– Oppenheimer: “Time To Cover All Shorts In Gold And Gold Miners” Because “Gold Stocks Are So Bad, They’re Good” (ZeroHedge, July 1, 2013)

Economy

The Golden Cycle – Gold Bug Bashing, 1976 Edition

– The Golden Cycle (Euro Pacific Capital, July 1, 2013, by Peter Schiff):

The New York Times had the definitive take on the vicious sell off in gold. To summarize one of their articles:

Two years ago gold bugs ran wild as the price of gold rose nearly six times. But since cresting two years ago it has steadily declined, almost by half, putting the gold bugs in flight. The most recent advisory from a leading Wall Street firm suggests that the price will continue to drift downward, and may ultimately settle 40% below current levels.

The rout says a lot about consumer confidence in the worldwide recovery. The sharply reduced rates of inflation combined with resurgence of other, more economically productive investments, such as stocks, real estate, and bank savings have combined to eliminate gold’s allure.

Although the American economy has reduced its rapid rate of recovery, it is still on a firm expansionary course. The fear that dominated two years ago has largely vanished, replaced by a recovery that has turned the gold speculators’ dreams into a nightmare.

This analysis provides a good representation of the current conventional wisdom. The only twist here is that the article from which this summary is derived appeared in the August 29, 1976 edition of The New York Times. At that time gold was preparing to embark on an historic rally that would push it up more than 700% a little over three years later. Is it possible that the history is about to repeat itself?

The Fed Is Paying Banks NOT To Lend 1.8 Trillion Dollars To The American People

– The Federal Reserve Is Paying Banks NOT To Lend 1.8 Trillion Dollars To The American People (Economic Collapse, July 1, 2013):

Did you know that U.S. banks have more than 1.8 trillion dollars parked at the Federal Reserve and that the Fed is actually paying them not to lend that money to us? We were always told that the goal of quantitative easing was to “help the economy”, but the truth is that the vast majority of the money that the Fed has created through quantitative easing has not even gotten into the system. Instead, most of it is sitting at the Fed slowly earning interest for the bankers. Back in October 2008, just as the last financial crisis was starting, Federal Reserve Chairman Ben Bernanke announced that the Federal Reserve would start paying interest on the reserves that banks keep at the Fed. This caused an absolute explosion in the size of these reserves. Back in 2008, U.S. banks had less than 2 billion dollars of excess reserves parked at the Fed. Today, they have more than 1.8 trillion. In less than five years, the pile of excess reserves has gotten nearly 1,000 times larger. This is utter insanity, and it will have very serious consequences down the road.

Posted below is a chart that shows the explosive growth of these excess reserves in recent years…

Read moreThe Fed Is Paying Banks NOT To Lend 1.8 Trillion Dollars To The American People

36 Tough Questions About The U.S. Economy That Everyone Should Be Asking

– 36 Hard Questions About The U.S. Economy That The Mainstream Media Should Be Asking (Economic Collapse, June 30, 2013):

If the economy is improving, then why aren’t things getting better for most average Americans? They tell us that the unemployment rate is going down, but the percentage of Americans that are actually working is exactly the same it was three years ago. They tell us that American families are in better financial shape now, but real disposable income is falling rapidly. They tell us that inflation is low, but every time we go shopping at the grocery store the prices just seem to keep going up. They tell us that the economic crisis is over, and yet poverty and government dependence continue to explode to unprecedented heights. There seems to be a disconnect between what the government and the media are telling us and what is actually true. With each passing day the debt of the federal government grows larger, the financial world become even more unstable and more American families fall out of the middle class. The same long-term economic trends that have been eating away at our economy like cancer for decades continue to ruthlessly attack the foundations of our economic system. We are rapidly speeding toward an economic cataclysm, and yet the government and most of the media make it sound like happy days are here again. The American people deserve better than this. The American people deserve the truth.

