– Share This Chart With Anyone That Believes The U.S. Economy Is Not Going To Crash (Economic Collapse, July 22, 2013)

GDP

40 Stats That Prove The U.S. Economy Has Already Been Collapsing Over The Past Decade

– 40 Stats That Prove The U.S. Economy Has Already Been Collapsing Over The Past Decade (Economic Collapse, July 17, 2013):

The “coming economic collapse” has already been happening. You see, the truth is that the economic collapse is not a single event. It has already started, it is happening right now, and it will accelerate during the years ahead. The statistics in this article show very clearly that the U.S. economy has fallen dramatically over the past ten years or so. Unfortunately, there are lots of mockers out there that love to mock the idea of an economic collapse even though one is happening right in front of our eyes. They love to say stuff like this (and I am paraphrasing): “An economic collapse is never going to happen. We can consume far more wealth than we produce forever. We can pile up gigantic mountains of debt forever. There is no way that the party is over. In fact, the party is just getting started. Woo-hoo!” That sounds absolutely ridiculous, but “economists” and “journalists” actually write things that reflect these kinds of sentiments every single day. They do not seem alarmed about the fact that our national debt is nearly 17 times larger than it was 30 years ago. They do not seem alarmed about the fact that the total amount of debt in our country is more than 28 times larger than it was 40 years ago. They do not seem alarmed about the fact that our economic infrastructure is being absolutely gutted and we are steadily becoming poorer as a nation. They just think that the magic formula of print, borrow, spend and consume can go on indefinitely. Unfortunately, the truth is that a massive economic disaster has already started to unfold. We inherited the greatest economic machine in the history of the world, but we totally wrecked it. We have been able to live far, far beyond our means for the last couple of decades thanks to the greatest debt bubble in the history of the planet, but now that debt bubble is getting ready to burst. Anyone with half a brain should be able to see what is coming. Just open your eyes and look at the facts.

The following are 40 stats that prove the U.S. economy has already been collapsing over the past decade…

Read more40 Stats That Prove The U.S. Economy Has Already Been Collapsing Over The Past Decade

JPMorgan Slashes U.S. Q2 GDP Forecast By Half To 1%

– JPMorgan Slashes Q2 GDP By Half To 1% (ZeroHedge, July 12, 2013):

Following closely on the heels of Barclays significant downgrade, JPMorgan has cut its forecast for second-quarter GDP by 50% to a mere 1% growth (from their previous 2% expectation). Citing downside surprises to inventories, they note that “Fed officials won’t be thrilled about easing back on stimulus in September in the face of back-to-back one-handles on GDP growth.” Have no fear tyhough, as the rest of the year prmises to hockey-stick right back up to 2.5% (and 2.7% in 2014).

Via JPMorgan,

We are revising down our estimate for Q2 real annualized GDP growth from 2.0% to 1.0%, and revising up our projection for Q3 growth from 2.0% to 2.5%. We came into this week tracking a little light on our second quarter estimate, and the large downside surprise to May wholesale inventories moved that estimate much lower. Inventory accumulation was running light in Q1, and we had expected a significant contribution to Q2 growth from a rebuilding of stockpiles.

Read moreJPMorgan Slashes U.S. Q2 GDP Forecast By Half To 1%

The Wheels Are Coming Off The Whole Of Southern Europe (Telegraph)

Europe’s debt-crisis strategy is near collapse. The long-awaited recovery has failed to take wing. Debt ratios across southern Europe are rising at an accelerating pace. Political consent for extreme austerity is breaking down in almost every EMU crisis state. And now the US Federal Reserve has inflicted a full-blown credit shock for good measure.

– The wheels are coming off the whole of southern Europe (Telegraph, July 10, 2013):

None of Euroland’s key actors seems willing to admit that the current strategy is untenable. They hope to paper over the cracks until the German elections in September, as if that is going to make any difference.

A leaked report from the European Commission confirms that Greece will miss its austerity targets yet again by a wide margin. It alleges that Greece lacks the “willingness and capacity” to collect taxes. In fact, Athens is missing targets because the economy is still in freefall and that is because of austerity overkill. The Greek think-tank IOBE expects GDP to fall 5pc this year. It has told journalists privately that the final figure may be -7pc. The Greek stabilisation is a mirage.

