– European Bonds Give Up ALL Draghi “Believe” Gains In Worst Day In Over A Decade (ZeroHedge, Aug 2, 2012)

Economy

Hyper Mario And Germany On Verge Of All Out Warfare

– Hyper Mario And Germany On Verge Of All Out Warfare (ZeroHedge, Aug 2, 2012):

Back in March we wrote “Mario Draghi Is Becoming Germany’s Most Hated Man” for one reason: a few months after the former Goldman appartchik was sworn in to replace Trichet with promises he would not “print” Draghi did just that in a covert way via $1.3 trillion in LTROs, that immediately hit the economy and sent inflation across Europe soaring. We said that: “Slowly but surely the realization is dawning on Germany that while it was sleeping, perfectly confused by lies spoken in a soothing Italian accent that the ECB will not print, not only did Draghi reflate the ECB’s balance sheet by an unprecedented amount in a very short time, in the process not only sending Brent in Euros to all time highs (wink, wink, inflation, as today’s European CPI confirmed coming in at 2.7% or higher than estimated) but also putting the BUBA in jeopardy with nearly half a trillion in Eurosystem”receivables” which it will most likely never collect.”

Read moreHyper Mario And Germany On Verge Of All Out Warfare

GM Profits Slip 41 Percent, European Division Reports Operating Loss Of $361 Million

America’s largest car firm made $1.5bn in the second quarter of 2012, with European division reporting operating loss of $361m

GM’s CEO Dan Akerson said: ‘We have more work to do to offset the headwinds we face.’ Photograph: Jeff Kowalsky/EPA

– GM profits slip 41% as European struggles take their toll (Guardian, Aug 2, 2012):

General Motors’ profits fell 41% in the second quarter as troubles in Europe undercut strong sales in North America.

America’s largest automaker made $1.5bn in the second quarter of 2012, compared with $2.5bn for the same period last year. Revenue fell to $37.6bn from $39.4bn in the second quarter of 2011. The results exceeded analysts’ estimates, but further underlined Europe’s drag on the US economy.

“Our results in North America were solid, but we clearly have more work to do to offset the headwinds we face, especially in regions like Europe and South America,” said GM chairman and CEO Dan Akerson. “Despite the challenging environment, GM has now achieved 10 consecutive quarters of profitability, which is a milestone the company has not achieved in more than a decade.”

Read moreGM Profits Slip 41 Percent, European Division Reports Operating Loss Of $361 Million

TEPCO Receives $12.8 BILLION BAILOUT

– TEPCO receives $12.8 billion public bailout (AFP, July 30, 2012):

The operator of Japan’s crippled Fukushima nuclear power plant was effectively nationalised Tuesday as it received one trillion yen ($12.8 billion) of taxpayer money to stay afloat.

The public bailout of Tokyo Electric Power Co. (TEPCO) in the wake of last year’s tsunami-triggered accident gives the government 50.11 percent of the utility’s voting rights.

And the deal has an option which allows the Nuclear Damage Liability Facilitation Fund to raise the stake up to 75.84 percent to impose stronger control if TEPCO fails to push reforms.

The country’s biggest utility will remain under state control for a “considerably long period of time”, Yukio Edano, the minister of economy, trade and industry, told a news conference.

Bolivia To Expel Coca-Cola In Wake Of 2012 Mayan ‘Apocalypse’

– ‘End of capitalism’: Bolivia to expel Coca-Cola in wake of 2012 Mayan ‘apocalypse’ (RT, Aug 1, 2012):

In a symbolic rejection of US capitalism, Bolivia announced it will expel the Coca-Cola Company from the country at the end of the Mayan calendar. This will mark the end of capitalism and usher in a new era of equality, the Bolivian govt says.

“December 21 of 2012 will be the end of egoism and division. December 21 should be the end of Coca-Cola,” Bolivian foreign minister David Choquehuanca decreed, with bombast worthy of a viral marketing campaign.

The coming ‘end’ of the Mayan lunar calendar on December 21 of this year has sparked widespread doomsaying of an impending apocalypse. But Choquehuanca argued differently, claiming it will be the end of days for capitalism, not the planet.

