Former CEO of Deutsche Bank Josef Ackermann in 2008

– Bombshell: Deutsche Bank Hid $12 Billion In Losses To Avoid A Government Bail-Out (ZeroHedge, Dec 5, 2012):

Forget the perfectly anticipated Greek (selective) default. This is the real deal. The FT just released a blockbuster that Europe’s most important and significant bank, Deutsche Bank, hid $12 billion in losses during the financial crisis, helping the bank avoid a government bail-out, according to three former bank employees who filed complaints to US regulators. US regulators, whose chief of enforcement currently was none other than the General Counsel of Deutsche Bank at the time!

The three complaints, made to regulators including the US Securities and Exchange Commission, claim that Deutsche misvalued a giant position in derivatives structures known as leveraged super senior trades, according to people familiar with the complaints.

All three allege that if Deutsche had accounted properly for its positions – worth $130bn on a notional level – its capital would have fallen to dangerous levels during the financial crisis and it might have required a government bail-out to survive.

Instead, they allege, the bank’s traders – with the knowledge of senior executives – avoided recording “mark-to-market”, or paper, losses during the unprecedented turmoil in credit markets in 2007-2009.

Two of the former employees allege that Deutsche mismarked the value of insurance provided in 2009 by Warren Buffett’s Berkshire Hathaway on some of the positions. The existence of these arrangements has not been previously disclosed.

Naturally, DB is defending itself in the only way it knows: “this is complicated stuff, and we know better than those guys.” In other words, this is just a “tempest in a teapot.” Where have we heard that before…

The bank said the investigation revealed that the allegations “stem from people without personal knowledge of, or responsibility for, key facts and information”. Deutsche promised “to continue to co-operate fully with the SEC’s investigation of this matter”.

The complaints were made at different times in 2010 and 2011 independently of each other. All of the men spent hours with SEC enforcement attorneys and provided internal bank documents during multiple meetings, people familiar with the matter say.

SEC enforcement attorneys eh? Because this is where it gets really fun: the person who was in charge of DB’s legal compliance at the time was none other than Robert Khuzami. The same Robert Khuzami who just happens to be the chief of enforcement at the SEC!