Italy’s slow crisis is again flaring up. Its debt trajectory has punched through the danger line over the past two years. The country’s €2.1 trillion (£1.8 trillion) debt – 129pc of GDP – may already be beyond the point of no return for a country without its own currency.

Standard & Poor’s did not say this outright when it downgraded the country to near-junk BBB on Tuesday. But if you read between the lines, it is close to saying the game is up for Italy.

The Bank Of International Settlements Warns The Monetary Kool-Aid Party Is Over

– The Bank Of International Settlements Warns The Monetary Kool-Aid Party Is Over (ZeroHedge, June 23, 2013):

When a month ago the Central Banks’ Central Bank, aka the Bank of International Settlements (or BIS) in Basel where the MIT central-planning braintrust meets every few months to decide the fate of the world, warned that the Fed-induced collateral shortage is distorting the markets, few paid attention. That the implication behind said warning was that QE can not continue at the current pace, was just as lost. A few short weeks later following the biggest plunge in markets since 2011 in the aftermath of Bernanke’s taper tantrum, some are finally willing to listen.However, they will certainly not like what the BIS just released as a follow up, both in the form of the BIS’ 83rd Annual Report, and the speech by Jaime Caruana to commemorate said annual meeting. For the simple reason that it reads like a Zero Hedge sermon, which says, almost verbatim, that the days of kicking the can via flawed monetary policy are now over, and that the time for central banks to head for the exit has finally come.

The BIS message, as summarized by the FT, is that “central banks must head for the exit and stop trying to spur a global economic recovery… cheap and plentiful central bank money had merely bought time, warning that more bond buying would retard the global economy’s return to health by delaying adjustments to governments’ and households’ balance sheets.”

Read moreThe Bank Of International Settlements Warns The Monetary Kool-Aid Party Is Over

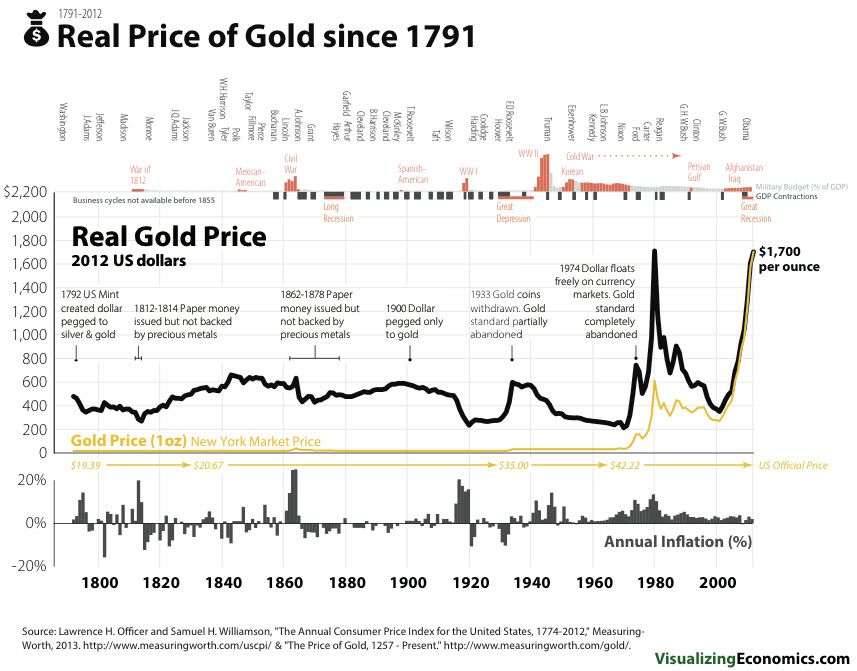

222 Years Of Gold, Wars, Inflation, Economies, And U.S. Presidents

– 222 Years Of Gold, Wars, Inflation, Economies, And Presidents (ZeroHedge, June 15, 2013):

Whether as the basis for the monetary unit of a country, or in its role in comparison to the currency of other assets, the price of gold has long been a subject of great interest to both the scholar and the general public. MeasuringWorth has created a multi-century time series of the barbarous relic’s USD price. From the penny, the crown, the rose ryal, the guinea and the sovereign coin, the question of “what was the price then” is answered combining a number of sources and Visualizing Economics compares the ‘real’ price of gold since 1791 to GDP, wars, US presidents, and inflation…

