Added: 27.03.2013

Economy

AND NOW: Paul Krugman Calls Bitcoin ‘Antisocial’

– Paul Krugman Goes on the Attack: Calls Bitcoin “Antisocial (Liberty Blitzkrieg, April 15, 2013):

Anyone on the fence with regard to Bitcoin should consider coming to the side of supporting it after reading Paul Krugman’s ridiculous and riddled with errors hit-piece in the New York Times this weekend. The key tipoff as to where he is coming from in this absurd editorial is in the title itself in which he calls Bitcoin an “antisocial network.” Anti-social is one of the most favored collectivist/fascist terms and concepts of all time. A term meant to demonize those in a particular society that think for themselves rather than conform to whatever the oligarchs or dictators in charge of the state deem appropriate or “social.” Jews would have been seen as “antisocial” in Nazi Germany, just as anyone with glasses would have been deemed “antisocial” in Pol Pot’s Cambodia. This is a very dangerous term and one that is intended to guilt people into the acceptance of a stale, authoritarian and conformist society.

Now let’s get to some of the more ridiculous passages from his editorial. From the New York Times:

The economic significance of this roller coaster was basically nil. But the furor over bitcoin was a useful lesson in the ways people misunderstand money — and in particular how they are misled by the desire to divorce the value of money from the society it serves.

The similarity to goldbug rhetoric isn’t a coincidence, since goldbugs and bitcoin enthusiasts — bitbugs? — tend to share both libertarian politics and the belief that governments are vastly abusing their power to print money. At the same time, it’s very peculiar, since bitcoins are in a sense the ultimate fiat currency, with a value conjured out of thin air. Gold’s value comes in part because it has nonmonetary uses, such as filling teeth and making jewelry; paper currencies have value because they’re backed by the power of the state, which defines them as legal tender and accepts them as payment for taxes. Bitcoins, however, derive their value, if any, purely from self-fulfilling prophecy, the belief that other people will accept them as payment.

This paragraph is so riddled with blatant errors it is almost difficult to know where to start.

Nuclear Power Is NOT A Low-Carbon Source Of Energy

– Nuclear Is NOT a Low-Carbon Source of Energy (ZeroHedge, April 14, 2013):

Why Do People Claim that Nuclear Power is a Low-Carbon Source of Energy?

Even well-known, well-intentioned scientists sometimes push bad ideas. For example, well-known scientists considered pouring soot over the Arctic in the 1970s to help melt the ice – in order to prevent another ice age. That would have been stupid. Even Obama’s top science adviser – John Holdren – warned in the 1970?s of a new ice age … and is open to shooting soot into the upper atmosphere. That might be equally stupid.

DARPA Cyber Chief Peiter ‘Mudge’ Zatko Heads To Google

– Update: DARPA Cyber Chief Peiter “Mudge” Zatko Heads To Google (The Security Ledger, April 14, 2013):

Noted hacker and innovator Peiter “Mudge” Zatko, a project manager for cyber security research at DARPA for the past three years- will be setting up shop in the Googleplex, according to a post on his Twitter feed.

Zatko, who earned fame as a founding member of the early 1990s Boston-area hacker confab The L0pht and later as a division scientist at government contractor BBN Technologies, announced his departure from DARPA following a three-year stint as a Program Manager in DARPA’s Information Innovation Office on Friday. “Given what we all pulled off within the USG, let’s see if it can be done even better from outside. Goodbye DARPA, hello Google!” he Tweeted.

Read moreDARPA Cyber Chief Peiter ‘Mudge’ Zatko Heads To Google

We Have A Hindenburg Omen Sighting

– We Have A Hindenburg Omen Sighting (ZeroHedge, April 15, 2013)

Gold Takedown Signalling U.S. Dollar Endgame? – BOOM!: Boston Marathon Bombings – On April 15, 1912 (101 Years Ago) The Titanic Sank – Is The USS Titanic About To Sink?

Gold takedown …

– What Happened Last Time When Gold Dropped Like This?

– Gold Plummets By Most In 30 Years, Stocks Have Biggest Drop Of 2013

– Dr. Paul Craig Roberts: The Assault On Gold – Assault On Gold UPDATE:

Consider the 500 tons of paper gold sold on Friday. Begin with the question, how many ounces is 500 tons? There are 2,000 pounds to one ton. 500 tons equal 1,000,000 pounds. There are 16 ounces to one pound, which comes to 16 million ounces of short sales on Friday.

Who has 16 million ounces of gold? At the beginning gold price that day of about $1,550, that comes to $24,800,000,000. Who has that kind of money?