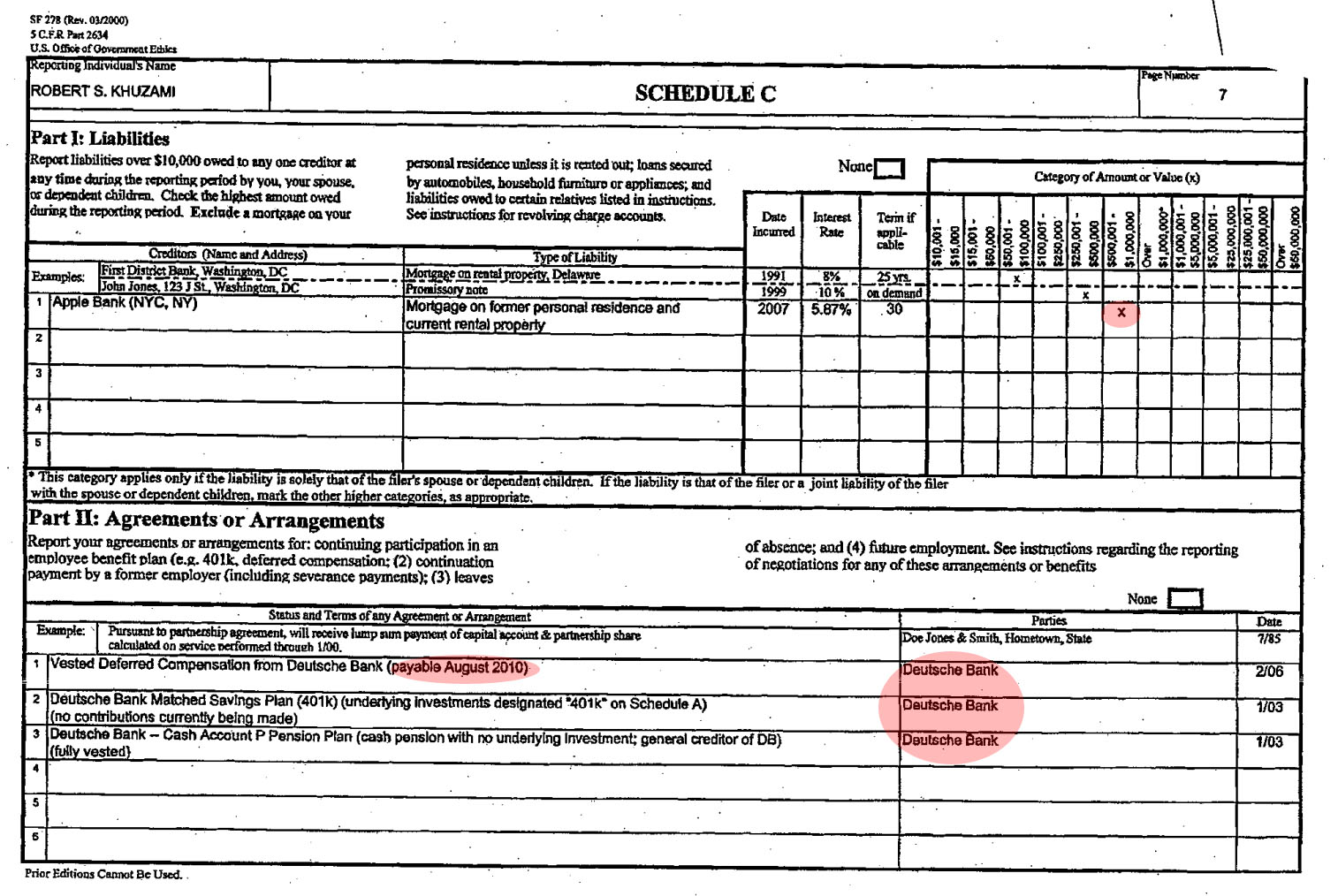

Robert Khuzami, head of enforcement at the SEC, has recused himself from all Deutsche Bank investigations because he was Deutsche’s general counsel for the Americas from 2004 to 2009. Dick Walker, Deutsche’s general counsel, is a former head of enforcement at the SEC. The SEC declined to comment on the investigation.

Sadly, the “we are too sophisicated” defense may not be very effective this time.

Two of the former Deutsche employees have alleged they were pushed out of the bank as a result of reporting their concerns internally.

One of them, Eric Ben-Artzi, a risk manager at Deutsche, was fired three days after submitting a complaint to the SEC. In a separate complaint to the Department of Labor, he claims his dismissal was retaliation for his allegations.Matthew Simpson, a senior trader at Deutsche, also left the company after submitting his own complaint to the SEC. Mr Simpson declined to comment. Deutsche Bank paid Mr Simpson $900,000 to settle his anti-retaliation lawsuit. Reuters reported in June 2011 that Mr Simpson had raised concerns about improper valuation of the derivatives portfolio.

The third complainant, who worked in risk management and has requested anonymity, raised his concerns to the SEC and voluntarily left the bank.

Or actually, since every bank in the world is forced to lie, cheat and mismark its own balance sheets every single day, not least of all the European Central Bank which as of moments ago has to accepted defaulted Greek bonds as collateral, this may just be completely ignored.

After all opening this particular Pandora’s Box may well reveal that not only DB but the world’s entire financial system is completely and totally insolvent.