(click image for larger version)

IMF Says Another Greek Bailout Necessary

Related info:

– IMF Says Another Greek Bailout Necessary (ZeroHedge, June 9, 2013):

Just six short months ago (before GGBs rallied 119% and the Athens Stock Index 53%), the EU and IMF agreed on Greek Debt/GDP targets, pronounced the nation “fixed”, and went on winter vacation. Well, surprise, the hockey-stick of expected GDP has not come to pass and now, as Der Spiegel reports, the IMF is refusing to participate in further rescue programs for Greece unless financing for the nation is secured for the next 12 months – in other words – a new haircut for Greece will be required to cover the EUR4.6 billion funding shortfall.

Christine Lagarde’s ‘fund’ is putting pressure on EUR members, after their mea culpa last week at the biliousness of their previous efforts to save the troubled PIIG nation, to agree to these new haircuts. This will not be a pretty dance – as with Merkel now a few short months away from a general election (and Germany owed EUR15 billion in KfW loans and a further EUR35 billion contributions to ESM/EFSF mechanisms), any agreement on her part would solidify opposition parties’ proof that taxpayer money was lost (and the good money after bad argument).

Perhaps that is why GGB prices have dropped over 10% in the last week?

Top 1% Own 39% Of All Global Wealth – Bottom 50% Only Own 1% Of All Global Wealth – 1 Billion People Go To Bed Hungry Every Night

– Top 1% Own 39% Of All Global Wealth: Hoarding Soars As We Hurtle Toward Economic Oblivion (Economic Collapse, May 31, 2013):

According to a study that was just released by Boston Consulting Group, the wealthiest one percent now own 39 percent of all the wealth in the world. Meanwhile, the bottom 50 percent only own 1 percent of all the wealth in the world combined. The global financial system has been designed to funnel wealth to the very top, and the gap between the wealthy and the poor continues to expand at a frightening pace. The global elite continue to hoard wealth and heap together enormous mountains of treasure in these troubled days even though the economic suffering around the planet continues to grow. So exactly how have the global elite accumulated so much wealth? Well, one of the primary ways is through the use of debt. As I have written about previously, there is about 190 trillion dollars of debt in the world but global GDP is only about 70 trillion dollars. Our debt-based global financial system systematically transfers wealth from us and our governments into the hands of the global elite. And of course the gigantic banks and corporations that the elite control are constantly gobbling up everything of value that they can find: natural resources, profitable small businesses, real estate, politicians, etc. Money, power, ownership and control are becoming very, very tightly concentrated at the top of the food chain, and that is a very dangerous thing for humanity. When too much money and power gets into too few hands, it almost always results in tyranny.

What will eventually happen when the global elite have ALL the wealth?

40 Statistics About The Fall Of The U.S. Economy That Are Almost Too Crazy To Believe

– 40 Statistics About The Fall Of The U.S. Economy That Are Almost Too Crazy To Believe (Economic Collapse, May 26, 2013):

If you know someone that actually believes that the U.S. economy is in good shape, just show them the statistics in this article. When you step back and look at the long-term trends, it is undeniable what is happening to us. We are in the midst of a horrifying economic decline that is the result of decades of very bad decisions. 30 years ago, the U.S. national debt was about one trillion dollars. Today, it is almost 17 trillion dollars. 40 years ago, the total amount of debt in the United States was about 2 trillion dollars. Today, it is more than 56 trillion dollars. At the same time that we have been running up all of this debt, our economic infrastructure and our ability to produce wealth has been absolutely gutted. Since 2001, the United States has lost more than 56,000 manufacturing facilities and millions of good jobs have been shipped overseas. Our share of global GDP declined from 31.8 percent in 2001 to 21.6 percent in 2011. The percentage of Americans that are self-employed is at a record low, and the percentage of Americans that are dependent on the government is at a record high. The U.S. economy is a complete and total mess, and it is time that we faced the truth.