What happens when 500 tons of gold sales are dumped on the market at one time or on one day? Correct, it drives the price down. Investors who want to get out of large positions would spread sales out over time so as not to lower their sales proceeds. The sale took gold down by about $73 per ounce. That means the seller or sellers lost up to $73 dollars 16 million times, or $1,168,000,000.

Who can afford to lose that kind of money? Only a central bank that can print it.

… signalling U.S. dollar endgame?:

DH: How soon do you see things taking place?

RB: They already are in motion. If you’re looking for a date I can’t tell you. Remember, the objectives are the same, but plans, well, they adapt. They exploit. Watch how this fiscal cliff thing plays out. This is the run-up to the next big economic event.

I can’t give you a date. I can tell you to watch things this spring. Start with the inauguration and go from there. Watch the metals, when they dip. It will be a good indication that things are about to happen. I got that little tidbit from my friend at [REDACTED].

– – –

BOOM!: Boston marathon bombings:

– Boston Globe Twitter Feed: ‘Officials: There will be a controlled explosion opposite the library within one minute as part of bomb squad activities.’

– Copley Square will remain ‘locked down’ (Boston Herald, April 15, 2013):

… the National Guard has secured a 15-block crime scene and is limiting access in the area, and the Federal Bureau of Investigation has taken over the probe into who planted the explosives.

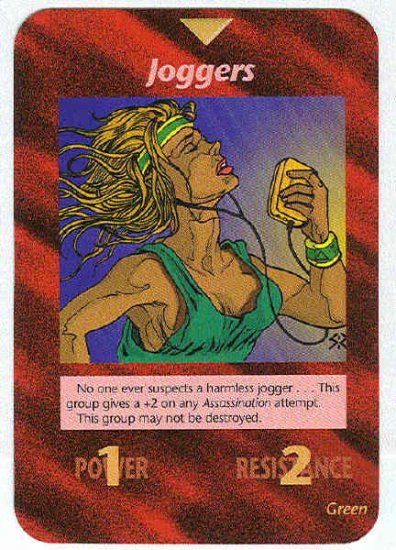

‘Illuminati Cards’ – Joggers – by Steve Jackson 1995

More cards here: 515 Iluminatti Playing Cards (Please share)

– – –

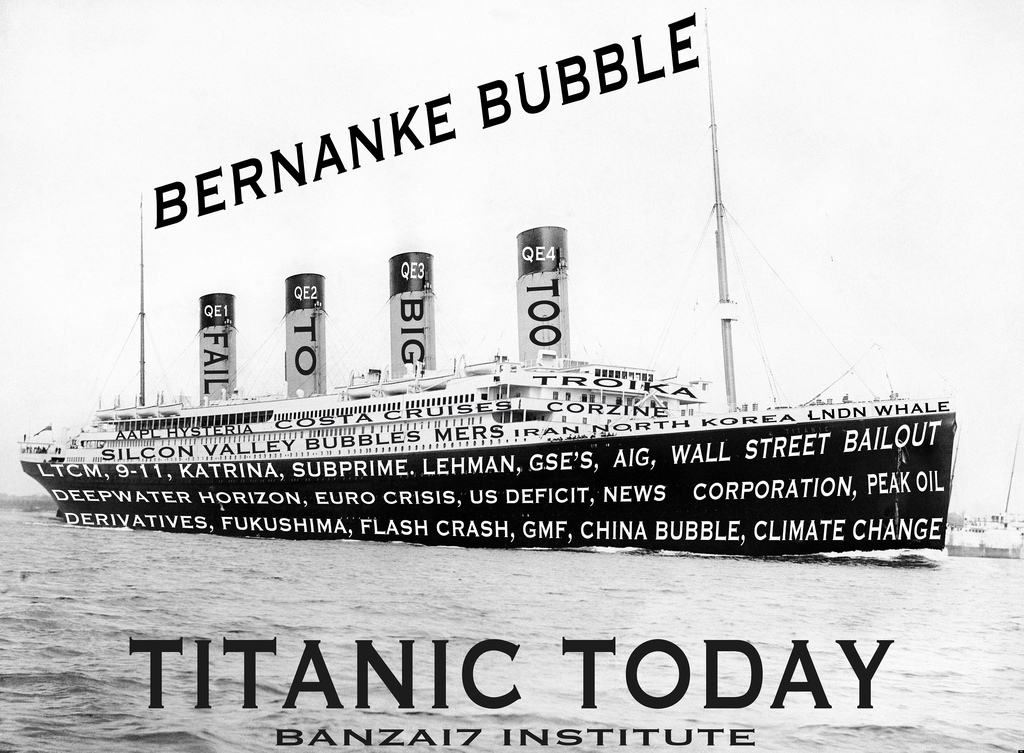

The Titanic sank on April 15, 1912 – Is the USS Titanic about to sink?:

( I hope you are all familiar with William Banzai’s ‘humor’!)