The following are 36 hard questions about the U.S. economy that the mainstream media should be asking…

Read more36 Tough Questions About The U.S. Economy That Everyone Should Be Asking

Eurozone Unemployment Hits All-Time High In May (AP, July 1, 2013)

From the article:

“Whereas the youth unemployment rate for the 17-country eurozone as a whole is 23.8 percent, the proportion of Spain‘s 15-24 year olds out of work is 56.5 percent while Greece‘s stands at 59.2 percent.”

– Eurozone Unemployment Hits All-Time High In May (Huffington Post/AP, July 1, 2013):

LONDON — Unemployment across the 17 European Union countries that use the euro hit another all-time high in May, official data showed Monday.

Eurostat, the EU’s statistics office, said the eurozone’s unemployment rate rose 0.1 percentage point in May to 12.1 percent. April’s unemployment rate was initially estimated to be 12.2 percent, but it was revised down to 12.0 percent thanks to new data, particularly from France.

Read moreEurozone Unemployment Hits All-Time High In May (AP, July 1, 2013)

Apparently This MF Global ‘Clusterfuck’ Does Not Deserve Criminal Charges

– Apparently This MF Global “Clusterfuck” Does Not Deserve Criminal Charges (ZeroHedge, July 1, 2013):

We salute the CFTC for finally, if belatedly, doing the right thing and going after Jon “the bundler” Corzine. However, we wonder, just how is the following documented exchange between Edith O’Brien, MFG’s assistant treasurer, and some MF Global employee, not considered crime-worthy by Eric Holder? Or is the US Attorney General too busy to answer, having to come up with his own alibi to avoid going to jail for lying to Congress under oath?From the MF Global Civil, not Criminal, Complaint

Just prior to 6:30 p.m. ET, O’Brien told Employee #2 on a recorded telephone line that the Firm would not be in compliance with customer segregation rules because funds were not being returned to customer segregated accounts:

O’BRIEN: It is a total clusterfuck . . . . They have to move half a billion dollars out of BONY to pay me back . . . . Tell me how much money is coming in and I will make sure it gets posted. But if you don’t tell me, then tomorrow morning I am going to have a seg problem . . . . I need the money back from the broker-dealer I already gave them. I can’t afford a seg problem.

Read moreApparently This MF Global ‘Clusterfuck’ Does Not Deserve Criminal Charges

Dubai Gold Demand Off the Charts

– Dubai Gold Demand Off the Charts as Price Plunges (Liberty Blitzkrieg, June 27, 2013):

Only in the gold market does huge demand equal a price collapse! I suppose the problem is they don’t buy Comex contracts in Dubai and India. As I mentioned on Twitter earlier today, the pile-on from gold bears is reaching extreme proportions, something like you’d expect near a bottom. I bought physical silver today for the first time in over a year.

From the UAE’s The National:

There is not enough space on airlines flying in to Dubai to meet the rapidly rising demand for physical gold in the emirate since the price plunged to record lows this week.

The price drop led to a rush of buyers for Dubai gold from the Middle East, South East Asia, the Balkans, Turkey and parts of Europe according to Tarek El Mdaka, the managing director of Kaloti Gold in Dubai.

“I cannot find a place for transporting gold on Emirates, on BA on Swiss Airlines this weekend,” Mr El Mdaka said. “I am shipping in one-and-a-half to two tonnes of gold every day and it is going straight out.”

Jim Rogers: “This Is Too Insane – And I’m Afraid We’re All Going To Suffer For The Rest Of This Decade From This Crazy, Crazy Money Printing”

– Jim Rogers: “This Is Too Insane–And I’m Afraid We’re All Going To Suffer For The Rest Of This Decade” (Bull Market Thinking, June 26, 2013):

I was able to reconnect with Jim Rogers this morning out of Spain, legendary co-founder of the Quantum Fund with George Soros, author of Hot Commodities, and chairman of the private Beeland Holdings.

It was an especially powerful interview, as Jim spoke towards the relentless downward pressure on gold, the upward explosion in interest rates, central bank money printing, and how to protect yourself ahead of the disastrous times he sees coming.

