From the article:

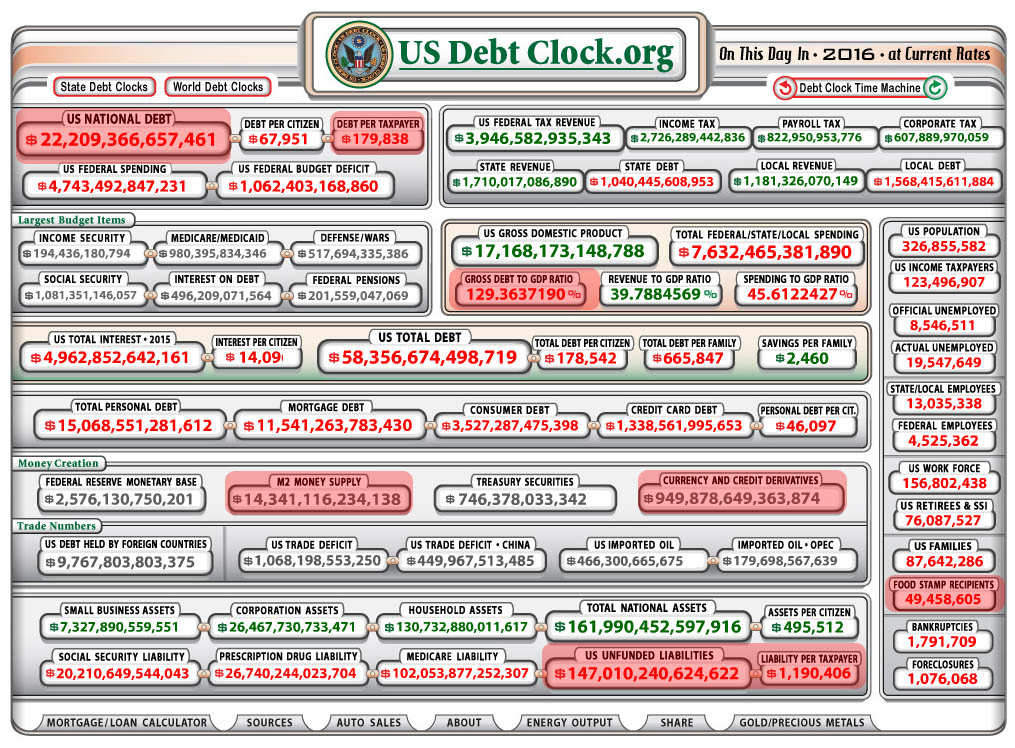

“The oligarchs have succeeded in making americans a dispossessed majority in their own country. In November americans will again give their approval to one of the oligarchy’s two candidates.”

“If americans had any sense, they would stay home and not vote.”

See also:

– Dr. Paul Craig Roberts: ‘War Criminals Run The State Department And The Entire US Government’

Paul Craig Roberts was Assistant Secretary of the Treasury during President Reagan’s first term. He was Associate Editor of the Wall Street Journal. He has held numerous academic appointments, including the William E. Simon Chair, Center for Strategic and International Studies, Georgetown University, and Senior Research Fellow, Hoover Institution, Stanford University.

– The Dispossessed Majority (Paul Craig Roberts, Aug 8, 2012):

The bumper sticker on the beat-up pickup truck read: “Friends don’t let friends vote Democrat.”

The driver was obviously not affluent. Yet, despite all the news about mega-trillion dollar bankster bailouts, mega-million dollar bonuses for financial crooks, and unimaginable compensation packages for corporate CEOs who have moved middle class jobs out of America, something made the down-and-out pickup truck driver associate with the political party of the super-rich.

As I wondered at this strange alliance of the dirt poor with the mega-rich, I remembered that in 2004 Thomas Frank wondered about how the Republicans had managed to convince the poor to vote against their best interests. Frank’s answer, or part of his answer, is that the Republicans use “social issues,” such as gay marriage and Janet Jackson’s exposed nipple to work up indignation over the threat to moral values posed by liberal Democrats.

The working poor have been convinced by Republican propaganda that voting Democrat means giving the working poor’s tax dollars to the non-working poor, to providing medical care and schooling for illegal aliens, and being soft on terrorism.

To the pick-up truck driver, standing up for America means standing up for bankster bailouts and the military/security complex’s multi-trillion dollar wars.