The following are 40 statistics about the fall of the U.S. economy that are almost too crazy to believe…

Read more40 Statistics About The Fall Of The U.S. Economy That Are Almost Too Crazy To Believe

Four Signs That We’re Back in Dangerous Bubble Territory: Stocks, Bonds – Everything – At Risk

– Four Signs That We’re Back in Dangerous Bubble Territory (Peak Prosperity, May 21, 2013):

Stocks, bonds – everything – at risk…

America’s Giant Bubble Economy Is Going To Become An Economic Black Hole

– America’s Bubble Economy Is Going To Become An Economic Black Hole (Economic Collapse, May 22, 2013):

What is going to happen when the greatest economic bubble in the history of the world pops? The mainstream media never talks about that. They are much too busy covering the latest dogfights in Washington and what Justin Bieber has been up to. And most Americans seem to think that if the Dow keeps setting new all-time highs that everything must be okay. Sadly, that is not the case at all. Right now, the U.S. economy is exhibiting all of the classic symptoms of a bubble economy. You can see this when you step back and take a longer-term view of things. Over the past decade, we have added more than 10 trillion dollars to the national debt. But most Americans have shown very little concern as the balance on our national credit card has soared from 6 trillion dollars to nearly 17 trillion dollars. Meanwhile, Wall Street has been transformed into the biggest casino on the planet, and much of the new money that the Federal Reserve has been recklessly printing up has gone into stocks. But the Dow does not keep setting new records because the underlying economic fundamentals are good. Rather, the reckless euphoria that we are seeing in the financial markets right now reminds me very much of 1929. Margin debt is absolutely soaring, and every time that happens a crash rapidly follows. But this time when a crash happens it could very well be unlike anything that we have ever seen before. The top 25 U.S. banks have more than 212 trillion dollars of exposure to derivatives combined, and when that house of cards comes crashing down there is no way that anyone will be able to prop it back up. After all, U.S. GDP for an entire year is only a bit more than 15 trillion dollars.

But most Americans are only focused on the short-term because the mainstream media is only focused on the short-term. Things are good this week and things were good last week, so there is nothing to worry about, right?

Read moreAmerica’s Giant Bubble Economy Is Going To Become An Economic Black Hole

ABNORMALCY BIAS

“The real hopeless victims of mental illness are to be found among those who appear to be most normal. Many of them are normal because they are so well adjusted to our mode of existence, because their human voice has been silenced so early in their lives that they do not even struggle or suffer or develop symptoms as the neurotic does. They are normal not in what may be called the absolute sense of the word; they are normal only in relation to a profoundly abnormal society. Their perfect adjustment to that abnormal society is a measure of their mental sickness. These millions of abnormally normal people, living without fuss in a society to which, if they were fully human beings, they ought not to be adjusted.”

– Aldous Huxley – Brave New World Revisited“If you want a vision of the future, imagine a boot stamping on a human face – forever.”

– George Orwell

“There will be, in the next generation or so, a pharmacological method of making people love their servitude, and producing dictatorship without tears, so to speak, producing a kind of painless concentration camp for entire societies, so that people will in fact have their liberties taken away from them, but will rather enjoy it, because they will be distracted from any desire to rebel by propaganda or brainwashing, or brainwashing enhanced by pharmacological methods. And this seems to be the final revolution.”

–Aldous Huxley, 1961

– ABNORMALCY BIAS (The Burning Platform , May 9, 2013)

The Latest Contribution To US GDP: CORPORATE PROMISES … No Really

– The Latest Contribution To US GDP: Promises… No Really (ZeroHedge, May 6, 2013):

Sadly, we are not making this up: as part of the BEA’s latest revision to the way it calculates GDP, the government will no longer count the amount of pension funding that is actually allocated to retirement accounts (counted as wages in the GDP calculation): i.e., an actual cash outlay. Instead, what the Bureau of Economic Analysis will count are corporate promises of how much companies will (may? might?) pay… eventually. The bigger the lie and the promise, the higher the GDP. And presto.

Elliott Management’s Paul Singer explains this pathetic adjustment as follows:

We have commented in the past on government statistical fakery and fudges, in the inflation numbers, in employment and long-term budgeting. But recent changes to the national GDP accounts by the Bureau of Economic Analysis may “take the cake.” As part of the revisions, they change the way pension payments are counting in GDP. Previous to the change, when a company paid money into a pension plan, the money was counted as wages in the GDP calculation. After the change, what companies have promised to pay in the future, not what they are actually paying, will be added to GDP. This is fantastic. The bigger the unpayable promise made to unsuspecting retirees (promises that are not fully funded), the more GDP supposedly goes up!