– QE TiTaNiC 2013… (ZeroHedge, By William Banzai, April 15, 2013):

Farewell to the mighty QE

A ship for The Powers That Be

Ben keeps her afloat

‘Till Elites board their boat

While sheeple sink into the sea

The Limerick King

<blockquote>DH: How soon do you see things taking place?

RB: They already are in motion. If you’re looking for a date I can’t tell you. Remember, the objectives are the same, but plans, well, they adapt. They exploit. Watch how this fiscal cliff thing plays out. <strong><span style=”color: #ff0000;”>This is the run-up to the next big economic event.</span></strong>

I can’t give you a date. <span style=”color: #ff0000;”><strong>I can tell you to watch things this spring.</strong></span> Start with the inauguration and go from there. <span style=”color: #ff0000;”><strong>Watch the metals, when they dip. It will be a good indication that things are about to happen.</strong></span> I got that little tidbit from my friend at [REDACTED].</blockquote>

<strong>- <a title=”Permanent Link to Hedge Fund Manager Kyle Bass: Senior Obama Administration Official Said: ‘We’re Just Going To Kill The Dollar’ (Video)” rel=”bookmark” href=”http://www.infiniteunknown.net/2013/04/05/hedge-fund-manager-kyle-bass-senior-obama-administration-official-said-were-just-going-to-kill-the-dollar-video/”>Hedge Fund Manager Kyle Bass: <span style=”color: #ff0000;”>Senior Obama Administration Official Said: ‘We’re Just Going To Kill The Dollar’</span> (Video)</a></strong>

500 Tons Of Paper Gold Dumped on Friday, What’s Next?

– 500 Tons of Paper Gold Dumped on Friday, What’s Next? (Liberty Blitzkrieg, April 14, 2013):

I wish I knew the answer to the above question. As of the last year or so, I admittedly have not had a good feel about the direction of gold and silver prices. I always thought that as things got more severe and more terminal, the prices of assets we see on our screens would be more and more quite intentionally disconnected from the reality on the ground due to increasingly aggressive, desperate and coordinated action by the power structure. Looking back, it seems this really got underway in the fall of 2011, shortly after the U.S. treasury market was downgraded and gold shot up to over $1,900/oz. I have gradually recognized my inability to call things in such manipulated financial markets, which is why I decided to step away and offer less commentary on these topics as things play out in the end game.

I do not think it is at all coincidental that Bitcoin and gold (two currency threats to Federal Reserve power) both got smashed within a couple days of each other. In the case of gold, it was a day after Obama had a private meeting with all of the key bankster oligarchs that 500 tons of paper gold, or about 25% of annual production was sold on the market.

As such, I think the interview below from Marin Katusa of Casey research is a great listen for anyone wanting to take a step back and look at the market. Enjoy!

Don’t miss:

– Dr. Paul Craig Roberts: The Assault On Gold – Assault On Gold UPDATE:

Consider the 500 tons of paper gold sold on Friday. Begin with the question, how many ounces is 500 tons? There are 2,000 pounds to one ton. 500 tons equal 1,000,000 pounds. There are 16 ounces to one pound, which comes to 16 million ounces of short sales on Friday.

Who has 16 million ounces of gold? At the beginning gold price that day of about $1,550, that comes to $24,800,000,000. Who has that kind of money?

What happens when 500 tons of gold sales are dumped on the market at one time or on one day? Correct, it drives the price down. Investors who want to get out of large positions would spread sales out over time so as not to lower their sales proceeds. The sale took gold down by about $73 per ounce. That means the seller or sellers lost up to $73 dollars 16 million times, or $1,168,000,000.

Who can afford to lose that kind of money? Only a central bank that can print it.

