More bonuses for total failure:

“Despite the magnitude of the losses, Merrill had set aside $15bn for 2008 compensation…”

“The bulk of $15bn in compensation was paid out as salary and benefits throughout the course of the year. A person familiar with the matter estimated that about $3bn to $4bn was paid out in bonuses in December.”

I have posted so much evidence that it should be obvious now that the entire financial crisis is fabricated by the elite to loot the taxpayers’ until there is nothing left and to bankrupt the U.S.

The majority of the banksters are not even aware of what the elite is planning, but many billionaires have already left the U.S. and they knew that they had to be gone by early 2009.

Merrill paid bonuses as losses mounted ahead of sale to BofA

Merrill Lynch took the unusual step of accelerating bonus payments by a month last year, doling out billions of dollars to employees just three days before the closing of its sale to Bank of America.

The timing is notable because the money was paid as Merrill’s losses were mounting and Ken Lewis, BofA’s chief executive, was seeking additional funds from the government’s troubled asset recovery programme to help close the deal.

Merrill and BofA shareholders voted to approve the takeover on December 5. Three days later, Merrill’s compensation committee approved the bonuses, which were paid on December 29. In past years, Merrill had paid bonuses later – usually late January or early February, according to company officials.

Within days of the compensation committee meeting, BofA officials said they became aware that Merrill’s fourth-quarter losses would be greater than expected and began talks with the US Treasury on securing additional Tarp money.

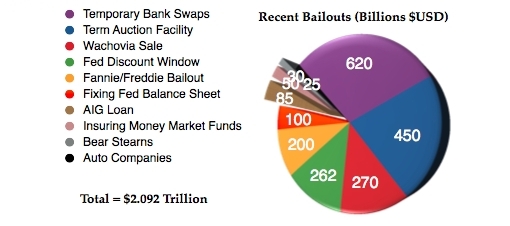

Last week, BofA said it would be receiving $20bn in Tarp money, in addition to the $25bn that had been earmarked for it and Merrill last year. It was then revealed that Merrill had suffered a $21.5bn operating loss in the fourth quarter.

Despite the magnitude of the losses, Merrill had set aside $15bn for 2008 compensation, a sum that was only 6 per cent lower than the total in 2007, when the investment bank’s losses were smaller.

The bulk of $15bn in compensation was paid out as salary and benefits throughout the course of the year. A person familiar with the matter estimated that about $3bn to $4bn was paid out in bonuses in December.

Nancy Bush, an analyst with NAB Research, described the size of the 2008 Merrill bonus payments as “ridiculous”.

Read moreMerrill banksters paid bonuses as losses mounted ahead of sale to BofA