– CFTC Announces It Is Undercounting Size Of Swaps Market By As Much As $55 Trillion (ZeroHedge, Dec 19, 2013):

What is $55 trillion between friends? Very little according to the CFTC. In perhaps the biggest under the radar news of the day – to be expected with every watercooler occupied by taper experts – the WSJ reports that the Commodity Futures Trading Commission said Wednesday that technical errors at two so-called swaps data repositories, which collect and supply regulators with transaction data, have led the CFTC to misreport the overall size of the swaps market by undercounting its size. Isn’t it curious how all these “glitches” always work out in the favor of preserving market calm and confidence and away from spooking investors and speculators? Either way, a better question is how big was the so called undercounting? The answer: as large as $55 trillion!

Regulators aren’t sure how much the repositories are undercounting. One CFTC official familiar with the matter said the discrepancy could be as high as $55 trillion, though another official said the figure is closer to $10 trillion once regulators cancel out certain transactions to prevent double counting.

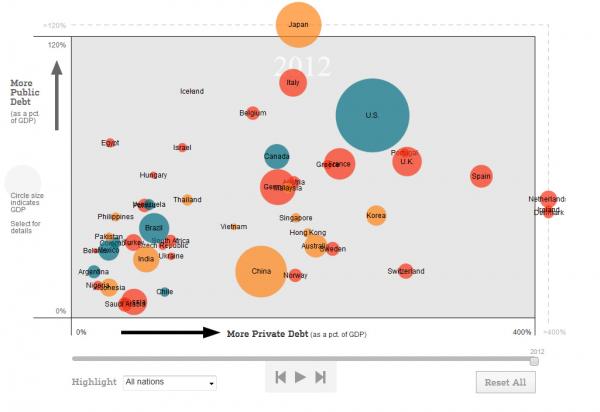

One just has to laugh: the total US swaps market is what – roughly $400 trillion? So… just add enough notional to that number equal to the GDP of the entire world – or 4 times the size of US GDP – and call it a day. And in this environment somehow the Fed and other central planners are expected to have any clue what they are doing on a day to day basis?

Read moreCFTC Announces It Is Undercounting Size Of Swaps Market By As Much As $55 TRILLION