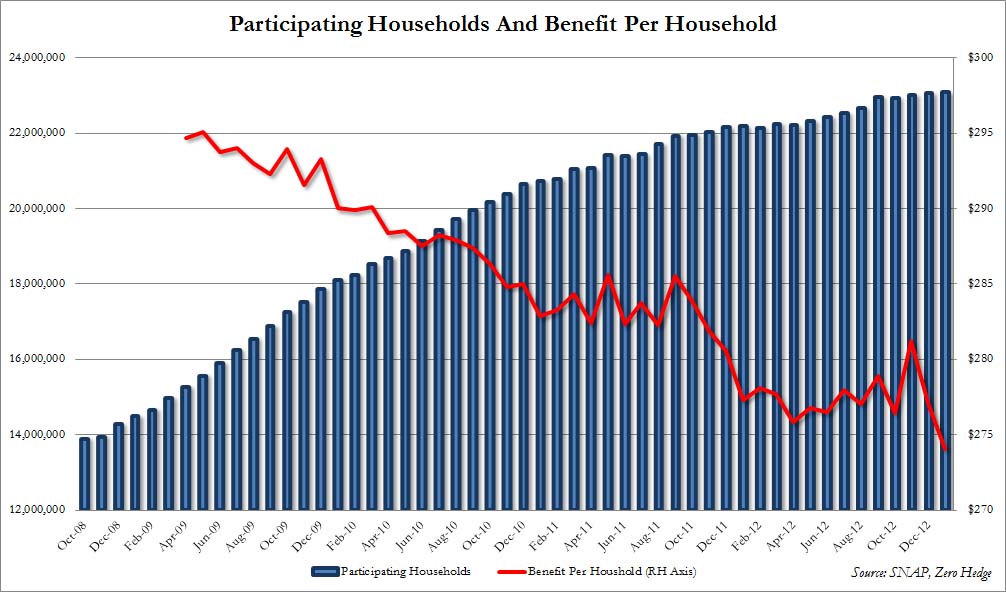

US Households On Foodstamps Hit Record High

– US Households On Foodstamps Hit Record High (ZeroHedge, April 15, 2013):

Record Dow, record S&P, record debt, record plunge in gold, and now: record US households on foodstamps. What’s not to like. While today’s gold selloff may be confusing to everyone, one can scratch off some 23,087,886 US households, or the number that according to the USDA were on foodstamps in January and just happen to be a fresh all time high, as the likely sellers, especially when one considers that the average monthly benefit to each household dropped to a record low of $274.04. This number probably ignores, for good reason, the once every four years fringe benefits of Obamaphones and other such made in China trinkets.

What Happened Last Time When Gold Dropped Like This?

– What Happened The Last Time We Saw Gold Drop Like This? (ZeroHedge, April 15, 2013):

The rapidity of gold’s drop is impressive, concerning, and disorderly. We have seen two other such instances of disorderly ‘hurried’ selling in the last five years. In July 2008, gold quickly dropped 21% – seemingly pre-empting the Lehman debacle and the collapse of the western banking system. In September 2011, gold fell 20% in a short period – as Europe’s risks exploded and stocks slumped prompting a globally co-ordinated central bank intervention the likes of which we have not seen before. Given the almost-record-breaking drop in gold in the last few days, we wonder what is coming?

This is what it looked like in Q3 2008…

and in 2011…

Read moreWhat Happened Last Time When Gold Dropped Like This?

Why Is Gold Crashing?

– Why Is Gold Crashing? (ZeroHedge, April 15, 2013):

Gold Crashes Most in 30 Years … What Does It Really Mean?

Gold has fallen off a cliff. It has fallen faster than at any time in the last 30 years.

Dr. Paul Craig Roberts: The Assault On Gold – Assault On Gold UPDATE

Paul Craig Roberts was Assistant Secretary of the Treasury during President Reagan’s first term. He was Associate Editor of the Wall Street Journal. He has held numerous academic appointments, including the William E. Simon Chair, Center for Strategic and International Studies, Georgetown University, and Senior Research Fellow, Hoover Institution, Stanford University.

– Assault On Gold Update — Paul Craig Roberts (April 13, 2013):

NOTE: Gold weights are based on metric tons and Troy ounces. 500 metric tons of gold would be 16,075,000 troy ounces. This changes the arithmetic slightly but not the point

I was the first to point out that the Federal Reserve was rigging all markets, not merely bond prices and interest rates, and that the Fed is rigging the bullion market in order to protect the US dollar’s exchange value, which is threatened by the Fed’s quantitative easing. With the Fed adding to the supply of dollars faster than the demand for dollars is increasing, the price or exchange value of the dollar is set up to fall.A fall in the dollar’s exchange rate would push up import prices and, thereby, domestic inflation, and the Fed would lose control over interest rates. The bond market would collapse and with it the values of debt-related derivatives on the “banks too big too fail” balance sheets. The financial system would be in turmoil, and panic would reign.