“The planets will align for the first time in 26,000 years and this is the end of capitalism and the beginning of communitarianism,” said Choquehuanca as quoted by Venezuelan newspaper El Periodiquito.Read moreBolivia To Expel Coca-Cola In Wake Of 2012 Mayan ‘Apocalypse’

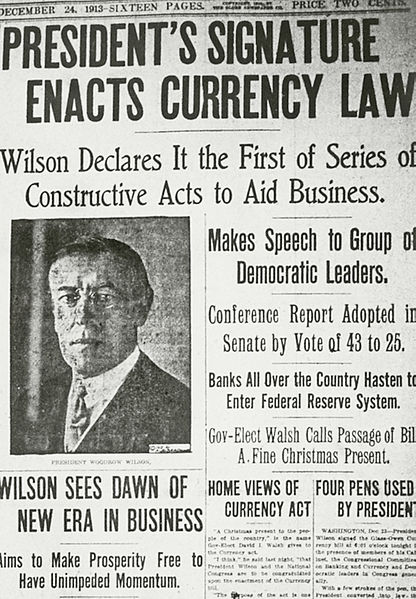

MSM Reporter Tells The Truth About Audit The Fed And The Creation Of The Federal Reserve (Video)

“I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated governments in the civilized world. No longer a government by free opinion, no longer a government by conviction and the vote of the majority, but a government by the opinion and duress of a small group of dominant men.”

– Woodrow Wilson“Since I entered politics, I have chiefly had men’s views confided to me privately. Some of the biggest men in the United States, in the Field of commerce and manufacture, are afraid of something. They know that there is a power somewhere so organized, so subtle, so watchful, so interlocked, so complete, so pervasive, that they better not speak above their breath when they speak in condemnation of it.”

– Woodrow Wilson, The New Freedom (1913)“A little group of willful men, representing no opinion but their own, have rendered the great government of the United States helpless and contemptible.”

– Woodrow Wilson

– Mainstream Reporter Tells The Truth About Audit The Fed And The Creation Of The Federal Reserve (Economic Collapse, Aug 2, 2012):

When someone in the mainstream media goes out on a limb to tell the truth, then the rest of us should go out of our way to applaud that effort. Reporter Ben Swann of Fox 19 in Cincinnati is one of the few local television reporters in the United States that consistently tackles the tough issues. As you can see from his “Reality Check” archives, he regularly does reports on the Federal Reserve, the emerging police state, the loss of our freedoms and liberties, the advance of globalism, the economic collapse, political corruption, etc. etc. That is one reason why his YouTube channel is rapidly approaching a million views. In his most recent Reality Check, Ben Swann asked this question: “Is auditing the Federal Reserve really necessary?” In just four minutes, Swann covered the creation of the Federal Reserve, where money comes from, the 16 trillion dollars in secret loans given out by the Fed during the last financial crisis, and why an audit of the Fed is so important. It really was extraordinary to watch a local mainstream news reporter tell the truth about these things. We could definitely use about 1000 more reporters just like him.

The video of Ben Swann’s recent Reality Check is posted below. If you have not seen it yet, it is definitely worth the 4 minutes that it takes to watch it….

What in the world would this country look like if we had hundreds of other real journalists such as Ben Swann that were willing to tackle these kinds of issues head on?

Certainly nobody is perfect, but when a reporter like Swann is willing to go out on a limb and attack the Fed we need to applaud his efforts.

Batman Massacre: WHY and HOW and WHO (Videos)

– Batman Massacre: WHY and HOW and WHO (Help Free The Earth, July 28, 2012)

The Smoking Gun: The Federal Reserve On Gold Price Manipulation

– The Fed On Gold Price Manipulation (ZeroHedge, July 30, 2012):

