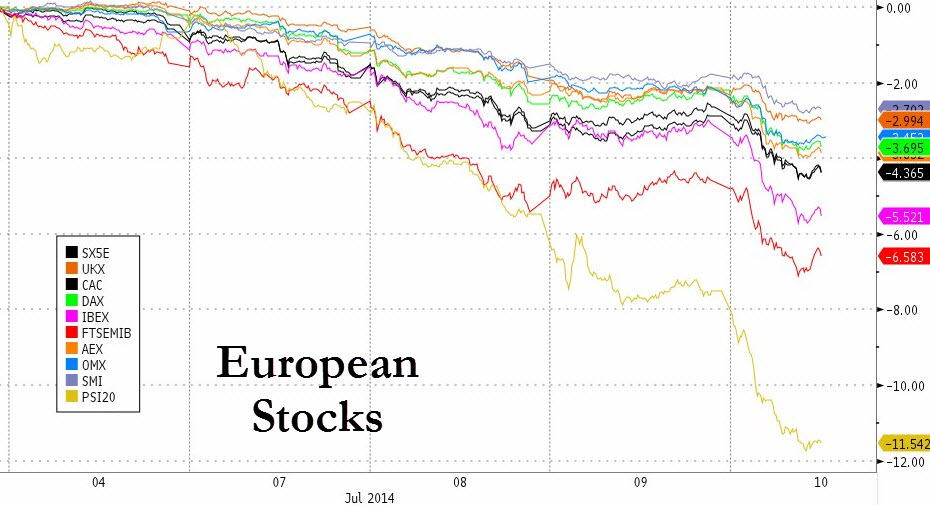

Then, the contagion spread to stocks as first European shares tumbled, with the banks and travel & leisure sectors underperforming and personal & household, telco outperforming. The Italian and Spanish markets are the worst-performing larger bourses, the U.K. the best. Then, it moved across the atlantic as S&P futures have tumbled the most in months in the premarket.

Adding insult to Portuguese bank injury, was very disappointing French (-1.7%, Exp. 0.2%, Last 0.3%), Italian (-1.2%, Exp. 0.2%, Last 0.5%) and Dutch (-1.9%, Exp. 0.3%, Last 2.3%) industrial Production data, confirming any illusions about a European recovery absent a fix of the broken credit channel are utterly ridiculous, and that the ECB was once again wrong focusing on boosting the carry trade – the very same reason why Portugal is today picking up the pieces as Draghi forced traders in the very same trades which today are halted in Portugal!

In other news commodities decline, with nickel, WTI crude underperforming and silver outperforming. But not gold and silver: the precious metals have exploded this morning, with gold trading north of $1340 (but… but… Morgan Stanley said…) and silver at $21.50.

Finally, US equity futures are tumbling. This may be the day contagion and volatility finally comes back with a vengeance, which is great news for all those who plodded through months of centrally-planned boredom and artificial stability. Let the games finally begin.

Market Wrap

- S&P 500 futures down 0.5% to 1958.2

- Stoxx 600 down 0.8% to 337.4

- US 10Yr yield down 2bps to 2.53%

- German 10Yr yield down 3bps to 1.2%

- MSCI Asia Pacific down 0.1% to 146.5

- Gold spot up 0.1% to $1329.8/oz

EUROPE MARKET

- All 19 Stoxx 600 sectors fall; personal & household, telco outperform, banks, travel & leisure underperform

- 13.5% of Stoxx 600 members gain, 84.8% decline

- Eurostoxx 50 -0.7%, FTSE 100 -0.4%, CAC 40 -0.9%, DAX -0.8%, IBEX -1.6%, FTSEMIB -1.7%, SMI -0.4%

ASIA MARKET

- Asian stocks little changed with the Sensex outperforming and the Nikkei underperforming.

- MSCI Asia Pacific down 0.1% to 146.5

- Nikkei 225 down 0.6%, Hang Seng up 0.3%, Kospi up 0.1%, Shanghai Composite down 0%, ASX up 0.2%, Sensex up 1.5%

- 5 out of 10 sectors rise with energy, utilities outperforming and telcos, health care underperforming

Bulletin headline summary from RanSquawk and Bloomberg

- Treasuries gain as bank stocks lead European equities lower, peripheral sovereign yields surge, with Portugal’s 10Y yield +22bps amid concern over problems at the nation’s second largest bank.