When asked if we’re seeing forced liquidation leading the smash down in gold this morning, Jim said, “We certainly are. There are a lot of leveraged players who are now being forced to sell. Usually when you have this kind of forced liquidation, you’re getting closer to a bottom, maybe not the final bottom, but certainly close to a bottom. I even bought a little bit [today].”

With regard to the intense bearish news stories being published on gold, Jim suggested investors shouldn’t ”Pay [much] attention to other people. I pay attention to what’s going on…Obviously with gold collapsing I know about that—but I don’t listen to other people.”

Fed: Foreign Central Banks’ Selling U.S. Government Debt

– Foreign central banks’ U.S. debt holdings fall: Fed (Reuters, June 27, 2013):

Foreign central banks’ overall holdings of U.S. marketable securities at the Federal Reserve fell in the latest week, data from the U.S. central bank showed on Thursday.

The Fed said its holdings of U.S. securities kept for overseas central banks fell $29 billion in the week ended June 26, to stand at $3.3 trillion.

Read moreFed: Foreign Central Banks’ Selling U.S. Government Debt

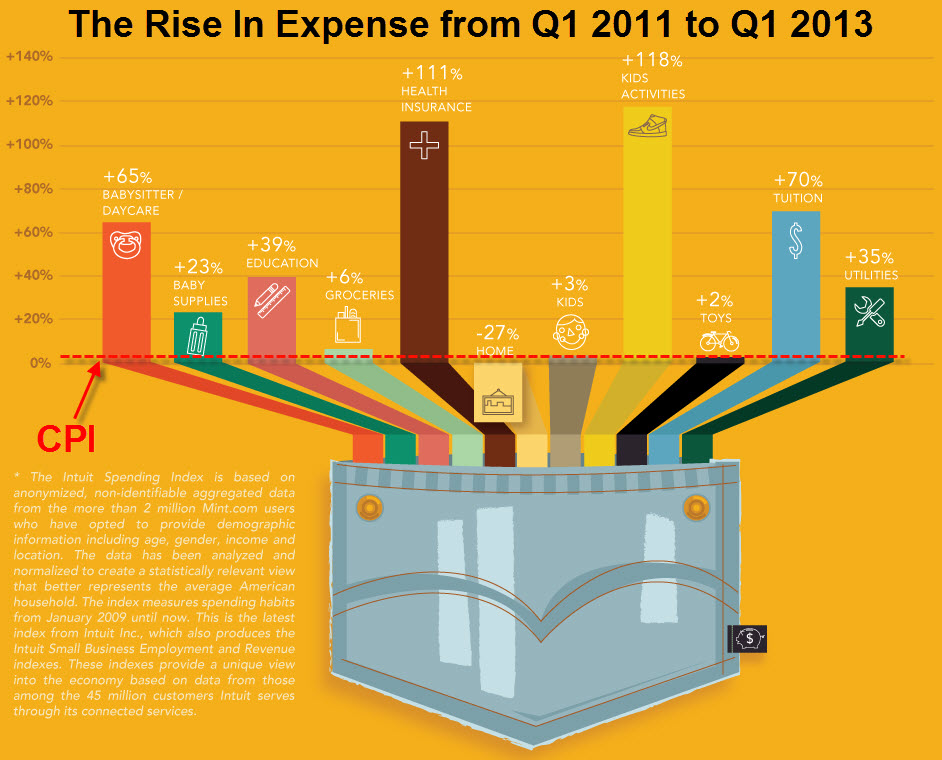

Presenting Inflation …

– Presenting Inflation… (ZeroHedge, June 29, 2013):

In the last two years, according to Intuit, Americans are reaching deeper into their pockets to cover family-related expenses. Given the current concerns over dis-inflationary pressures, we thought the following infographic might highlight just where that hidden liquidity-/credit-fueled inflation is leaking out.