Lately various media outlets have been swamped with stories and allegations of precious metal manipulation ranging from the arcane, to the bizarre to the outright ridiculous. At issue is not that these claims of price fraud are unfounded – they very well may be completely true – but without a notarized facsimile of an actual trade ticket signed by Brian Sack, or his replacement Simon Potter, or any of the BIS traders confirming they are indeed selling gold on behalf of the Fed, BOE, ECB, SNB or BOJ simply to keep the price of the metal down, what such constant factless accusations (and no, sorry, a chart showing that the price of gold may go up or go down sharply indicates merely that and nothing about the underlying factors for such a move) do is to habituate the broader public to the real issues surrounding precious metal, and other asset class, manipulation. So instead of searching for circumstantial evidence which one can easily find everywhere, we decided to go straight to the source. To do that we go back to a post we wrote back in September of 2009, based on an internal previously confidential Fed document, which conveniently enough explains everything vis-a-vis gold manipulation and leaves nothing to speculation or misinterpretation. Zero Hedge presents the smoking gun that may provide responses to all the various open questions regarding the Fed’s Modus Operandi in the gold arena which answer the core question – motive – courtesy of a declassified memorandum, written by none other than the then Fed Chairman, and addressed to the president of the United States.

From Zero Hedge, September 27, 2009.

Exclusive Smoking Gun: The Fed On Gold Manipulation

Zero Hedge has recently presented several declassified documents from the pre-1971 “Nixon Shock” days, that endorse the case for gold as a major historical factor in US monetary and foreign policy, as demonstrated by State Department and CIA disclosure. Gold’s special status in policy and administrative decision-making was a direct factor in Nixon’s choice to abolish the gold reserve at a time of an exploding budget deficit.

Yet what about the days after 1971, and specifically, how did that critical “behind the scenes” organization, the Federal Reserve, perceive and manipulate gold in the post Bretton-Woods world? Was gold, freed from its shackles to the dollar, once again merely a symbolic representation for money?

Zero Hedge presents the smoking gun that may provide responses to all the various open questions, courtesy of a declassified memorandum, written by none other than the then Fed Chairman, addressed to the president of the United States.

Read moreThe Smoking Gun: The Federal Reserve On Gold Price Manipulation

65 Signs That The Economic Collapse Is Already Happening

From the article:

“I just don’t know what you are talking about. Where I live everything is just fine. The malls are packed, the restaurants are full and everybody I know is going on vacation this summer.

…

Those in charge know what they are doing and America has the greatest economy on earth.”

Hopeless!

– Just Open Up Your Eyes And Look – 65 Signs That The Economic Collapse Is Already Happening (Economic Collapse, July 31, 2012):

Do you want to know when the “economic collapse” is going to happen? Just open up your eyes and take a look. The “economic collapse” is already happening all around us. So many people talk about the coming economic collapse as if it is some massively hyped event that they will be able to point to on the calendar, and a lot of writers spend a lot of time speculating about exactly when it will happen. But as I have written about before, the economic collapse is not a single event. The economic collapse has been happening, it is happening right now, and it will be getting a lot worse. Yes, there will be moments of great crisis. We saw one of those “waves” back in 2008 and another “wave” is rapidly approaching. But all of the waves are part of a process that is continually unfolding. Over the past 40 years, the United States and Europe have piled up the greatest mountain of debt in the history of the world, and now a tremendous amount of pain is heading our way. Economic conditions in the United States and Europe have already deteriorated badly and they are going to continue to deteriorate. Nothing is going to stop what is coming.

Read more65 Signs That The Economic Collapse Is Already Happening

11 Signs Time Is Quickly Running Out For The Global Financial System

– 11 Signs That Time Is Quickly Running Out For The Global Financial System (Economic Collapse, July 30, 2012):

Are we rapidly approaching a moment of reckoning for the global financial system? August is likely to be a relatively slow month as most of Europe is on vacation, but after that we will be moving into a “danger zone” where just about anything could happen. Historically, a financial crisis has been more likely to happen in the fall than during any other time, and this fall is shaping up to be a doozy. Much of the focus of the financial world is on whether or not the euro is going to break up, but even if the authorities in Europe are able to keep the euro together we are still facing massive problems. Countries such as Greece and Spain are already experiencing depression-like conditions, and much of the rest of the globe is sliding into recession. Unemployment has already risen to record levels in some parts of Europe, major banks all over Europe are teetering on the brink of insolvency, and the flow of credit is freezing up all over the planet. If things take a really bad turn, this crisis could become much worse than the financial crisis of 2008 very quickly.

All over the world people are starting to write about the possibility of a major economic crisis starting this fall.

For example, a recent article in the International Business Times discussed how some economists around the globe are fearing the worst for the coming months….

Read more11 Signs Time Is Quickly Running Out For The Global Financial System

Keiser Report: Virtual Virtual Economy (Video)

YouTube Added: 31.07.2012

Description:

In this episode, Max Keiser and Stacy Herbert discuss the virtual virtual economy getting hit by a dustbowl and there are no gully washers or toad stranglers on the horizon to bring reliefe; meanwhile out in the virtual real economy it’s all the bath-salts and beer you can drink and scalps for sale in California as eminent domain falls into the hands of private bankers. In the second half, Max interviews Teri Buhl about the possibility of San Bernardino county using eminent domain to seize mortgages from one set of rich private investors to give them to another set of rich private investors.

Chinese Ultra-Luxury Car Bubble Pops As 1 Year Old Used Lamborghini Gallardo Sells 70% Off Sticker

– Chinese Ultra-Luxury Car Bubble Pops As 1 Year Old Used Lambo Gallardo Sells 70% Off Sticker (ZeroHedge, July 31, 2012):

Rumors are circulating that reports of the demise of the Chinese auto market may be exaggerated now that even David Einhorn is forced to defend his GM long (because it “has a strong cash position” – sure, and stuffs channels like no other) however stripped of stereotypes and hype, the reality is that even the one time impregnable ultra luxury car market in China is now faltering at an ever faster pace. BusinessWeek reports: “Waiting lists for ultra-luxury cars in Hong Kong are getting shorter and used-car lots are cutting prices on Lamborghinis, Ferraris and Bentleys in the latest sign of China’s slowdown. At first glance, the numbers are deceiving: Sales of very expensive new autos surged 47 percent in the first six months, according to industry analyst IHS Automotive. Look more deeply, however, and another picture emerges, especially in the city’s used-car lots.” The picture is ugly: ““The more expensive the car, the more dry the business,” said Tommy Siu at the Causeway Bay showroom of Vin’s Motors Co., the used-car dealership he founded two decades ago. Sales of ultra-luxury cars have halved in the past two or three months, he said. “A lot of bankers don’t want to spend too much money for a car now. At this moment, they don’t know if they’ll have a big bonus.”” Sad: they should all just go to Singapore and manipulate Libor. Oh wait, too soon?

Curiously, unlike virtually every other manipulated asset class, Hong Kong car sales provide a somewhat insulated view into the heart of China’s beating economy:

Facebook, FaceBerg, Fadebook Hits 21 The Hard Way … Down 53% From Its IPO-Day Highs

– FaceBerg Hits 21 The Hard Way (ZeroHedge, July 31, 2012):

Was it only two months ago that Faceplant was heralded as bringing in the new era of well something… the public markets are a cruel friend it seems as FB just traded with a $21 handle for the first time – down a marvelous 53% from its IPO-day highs… Volume exploded once it crossed that barrier as we suspect Margin Stanley was aggressively defending its new line in the sand (how did that defense work at $38, $37, $35, and $30 – but maybe this time is different).

Is Europe’s Largest Economy A Fraud?

– GM’s Channel Stuffing Goes To Germany: Is Europe’s Largest Economy A Fraud? (ZeroHedge, July 31, 2012)

We have long argued that auto manufacturers have been channel-stuffing (and subprime-lending) themselves back into a disaster and as such class-action lawsuits have begun. Recently we also pointed out the epidemic of dealer-inventory-stuffing in China (and again this morning the Chinese luxury car market’s over-stuffing). So today’s report from Reuters that German auto manufacturers have been stuffing dealer channels just like the rest of the world as Europe’s largest car market is in recession even if few outside of the industry would know it. “Essentially, the carmakers are deceiving their shareholders, since they make it look as if the vehicles were actually sold. They want to pull the wool over their eyes,” as three in every ten new vehicles in Germany are sold not to customers, but to carmakers and their dealers – a type of automotive industry pump priming known as “self-registration”. At nearly half a million such registrations in the six months through June, the total is greater than the entire new car market in Spain. Is Germany’s economy really what it is reported to be given all this fake demand pull-forward – or is it a total fraud?

Via Reuters

Reality versus ‘official’ figures:

Greece Runs Out Of Money. AGAIN

– Greece Runs Out Of Money. Again (ZeroHedge, July 31, 2012):

While we are not certain how many times we have used the above headline in the past we know it is not the first time. Nor the fifth. Yet here we are again, reporting that Greece is out of money again. “Near-bankrupt Greece is fast running out of cash while it waits for its next installment of aid from international lenders, a deputy finance minister said on Tuesday, sounding the alarm on the country’s precarious financial position. Greece’s European partners have repeatedly promised the country will be funded through August, when it must repay a 3.2 billion euro bond, but the details of the funding have yet to be disclosed. In the absence of that money, Greece would run out of funds to pay everyday public expenses ranging from police and other public service wages to pensions and social benefits. “Cash reserves are almost zero. It is risky to say until when (they will last) as it always depends on the budget execution, revenues and expenditure,” Deputy Finance Minister Christos Staikouras told state NET television” In other words just like the US yesterday, Greece has also overestimated its revenues and underestimated its expenditures; also Greece in August is what the US itself will be in about 3-4 months, when the debt ceiling is hit. Luckily, the political environment in D.C. is open and cordial, and a prompt resolution to both the debt ceiling issue and the fiscal cliff, especially as they all coincide just in time for the presidential election is guaranteed.

The tragic Greek lament continues via Reuters:

“[W]e are certainly on the brink, we did not receive the aid tranche we were supposed to and we have the pending issue of an ECB bond maturing on Aug. 20.”

Food Industry Refuses To Take Out Harmful BPAs

Related info:

– WAR ON HEALTH – The FDA’s Cult of Tyranny (Documentary):

– Food Industry Won’t Take out Harmful BPAs (Natural Society, July 30, 2012):

What do latchkey kids, college students, and busy parents have in common? Well, one thing is that they save valuable time and money by cooking with canned foods. The bad news? Tagging along with these foods is a hefty dose of bisphenol A.

According to a past study conducted by the nonprofit Consumers Union, 18 of 19 canned foods contained 22 micrograms of BPA per serving—116 times more than the ‘daily recommended limit.’ Progresso, Del Monte, Campbell’s, Annie’s, and Hormel soups took the BPA lead. Unfortunately, BPA still continues to taint food cans today.

BPA Affects Fertility

Researchers have linked BPA consumption to hyperactivity, aggression, depression, obesity, diabetes, heart disease, various cancers, and reproductive difficulties including Anogenital distance. Males with short AGD have been found to have 7 times the chance of being sub-fertile. This is a troubling statistic given that prenatal BPA exposure through parental consumption is associated with shortened AGD.

Money-Laundering: ‘Shamed HSBC Takes $2 BILLION Hit For U.S., UK Scandals’ (Reuters)

And who is going to jail?

– Shamed HSBC takes $2 bln hit for U.S., UK scandals (Reuters, July 30, 2012):

* $700 mln provision for U.S. anti-money laundering failures

* Cost of U.S. fine, charges may be “significantly higher” -CEO

* $1.3 billion set aside to compensate UK customers for mis-selling

* Shares up 1.9 percent

LONDON, July 30 (Reuters) – Revelations of lax anti-money laundering controls at HSBC are “shameful and embarrassing” for Europe’s biggest bank, its boss said on Monday, and it may have to pay out well over $2 billion for the scandal and in compensation for UK mis-selling.

HSBC set aside $700 million to cover fines and other costs after a U.S. Senate report criticised it this month for letting clients shift funds from dangerous and secretive countries, notably Mexico.

Chief Executive Stuart Gulliver told reporters the ultimate cost could be “significantly higher”.

“What happened in Mexico and the U.S. is shameful, it’s embarrassing, it’s very painful for all of us in the firm,” he said on a conference call. “We need to execute on the compliance changes and then prove ourselves worthy and rebuild this over a number of years. There are no quick and easy fixes.”

The Senate report criticised a “pervasively polluted” culture at the bank and said HSBC’s Mexican operations had moved $7 billion into its U.S. operations between 2007 and 2008.

“The firm clearly lost its way in this regard and it’s right that we apologise,” said Gulliver. “Colleagues internally have been aware that this is the backdrop of why we had to change the firm.”

Read moreMoney-Laundering: ‘Shamed HSBC Takes $2 BILLION Hit For U.S., UK Scandals’ (Reuters)

Troika’s Athens Demand: More Axe, And More Tax

– Troika’s Athens demand: More axe, and more tax (The Slog, July 29, 2012):

TROIKA READS RIOT ACT TO GREEK COALITION

Evangelo Venizelos more Friar Tuck than Robin Hood

But Privatisation demands may produce stalemate today

I’ve been getting some irate emails from Greek Sloggers of late – especially those who earn a living suplying goods to the Athens Government. Their bitch is simple: while the new Coalition is very happy to suck up to the Troika, monies it owes to its own citizens can go hang. As one correspondent remarked last Thursday, “It’s easy to balance the books if you don’t pay any bills”.

The day before, the Troikanauts came to town with a very clear message: no more backsliding, or no more money. But it all depends on how you define ‘backsliding’. If a Vesuvius of debt just erupted and you’re on the side of the mountain, chances are you’ll backslide. In fact, the reality is, you’ll perish.

Prior to the meeting, the key Greek Party leaders – Antonis Samaras, Fotis Kouvelis and Evangelos Venizelos – had pledged to stand firm on ‘no further cuts, and no further taxes’. At the meeting, the Coalition presented further spending, pension and salary cuts, with an update on the progress of tax collection following the recent elections. Together they totalled just under €13bn

The Slog can reveal that the tax situation is dire. It is 20% won’t pay, and 80% can’t pay. The savings are impressive, but the Athens regime is miles off target. (As any government faced with this

mad Troika fantasyHerculean task would be). However, in the context of an economy at close to standstill, Coalition leaders put their case for no further attacks on the populace.

GREECE EXCLUSIVE: Geithner Envoy ‘Assured Athens Of US Support On Return To Drachma’ – Sources

– GREECE EXCLUSIVE: Geithner envoy ‘assured Athens of US support on return to drachma’ – sources (The Slog, July 29, 2012):

Meanwhile, the EFSF robs Petros to pay Pavlos

The US Treasury’s Assistant Secretary for International Finance Charles Collyns had a meeting with Greek Finance Minister Yiannis Stournaras in Athens on Wednesday morning. The official Greek media version was that Collyns ‘expressed the support of US-Finance Secretary Tomothy Geithner to Greece and his confidence in Greek efforts. Yinannis Stournas briefed Collyns on the situation of the Greek fiscal condition, and the key challenges of the Greek economy’.

In fact, Washington sources told The Slog last night BST that Collyns – a confidante of both Geithner and Stournas – was on a specific mission to impress on Greek Finance bosses the US Treasury’s sincerity in offering Greece “almost unqualified support in the event of a return to the drachma”. The White House is betting on the strong likelihood of Greece becoming formally insolvent before any more bailout monies are available from Berlin-am-Brussels.

UK Economic Outlook Slumps – UK May Lose Triple-A Rating If GDP Growth Continues To Disappoint, Warns Moody’s

– UK economic outlook slumps on eurozone crisis (Guardian, July 31, 2012):

UK may lose triple-A rating if GDP growth continues to disappoint, Moody’s ratings agency warns

The UK’s economic outlook has weakened as a result of the eurozone debt crisis, Moody’s has said in a fresh blow to the chancellor George Osborne.

The ratings agency cut its forecasts for GDP growth, after figures last week showed the UK economy shrank by 0.7% in the second quarter – far more than expected.

Moody’s expects GDP to grow by just 0.4% this year and 1.8% in 2013, which is considerably more optimistic than many economists, who expect the economy to contract this year. Gerard Lyons at Standard Chartered said after the GDP figures were published: “I think it’s inconceivable that there will be positive growth this year.”

Moody’s warned on Tuesday that Britain could lose its triple-A rating if economic growth did not meet expectations, and if the country’s debt burden increased. It said the weaker economic environment could challenge the government’s efforts to reduce debt in the coming years.

Is Facebook’s Ad Model a Scam? … ‘This Is Why We Need To Delete This Page And Move Away From Facebook. They’re Scumbags And We Just Don’t Have The Patience For Scumbags’

FLASHBACK:

– Facebook founder called trusting users ‘DUMB FUCKS’

– Is Facebook’s Ad Model a Scam? (Naked Capitalism, July 30, 2012):

I’ve watched the Facebook

phenomenon with considerable skepticism, and have refrained from commenting on it, save linking to stories such as GM canceling all of its Facebook ads because they didn’t see the benefit.

But this item via reader Chuck L was a real eye-opener. It suggests that Facebook may be a large-scale fraud. If not Facebook, who would be running the bots in question? Their second complaint, about the cost of a name change, is merely tacky customer-gouging, but the first suggests that the Facebook business model is a complete fail, whether the clicks are from Facebook bots or other bots.

I’ve snapshotted this page in case it disappears, but this is on Facebook now, from Limited Run:

Four Sentenced To Death Over $2.6 BILLION Iran Bank Fraud

– Four sentenced to death over $2.6bn Iran bank fraud (BBC News, July 30, 2012):

Four people have been sentenced to death for their roles in Iran’s biggest-ever bank fraud scandal.

Two other defendants received life sentences, while 33 more will spend up to 25 years in jail, the chief prosecutor was quoted as saying.

The scandal involved forged documents reportedly used by an investment company to secure loans worth $2.6bn.

Read moreFour Sentenced To Death Over $2.6 BILLION Iran Bank Fraud

Max Keiser Talks About Bailouts In 60 Seconds (Video)

YouTube Added: 28.07.2012

Keiser Report: Hang ‘Em High! (Video)

YouTube Added: 28.07.2012

Description:

In this episode, Max Keiser presents a double header with co-host, Stacy Herbert, to discuss crime and punishment in the financial sector. In London, JP Morgan banker, Tony Blair, has responded to the Keiser Report with his claim that hanging 20 bankers will not help and that, in fact, he asserts, public anger with the financial crisis is wrong. They also discuss the ‘blazer over cuffs look’ being the new black this season as Sean Fitzpatrick is arrested in Dublin, while over in Pennsylvania, Joe Paterno’s statue is draped in blue tarpaulin and hauled away as bond investors punish the university with higher rates and Moody’s threatens a downgrade. Finally, in Los Angeles, victims of vandalism are shocked to discover that it was a senior UBS banker who was smashing windows with a slingshot.

September: Crunchtime For Europe And Germany

So get your popcorn ready!

Related info:

– CDU’s Michael Fuchs: ‘Greece Cannot Be Saved, That Is Simple Mathematics’

– Greece To Run Out Of Money And Go Bankrupt By August 20

– Spain Is Out Of Money In 40 Days … And ‘Spain Has No Plan B’ (FAZ)

– September: Crunchtime For Europe And Germany (ZeroHedge, July 30, 2012):

“September will undoubtedly be the crunch time,” one senior euro zone policymaker said. “In nearly 20 years of dealing with EU issues, I’ve never known a state of affairs like we are in now,” one euro zone diplomat said this week. “It really is a very, very difficult fix and it’s far from certain that we’ll be able to find the right way out of it.”

As Europe’s fight with the twin demons of logic and math continues, time is running out. And as eurocrats take their mandatory vacations for a job well done and spend the next two weeks lounging on some Mediterranean island or listening to opera, Europe will enter hibernation mode, courtesy of a slow down in sovereign bond issuance, all of which however will change very quickly once September rolls in which as Reuters describes, “is shaping up as a “make-or-break” month as policymakers run desperately short of options to save the common currency.” It is then that we will find if all that money spent on newsletter promoting active prayer to push the hands of central planners in that direction or the other, was well spent, or just thrown in the same cash black hole which is the final restring place for hundreds of billions in “bailout money” which has achieved nothing but perpetuating the same destructive behavior that it was meant to change.

Reuters explains why September will also be known as the popcorn month: