Most countries in Europe are already in depression.

Ask Gerald Celente and others if you don’t believe me.

The big reset, the greatest economic collapse in world history is coming.

This is the ‘Greatest Depression’.

And many people seem not to get what I am really talking about when I say ‘prepare for collapse’ and what I mean by ‘total collapse’ and the resulting consequences.

(You need food, water and full survival gear [And don’t forget that sleeping bag for extreme cold conditions!], gold & silver and if possible a fully equipped, self-sufficient remote farm … and friends.)

– Wake Up! 11 Facts That Show That Europe Is Heading Into An Economic Depression (Economic Collapse, Nov 30, 2012):

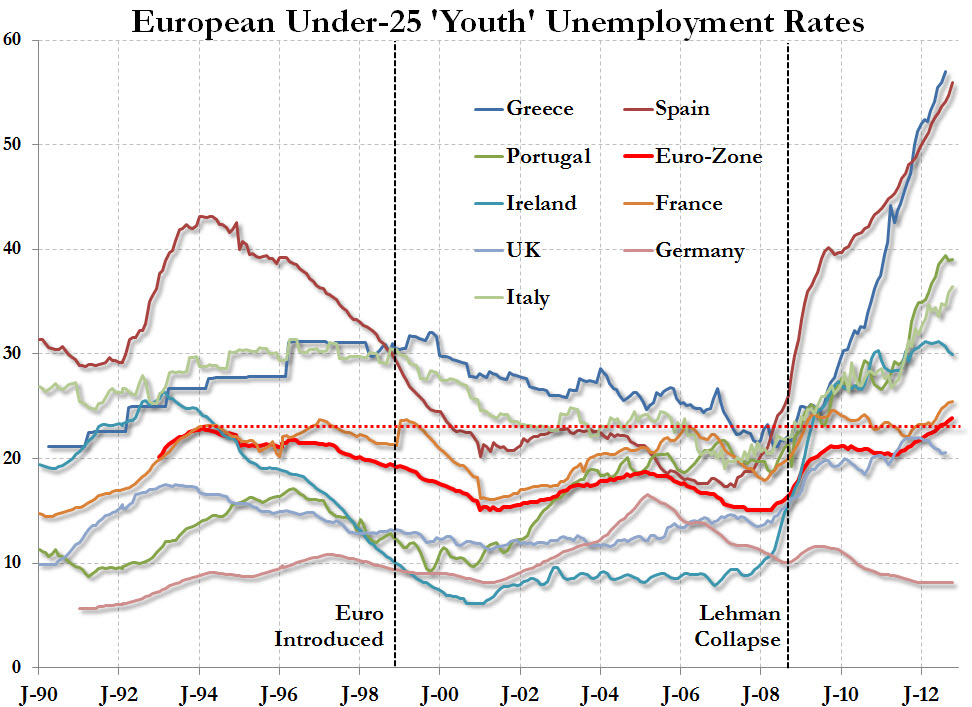

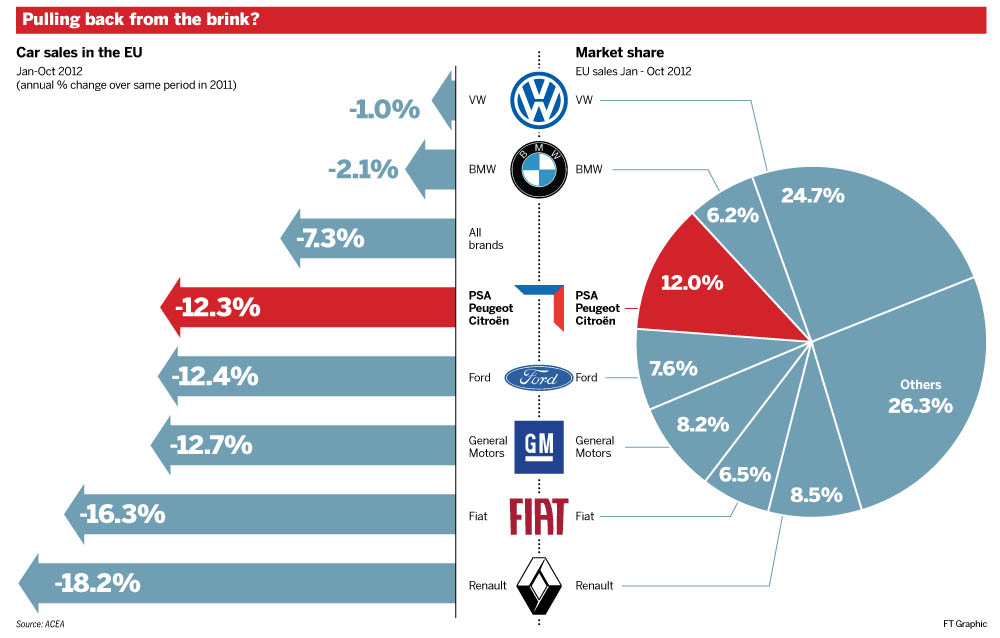

Europe is not just heading into another recession. The truth is that Europe is heading into a full-blown depression. The economy of the EU is actually larger than the U.S. economy, and we are watching it melt down right in front of our eyes. Things just continue to get worse in Europe, and yet somehow the authorities over in Europe just keep insisting that everything is going to be “just fine”. Well, everything is not “just fine” over in Europe right now. Unemployment in the eurozone has just hit another brand new record high. In some nations in Europe, the unemployment rate is already significantly higher than anything the United States experienced during the Great Depression of the 1930s. Europe is a continent that is collapsing under the weight of its own debt, and this is just the beginning. A lot more pain is on the way. Officials over in Europe are trying to hold the European financial system together with duct tape and prayers, but it could literally fall apart at any moment. Europe has a much larger banking system than the United States does, so when a financial collapse happens in Europe, it is going to be very significant for the entire globe. Sadly, most Americans do not even pay attention to much of anything that is happening in Europe. They tend to think that the United States is the center of the universe and that as long as we are fine that everything will be okay. Well, all of those people who are not paying attention need to wake up. First of all, the U.S. economy is most definitely in decline. Secondly, the European economy is imploding right in front of our eyes and Europe is going to end up dragging the entire globe down with it.The following are 11 facts that show that Europe is heading into an economic depression…

Read moreWake Up! 11 Facts That Show That Europe Is Heading Into An Economic Depression