Chart: Mint.com / Intuit

EU: Investors To Pay For Bank Failures

h/t by reader M.G.:

“Just saw this story on Rt.com. The new plan is for investors to rescue the crumbling banks. Brilliant. What a way to get people to stop using banks! It is beyond stupid, it is outright stealing. Here is the link. I am too angry to say any more right now. Damn these thieving bastards!”

Eurogroup President and Dutch Finance Minister Jeroen Dijsselbloem talks to journalists during a joint news conference with Portuguese Finance Minister Vitor Gaspar in Lisbon May 27, 2013.(Reuters)

– Investors to pay for bank failures – EU (RT, June 27, 2013):

European Union finance chiefs agreed Thursday investors and wealthy depositors will foot the bill for bank bailouts, in a break with the past convention of burdening taxpayers.

If pursued, bailout strategy, shareholders, bondholders and depositors with more than 100,000 euro will share the financial strain of saving a bank. Deposits under 100,000 will be protected.

Over $30 Million Spent Last Year On Lobbying To Keep GMOs Hidden In Foods

– Over $30M spent last year on lobbying to keep GMOs hidden in foods (Natural News, June 27, 2013):

Guess who spends the most money lobbying on agricultural lobbying? If you answered, “Monsanto,” you’re correct. Most of their efforts, of course, are focused on lobbying for GMOs — to keep them legal and keep them hidden in foods.

Do you know how much money Monsanto spent on lobbying in 2012?

The answer is nearly $6 million!

And in a close second, the American Farm Bureau spent $5.7 million on lobbying in 2012.

Read moreOver $30 Million Spent Last Year On Lobbying To Keep GMOs Hidden In Foods

Monsignor Nunzio Scarano Held In Vatican Bank Inquiry

– Monsignor Nunzio Scarano held in Vatican bank inquiry (BBC News, June 28, 2013):

A senior Italian cleric has been arrested in connection with an inquiry into a Vatican bank scandal over allegations of corruption and fraud.

Monsignor Nunzio Scarano works in the Vatican’s financial administration. A secret service agent and a financial broker have also been arrested.

They are suspected of trying to move 20m euros ($26m; £17m) illegally.

Read moreMonsignor Nunzio Scarano Held In Vatican Bank Inquiry

Foxconn CEO Terry Gou: “We Have Over 1 Million Workers. In The Future We Will Add 1 Million Robotic Workers. Our [Human] Workers Will Then Become Technicians And Engineers.”

– Foxconn to speed up ‘robot army’ deployment; 20,000 robots already in its factories (ITworld, June 26, 2013):

Manufacturing giant Foxconn Technology Group is on track with its goal to a create a “million robot army”, and already has 20,000 robotic machines in its factories, said the company’s CEO Terry Gou on Wednesday.

Workers’ wages in China are rising, and so the company’s research in robots and automation has to catch up, Gou said, while speaking at the company’s annual shareholder’s meeting in Taipei. “We have over 1 million workers. In the future we will add 1 million robotic workers,” he said. “Our [human] workers will then become technicians and engineers.”

Foxconn is the world’s largest contract electronics maker and counts Apple, Microsoft and Sony as some of its clients. Many of its largest factories are in China, where the company employs 1.2 million people, but rising are threatening to reduce company profits.

India: Gold Premiums DOUBLE As PHYSICAL DEMAND Outstrips SUPPLY

“The man who reads nothing at all is better educated than the man who reads nothing but newspapers.”

– Thomas Jefferson

“What good fortune for governments that the people do not think.”

– Adolf Hitler“War is peace.

Freedom is slavery.

Ignorance is strength.”

– George Orwell

Related info: – ‘The Dark Side of the QE Circus’

“Somewhere ahead I expect to see a worldwide panic-scramble for gold as it dawns on the world population that they have been hoodwinked by the central banks’ creation of so-called paper wealth. No central bank has ever produced a single element of true, sustainable wealth. In their heart of hearts, men know this. Which is why, in experiment after experiment with fiat money, gold has always turned out to be the last man standing.”