Rapidly rising bullion prices were an indication of loss of confidence in the dollar and were signaling a drop in the dollar’s exchange rate. The Fed used naked shorts in the paper gold market to offset the price effect of a rising demand for bullion possession. Short sales that drive down the price trigger stop-loss orders that automatically lead to individual sales of bullion holdings once their loss limits are reached.

According to Andrew Maguire, on Friday, April 12, the Fed’s agents hit the market with 500 tons of naked shorts. Normally, a short is when an investor thinks the price of a stock or commodity is going to fall. He wants to sell the item in advance of the fall, pocket the money, and then buy the item back after it falls in price, thus making money on the short sale. If he doesn’t have the item, he borrows it from someone who does, putting up cash collateral equal to the current market price. Then he sells the item, waits for it to fall in price, buys it back at the lower price and returns it to the owner who returns his collateral. If enough shorts are sold, the result can be to drive down the market price.

A naked short is when the short seller does not have or borrow the item that he shorts, but sells shorts regardless. In the paper gold market, the participants are betting on gold prices and are content with the monetary payment. Therefore, generally, as participants are not interested in taking delivery of the gold, naked shorts do not need to be covered with the physical metal.

In other words, with naked shorts, no physical metal is actually sold.

People ask me how I know that the Fed is rigging the bullion price and seem surprised that anyone would think the Fed and its bullion bank agents would do such a thing, despite the public knowledge that the Fed is rigging the bond market and the banks with the Fed’s knowledge rigged the Libor rate. The answer is that the circumstantial evidence is powerful.

Consider the 500 tons of paper gold sold on Friday. Begin with the question, how many ounces is 500 tons? There are 2,000 pounds to one ton. 500 tons equal 1,000,000 pounds. There are 16 ounces to one pound, which comes to 16 million ounces of short sales on Friday.

Who has 16 million ounces of gold? At the beginning gold price that day of about $1,550, that comes to $24,800,000,000. Who has that kind of money?

What happens when 500 tons of gold sales are dumped on the market at one time or on one day? Correct, it drives the price down. Investors who want to get out of large positions would spread sales out over time so as not to lower their sales proceeds. The sale took gold down by about $73 per ounce. That means the seller or sellers lost up to $73 dollars 16 million times, or $1,168,000,000.

Who can afford to lose that kind of money? Only a central bank that can print it.

I believe that the authorities would like to drive the gold price down further and will, if they can, hit the gold market twice more next week and put gold at $1,400 per ounce or lower. The successive declines could perhaps spook individual holders of physical gold and result in actual net sales of physical gold as people reduced their holdings of the metal.

Read moreDr. Paul Craig Roberts: The Assault On Gold – Assault On Gold UPDATE

Gold Crush Started With 400 Ton Friday Forced Sale On COMEX

– Gold Crush Started With 400 Ton Friday Forced Sale On COMEX (ZeroHedge, April 15, 2013):

On The Forced Sale…

Via Ross Norman of Sharps Pixley,

The gold futures markets opened in New York on Friday 12th April to a monumental 3.4 million ounces (100 tonnes) of gold selling of the June futures contract in what proved to be only an opening shot. The selling took gold to the technically very important level of $1540 which was not only the low of 2012, it was also seen by many as the level which confirmed the ongoing bull run which dates back to 2000. In many traders minds it stood as a formidable support level… the line in the sand.

Read moreGold Crush Started With 400 Ton Friday Forced Sale On COMEX

Which Country Will Be Forced To Sell Its Gold Holdings Next ?

– Which Country’s Gold Will Be Sold Next? (ZeroHedge, April 15, 2013):

The first time the Status Quo/Troika tried to force a (not so) stealthy gold confiscation on an insolvent European country was back in early 2012, when as part of the most recent Greek bailout MOU, it was disclosed that “Greece’s lenders will have the right to seize the gold reserves in the Bank of Greece under the terms of the new deal.” However, the public outcry was so loud that the Troika had no choice but to shelve its plans and proceed with a full scale bondholder restructuring instead. Fast forward to last week, when Europe’s appetite for physical gold came back with a bang, this time as part of the Cyprus “Debt Sustainability Analysis“, and subsequent comments from Mario Draghi, demanding that tiny Cyprus, whose opposition, already weakened by the confiscation of uninsured deposits would be far less vocal than Greece’s, sell off €400MM, or virtually all of its sovereign gold, over 10 of its 13.9 total tons, to cover the excess costs of its ever ballooning sovereign bailout.

Read moreWhich Country Will Be Forced To Sell Its Gold Holdings Next ?

