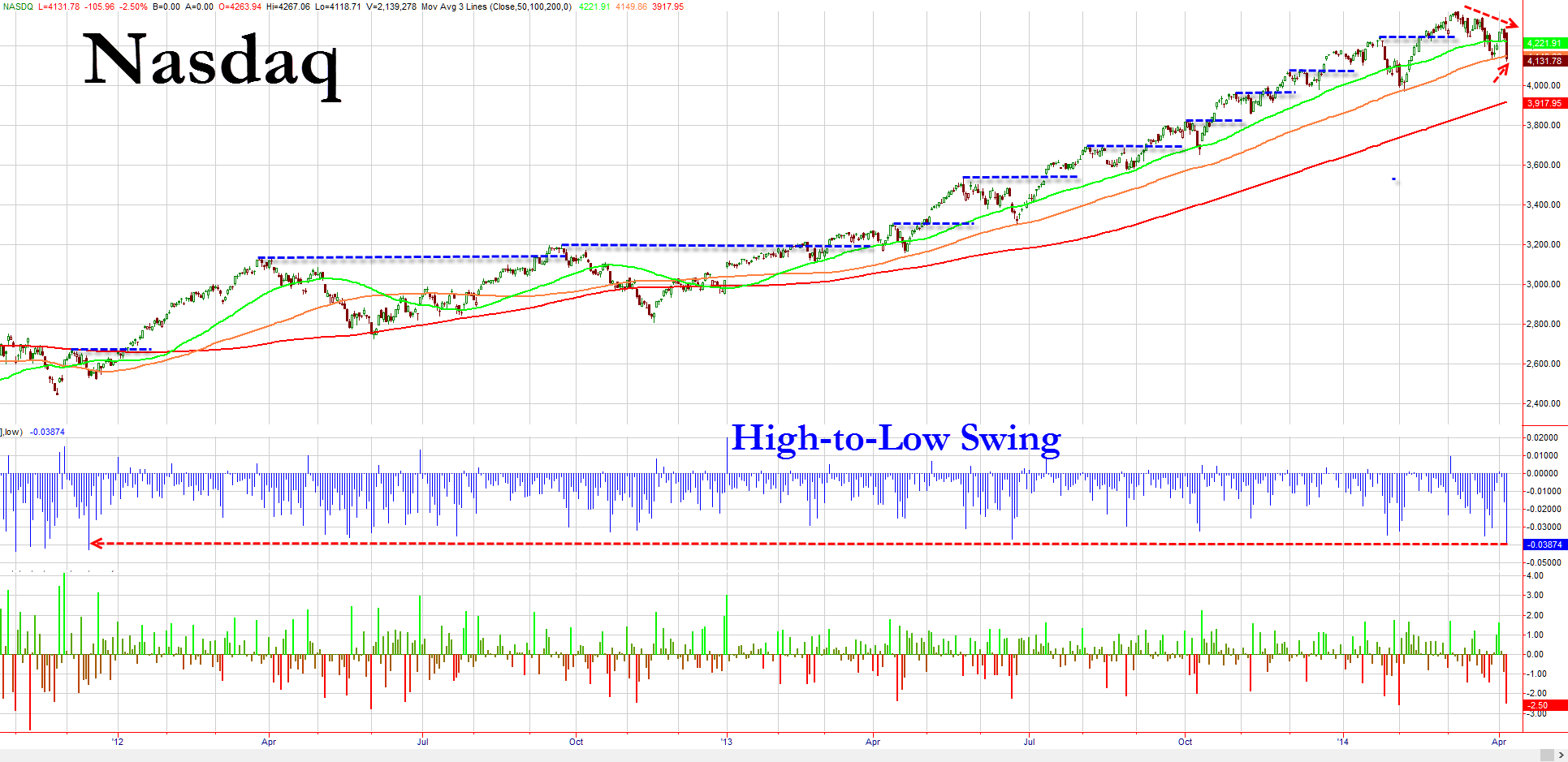

Carnage Continues After-Hours – Dow Down 1000 Pts, #Nasdaq Collapses 5%

After the ugliest day in years, things got uglier after-hours…https://t.co/3RjsMJlTer#Investing #Breaking #BreakingNews #DowJones