* * *

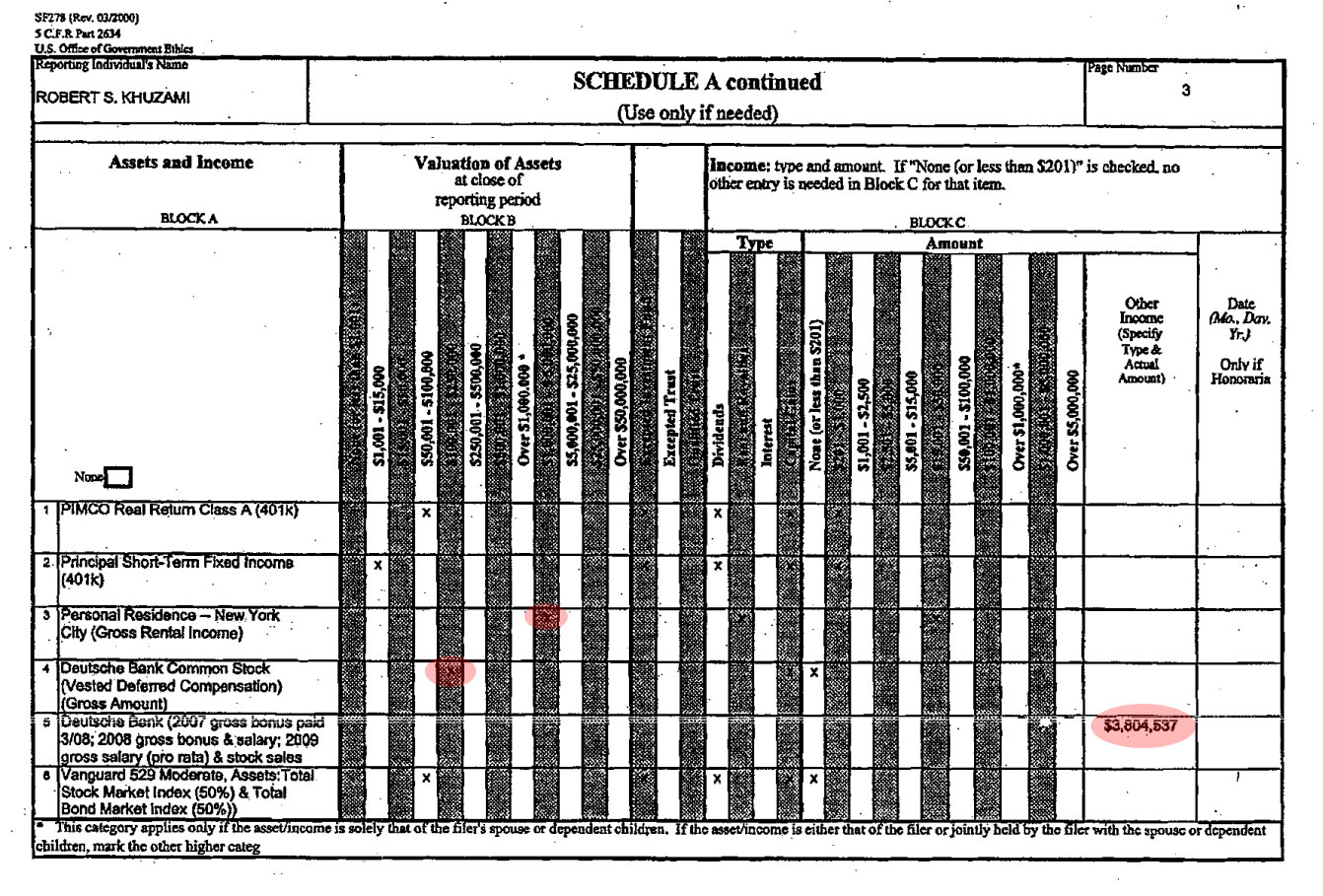

And for those curious why the SEC’s chief enforcer will never lift a finger against his own bank, all other considerations and recusals aside, here is what we wrote back in May 2010

Robert Khuzami Stands To Lose Up To $250,000 If He Pursues Action Against Deutsche Bank

When the SEC’a Robert Khuzami recently recused himself of pursuing an investigation against Deutsche Bank in regard to potential CDO malfeasance, a bank where it is common knowledge the CDOs flowed (and were shorted “where appropriate” by Mr. Lippmann and his henchmen) like manna from heaven, we were curious just how large the conflict of interest must be for him to not pursue his official duty. Luckily, we were able to answer this question when we recently encountered Mr. Khuzami’s Public Financial Disclosure Report for Executive Branch Personnel. It appears that Mr. Khuzami, who from 2002 to 2009 worked at DB, most recently as General Counsel, might have directly profited quite handsomely from the very activity he is now prosecuting Goldman, and other banks very likely soon, for engaging in. How handsomely? His 2007 bonus, 2008 salary and bonus, and 2009 salary added up to $3,804,537. This works out to about $1.9 million in comp per year. And let’s not forget that 2006/2007 was the peak years for DB’s CDO issuance. It sure seems Mr. Khuzami benefited nicely as a participant in precisely the kind of CDO gimmickry that he is currently all over Goldman for. Yet most ironic, is that Robert is expecting to receive between $100,001 and $250,000 in vested deferred stock comp from Deutsche Bank in August 2010. Should he, or someone else at the SEC, commence an investigation into Khuzami’s former employer, the SEC’s Director of Enforcement is sure to lose a substantial amount of money tied into the absolute value of Deutsche Bank stock.