- Shares of Banco Espirito Santo SA tumbled more than 14%, bonds to record lows; central bank assurances that it is protected after parent company missed debt payments are failing to ease creditor concern they may also suffer losses

- Spain’s Banco Popular postponed a planned euro benchmark offering of PNC5 AT1 notes, citing heightened volatility in secondary markets; IPT had been 7%/7.25%

- China’s exports trailed estimates in June, suggesting support for growth from global demand will be limited as leaders try to defend their economic-expansion goal of about 7.5% this year

- Japan’s machinery orders fell the most on record in May, suggesting that companies remain cautious about deploying record cash reserves into investment

- Israel has mobilized 20,000 soldiers for a possible ground invasion of the Gaza Strip, as militants there extended their rocket barrage and the Palestinian death toll climbed to at least 75

- Donetsk is steeling itself for a siege as troops encircle separatists who’ve pulled back to the biggest city in Ukraine’s conflict zone after months of bloody unrest

- Four months after Vladimir Putin’s government annexed Crimea, the U.S. and EU have failed to deliver on threats to cripple Russia’s economy, penalizing fewer than 100 people and companies

- Sovereign yields lower with the exception of peripheral Europe; Greek, Spanish and Italian 10Y spreads to Germany all above 100-DMAs. Euro Stoxx Banks index slides 3.2%, at lowest since January. Asian stocks mixed; Japan and China fall. European equities, U.S. stock futures decline. WTI crude and copper lower; gold surges 1.2%

US Event Calendar

- 8:30am: Initial Jobless Claims, July 5 est. 315k (prior 315k); Continuing Claims, June 28 est. 2.565m (prior 2.579m)

- 8:45am: Bloomberg July U.S. Economic Survey

- 9:45am: Bloomberg Consumer Comfort, July 6 (prior 36.4)

- 10:00am: Wholesale Inventories m/m, May, est. 0.6% (prior 1.1%); Wholesale Trade Sales m/m, May (prior 1.3%) Central Banks

- 11:00am: Fed to purchases $450m-$600m TIPS in 2018-2044 sector

- 1:00pm: U.S. to sell $13b 30Y bonds in reopening

ASIA NEWS

Mixed performance overnight with the Nikkei 225 finishing the session down 0.56% weighed upon by a stronger JPY and a record decline in Japanese machine tool orders (M/M -19.5% vs Exp. +0.7%), whereas the Chinese equity market finished with marginal gains despite Chinese Trade Balance missing expectations (USD 31.56bln vs Exp. USD 36.95bln) as exports saw a third consecutive month of growth.

FIXED INCOME

German bund yields have printed fresh all-time lows this morning below 1.2%, weighed on by very disappointing French, Italian and Dutch industrial Production data, as Bund futures hit fresh contract highs. Notably the GR/GE 10y spread is wider by 14bps, with reports that the Greek PDMA is to price 3y bond at 3.5% yield and not below 3% that was expected. This coupled with the Portuguese bank debt worries lead the Portuguese/German 10y spread to widen 16.3bps to a session high of 268bps, the widest since late March 2014. Note that today’s moves may well be also exacerbated by the thin summer volumes with the bund future only trading 200k contracts at the time of writing.

EQUITIES

DAX futures have printed multi-month lows and are approaching the 100DMA, with the PSI 20 in Portugal down once again weighed by lingering concerns over the health of Espirito Santo Financial (ESF PL) after the Co. missed a short-term debt payment earlier in the week prompting weakness across European financials.

FX

In the forex market the USD has recouped some of its lost ground that was seen post the FOMC minutes allied to the general risk off sentiment. This move has consequently weighed on both the EUR and GBP currencies with EUR/USD trading just around the 1.3600 level where there is a cluster of option expiries due for today’s NY cut.

COMMODITIES

A combination of risk averse sentiment and failure by the India government to alter gold import duty, continue to prove supportive for gold and silver prices, both trading at its highest levels since March. Earlier this morning, Indian jewellery industry said that expected tax on gold imports to be cut and that Indian gold prices, premiums may rise as import curbs retained. Jewellers in Mumbai were quoted as saying that people had held back on purchases expecting a duty cut and may well now come back to the market. Elsewhere, COMEX copper is under pressure following somewhat less than impressive Chinese trade balance data overnight.

* * *

DB’s Jim Reid concludes the overnight news roundup

There are armies of strategists paid to mull over the FOMC minutes last night but however deep people try to decipher them the reality is that there was little new news outside of a few clarifications – the most important of which was the news that they aim to finish QE with a $15bn taper in October rather than leave $5bn hanging over until December. A personal view is that QE could easily come back in the next recession as the terminal funds rate may end up being pretty low this cycle thus leaving us pretty close to the zero bound when the Fed need to start easing again. Added to this is the fact that both the BoJ and the ECB could be in full flung QE mode by then, adding to the pressure to keep up and ensure the Dollar isn’t prohibitively strong. Anyway this is probably a discussion for another day.

The other highlight of the minutes was the discussion around the Fed’s potential rate normalisation path. On this topic, most participants agreed that adjustments in IOER should play a central role during the normalization process and many participants agreed that ending reinvestments at or after the time of (rates) liftoff would be best. This is consistent with the recent comments of the NY Fed President Dudley. The other sections of the minutes were not particularly groundbreaking with nothing particularly hawkish to highlight and it was clear that policy remains data-dependent. In terms of the outlook for inflation, the discussion amongst Committee members was very benign. The FOMC acknowledged the recent move upwards in the PCE price index and CPI but “reports from business contacts were mixed, spanning an absence of price pressures in some Districts and rising input costs in others”. Indeed “some participants expressed concern about the persistence of below-trend inflation, and a couple of them suggested that the Committee may need to allow the unemployment rate to move below its longer-run normal level for a time in order keep inflation expectations anchored and return inflation to its 2% target”. But this was offset by others who “expected a faster pickup in inflation or saw upside risks to inflation and inflation expectations because they anticipated a more rapid decline in economic slack”.

