The June 2008 Dow Crash

and the coming first strike attack on Iran

herald the end of dollar hegemony.

BREAK-DOW!

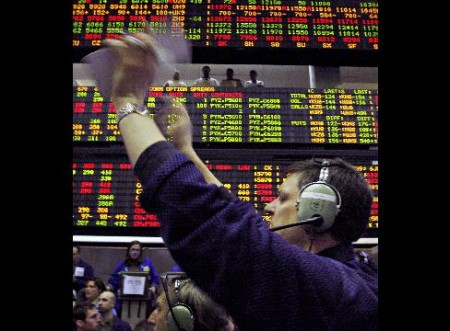

They say that pictures speak a thousand words, so let’s start this with a picture:

Today, the Dow crashed through its eight-year support level at 11,750. There isn’t much below now to keep it from dropping all the way back down to the 7,500-range. What that will do to American investor psychology and worse, consumer confidence, and therefore spending, and therefore the economy, is only too apparent.

The gold-attack on Monday obviously didn’t take. Gold recovered the following day and powered up by $26 the very next day to close in NY at $911. On Friday, gold confirmed its breakout, which means there will be little holding it back – just like there is now very little that’s holding the Dow up.

Unsurprisingly, the US war machinery is in full swing at this time. Troop and military asset movements into the Iranian theater are nearly complete, the Israelis have flown their practice-attack of 100-plus fighter jets over the Mediterranean, and Congress has again prostrated itself before its banking-guild rulers who want total government (and therefore banking) of all economic activity.

Congress did this by passing the FISA Amendments Act of 2008 to give retroactive immunity to telcoms spying for the government, and by proposing a resolution (the already infamous H. Con. Res. 362) by which Congress demands that Bush completely blockade Iran in order to force it to stop enriching uranium. This, naturally, is a perfect setup for unleashing the long-planned bombing campaign on Iran. Congressmen know that Iran will not accede to these international demands.

End result: We will probably get another war because of all this, just like we got one back in 2002-03 when the Dow plunged into the chasm this recently broken support level has bridged for these past eight years (see chart above).

The problem is that this time, it is a bipartisan gang of US war mongers in our Congress who all appear hell-bent on forcing Bush to attack Iran with a preemptive strike, possibly even an unprovoked nuclear first strike – something that human history so far has not had to deal with.

It is also something that will cause the US to forfeit any legitimate claims of world leadership for the remainder of that history.

The War Currency

Wars are rarely fought over national security issues, as political leaders often claim. At rock bottom, they are mostly fought over economic issues.

Iraq and Iran (if Congress and the administration get their way) are the only two countries the US has ever attacked preemptively. They are also the only two oil-producing countries that ever went off the petrodollar. The alleged nuclear ambitions of a terrorist-sponsoring country cannot be the real reason for the planned attack – because terrorist-sponsor North Korea was not only allowed to develop nuclear weapons unmolested, it was even allowed to test-launch a potentially nuclear-tipped ICBM at the US without any military repercussions whatsoever.

There goes the “national security” rationalization for this planned attack.

This fact exposes the attacks for what they really are. tools of US monetary policy. The dollar has no real value internationally, save for the fact that the now militarily enforced necessity for countries to buy dollars in order to buy oil creates artificial demand.

The euro’s existence threatens all of this, now. Oil countries have a dollar-alternative in the euro, and so does the rest of the world. The euro is designed to not be quite as inflationary as the dollar is and has been. This is done by virtue of the ECB’s exclusive mandate of “price stability”, another word for inflation fighting.

Yet Another War Currency