– Richard Russell

– Gold premiums jump as physical demand outstrips supply (Reuters, June 26, 2013):

Gold premiums doubled in India on Wednesday as suppliers struggled to meet surging demand after a ban on consignment imports, but futures prices fell to their lowest in more than a month as international gold prices fell due to a strong dollar.

India, the world’s biggest buyer of gold, now requires importers to pay upfront for inventory, making it difficult for smaller jewellers with lower working capital to source supplies. The government also raised the import duty to 8 percent in May to keep a lid on the surging current account deficit.

Read moreIndia: Gold Premiums DOUBLE As PHYSICAL DEMAND Outstrips SUPPLY

‘The Dark Side of the QE Circus’

– “The Dark Side of the QE Circus” (Silver Bear Cafe, June 25, 2013):

There may come a day soon where the markets sell off if one of the whiskers in Big Ben’s beard is out of place. Or perhaps if his tie is a bit crooked. Or maybe we end up with Janet Yellen as the next puppet in charge over at the local banking cabal and we fret about her hairdo. I don’t know, but one thing that is for certain is that this central bank so wants to be loved and we are so under psychological attack with all of this QE nonsense that it isn’t even funny.

QE is the endgame. ZIRP was only the beginning. QE, or monetization (which they’ll never call it because of the negative connotations), is the heroic measure applied to an already dead system. Our system, for all intent and purposes, died in 2008. It ceased to exist. The investing, economic, and business paradigm that has existed since is drastically different than its predecessor despite all the efforts being made to convince everyone, including Humpty Dumpty, that it is in fact 2005 all over again.

Quantitative Conditioning

Now we get to the fun part of the game. This is the part where the not-so-USFed wants to give the idea that it is tapering (buzzword of the month) without actually doing so. There will be no tapering. There will be no end to QE. The goose (Americans and their willingness to continue to pile up debt) is still laying the golden eggs. And even if they make paper contracts on those golden eggs gyrate wildly in price, they still want them. The quislings on television who are gleefully bashing precious metals this morning? They want them. They want your physical metal. These folks will swim through any sewer to get that which they desire. If you don’t understand the Machiavellian nature of your enemy, then you’re in for an extremely rough ride. This is no playground. This is a battlefield (credit to Chuck Baldwin). They’re playing chess and we’re still playing Tiddly Winks.

Paul Krugman the Marxist

– Paul Krugman the Marxist (Ludwig von Mises Insitute, June 24, 2013):

Someone once wrote that criticizing economist and New York Times columnist Paul Krugman is the internet’s favorite pastime. I, too, have engaged in the sport – with no success of changing what Robert Higgs calls the “vulgar Keynesianism” that dirties the Grey Lady’s editorial page. To the betterment of my pride, nobody else has had much luck in the arena of ideas either. Krugman continues to carry the torch of excuses for the Democratic Party while lampooning the bigoted, racist, old, white, and rich GOP.All along, the Princeton prof has stayed true to the cause of aggressive government action to forestall the downtrodden economy. Large fiscal expenditures, aggressive monetary stimulus, increased legal privileges for organized labor, and boosting the degree of state pillaging – Krugman is the caricature of a tyrannical apologizer who will defend the cause of rampant statism at any cost. He has been accused of being a communist, socialist, a Democratic shill, and every other leftist insult that might exist. Much of this is done in a tongue-and-cheek style. Still, the underlying charge of Krugman being a vehement statist willing to justify any and all government action remains accurate. Basically, there is little activity Uncle Sam could do that he wouldn’t approve of.

But now, it appears Krugman has gone overboard with his progressive moaning. In a recent column, he laments, once again, over the fact that some people make more money than others. The wealth inequality canard – which is favored by every leftist under the sun – has become a tiresome ploy at this point. I think Krugman knows this, so he proceeds to justify his indignation by bringing some new evidence into the mix. Now things start getting interesting.