And it doesn’t end there. Khuzami lists the following asset holdings as of June 2009:

- Federated US Treasury Cash Reserves: $1,001-$15,000

- US Treasury Cash Reserves: $1,000,001-$5,000,000

- Fidelity Advisor New Insights Fund: $15,001-$50,000

- Henderson Int’l Opportunities Fund: $15,001-$50,000

- Deutsche Bank Cash Account Pension Plan: $100,001-$250,000

- DB Stable Value Fund: $1,001-$15,000

- Goldman Sachs Mid Cap Value Fund: $1,001-$15,000

- Dodge and Cox Int’l Stock Fund: $50,001-$100,000

- SSGA Money Market Fund: $15,001-$50,000

- Delaware Emerging Markets: $50,001-$100,000

- Gateway Fund (401k): $15,001-$50,000

- Third Avenue Real Estate Fund (401k): $15,001-$50,000

- Touchstone MidCap Growth Class A (401k): $15,001-$50,000

- Wells Fargo Endeavor Select FD (401k): $15,001-$50,000

- Yacktman Fund (401k): $15,001-$50,000

- PIMCO Real Return Class A (401k): $50,001-$100,000

- Principal Short-Term Fixed Income (401k): $1,001-$15,000

- Personal Residence – New York (Gross Rental Income): $1,000,001-$5,000,000

- Deutsche Bank Common Stock (Vested Amount Compensation): $100,001-$250,000

- Vanguard 529 Moderate: $50,001-$100,000

- Vanguard 529 Aggressive: $1,001-$15,000

It appears Mr. Khuzami has done quite well while working in the private sector, undoubtedly defending his German employer from precisely the same actions he, or someone else at the SEC, may soon charge the firm was defrauding investors by. His total disclosed asset range from $2,525,000 to $11,375,000. It is also ironic that nearly half Mr. Khuzami’s assets are contained in real estate, and not to mention that a substantial amount of his assets are also contained in Deutsche Bank plans as well as DB stock deferred comp. In fact, let’s take a look at that deferred comp of $100,001-$250,000 a little closer.

It appears the SEC’s Enforcement Director has between $100,001 and $250,000 in DB deferred stock compensation, which becomes payable in August 2010. Obviously this is not a trivial number. And while Khuzami may have recused himself from pursuing DB for CDO infarctions, that does not mean that some other SEC enforcer (surely, their $1 billion a year budget allows them at least more than one enforcement professional) would not be able to go after DB. The problem as we see it is that since the announcement of the SEC case against Goldman the firm has lost about 25% of its market cap. It is conceivable that DB, which dabbled far more in CDOs, and thus the SEC would have a much stronger case agaisnt the bank, would thus lose far more of its market cap should the SEC announce a case against the Germans. In fact, we could be looking at Mr. Khuzami’s Vested Deferred Compensation value dropping from $100,001 – $250,000 to maybe even as low as $15,001-$50,000. Then again, this becomes irrelevant after August, when the former DB GC will have collected all his dues. Does this mean we should expect nothing from the SEC against Deutsche Bank for at least 4 more months? And is September 1 the day when the SEC formally announces charges against Deutsche? We would love to get the SEC’s feedback on this.