Adding Insult To Injury: Shanghai Gold Exchange To Hike Gold, Silver Margins

– Shanghai Gold Exchange To Hike Gold, Silver Margins (ZeroHegdge, April 15, 2013):

Adding insult to injury, the Shanghai Gold Exchange overnight announced that following the tumbling precious metal prices and limit down drop in early trading, it may raise trading margins for its gold and silver forward contracts. The SGE announced that should prices not recover by the end of the trading day (which they didn’t), trading margins for the gold forward contract will be raised to 12 percent, while margins for the silver forward contract will be hiked to 15 percent, the exchange said in a statement on its website. Curiously, gold prices in China were up in early trading only to take a dramatic U-turn on Monday, reversing early gains to drop to a two-year trough once the Japanese pre-margining onslaught was unleashed on the market.

Read moreAdding Insult To Injury: Shanghai Gold Exchange To Hike Gold, Silver Margins

Ex-Soros Advisor Sells ‘Almost All’ Japan Holdings, Shorts Bonds; Sees Market Crash, Default And Hyperinflation

Don’t miss!

– Ex-Soros Advisor Sells “Almost All” Japan Holdings, Shorts Bonds; Sees Market Crash, Default And Hyperinflation (ZeroHedge, April 14, 2013):

Previously, we have pointed out why Japan’s attempt at reincarnating its economy, geared solely at generating a stock market-based “wealth effect”, and far less focused on boosting the country’s trade surplus or current account, is doomed to failure, namely due the drastically lower equity participation by the general population and financial institutions in the country’s stock market. Sure, foreign investors will come and go renting each rally for a period of time, but unless the local population participates in the “reflation attempt” (which has already sent the price of luxury goods, energy and food through the rood), or in other words change the behavioral patterns of two generations of Japanese in under two years, the inflationary shock will simply leads to a loss of faith in the government and ultimately Abe’s second untimely demise. Not surprisingly, 4 months after Japan set off on the most ludicrous economic experiment in history, and one week after the BOJ announced its plans to double its balance sheet, Abe’s approval rating has already begun sliding with a poll by Asahi just reporting that popular support of Abe’s cabinet is already down to 60%, down from 71% a month ago.

China Takes Another Stab At The Dollar, Launches Currency Swap Line With France

– China Takes Another Stab At The Dollar, Launches Currency Swap Line With France (ZeroHedge, April 13, 2013):

One more domino in the dollar reserve supremacy regime falls. Following the announcement two weeks ago that “Australia And China will Enable Direct Currency Convertibility“, which in turn was the culmination of two years of Yuan internationalization efforts as summarized by the following: “World’s Second (China) And Third Largest (Japan) Economies To Bypass Dollar, Engage In Direct Currency Trade“, “China, Russia Drop Dollar In Bilateral Trade“, “China And Iran To Bypass Dollar, Plan Oil Barter System“, “India and Japan sign new $15bn currency swap agreement“, “Iran, Russia Replace Dollar With Rial, Ruble in Trade, Fars Says“, “India Joins Asian Dollar Exclusion Zone, Will Transact With Iran In Rupees“, and “The USD Trap Is Closing: Dollar Exclusion Zone Crosses The Pacific As Brazil Signs China Currency Swap“, China has now launched yet another feeler to see what the apetite toward its currency is, this time in the heart of the Eurozone: Paris. According to China Daily, as reported by Reuters, “France intends to set up a currency swap line with China to make Paris a major offshore yuan trading hub in Europe, competing against London.” As a reminder the BOE and the PBOC announced a currency swap line back in February, in effect linking up the CNY to the GBP. Now it is the EUR’s turn.

More on this curious move by the Bank of France and the PBOC from Reuters:

Read moreChina Takes Another Stab At The Dollar, Launches Currency Swap Line With France

Marc Faber: ‘I Love The Fact That Gold Is Finally Breaking Down’

– Marc Faber “I love the Fact that Gold is Finally Breaking Down”; Gold vs. Apple; Patience, Gold, Japan (Global Economic Analysis, April 12, 2013):

Marc Faber loves that gold is finally breaking down. The reason is not to gloat, or a prediction. Rather “gold will offer an excellent buying opportunity“.

Video link: Faber: Gold Isn’t Down as Much as Apple.

