YouTube Added: 24.04.2013

Central Bank

Bill Fleckenstein Of Fleckenstein Capital: Hold Tight To Your Gold (Video)

Click the play button below to listen to Chris’ interview with Bill Fleckenstein (28m:26s)

– Bill Fleckenstein: Hold Tight To Your Gold (PeakProsperity, April 21, 2013):

Why it’s going to go “one hell of a lot” higher

The bond market is an accident waiting to happen.

When the bond market finally does crack, it is going to be one epic nightmare that is going to make 2008 and 2009 seem like a picnic. It will be a different kind of a crisis; but it will be an enormous crisis. These people that are bullish about stocks and bonds and the bond market, they do not understand anything.

We will hit a moment in time where there will be a rapid acceleration of the perception that people are being cheated via inflation by these money-printing policies. Why Americans seem to think there is no inflation just because the CPI says so, when their checkbooks every day ought to tell them there is, I cannot explain that. But there will be a change in psychology, and there will be a massive stampede into gold here and everywhere else around the world, because it is the only way you can protect yourself against these policies.

Pity the wise money manager these days. Our juiced-up financial markets, force-fed liquidity by the Fed the other major world central banks, are pushing asset prices far beyond what the fundamentals merit.

If you see this reckless central planning behavior for what it is – a deluded attempt to avoid reality for as long as possible – your options are limited if you take your fiduciary duty to your clients seriously.

Read moreBill Fleckenstein Of Fleckenstein Capital: Hold Tight To Your Gold (Video)

Bank Of England Admits ‘Stocks Don’t Reflect Economic Reality’

– Bank Of England Admits “Stocks Don’t Reflect Economic Reality” (ZeroHedge, April 5, 2013):

The Bank of England’s Financial Policy Committee (BoEFPC) warns there is “evidence of the re-emergence of… behavior in financial markets not seen since before the financial crisis,” citing the increased issuance of synthetic products and added that banks have “little margin for error against a backdrop of low growth in the advanced economies,” despite what we are told about their ‘fortress balance sheets. Bloomberg Businessweek adds that the BoE were careful not to scare the public, they add, events currently “did not appear indicative of widespread exuberance in markets. But developments would need to be monitored closely.” This following the Fed’s warnings of ‘froth’ in the credit markets suggests central bans are considerably more concerned at blowing bubbles than they want to admit in public. ECB’s Weber recently commented that he feared, “the recent rally in financial markets could be a misleading signal,” which appears confirmed by the BoEFPC noting that equity performance since mid-2012, “in part reflected exceptionally accommodative monetary policies by many central banks… But market sentiment may be taking too rosy a view of the underlying stresses.”

The Bank of England said rising equity markets don’t reflect the underlying economic situation and warned that investors may be underestimating risks in the financial system.

Gains by equities since mid-2012 “in part reflected exceptionally accommodative monetary policies by many central banks,” the BOE’s Financial Policy Committee said today in London in the minutes of its March 19 meeting. “It was also consistent with a perception among some contacts that the most significant downside risks had attenuated. But market sentiment may be taking too rosy a view of the underlying stresses.”

Read moreBank Of England Admits ‘Stocks Don’t Reflect Economic Reality’

Hedge Fund Manager Kyle Bass: ‘Japan Will Implode Under Weight Of Their Debt’ (Video)

– Kyle Bass: “Japan Will Implode Under Weight Of Their Debt” (ZeroHedge, April 4, 2013):

As the fast-money flabber-mouths stare admiringly at the rise in nominal prices of Japanese (and the rest of the world ex-China) stock prices amid soaring sales of wheelbarrows following Kuroda’s ‘shock-and-awe’ last night, it is Kyle Bass who brings these surrealists back to earth with some cold-hard-facting. Out of the gate Bass explains the massive significance of what the Japanese are embarking on, “they are essentially doubling the monetary base by the end of 2104.”