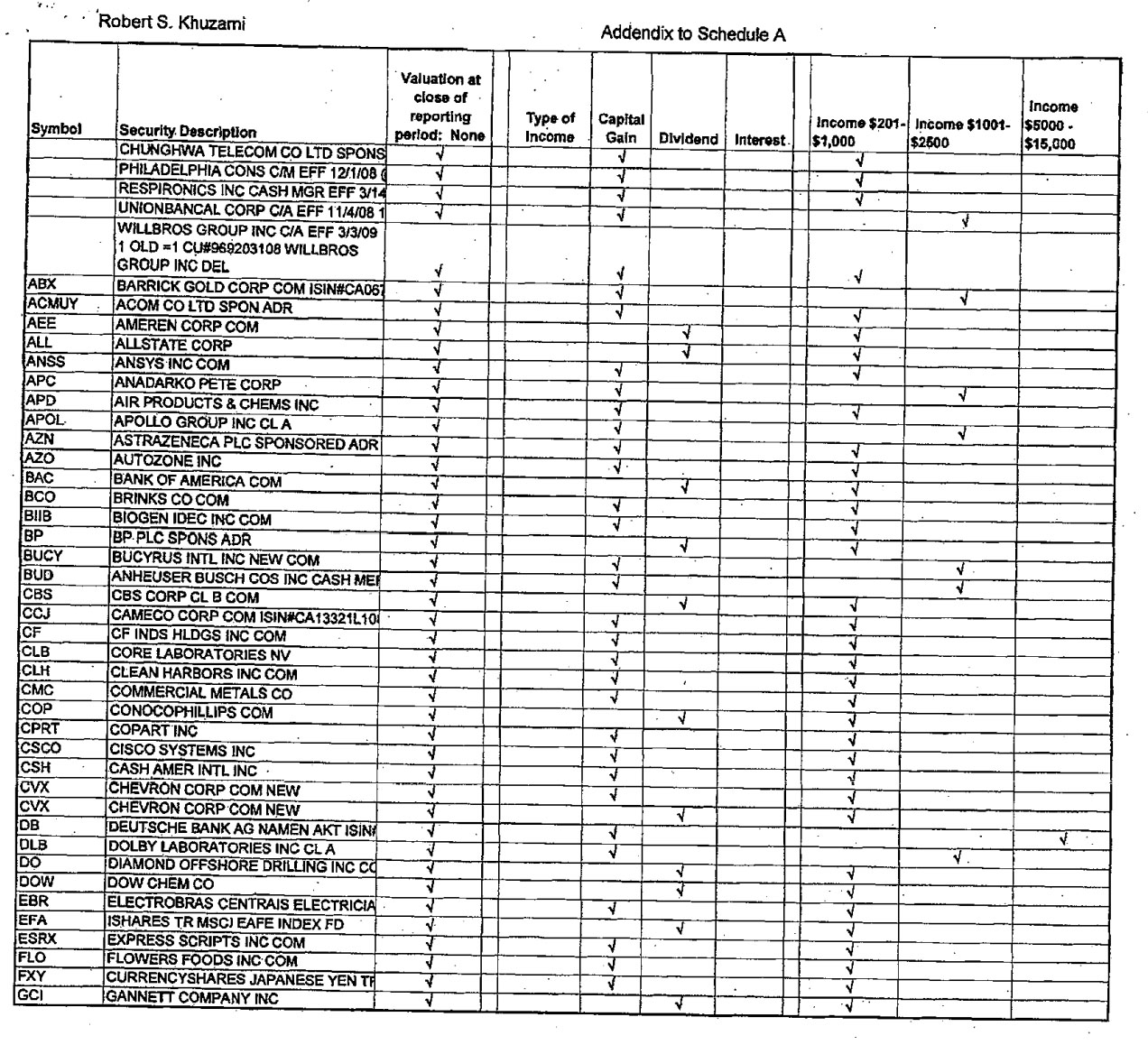

Mr. Khuzami’s potential conflicts of interest do not end with his open exposure to Deutsche Bank. His Schedule A appendix indicates that the man has open equity positions with firms such as Bank of America, Deutsche Bank, and JP Morgan. To wit:

Would this mean that Mr. Khuzami, and thus the entire SEC Enforcement Division, if judging by the Deutsche Bank case study, would recuse itself of investigating these three firms from an enforcement standpoint?

We certainly do not begrudge Khuzami’s generous winnings as part of the private sector. If anything, any borderline criminal activity he may have helped cover up as GC of Deutsche (an act he was supposed to do so no ill-will there) should provide him with the knowledge to prosecute just such activity. However, when the head of the main US regulator’s enofrcement body is so terminally ensnared in not just the Wall Street complex, but in the very fabric of Keynesianism (that up to $5,000,000 Treasury holding for example and not to mention his up to $5,000,000 rental property), the population should ask just how extremely biased this man can be when prosecuting the very system that allows him to have up to $11 million in assets currently tied in to the perpetuated status quo. Surely, should the Fed, and the market in general, be “surprisingly” uncovered to be the same ponzi construct as Madoff’s pyramid scheme, Khuzami, and who knows how many other people, stand to lose virtually the bulk of their assets. This makes them very much conflicted in any real enforcement action, and certainly not independent or impartial. Perhaps Dodd, in his joke of a bill, can consider just how to establish a securities regulator which by its very nature is not constantly in bed with the very subject it is supposed to be investigating.

The entire Eurozone is leaning on Germany to keep them afloat……..this is powerful and very dangerous news. At least the Financial Times covered it, I bet most of the media will bury it. The portend of this is too serious to comtemplate…….it is a disaster.

The only growth over the past 12+ years in the western economy has been debt…….nothing else. Unsustainable. If the Euro goes down, so goes the rest of us, the Euro is (supposedly) the largest economy in the world…..except it is based on lies and fiction, just like the US banks.

We have all been fortunate to live in an era of a stable world economy. That is gone, and when it comes to light, the chaos will be something we have never experienced.