Marc Faber on Bloomberg TV on the Fall in Gold Prices“I love the markets. I love the fact that gold is finally breaking down. That will offer an excellent buying opportunity. I would just like to make one comment. At the moment, a lot of people are knocking gold down. But if we look at the records, we are now down 21% from the September 2011 high. Apple is down 39% from last year’s high. At the same time, the S&P is at about not even up 1% from the peak in October 2007. Over the same period of time, even after today’s correction gold is up 100%. The S&P is up 2% over the March 2000 high. Gold is up 442%. So I am happy we have a sell-off that will lead to a major low. It could be at $1400, it could be today at $1300, but I think that the bull market in gold is not completed.”

Read moreMarc Faber: ‘I Love The Fact That Gold Is Finally Breaking Down’

Peter Schiff: ‘When People Realize Where All This Gold Is Going – There Will Be A Scramble To Buy It Back’

Flashback:

Peter Schiff Was Right 2006 – 2007 (2nd Edition):

– Peter Schiff: “When People Realize Where All This Gold Is Going—There Will Be A Scramble To Buy It Back” (Bull Market Thinking, April 12, 2013):

had the opportunity this afternoon to connect with Peter Schiff, CEO and Chief Global Strategist of Euro Pacific Capital. It was a fascinating conversation, which took place while gold was absolutely collapsing.During the interview, Peter explained that today’s sell-off, triggered by a Goldman Sachs sell recommendation was based on the “false idea” of European Central Bank gold sales hitting the market. Instead he explained, gold is preparing its move “from weak hands to strong hands”, before heading to new all-time highs.

When asked his thoughts on the complete panic in the market this afternoon, Peter commented that, ”Gold had [previously] sold-off on false anticipation of [economic] recovery bringing an early end to QE. But when Goldman Sachs came out with the sell recommendation…sentiment was already negative…so I think there’s a lot of stops being hit [right now]…[However], the lower prices will create an opportunity for buyers…wanting to accumulate large positions without moving the market. The only way to do that, is to have a lot of selling...Goldman Sachs certainly could have done a lot of favors for people interested in accumulating gold, because now you’ve got the selling that makes [it] possible.”

John Paulson Loses Over $300 MILLION On Friday’s Gold Tumble

– John Paulson Loses Over $300 Million On Friday’s Gold Tumble (ZeroHedge, April 13, 2013):

There were many casualties following Friday’s 4% gold rout, but none were hurt more than one-time hedge fund idol John Paulson, who according to estimates, lost more than $300 million of his own money in one day.

Per Bloomberg: “Paulson has roughly $9.5 billion invested across his hedge funds, of which about 85 percent is invested in gold share classes. Gold dropped 4.1 percent today, shaving about $328 million from his net worth on this bet alone.” This is merely the latest insult to what has otherwise been a 3 year-long injury for Paulson and his few remaining investors, whose very inappropriately named Advantage Plus is among the bottom 10 hedge funds for the third year in a row. Yet despite being a one-hit wonder thanks to one lucrative idea (long ABX CDS) generated by one of his former employees (Pelegrini), Paulson still has been lucky enough to somehow amass a $10 billion personal fortune which can have a $300 million downswing in one day, even if it is in an asset class which eventually will go only one way – up. Unless, of course, like so many other fly by night billionaires, Paulson too hasn’t somehow managed to lever up all his equity into numerous other downstream ventures, and where a $300 million blow up leads to margin calls and other terminal liquidity outcomes.

More:

“The recent decline in gold prices has not changed our long-term thesis,” John Reade, a partner and gold strategist at Paulson & Co., said in an e-mailed statement. “We started investing in gold at $900 in April 2009 and while it’s down from its peak to $1500, it’s up considerably from our cost.”

Read moreJohn Paulson Loses Over $300 MILLION On Friday’s Gold Tumble

Goldman Sachs Paid CEO Lloyd Blankfein $21 Million Last Year

See also:

– Goldman Sachs Buying Gold, Selling Treasurys To Muppets Whom It Advises To Do Opposite

– Goldman Made $400 Million Betting On Food Prices In 2012 While Hundreds Of Millions Starved

– Matt Taibbi: The People vs. Goldman Sachs (Rolling Stone)

Lloyd Blankfein ‘doing God’s work‘!

– Lloyd Blankfein’s $21m haul makes him the world’s best paid banker (Guardian, April 12, 2013):

Goldman Sachs paid its chief executive, Lloyd Blankfein, $21m last year – and granted him a further $5m in bonus shares in January.

The Wall Street bank handed Blankfein $13.3m (£8.7m) in restricted shares and a $5.7m cash bonus on top of his $2m annual salary last year.

His total 2012 pay was $9m more than in 2011, and the highest since the $68m he received in 2007, before the financial crisis struck.