It is a “Giant Experiment,” he warns, but when you are backed into a corner and your debts are north of 20 times your government tax revenue, “you’re already insolvent.” Simply put, Bass says they have to do something and they have to something big because they are “about to implode under the weight of their debt.” For a sense of the scale of the BoJ’s ‘experimentation’, Bass sums it up perfectly (and concerningly), “the BoJ is monetizing at a rate around 75% of the Fed on an economy that is one-third the size of the US!”

What they are trying to do is devalue the currency to attempt to become more competitive while holding their rates market flat – the economic zealots running the world’s central banks believe they can live in that Nirvana – and Bass believes that is not the case, as they will lose control of rates, since leaving the zone of insolvency is impossible now. His advice, “if you’re Japanese, spend! or take it out of your country. If you’re not, borrow in JPY and invest in productive assets.” Do not be long JPY or Japanese assets as he concludes with the reality of Japan’s “hollowed out” manufacturing industry and why USDJPY is less important that KRWJPY.

Bank Of Japan To Pump $1.4 TRILLION Into Economy In Unprecedented ‘Stimulus’

Commentary:

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. … This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.”

– Alan Greenspan“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

– John Maynard KeynesQuantitative easing = printing money = creating money out of thin air = increasing the money supply = inflation = hidden tax on monetary assets = theft!

– Where Humor & Reality Meet: Quantitative Easing Explained (Video):

Bank of Japan Governor Haruhiko Kuroda

– BOJ to pump $1.4 trillion into economy in unprecedented stimulus (Reuters, April 4, 2013):

The Bank of Japan unleashed the world’s most intense burst of monetary stimulus on Thursday, promising to inject about $1.4 trillion into the economy in less than two years, a radical gamble that sent the yen reeling and bond yields to record lows.

New Governor Haruhiko Kuroda committed the BOJ to open-ended asset buying and said the monetary base would nearly double to 270 trillion yen ($2.9 trillion) by the end of 2014, a dose of shock therapy officials hope will end two decades of stagnation.

The policy was viewed as a radical gamble to boost growth and lift inflation expectations and is unmatched in scope even by the U.S. Federal Reserve’s own quantitative easing program.

The Fed may buy more debt, but since Japan’s economy is about one-third the size of the economy, Kuroda’s plan looks even bolder.

“This is an unprecedented degree of monetary easing,” a smiling Kuroda told a news conference after his first policy meeting at the helm of the central bank.

Read moreBank Of Japan To Pump $1.4 TRILLION Into Economy In Unprecedented ‘Stimulus’

Oooops … (Memo From The Central Bank Of Cyprus Sent To Bank CEOs)

– Oooops… (ZeroHedge, March 29, 2013)

After reading this memo from the Central Bank of Cyprus sent to bank CEOs on February 11, arguably to put them at ease, all we can say is “Oooops”…

We’ll ignore the contents of the memo, including such statements that “restricting the property rights of depositors” is unconstitutional – that is after all for the people of Cyprus to opine on (we did however have a hearty laugh upon learning that there is a European Convention of Human Rights),

As for the FT article referenced? The following, from February 10, which references a “confidential memo” which foretold the events from two weeks ago with absolute precision :

Read moreOooops … (Memo From The Central Bank Of Cyprus Sent To Bank CEOs)

Cyprus Church Loses EUR100 Million, Curses Those Responsible

– Cyprus Church Loses EUR100 Million, Curses Those Responsible (ZeroHedge, March 25, 2013):

Perhaps it was their comment last week that “with the brains in Brussels… the Euro can’t last,” but the Orthodox Church of Cyprus has lost over EUR100 million reacted to its holdings in Bank of Cyprus. Church leader Archbishop Chrysostomos II, in comments on TV, noted that “Cyprus asked for ‘crumbs’ compared to large size of Europe’s budget,” and that those responsible in Cyprus should be punished (he blames the outgoing government, Ministers of Finance, the Central Bank, and the Executive Directors of Banks) – “those that brought the place into this mess, should sit on the stool.” He noted that people will lose jobs and the state will be poorer but that the Church is prepared to help; and his first step – to send invitations to the heads of various Russian companies on the island.

Heads of Russian companies operating in Cyprus will call a working lunch, next Thursday, March 28, 2013, His Beatitude Archbishop Chrysostomos Mr. to encourage them to remain in Cyprus.

Read moreCyprus Church Loses EUR100 Million, Curses Those Responsible

US Begins Regulating BitCoin, Will Apply ‘Money Laundering’ Rules To Virtual Transactions

From the article:

The WSJ reports that, “the U.S. is applying money-laundering rules to “virtual currencies,” amid growing concern that new forms of cash bought on the Internet are being used to fund illicit activities. The move means that firms that issue or exchange the increasingly popular online cash will now be regulated in a similar manner as traditional money-order providers such as Western Union Co. They would have new bookkeeping requirements and mandatory reporting for transactions of more than $10,000. Moreover, firms that receive legal tender in exchange for online currencies or anyone conducting a transaction on someone else’s behalf would be subject to new scrutiny, said proponents of Internet currencies.

– US Begins Regulating BitCoin, Will Apply “Money Laundering” Rules To Virtual Transactions (ZeroHedge, March 21, 2013):

Last November, in an act of sheer monetary desperation, the ECB issued an exhaustive, and quite ridiculous, pamphlet titled “Virtual Currency Schemes” in which it mocked and warned about the “ponziness” of such electronic currencies as BitCoin. Why a central bank would stoop so “low” to even acknowledge what no “self-respecting” (sic) PhD-clad economist would even discuss, drunk and slurring, at cocktail parties, remains a mystery to this day. However, that it did so over fears the official artificial currency of the insolvent continent, the EUR, may be becoming even more “ponzi” than the BitCoins the ECB was warning about, was clear to everyone involved who saw right through the cheap propaganda attempt. Feel free to ask any Cypriot if they would now rather have their money in locked up Euros, or in “ponzi” yet freely transferable, unregulated BitCoins.For the answer, we present the chart showing the price of BitCoin in EUR terms since the issuance of the ECB’s paper:

Read moreUS Begins Regulating BitCoin, Will Apply ‘Money Laundering’ Rules To Virtual Transactions

Regulator: Cyprus Popular Bank To Be Shuttered … UPDATE: Central Bank Denies

– Cyprus Popular Bank To Be Shuttered (UPDATE: Central Bank Denies) (ZeroHedge, March 21, 2013):

UPDATE: Cyprus Central Bank says hasn’t been informed of closure (and then back-pedals)…

- *CYPRUS CENTRAL BANK HASN’T BEEN INFORMED, TAKEN SUCH DECISION

- *CYPRUS CENTRAL BANK SAYS REORGANISATION NOT SAME AS CLOSURE

Refuting earlier comments from the regulator that Cyprus Popular Bank would not be shuttered, CYBC is reporting (following the failure to sell it to the Russians) that the bank is to be shut down, split into good-bank-bad-bank, and that deposits under EUR100,000 will be protected.

- *CYPRUS POPULAR BANK TO BE SHUT DOWN, STATE-RUN CYBC SAYS

- *CYPRUS POPULAR BANK TO BE SPLIT IN GOOD, BAD BANKS: CYBC

- *CYPRUS POPULAR BANK ASSET PROCEEDS TO BE RETURNED TO DEPOSITORS

- *CYPRUS POPULAR BANK DEPOSITS OF LESS THAN EU100,000 GUARANTEED

Of course, we await the re-refutation but for now it seems the latest news trumps the regulators ‘lies’ earlier.

Former Cyprus Central Bank Head Anthanasios Orphanides: ‘EU Is Blackmailing Cyprus Government’ (Bloomberg Video)

MUST-SEE!

– EU Is Blackmailing Cyprus Government: Orphanides (Bloomberg, March 19, 2013):

March 19 (Bloomberg) — Anthanasios Orphanides, former Central Bank of Cyprus Governor, considers the proposed Cyprus bank depositor tax a form of blackmail against the government of Cyprus. He speaks on Bloomberg Television’s “Bloomberg Surveillance.”

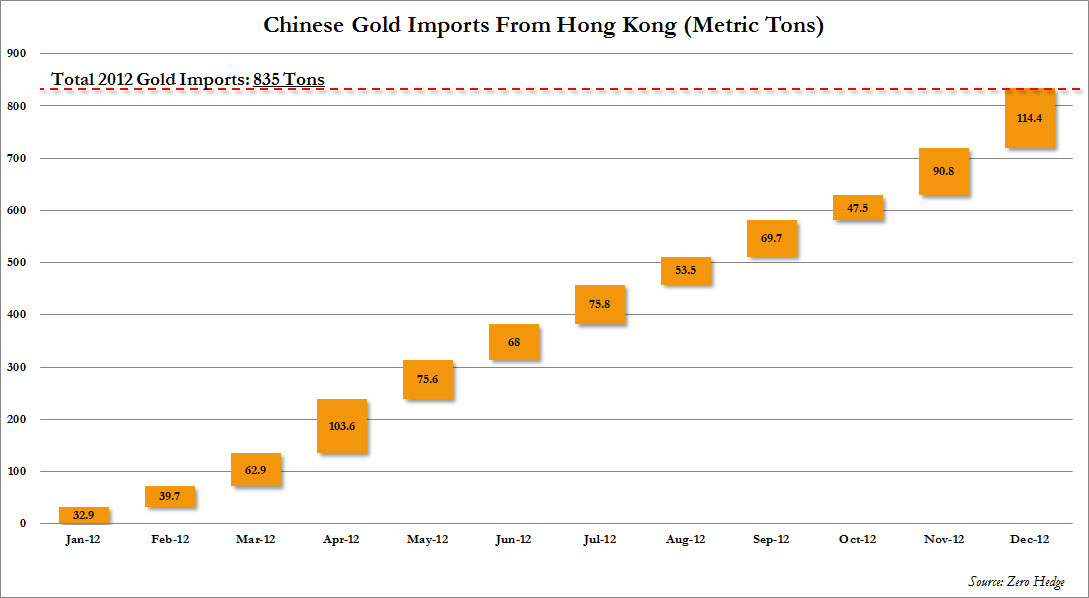

Sprott: China’s Gold Reserves: Watch What They Do, Not What They Say

Sprott had its origins in Sprott Securities Ltd., a brokerage firm founded in 1981 by Eric Sprott. Today, Sprott manages approximately $10 billion in assets and operates through four businesses:

- Asset Management

- Physical Bullion

- Private Equity and Debt

- Wealth Management

– China’s Gold Reserves: Watch What They Do, Not What They Say (ZeroHedge, March 18, 2013):

Yi Gang, Vice Governor of the People’s Bank of China (PBOC), recently made the headlines with his comments on Chinese gold reserves. On Wednesday, Mr. Yi stated that China’s gold reserves remain static at 1,054 tonnes, and suggested that a sizeable increase in those reserves would be unlikely in the future. “We need to take into account both the stability of the market and gold prices,” Mr. Yi stated, adding that as the world’s largest gold producer and importer, China produces about 400 tonnes of gold annually, and imports an additional 500 to 600 tonnes of gold every year. “Compared with China’s 3.3-trillion-U.S.-dollar foreign exchange reserves, the size of the gold market is too small,” Yi said, rejecting speculation that China would further diversify its foreign reserve investments into the precious metal. “If the Chinese government were to buy too much gold, gold prices would surge, a scenario that will hurt Chinese consumers … We can only invest about 1-2 percent of the foreign exchange reserves into gold because the market is too small,” Yi stated.

If Yi’s comments are to be believed, he is implying that the Chinese government has not added a single gold bar to its reserves since 2009 – which was the year the Chinese government officially announced its gold reserve increase to 1,054 tonnes. Given the production and import numbers stated above, we find that extremely hard to believe.

Mr. Yi’s comments stand in stark contrast to earlier comments made by Chinese government officials regarding the need to increase China’s gold reserves to ensure economic and financial safety, promote yuan globalization and act as a hedge against foreign-reserve depreciation. In 2009, a State Council advisor known as “Ji” said that a team of experts from Shanghai and Beijing had set up a task force to consider expanding China’s gold reserves. Ji was quoted as saying “we suggested that China’s gold reserves should reach 6,000 tons in the next 3-5 years and perhaps 10,000 tons in 8-10 years”.

Read moreSprott: China’s Gold Reserves: Watch What They Do, Not What They Say

Here Is Why Italy’s Beppe Grillo Is Causing The Power Elite Central Planners To Wet Their Pants (Video)

Must-see!

– Incredible Video: Beppe Grillo Dissects the Financial System…in 1998 (Liberty Blitzkrieg, March 9, 2013):

“Whom does the money belong to? Who does its ownership belong to? To the State fine…then to us, we are the State. You know that the State doesn’t exist, it is only a legal entity. WE are the state, then the money is ours…fine. Then let me know one thing. If the money belongs to us…Why…do they lend it to us??”

– Beppe Grillo in 1998

If you really want to know why Beppe Grillo is causing Central Planners throughout the European continent to wet themselves, this video will show you. There’s a real revolution happening in Italy. This guy is the real deal and he understands the heart of the whole issue plaguing the world. All I can say is: WOW.

China Central Bank Says It Is ‘Fully Prepared For Looming Currency War’

– China Central Bank Says It Is “Fully Prepared For Looming Currency War” (ZeroHedge, March 2, 2013):

Just in case Lagarde (and everyone else except for the Germans, who have a very unpleasant habit of telling the truth), was lying about that whole “no currency war” thing, China is already one step ahead and is fully prepared to roll out its own FX army. According to China Times, “China is fully prepared for a looming currency war should it, though “avoidable,” really happen, said China’s central bank deputy governor Yi Gang late Friday.” We look forward to the female head of the IMF explaining how China is obviously confused and that it is not currency war when one crushes their currency to promote “economic goals.” Of course, that same organization may want to read “Zero Sum for Absolute Idiots” because in this globalized economy any attempt to promote demand (by an end consumer who has no incremental income and stagnant cash flow) through currency debasement has no impact when everyone does it. But then again, this is the IMF – the same organization that declared Europe fixed in 2009, 2010, 2011, 2012, 2013 and so on.

More on China’s FX troop deployments:

Read moreChina Central Bank Says It Is ‘Fully Prepared For Looming Currency War’

Rick Santelli Bashes Central Bankers’ ‘Sand-Castle Economies’ (Video)

– Santelli Bashes Central Bankers’ “Sand-Castle Economies” (ZeroHedge, Feb 19, 2013):

It has been four years since Rick Santelli’s epic “are you listening Mr. President?” speech and the bad behavior has merely been more and more rewarded. Assisted by the enablers of the world – Central Bankers – and their liquidity pump of awesomeness, Santelli exclaims that all we are doing is “promoting bad behavior,” as the elites “build sand castle economies.” His frustration is contagious as he outlines just what has not happened in the last four years – from no-budget to blow-out deficits, and from grand deals to grand bargains to no deals, and Europe’s imploding economies – he sums it up perfectly – “we’re gonna need a lot of luck.”

The Reflation Party Is Ending As China Withdraws Market Liquidity For First Time In Eight Months

– The Reflation Party Is Ending As China Withdraws Market Liquidity For First Time In Eight Months (ZeroHedge, Feb 19, 2013):

Since institutional memories are short, it is time to remind readers that it was the threat, and subsequent reality, of China overheating in the spring and summer of 2011 (when record high food prices sent the entire North African region in a state of coordinated revolt and gradually moved far east), when even the Great firewall of China could not block news of frequent break outs of localized violence from hungry and angry mobs, that halted and broke the spine of the great reflation trade then (and yes, 2013 has so far been a carbon copy replica of 2011 as we summarized in “It’s Deja Vu, All Over Again: This Time Is… Completely The Same“).

Furthermore, as only Zero Hedge forecast back in mid-2012, when ever other commentator was shouting over the rooftops that an RRR or interest rate cut out of Beijing was imminent, the PBOC would be the last to stimulate the market with monetary easing as it was well-aware that an entire developed world reflating at the same time would hit none other than China the fastest as the hot money flew straight into Shanghai. Just as it did in 2011. So instead China proceeded to engage in a series of daily reverse repos, or ultra-short term liquidity injections that prevented the advent of wholesale inflation: after all the Fed, the BOJ, the ECB and soon, the BOE, were doing it for them. And the last thing the country with the highest allotment of CPI, or book inflation, to food and energy can afford, is to let foreign central banks dictate its price level. After all, it has more than enough of its own.

Well, the Chinese New Year celebration is now over, the Year of the Snake is here, and those following the Shanghai Composite have lots to hiss about, as two out of two trading days have printed in the red. But a far bigger concern to not only those long the SHCOMP, but the “Great Reflation Trade – ver. 2013″, is that just as two years ago, China appears set to pull out first, as once again inflation rears its ugly head. And where the PBOC goes, everyone else grudgingly has to follow: after all without China there is no marginal growth driver to the world economy.

End result: China’s reverse repos, or liquidity providing operations, have ended after month of daily injections, and the first outright repo, or liquidity draining operation, just took place after eight months of dormancy.

Chinese authorities took a step to ease potential inflationary pressures Tuesday by using a key mechanism for the first time in eight months.

The move by the central bank to withdraw cash from the banking system is a reversal after months of pumping cash in. That cash flood was meant to reduce borrowing costs for businesses as the economy slowed last year—but recent data has shown growth picking up, along with the main determinants of inflation: housing and food prices.

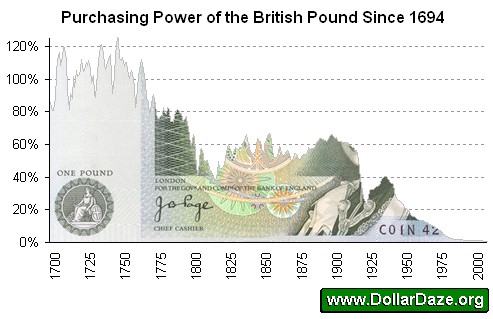

UBS: The British Pound Is At Risk Of ‘Large-Scale Devaluation’

– Forex Flash: The British pound is the next big devaluation story – UBS (Nasdaq, Feb 17, 2013):

Sterling is likely to be the next major currency that depreciates strongly, says Mansoor Mohi-uddin, Head of Foreign Exchange Strategy at UBS Macro Research.

“As central banks tolerate higher levels of inflation, the pound is set to weaken further across the board particularly against our favourite G4 currency, the US dollar” Mr. Mohi-uddin adds.

He concludes: “The GBP seems clearly at risk of following the yen and suffering the next large scale devaluation. As a result, we issued a recommendation that clients buy a six-month sterling put/US dollar call option with a strike of 1.4800.”

Russia And China Hoarding Gold, Killing The Petrodollar

– Petrogold: Are Russia And China Hoarding Gold Because They Plan To Kill The Petrodollar? (Economic Collapse, Feb 12, 2013):

Will oil soon be traded in a currency that is thousands of years old? What would a “gold for oil” system mean for the petrodollar and the U.S. economy? Are Russia and China hoarding massive amounts of gold because they plan to kill the petrodollar? Since the 1970s, the U.S. dollar has been the currency that the international community has used to trade oil around the globe. This has created an overwhelming demand for U.S. dollars and U.S. debt. But what happens when the rest of the globe starts rejecting the increasingly unstable U.S. dollar and figures out that gold can be used as a currency in international trade? The truth is that it doesn’t take a lot of imagination to figure that out. Demand for the U.S. dollar and U.S. debt would fall off the map and there would be a rush into gold unlike anything we have ever seen before. So are Russia and China accumulating unprecedented amounts of gold right now because they eventually plan to cut the legs out from under the petrodollar and they want to gobble up huge stockpiles of gold before the cat is out of the bag? Of course they will never admit this publicly, but there are rumblings out there that this is exactly what is happening.

Read moreRussia And China Hoarding Gold, Killing The Petrodollar

Russia Flips Petrodollar On Its Head By Exporting Crude, Buying Record Gold

– Russia Flips Petrodollar On Its Head By Exporting Crude, Buying Record Gold (ZeroHedge, Feb 10, 2013):

China has been a very active purchaser of gold for its reserves in the last few years, as we extensively covered here and here, but another nation has taken over the ‘biggest buyer’ role (for the same reasons as China).

Central banks around the world have printed money to escape the global financial crisis, and as Bloomberg reports, IMF data shows Russia added 570 metric tons in the past decade. Putin’s fears that “the U.S. is endangering the global economy by abusing its dollar monopoly,” are clearly being taken seriously as the world’s largest oil producer turns black gold into hard assets. A lawmaker in Putin’s party noted, “the more gold a country has, the more sovereignty it will have if there’s a cataclysm with the dollar, the euro, the pound or any other reserve currency.”

Read moreRussia Flips Petrodollar On Its Head By Exporting Crude, Buying Record Gold

‘China Accounts For Nearly Half Of World’s New Money Supply’

– “China Accounts For Nearly Half Of World’s New Money Supply” (ZeroHedge, Feb 8, 2013):

When it comes to the creation of money in China, and specifically the asset side of the ledger, or loans, there is much more confusion than consensus, primarily because nobody knows who it is that is creating the money: private or public entities, SOEs, the PBOC, regional banks, shadow banks, or your next door neighbor.Another thing that is largely misreported: what the actual assets pledged as collateral to new loans are. Because while it is well-known that corporate debt in China is now greater as a percentage of GDP than in any other country, the comprehensive picture is still confusing (albeit GMO did a fantastic summary recently of what is known) as reporting standards are still non-existent, and the government flat out lies about its balance sheet.

Yet one very simple shortcut to get a sense of what is truly happening in monetary China is to peek at the liability side of the consolidated balance sheet, and one line in particular, namely deposits. Because unlike in the US, where the vibrant equity Ponzi scheme has rarely been stronger, in China it is still all about the cash and as a result the bulk of the newly created money once again return back to the banking sector in the form of a deposit. Ironically, that is what banking should be about (instead of the entire industry being a glorified hedge fund) although in China even this practice has gone on way too far, and like in Europe, has long passed the point where there is real collateral value backing up the new money created (which explains the emergence of various letters of credit collateralized by copper still not dug out of the ground which reappear every time Chinese inflation spikes above 5%).

So how do deposits look when comparing the US and China? Well, after having less than half the total US deposits back in 2005, China has pumped enough cash into the economy using various public and private conduits to make even Ben Bernanke blush: between January 2005 and January 2013, Chinese bank deposits have soared by a whopping $11 trillion, rising from $4 trillion to $15 trillion! We have no idea what the real Chinese GDP number is but this expansion alone is anywhere between 200 and 300% of the real GDP as it stands now.

Read more‘China Accounts For Nearly Half Of World’s New Money Supply’

An Unelected, Unaccountable Central Bank Of The World Secretly Controls The Money

– Who Controls The Money? An Unelected, Unaccountable Central Bank Of The World Secretly Does (Economic Collapse, Feb 5, 2013):

An immensely powerful international organization that most people have never even heard of secretly controls the money supply of the entire globe. It is called the Bank for International Settlements, and it is the central bank of central banks. It is located in Basel, Switzerland, but it also has branches in Hong Kong and Mexico City. It is essentially an unelected, unaccountable central bank of the world that has complete immunity from taxation and from national laws. Even Wikipedia admits that “it is not accountable to any single national government.” The Bank for International Settlements was used to launder money for the Nazis during World War II, but these days the main purpose of the BIS is to guide and direct the centrally-planned global financial system. Today, 58 global central banks belong to the BIS, and it has far more power over how the U.S. economy (or any other economy for that matter) will perform over the course of the next year than any politician does. Every two months, the central bankers of the world gather in Basel for another “Global Economy Meeting”. During those meetings, decisions are made which affect every man, woman and child on the planet, and yet none of us have any say in what goes on. The Bank for International Settlements is an organization that was founded by the global elite and it operates for the benefit of the global elite, and it is intended to be one of the key cornerstones of the emerging one world economic system. It is imperative that we get people educated about what this organization is and where it plans to take the global economy.