— Infinite Unknown (@SecretNews) October 10, 2018

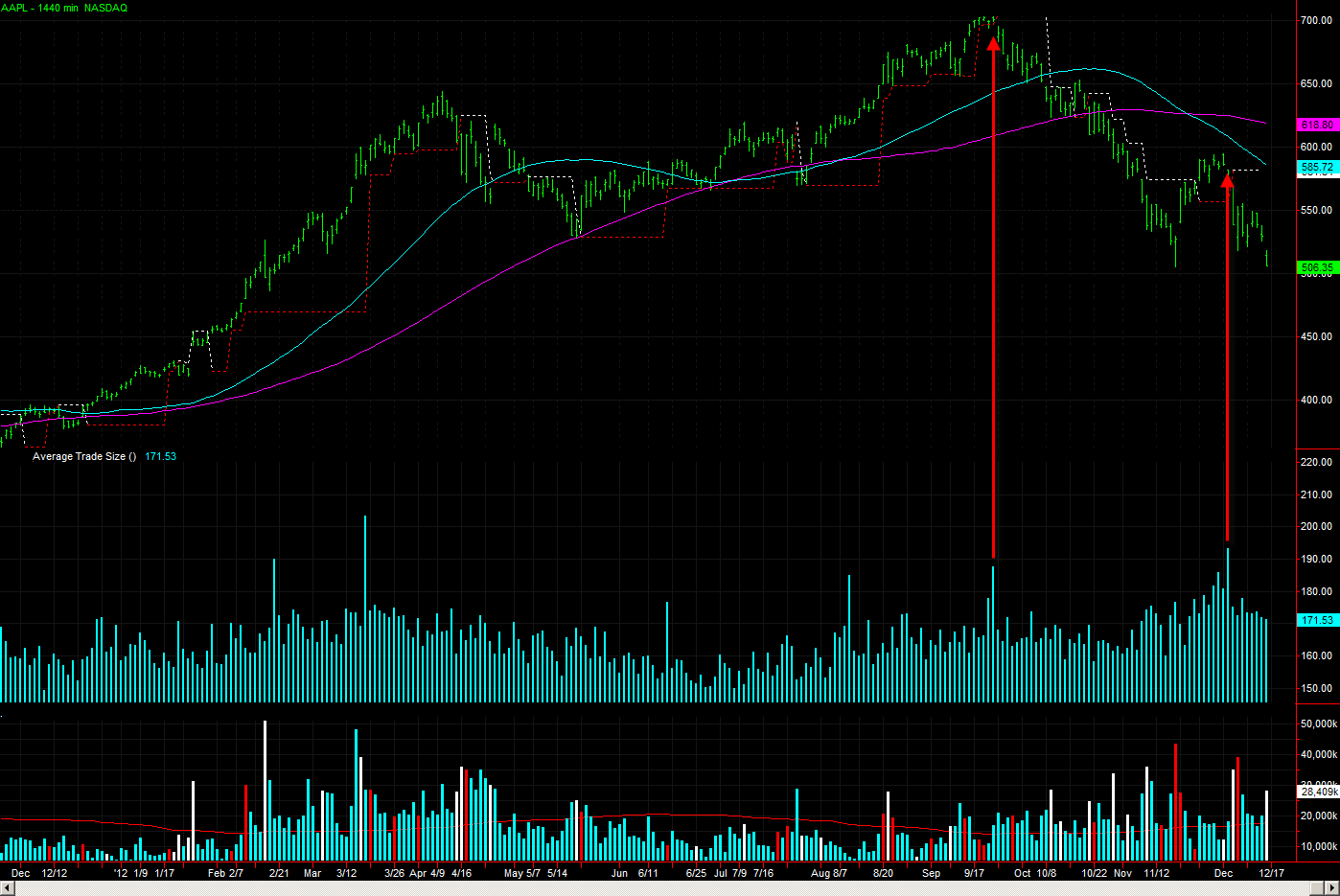

"Markets In Turmoil": FANG Freefall Sparks Longest Losing Streak Of Trump Erahttps://t.co/81GUDF7z5J

#Investing #Breaking #BreakingNews #DowJones

— Infinite Unknown (@SecretNews) October 10, 2018

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP