See also:

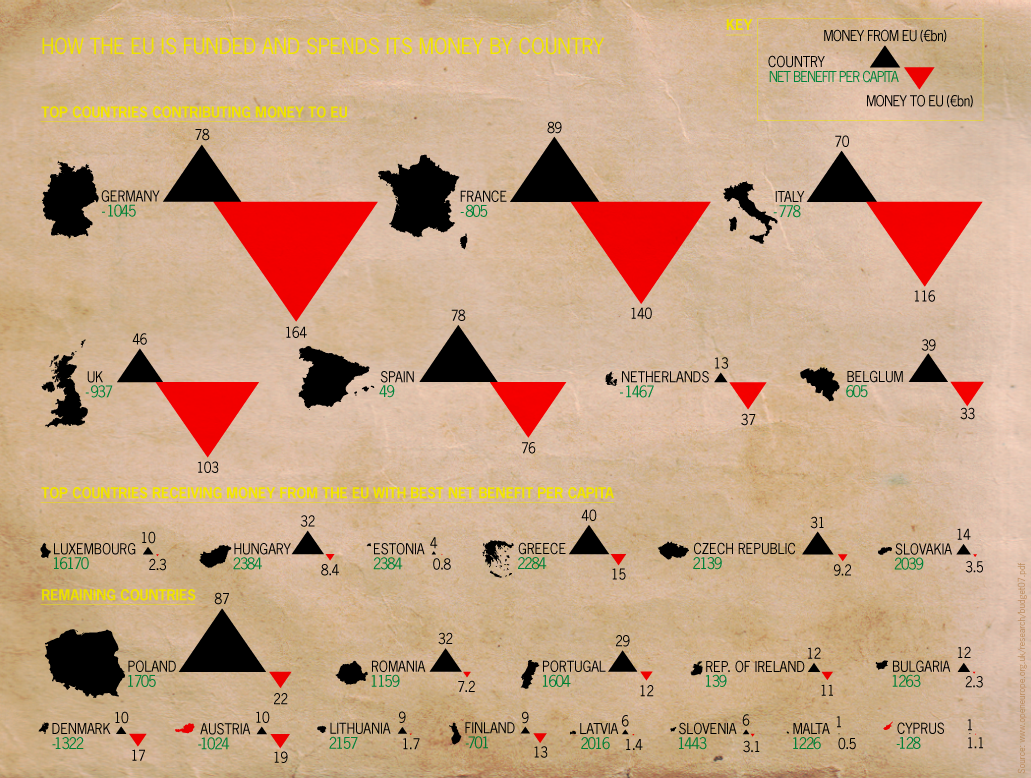

– Portugal, Not Greece, Poses The Greater Existential Threat To Europe’s Monetary Union (Telegraph)

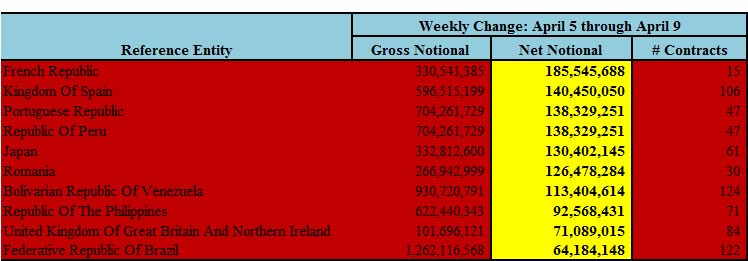

– CDS Traders Are Betting That France Is Next Up For A Sovereign Shakedown (As Are Spain And Portugal) (ZeroHedge)

– Q&A With Billionaire Jim Chanos Part I: ‘Greece Is A Prelude’ (Business Insider)

Protestors stand in front of the Greek Parliament in Athens, on April 22, 2010. (Bloomberg)

April 22 (Bloomberg) — The European Union said Greece’s budget deficit last year was worse than previously forecast and may top 14 percent of gross domestic product, fueling investor concern about a default and sending its bond yields soaring.

The EU’s statistics office said Greece’s deficit was 13.6 percent of GDP last year, topping the government’s two-week-old forecast of 12.9 percent and the EU’s November prediction of 12.7 percent. “Uncertainties” about the quality of the Greek data may lead to a further revision of as much of 0.5 percentage point, Luxembourg-based Eurostat said.

Greece’s benchmark 10-year bond yield rose to 8.49 percent, the highest since 1998 and more than twice the comparable German rate. The cost of insuring government debt against default climbed to a record today.

Greece’s widening deficit and questions about the accuracy of its economic data have undermined the credibility and enforcement of the EU’s budget rules and contributed to the 6.9 percent slide in the euro this year. The EU and the International Monetary Fund offered Greece as much as 45 billion euros ($60 billion) in emergency loans to assure investors the country can make its debt payments and shore up the euro.

Breaking the Rules

“They have played against the rules and now they’re getting the bill,” said Sylvain Broyer, chief European economist at Natixis in Frankfurt. “It’s a very uncomfortable situation for the Greek government. Greece has very much benefited from the currency region, but ignored the rules.”

Read moreGreece Faces Bond Rout as Budget Deficit Worsens, Greek Workers Strike