As a trader, I stopped getting disgusted at government manipulation of markets several years ago, didn’t pretend it wasn’t happening, just tried to find when it was coming. I decided to develop an indicator that would tell me when the probability was extremely high that the Master Planners would intervene. That approach has served us well, and that indicator is known as the Plunge Protection Team (PPT) Indicator. It flashed a new “buy” signal Monday, September 15th at the close, rising above positive + 20.00, warning that the decline from August 11th was terminal. The Industrials have risen 565 points since that buy signal. When this measure rises above positive + 20.00, it is usually early, but very right, an early warning indicator telling us to enjoy the decline for a few more trading days but get ready for a spike rally.

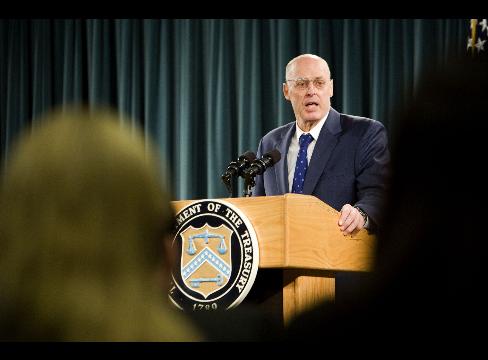

The current government market intervention (“manipulation” is probably a more appropriate word) that transpired the past two weeks, reaching crescendo Thursday on a rumor, and Friday on an announcement, is one of the most dramatic since the 1930’s. It really puts into question the notion of U.S. markets being under capitalism, not socialism. The government nationalized Fannie Mae and Freddie Mac last week, announced its intent to nationalize AIG, a component of the Dow 30, this week, and then pulled out all the stops with the Paulson manifesto Friday. Not sure why he didn’t nationalize Lehman Bros, unless it was personal, as he came from competitor Goldman Sachs, and enjoyed watching them declare bankruptcy. Okay, maybe I am a bit cynical — maybe.

Before getting into market performance and the forecast, let’s cover what we know about this historic redefining of the rules of the game that Paulson has placed on the table for Congress to consider next week:

Read moreThe Paulson Manifesto Will Fail Because It Fails American Households