Sadly, only a very small percentage of people actually know what the Bank for International Settlements is, and even fewer people are aware of the Global Economy Meetings that take place in Basel on a bi-monthly basis.

These Global Economy Meetings were discussed in a recent article in the Wall Street Journal…

Read moreAn Unelected, Unaccountable Central Bank Of The World Secretly Controls The Money

Former Iranian Central Bank Head Tahmasb Mazaheri Caught Smuggling $70 Million Bank Of Venezuela Check Into Germany

– Former Iranian Central Bank Head Caught Smuggling $70 Million Bank Of Venezuela Check Into Germany (ZeroHedge, Feb 3, 2013):

A week ago we described the sad tale of one Mahmoud Bahmani, who until recently supervised the unilateral destruction of the Iranian Rial, which on Friday just hit an all time low against the dollar down 21% in two weeks, as head of the Iranian central bank. While his currency-crushing performance would have been enough to get Mahmoud the “congressional medal of inflating away the debt” (not to mention a lifetime corner office at a TBTF bank of his choosing) at any self-respecting “developed world” banana republic, all of which have just one goal – to crush their currencies as Iran just did, in Iran it had precisely the opposite effect and let to his prompt termination. Yet this story is merely a trifle compared to the recent developments surrounding his predecessor, Tahmasb Mazaheri’s, who led the Iranian central bank for just one year until September 2008, at which point Ahmadinejad fired him to make way for the recently laid off Bahmani. It is this same Mazaheri, who had been off the world’s radar for over 4 years, until he trimumphantly resurfaced yesterday, when German Bild reported that he was caught last month trying to enter Germany with a check for 300 million Venezuelan Bolivars (some $70 million USD) issued by the Venezuelan Central Bank.

From AP:

The German newspaper Bild am Sonntag reports that a man caught last month trying to enter Germany with a check worth about $70 million was Iran’s former central bank chief.

The weekly reports that customs officials at Duesseldorf airport found the check in Tahmasb Mazaheri’s luggage Jan. 21 upon his arrival from Turkey.

German customs had issued a statement Friday saying a check for 300 million Venezuelan Bolivars issued by the Bank of Venezuela was found on an unnamed 59-year-old man.

Things That Make You Go Hmm – Such As Currency Wars

– Things That Make You Go Hmm – Such As Currency Wars (ZeroHedge, Jan 30, 2013)

Please Welcome The UK To The Global Currency Wars

– Please Welcome UK To The Global Currency Wars (ZeroHedge, Jan 23, 2013):

When it was announced in late November that Goldman’s Mark Carney would become head of the BOE (a “shocking” move only Zero Hedge predicted), we said that one has to be insane to be buying the GBP at those levels. Sure enough, it took just two short months before the implications of yet another Goldmanite’s pro-inflationary policies would become apparent. To wit:

- KING SAYS BOE IS READY TO PROVIDE MORE STIMULUS IF NEEDED

- KING SAYS QE WAS CRUCIAL IN AVOIDING U.K. DEPRESSION

- KING SAYS U.K. BANKS SOME WAY FROM CONVINCING MARKETS ON SAFETY

- KING SAYS POUND DROP WAS NEEDED FOR U.K. REBALANCING

- KING: U.K. 4Q GDP ALMOST CERTAINLY CONSIDERABLY WEAKER THAN 3Q

And the punchline:

- KING SAYS REBALANCING NEEDED TO AVOID CURRENCY WARS

In other words, please welcome the UK to the global currency wars.