Said otherwise, if US companies promise “infinity”, GDP will grow by a comparable amount. At least in a thought experiment… Right?

. . .

What else is there to say?

Cyprus Is Doomed: Parliament Approves Bailout … Expect A 20% GDP Drop Every Year For The Foreseeable Future And Triple Digit Unemployment

– Cypriot Parliament Approves Bailout (ZeroHedge, April 30, 2013):

As was announced earlier today, the Cypriot parliament was set to vote on the country’s deposit confiscatory bail in, a vote that was largely expected to pass. Moments ago it did.

- CYPRUS LAWMAKERS APPROVE BAILOUT IN PARLIAMENTARY VOTE WITH 29 VOTES IN FAVOR, 27 AGAINST

And with that, the resulting depression that is about to be unleashed in Cyprus is nobody else’s fault but of the country itself, its politicians and ultimately, its people. So dear Cyprus, you may have a 20% GDP drop every year for the foreseeable future and triple digit unemployment, but at least you will have the EUR and your Stockholm Serf Synd

20 Signs That The Next Great Economic Depression Has Already Started In Europe

– 20 Signs That The Next Great Economic Depression Has Already Started In Europe (Economic Collapse, April 29, 2013):

The next Great Depression is already happening – it just hasn’t reached the United States yet. Things in Europe just continue to get worse and worse, and yet most people in the United States still don’t get it. All the time I have people ask me when the “economic collapse” is going to happen. Well, for ages I have been warning that the next major wave of the ongoing economic collapse would begin in Europe, and that is exactly what is happening. In fact, both Greece and Spain already have levels of unemployment that are greater than anything the U.S. experienced during the Great Depression of the 1930s. Pay close attention to what is happening over there, because it is coming here too. You see, the truth is that Europe is a lot like the United States. We are both drowning in unprecedented levels of debt, and we both have overleveraged banking systems that resemble a house of cards. The reason why the U.S. does not look like Europe yet is because we have thrown all caution to the wind. The Federal Reserve is printing money as if there is no tomorrow and the U.S. government is savagely destroying the future that our children and our grandchildren were supposed to have by stealing more than 100 million dollars from them every single hour of every single day. We have gone “all in” on kicking the can down the road even though it means destroying the future of America. But the alternative scares the living daylights out of our politicians. When nations such as Greece, Spain, Portugal and Italy tried to slow down the rate at which their debts were rising, the results were absolutely devastating. A full-blown economic depression is raging across southern Europe and it is rapidly spreading into northern Europe. Eventually it will spread to the rest of the globe as well.

The following are 20 signs that the next Great Depression has already started in Europe…

Read more20 Signs That The Next Great Economic Depression Has Already Started In Europe

Matt Taibbi: Everything Is Rigged: The Biggest Price-Fixing Scandal Ever … ‘The Illuminati Were Amateurs’

‘The Illuminati were amateurs’???

J.P. Morgan is a Rothschild front and the Illuminati do not only control the big banks and the governments, they also took over control of the media a long time ago:

– J.P. Morgan Interests Buy 25 of America’s Leading Newspapers and Insert Editors:

U.S. Congressional Record February 9, 1917, page 2947

Congressman Calloway announced that the J.P. Morgan interests bought 25 of America’s leading newspapers, and inserted their own editors, in order to control the media.

Mr. CALLAWAY: Mr. Chairman, under unanimous consent, I insert into the Record at this point a statement showing the newspaper combination, which explains their activity in the war matter, just discussed by the gentleman from Pennsylvania [Mr. MOORE]:

“In March, 1915, the J.P. Morgan interests, the steel, ship building and powder interests and their subsidiary organizations, got together 12 men high up in the newspaper world and employed them to select the most influential newspapers in the United States and sufficient number of them to control generally the policy of the daily press in the United States.

“These 12 men worked the problems out by selecting 179 newspapers, and then began, by an elimination process, to retain only those necessary for the purpose of controlling the general policy of the daily press throughout the country. They found it was only necessary to purchase the control of 25 of the greatest papers. The 25 papers were agreed upon; emissaries were sent to purchase the policy, national and international, of these papers; an agreement was reached; the policy of the papers was bought, to be paid for by the month; an editor was furnished for each paper to properly supervise and edit information regarding the questions of preparedness, militarism, financial policies and other things of national and international nature considered vital to the interests of the purchasers.

