– No inflation Friday: 42.4% increase in the price of being… poor? (Sovereign Man, May 23, 2014):

One of the most intellectually disingenuous statements made by western policymakers is that inflation is tame… nonexistent.

For example, the minutes released this week from the most recent Federal Reserve policy meeting said that the Fed saw NO inflation risk in ‘fueling job growth’ [i.e. printing money].

So by their own admission, the Fed thinks they can conjure hundreds of billions of dollars out of thin air without any consequences whatsoever. Zero risk.

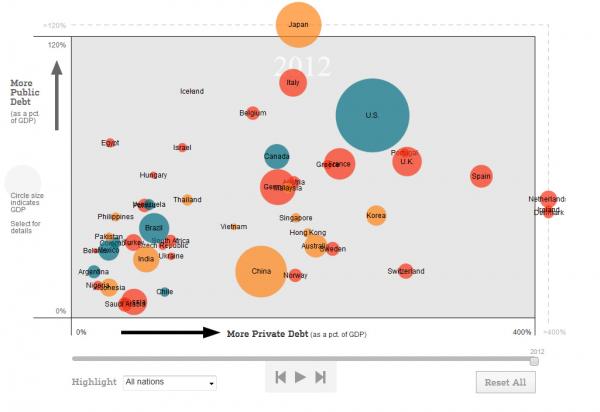

Every time I hear something like this it just makes my skin crawl… and I always think, “go get on a plane.”

Inflation is out there in the rest of the world. To deny its existence is massively arrogant, insensitive, and just plain wrong.

Read moreNo Inflation Friday: 42.4% Increase In The Price Of Being … Poor?