– British child abuser Sir Jimmy Savile and his political connections:

Related info:

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

April 28 (Bloomberg) — As farmers confront mounting costs and riots erupt from Haiti to Egypt over food, Garry Niemeyer is paying the price for Wall Street’s speculation in grain markets.

Commodity-index funds control a record 4.51 billion bushels of corn, wheat and soybeans through Chicago Board of Trade futures, equal to half the amount held in U.S. silos on March 1. The holdings jumped 29 percent in the past year as investors bought grain contracts seeking better returns than stocks or bonds. The buying sent crop prices and volatility to records and boosted the cost for growers and processors to manage risk.

Niemeyer, who farms 2,200 acres in Auburn, Illinois, won’t use futures to protect the value of the crop he will harvest in October. With corn at $5.9075 a bushel, up from $3.88 last year, he says the contracts are too costly and risky. Investors want corn so much that last month they paid 55 cents a bushel more than grain handlers, the biggest premium since 1999.

Read moreWall Street Grain Hoarding Brings Farmers, Consumers Near Ruin

With food prices rising, it is not just the world that is hungry for grain. So are investors.

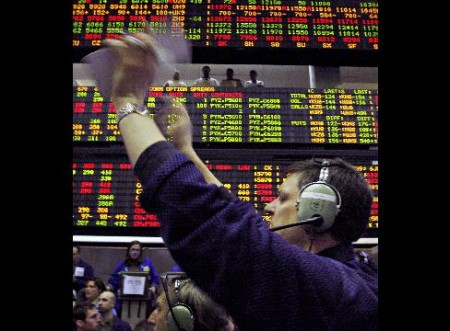

Trading in commodities such as wheat and corn is booming.