“This contract is in existence at the present time, and it accounts for the news columns of the daily press of the country being filled with all sorts of preparedness arguments and misrepresentations as to the present condition of the United States Army and Navy, and the possibility and probability of the United States being attacked by foreign foes.

“This policy also included the suppression of everything in opposition to the wishes of the interests served. The effectiveness of this scheme has been conclusively demonstrated by the character of the stuff carried in the daily press throughout the country since March, 1915. They have resorted to anything necessary to commercialize public sentiment and sandbag the National Congress into making extravagant and wasteful appropriations for the Army and Navy under false pretense that it was necessary. Their stock argument is that it is ‘patriotism.’ They are playing on every prejudice and passion of the American people.”

So FORGET about the Illuminati (the real elitists) and just blame their bankster elite puppets, their government elite puppets (like Obama, Bush, Clinton etc.) and their corporate media presstitutes for everything instead!!!

George carlin sums it up best:

– George Carlin: The American Dream (Video):

A short excerpt from the video “Life Is Worth Losing” (2005).

That said, enjoy Matt Taibbi’s otherwise excellent article and writing style.

The Illuminati were amateurs. The second huge financial scandal of the year reveals the real international conspiracy: There’s no price the big banks can’t fix

– Everything Is Rigged: The Biggest Price-Fixing Scandal Ever (Rolling Stone, by Matt Taibbi, April 25, 2013):

Conspiracy theorists of the world, believers in the hidden hands of the Rothschilds and the Masons and the Illuminati, we skeptics owe you an apology. You were right. The players may be a little different, but your basic premise is correct: The world is a rigged game. We found this out in recent months, when a series of related corruption stories spilled out of the financial sector, suggesting the world’s largest banks may be fixing the prices of, well, just about everything.

You may have heard of the Libor scandal, in which at least three – and perhaps as many as 16 – of the name-brand too-big-to-fail banks have been manipulating global interest rates, in the process messing around with the prices of upward of $500 trillion (that’s trillion, with a “t”) worth of financial instruments. When that sprawling con burst into public view last year, it was easily the biggest financial scandal in history – MIT professor Andrew Lo even said it “dwarfs by orders of magnitude any financial scam in the history of markets.”

That was bad enough, but now Libor may have a twin brother. Word has leaked out that the London-based firm ICAP, the world’s largest broker of interest-rate swaps, is being investigated by American authorities for behavior that sounds eerily reminiscent of the Libor mess. Regulators are looking into whether or not a small group of brokers at ICAP may have worked with up to 15 of the world’s largest banks to manipulate ISDAfix, a benchmark number used around the world to calculate the prices of interest-rate swaps.

Interest-rate swaps are a tool used by big cities, major corporations and sovereign governments to manage their debt, and the scale of their use is almost unimaginably massive. It’s about a $379 trillion market, meaning that any manipulation would affect a pile of assets about 100 times the size of the United States federal budget.

Federal Reserve And Bank Of Japan Caused Gold Crash (Telegraph, Ambrose Evans-Pritchard)

Compare Ambrose Evans-Pritchard’s article to …

– Former Assistant Secretary of the Treasury Dr. Paul Craig Roberts: The Assault On Gold – Assault On Gold UPDATE

– Fed and Bank of Japan caused gold crash (Telegraph, Ambrose Evans-Pritchard April 17, 2013):

Commodity prices have been falling since September, culminating in a rout over the past two weeks. That is a classic warning for the global economy.

It is becoming ever clearer that the roaring boom in global equities since last summer has priced in an economic recovery that does not in fact exist. The International Monetary Fund has had to nurse down its global growth forecasts yet again. We are still stuck in an old-fashioned trade depression, with pervasive over-capacity in manufacturing plant and a record global savings rate of 25pc of GDP.

German car sales fell 17pc in March. That should puncture the last illusions that Germany is about to pull Europe out of a self-inflicted slump.

As you can see from the chart below, the divergence between stock markets and the Deutsche Bank index of raw materials is astonishing to behold, so like the pattern in early 1929.