Contrary to some expectations, there wasn’t much substantive FOMC discussion on financial stability but the Committee thought “market participants were not factoring in sufficient uncertainty about the path of the economy and monetary policy”. This is an interesting point, and the WSJ highlights that it’s actually the Fed officials themselves who are factoring in a relatively low amount of uncertainty with respect to economic outcomes. Based on the self-assessment of uncertainty (included in yesterday’s minutes), the number of Fed officials saying that uncertainty in GDP, unemployment and inflation forecasts is “higher” than usual was 3 or less for each economic measure. This is around half the number who felt the same in the June 2013 FOMC, and significantly less than June 2012 when at least 10 officials thought that uncertainty was “higher” than usual in regards to each of their forecasts for growth, unemployment and inflation.

Overall markets responded reasonably positively to the minutes as perhaps the fear was that the minutes would show that the committee wasn’t quite as dovish as Yellen has been of late. However this wasn’t the main takeaway and the S&P 500 (+0.46%) edged higher after the release and ended up snapping a two day losing streak. Bonds were pretty flat which bucks the trend of the last 10 FOMC minutes where 10yr yields have traded higher. The minutes were released towards the end of the US session giving EM little chance to react. However there was a decent tone to LATAM bond and sovereign credit markets following the FOMC minutes. Gold closed near the highs of +0.65% and the US dollar index dropped 0.23%.

In Europe, the ongoing concerns surrounding delays in payments of short-term debt securities by Espirito Santo International continued to trouble markets in the European session yesterday as Espirito Santo Financial Group’s equity fell a further 12% yesterday and its senior and LT2 bond’s lost over 20 points and 12 points respectively (with the latter’s closing bid in the high teens). Its partially owned subsidiary Banco Espirito Santo’s equity was down almost 5% and its CDS was 80 bps wider whilst its senior and LT2 bonds were off 1 and 4 points respectively. Espirito’s stresses have brought questions over the underlying health of Peripheral banks and the still evolving mechanisms for dealing with struggling institutions back into the spot-light and yesterday concerns spilled over into the government bond market as Portugal’s 10Y yield widened by 12bps. The current perception is that this is an isolated incident but its caused some nervousness in the credit world with iTraxx Financial Senior vs Main widening 1.25bps to the widest differential in 5 weeks.

It’s been an interesting Asian session this morning with weaker than expected economic data in China, Japan and Australia shrugged off by most asset classes which have been buoyed by yesterday’s benign FOMC minutes. The Chinese trade numbers for June disappointed on both exports (+7.2% YoY vs +10.4% expected) and imports (+5.5% YoY vs +6.0% expected). This has corroborated with weaker than expected June export numbers from a number of neighbouring Asian export powerhouses including South Korea and Taiwan and places a question mark or two over the state of global demand. China’s customs bureau played down the June numbers somewhat, saying that exports will accelerate in Q3. The Hang Seng index (+0.33% on the day) fell 0.3% following the data release but bounced back shortly afterwards. The Australian dollar is down 0.2% today following weaker than expected employment numbers (unemployment 6.0% vs 5.8% previous, 5.9% expected). USDJPY is also a touch lower today, and is being weighed by a 19.5% MoM drop in May machine orders (+0.7% expected). The fall is the largest since at least 1987 and being taken as a sign of continuing caution in terms of Japanese corporate investment. So some worrying data points in Asia.

The focus in EM Asia remains on political developments. In Indonesia, though the polls are predominantly indicating a win by Jokowi, his presidential rival Prabowo has also claimed victory which sets up a potential constitutional contest. Despite this, the Rupiah has reopened this morning up 0.6% against the USD and local stocks are up 2.2%. DB’s Asia FX strategists warn that beyond the post-election rally, the fragmented legislature, continued fuel subsidies and structural issues remain concerning headwinds. In India, a big day today for the new Modi government with the government budget due to announced soon. DB’s India economist notes that given the paucity of time since their election, it would be unreasonable to expect the budget to be a game-changer in terms of policy announcements, but the market will be looking for signals underscoring fiscal responsibility. As long as the right signals and intent are in place, our economists think the government should get the benefit of doubt, especially considering that fiscal consolidation takes time and cannot be achieved overnight. Ahead of the announcement, the INR is trading 0.3% better against the USD today, poised for its third gain in a row.

Turning to the day ahead, on the central bank side the ECB publishes its monthly report and the BoE announces its latest policy decision. No change from the BoE is expected today. The highlights on the data docket include industrial production in France and Italy, UK trade, US wholesale inventories and weekly jobless claims. The Kansas City Fed’s George will be speaking on the US economy and Vice Chair Stanley Fischer speaks on financial sector reform at the National Bureau of Economic Research. Fischer will be taking questions from the audience. This is the first major speech from Fischer as Vice Chair of the Fed so we could gain some fresh insights into his policy thinking