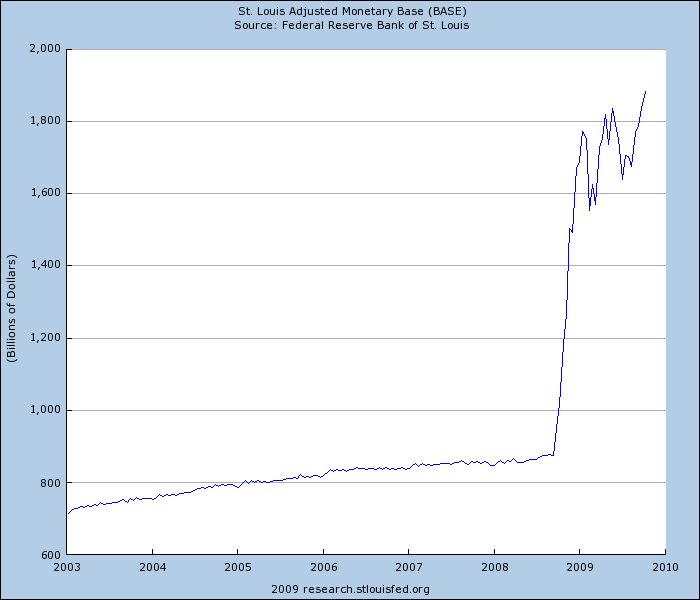

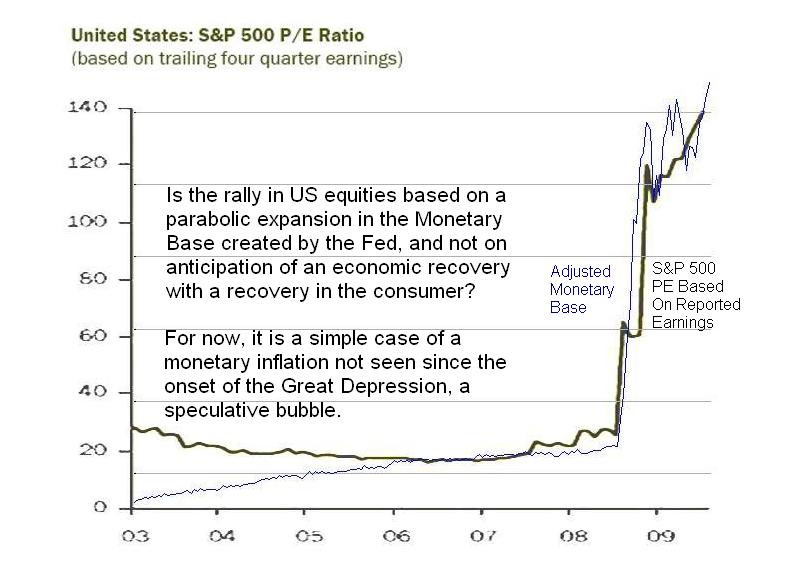

Quantitative easing is creating money out of thin air or “printing money.”

Quantitative easing increases the money supply, creates inflation and devalues the currency.

Inflation is a hidden tax. Quantitative easing is absolute stealing from the people.

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.“

– John Maynard Keynes

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. … This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.”

– Alan Greenspan

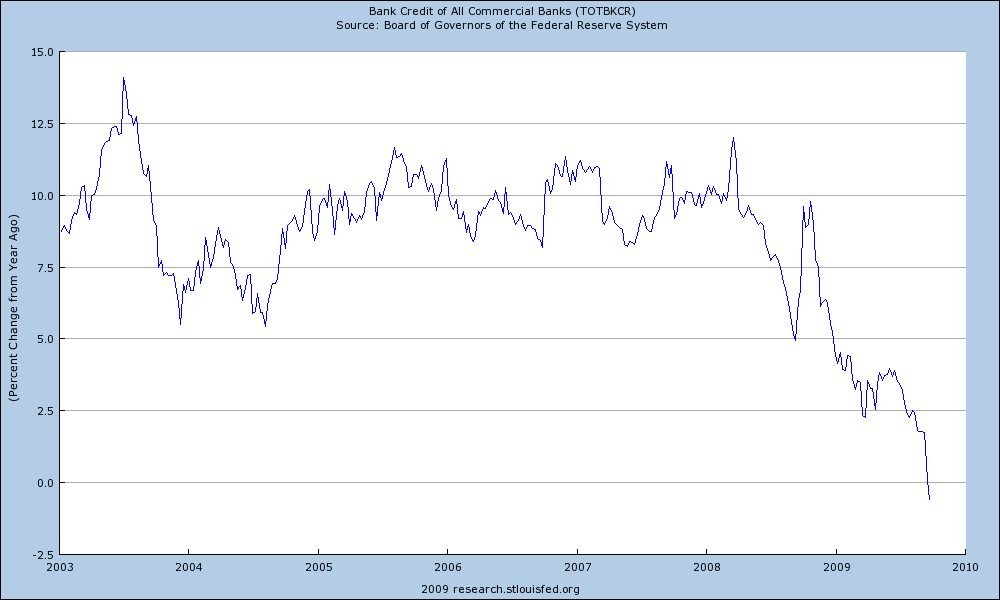

BoE warned that UK banks are still failing to provide enough credit to businesses and households as it held interest rates at 0.5%

Steve Bell, The Guardian, Friday 6 November 2009

The Bank of England will expand its programme of money creation by £25bn over the next three months to boost Britain’s recession-hit economy, Threadneedle Street announced today as it left interest rates unchanged again.

Warning that UK banks are still failing to provide enough credit to businesses and households, the Bank said it would increase the size of quantitative easing (QE) to £200bn.

The Bank’s nine-strong monetary policy committee also pegged bank rate at its record low level of 0.5%, where it has been since March. It said cheap borrowing and QE were needed to prevent inflation falling below its 2% target.

In a statement, the Bank said: “On balance, the committee believes that the prospect is for slow recovery in the level of economic activity, so that a substantial margin of under-utilised resources persists.”

Although the Bank said there were signs of recovery in the world economy, it added that output in the UK had dropped by 6% since the start of a recession that has now lasted for six quarters, the longest period of decline since records began in 1955. “Households have reduced their spending substantially and businesses investment has fallen especially sharply,” the statement said.

Offiicial data released today showed that manufacturing output improved in September, and the MPC said that there were signs a “a pick-up in economic activity may soon be evident”.

Under the QE programme, the Bank of England buys bonds from the commercial banks, thereby providing lenders with extra cash to lend. It received permission from the chancellor, Alistair Darling, to extend the scheme.

Read moreBank of England extends quantitative easing to £200 billion