Read moreFederal Reserve And Bank Of Japan Caused Gold Crash (Telegraph, Ambrose Evans-Pritchard)

Egan-Jones Downgrades GERMANY’s Credit Rating From A+ To A, Outlook Negative

– Egan-Jones Downgrades Germany From A+ To A, Outlook Negative (ZeroHedge, April 17, 2013):

The more you try to shut them up, the more they have to say…Just out from Egan-Jones

4/17/2013: Federal Republic Of Germany: EJR lowered A+ to A (Neg.) (S&P: AAA) (3413Z GR)

Read moreEgan-Jones Downgrades GERMANY’s Credit Rating From A+ To A, Outlook Negative

Harvard Economist Carmen Reinhart: ‘No Doubt. Our Pensions Are Screwed.’

– Carmen Reinhart: “No Doubt. Our Pensions Are Screwed.” (ZeroHedge, April 11, 2013):

“The crisis isn’t over yet,” warns Carmen Reinhart, “not in the US and not in Europe.” Known for her deep understanding that ‘it’s never different this time’, the Harvard economist drops the truth grenade a number of times in this excellent Der Spiegel interview. Sweeping away the sound and fury of a self-serving Federal Reserve or BoJ, she chides, “no central bank will admit it is keeping rates low to help governments out of their debt crises. But in fact they are bending over backwards to help governments to finance their deficits,” and guess what, “this is nothing new in history.”

After World War II, all countries that had a big debt overhang relied on financial repression to avoid an explicit default. After the war, governments imposed interest rate ceilings for government bonds; but, nowadays, she explains, “monetary policy is doing the job. And with high unemployment and low inflation that doesn’t even look suspicious. Only when inflation picks up, which is ultimately going to happen, will it become obvious that central banks have become subservient to governments.”

Nations “seldom just grow themselves out of debt,” as so many believe is possible, “you need a combination of austerity, so that you don’t add further to the pile of debt, and higher inflation, which is effectively a subtle form of taxation,” with the consequence that people are going to lose their savings. Reinhart succinctly summarizes, “no doubt, our pensions are screwed.”

This will take 3 minutes to read – read it. Understand what she is saying.

Read moreHarvard Economist Carmen Reinhart: ‘No Doubt. Our Pensions Are Screwed.’

Cyprus Bailout Size Increases By 35% In One Month To €23 Billion, 120% Of GDP

– Cyprus Bailout Size Increases By 35% In One Month To €23 Billion, 120% Of GDP (ZeroHedge, April 11, 2013):

As was reported in the previously presented Cypriot Debt Sustainability Analysis, which among other things had this stunner inside of it, things in Cyprus have gone from bad to worse in the brief span of a month. 35% worse to be exact, because this is how much the total bailout of Cyprus has grown by in a few shorts weeks, from €17 to €23 billion, which happened because just as we predicted the stealth outflow from banks was much worse (read bigger) than previously reported, leaving banks with a far bigger hole to plug. This is problematic because at least previously the bailout as a percentage of GDP was in the double digits. No longer so, as the latest (and soon to be re-revised higher) bailout figure now stands at over 120% of the country’s €18.8 billion GDP (which itself is about to tumble following the collapse of the economy).

From the Guardian:

Crisis-hit Cyprus will be forced to find an extra €6bn (£5.1bn) to contribute to its own bailout under leaked updated plans for the rescue.

In total, the bill for the bailout has risen to €23bn, from an original estimate of €17bn, less than a month after the deal was agreed – and the entire extra cost will be imposed on Nicosia.

Read moreCyprus Bailout Size Increases By 35% In One Month To €23 Billion, 120% Of GDP

Ron Paul: ‘The Great Cyprus Bank Robbery’

– The Great Cyprus Bank Robbery (Ron Paul, April 1, 2013):

The dramatic recent events in Cyprus have highlighted the fundamental weakness in the European banking system and the extreme fragility of fractional reserve banking. Cypriot banks invested heavily in Greek sovereign debt, and last summer’s Greek debt restructuring resulted in losses equivalent to more than 25 percent of Cyprus’ GDP. These banks then took their bad investments to the government, demanding a bailout from an already beleaguered Cypriot treasury. The government of Cyprus then turned to the European Union (EU) for a bailout.

