– The Latest Contribution To US GDP: Promises… No Really (ZeroHedge, May 6, 2013):

Sadly, we are not making this up: as part of the BEA’s latest revision to the way it calculates GDP, the government will no longer count the amount of pension funding that is actually allocated to retirement accounts (counted as wages in the GDP calculation): i.e., an actual cash outlay. Instead, what the Bureau of Economic Analysis will count are corporate promises of how much companies will (may? might?) pay… eventually. The bigger the lie and the promise, the higher the GDP. And presto.

Elliott Management’s Paul Singer explains this pathetic adjustment as follows:

We have commented in the past on government statistical fakery and fudges, in the inflation numbers, in employment and long-term budgeting. But recent changes to the national GDP accounts by the Bureau of Economic Analysis may “take the cake.” As part of the revisions, they change the way pension payments are counting in GDP. Previous to the change, when a company paid money into a pension plan, the money was counted as wages in the GDP calculation. After the change, what companies have promised to pay in the future, not what they are actually paying, will be added to GDP. This is fantastic. The bigger the unpayable promise made to unsuspecting retirees (promises that are not fully funded), the more GDP supposedly goes up!

Said otherwise, if US companies promise “infinity”, GDP will grow by a comparable amount. At least in a thought experiment… Right?

. . .

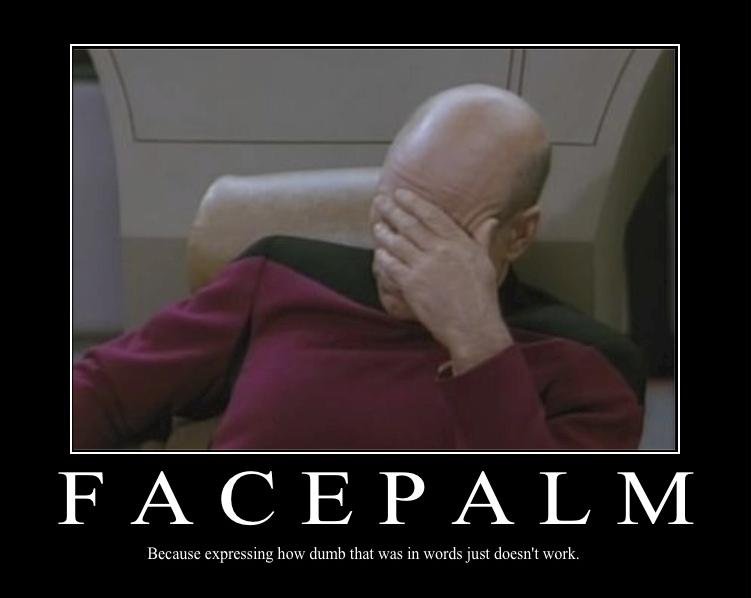

What else is there to say?