Read moreGoldman Sachs Paid CEO Lloyd Blankfein $21 Million Last Year

The Entire Economy Is A Ponzi Scheme!

–The Entire Economy Is a Ponzi Scheme (ZeroHedge, April 13, 2013):

Bill Gross, Nouriel Roubini, Laurence Kotlikoff, Steve Keen, Michel Chossudovsky, the Wall Street Journal and many others say that our entire economy is a Ponzi scheme.

Former Reagan budget director David Stockman just agreed:

YouTube Added: 10.04.2013

So did a top Russian con artist and mathematician.

Even the New York Times’ business page asked, “Was [the] whole economy a Ponzi scheme?”

In fact – as we’ve noted for 4 years (and here and here) – the banking system is entirely insolvent. And so are most countries. The whole notion of one country bailing out another country is a farce at this point. The whole system is insolvent.

As we noted last year:

Japan’s Full Frontal: Charting Abenomics So Far

– Japan’s Full Frontal: Charting Abenomics So Far (ZeroHedge, April 13, 2013)

11 Economic Crashes That Are Happening RIGHT NOW

– 11 Economic Crashes That Are Happening RIGHT NOW (Economic Collapse, April 12, 2013):

The stock market is not crashing yet, but there are lots of other market crashes happening in the financial world right now. Just like we saw back in 2008, it is taking stocks a little bit of extra time to catch up with economic reality. But almost everywhere else you look, there are signs that a financial avalanche has begun. Bitcoins are crashing, gold and silver are plunging, the price of oil and the overall demand for energy continue to decline, markets all over Europe are collapsing and consumer confidence in the United States just had the biggest miss relative to expectations that has ever been recorded. In many ways, all of this is extremely reminiscent of 2008. Other than the Bitcoin collapse, almost everything else that is happening now also happened back then. So does that mean that a horrible stock market crash is coming as well? Without a doubt, one is coming at some point. The only question is whether it will be sooner or later. Meanwhile, there are a whole lot of other economic crashes that deserve out attention at the moment.

The following are 11 economic crashes that are happening RIGHT NOW…

U.S. Congress Exempts Most Federal Workers From Key Insider Trading Reporting Requirement

– Congress Exempts Most Federal Workers From Key Insider Trading Reporting Requirement (ZeroHedge, April 13, 2013):

Back in 2012, amid “intense pressure from Obama” including an appeal for its passage in his 2012 State of the Union address, Congress passed the Stop Trading on Congressional Knowledge (STOCK) Act (with 96-3 theatrical votes in the Senate, and 417-2 even more theatrical votes in the House) – a bill prohibiting the use of non-public information for private profit, including insider trading by members of Congress and other government employees. It is unclear why until 2012 it was perfectly legal for congress to trade on inside information, something we pointed out in May 2011 when we wrote that a “A Hedge Fund Comprised Of Junior Congressional Democrats Should Outperform The Market By 9%” as it turned out flagrant insider trading abuse occurred mostly within the democrat ranks of the House (compared to a mere 2%+ outperformance by Congressional stock trading republicans).

It turns out that any cynical skepticism regarding Congress’ ability and willingness to police itself was well founded, as last night the House eliminated a “key requirement of the insider trading law for most federal employees, passing legislation exempting these workers, including congressional staff, from a rule scheduled to take effect next week that mandated online posting of financial transactions.”

The reason why one will have to take Congress at its word that it is not breaking the law? Because apparently posting Congress’ financial dealings online would be pose a “national risk” according to the National Academy of Public Administration.

Surely this explains why the bill was rushed and voted in the matter of hours: one can’t have a debate over matters of “national security” especially if the financial well-being of Congress is at risk. As Washington Times recaps, “Senate Majority Leader Harry Reid, Nevada Democrat, introduced the bill on Thursday and had the chamber vote on it late that evening. The House took the bill up on Friday afternoon and passed it by unanimous consent, with no members objecting. Republican leaders did not give lawmakers the traditional three days to read the bill before holding a vote. One GOP aide told The Washington Times the three-day rule did not apply to Friday’s action because the bill came from the Senate, while another said the House moved quickly because of a Monday deadline for the new disclosure mandates to take effect.”

In other words, while the STOCK Act passed nearly unanimously in 2012 just to show how “honest” congress is, the follow up legislation that effectively undoes the key reporting requirement of said anti-inside trading law passed just as unanimously, allowing congress to have its shady dealings cake, and eat its non-inside trading reputation too.

Read moreU.S. Congress Exempts Most Federal Workers From Key Insider Trading Reporting Requirement