Russia Is Next In Line To Restrict Cash Transactions

– Russia Is Next In Line To Restrict Cash Transactions (ZeroHedge, March 28, 2013):

The Russians are taking a page from the Europeans book (and not a positive one for libertarians). Given the substantial criminal activity and illegal entrepreneurship in Russia – the grey and black economies account for 50–65 percent of GDP and estimates that about $50 billion was taken out of Russia illegally in 2012 alone – the great and glorious leaders have decided to impose restrictions on cash transactions. As Russia Beyond The Headlines reports, Russia may ban cash payments for purchases of more than 300,000 rubles (around $10,000) starting in 2015 – starting with a higher ($19,500) restriction in 2014. They will also enforce mandatory cash-free salary payments (cash compensation accounts for 15% of GDP currently) in an effort to both bring some of the population’s ‘grey’ income out of the shadow; and increase the volume of cash reserves in the banks. It would appear that wherever we look now, leadership are realizing that the limits of fiscal and monetary policy have been reached and now changing rules, limiting freedom, and outright confiscation are the only way to maintain a status quo. Ironic really, when the enforcement of said rules may just be the catalyst for the end of the status quo as the middle class suffers.

Read moreRussia Is Next In Line To Restrict Cash Transactions

The Global Financial Pyramid Scheme By The Numbers

– Why Is The World Economy Doomed? The Global Financial Pyramid Scheme By The Numbers (Economic Collapse, March 20, 2013):

Why is the global economy in so much trouble? How can so many people be so absolutely certain that the world financial system is going to crash? Well, the truth is that when you take a look at the cold, hard numbers it is not difficult to see why the global financial pyramid scheme is destined to fail. In the United States today, there is approximately 56 trillion dollars of total debt in our financial system, but there is only about 9 trillion dollars in our bank accounts. So you could take every single penny out of the banks, multiply it by six, and you still would not have enough money to pay off all of our debts. Overall, there is about 190 trillion dollars of total debt on the planet. But global GDP is only about 70 trillion dollars. And the total notional value of all derivatives around the globe is somewhere between 600 trillion and 1500 trillion dollars. So we have a gigantic problem on our hands. The global financial system is a very shaky house of cards that has been constructed on a foundation of debt, leverage and incredibly risky derivatives. We are living in the greatest financial bubble in world history, and it isn’t going to take much to topple the entire thing. And when it falls, it is going to be the largest financial disaster in the history of the planet.

The global financial system is more interconnected today than ever before, and a crisis at one major bank or in one area of the world can spread at lightning speed. As I wrote about yesterday, the entire European banking system is leveraged 26 to 1 at this point. A decline in asset values of just 4 percent would totally wipe out the equity of many of those banks, and once a financial panic begins we could potentially see major financial institutions start to go down like dominoes.

The Last Time The Dow Jones Was Here … What Could Possibly Go Wrong?

– The Last Time The Dow Was Here… (ZeroHedge, March 5, 2013):

“Mission Accomplished” – With CNBC now lost for countdown-able targets (though 20,000 is so close), we leave it to none other than Jim Cramer to sum up where we stand (oh and the following list of remarkable then-and-now macro, micro, and market variables): “we all know it’s going to end badly, but in the meantime we can make some money” – ZH translation: “just make sure to sell ahead of everyone else.”

- Dow Jones Industrial Average: Then 14164.5; Now 14164.5

- GDP Growth: Then +2.5%; Now +1.6%

- Americans Unemployed (in Labor Force): Then 6.7 million; Now 13.2 million

- Labor Force Particpation Rate: Then 65.8%; Now 63.6%

- Americans On Food Stamps: Then 26.9 million; Now 47.69 million

- Size of Fed’s Balance Sheet: Then $0.89 trillion; Now $3.01 trillion

- US Debt as a Percentage of GDP: Then ~38%; Now 74.2%

- US Deficit (LTM): Then $97 billion; Now $975.6 billion

- Total US Debt Oustanding: Then $9.008 trillion; Now $16.43 trillion

- US Household Debt: Then $13.5 trillion; Now 12.87 trillion

- Consumer Confidence: Then 99.5; Now 69.6

- S&P Rating: Then AAA; Now AA+

- VIX: Then 17.5%; Now 14%

- 10 Year Treasury Yield: Then 4.64%; Now 1.89%

- EURUSD: Then 1.4145; Now 1.3050

- Gold: Then $748; Now $1583

- NYSE Average LTM Volume (per day): Then 1.3 billion shares; Now 545 million shares