The Secret Sauce Of Iceland’s Success Story: Debt Liquidation?

The secret sauce: NO BANKSTER BAILOUT!

– How Iceland Overthrew The Banks: The Only 3 Minutes Of Any Worth From Davos (Video)

– Impossible In America: ‘Executives At Collapsed Iceland Bank Jailed For Fraud’ (Reuters)

– Iceland’s Economy Now Growing Faster Than The U.S. And EU After Arresting The Banksters

– Here Is What Happens If You Do Not Bail Out The Banksters And Avoid Getting Raped By The IMF

– Two Thirds Of Icelanders Oppose EU Membership

– A Lesson For Europe: Why Iceland Won’t Join The Euro (Video)

Icelanders learned their lession …

– Iceland Cancels EU Membership Bid

… maybe also observing Greenland:

– Why is Greenland so rich these days? It said goodbye to the EU!

– The Secret Sauce Of Iceland’s Success Story: Debt Liquidation? (ZeroHedge, June 24, 2013):

That Iceland is so far the only success story in the continent of Europe, which continues sliding into an ever deeper depressionary black hole, as a result of the complete destruction of its financial sector and its subsequent rise from the ashes, is by known to most. What is still not exactly clear is what conditions have allowed success and growth to flourish in a barren wasteland where 60% youth unemployment is increasingly the norm, and where economic “outperformance” is measured in shades of red. As it turns out, perhaps the biggest jolt to Icelandic economic growth is what we said was the correct prescription for resolving not only the US but global growth malaise that struck in 2008: debt liquidation. Of course, instead the powers that be opted for merely masking unsustainable debt with more debt in the hope of preserving the global financial equity tranche, where some $50 trillion, or two-thirds of total, in US household wealth is concentrated, by drowning out hundreds of trillions in global debt through controlled debt inflation – which four years later still has yet to take hold, and which with every incremental dollar, yen, franc or pound printed threatens to spillover into uncontrolled hyperinflation, i.e., loss of fiath.

Read moreThe Secret Sauce Of Iceland’s Success Story: Debt Liquidation?

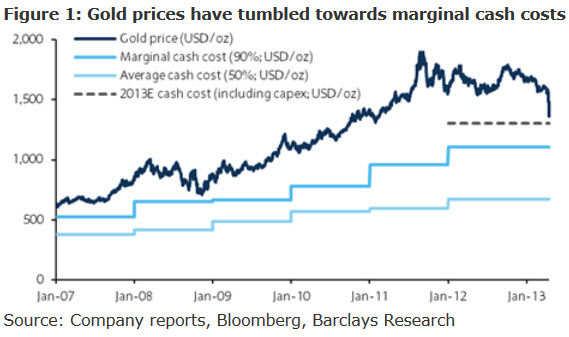

Gold Plummets To 34-Month Lows, Drops Below Its Average Cash Cost

– Gold Plummets to 34-Month Lows as Investors Flee (Wall Street Journal, June 26, 2013):

Prices are down about 25% this year, with the bulk of the losses occurring since April. On Wednesday, prices fell below $1,250 a troy ounce for the first time in nearly three years.

– Gold Drops to 34-Month Low as Precious Metals Slide on Fed View (Businessweek, June 26, 2013):

Silver futures fell to the lowest since August 2010.

– Gold Drops Below Its Average Cash Cost (ZeroHedge, June 26, 2013):

As shown two months ago, the marginal cost of production of gold (90% percentile) in 2013 was estimated at $1300 including capex. Which means that as of a few days ago, gold is now trading well below not only the cash cost, but is rapidly approaching the marginal cash cost of $1104…

Which means that of the following mines (as we showed here) which make up the gold cost curve, one by one, starting on the right and going left, production is going to go dark, even without the recent demand by South African gold miner labor unions to have their wages doubled. Until eventually virtually no gold will be produced.

Read moreGold Plummets To 34-Month Lows, Drops Below Its Average Cash Cost

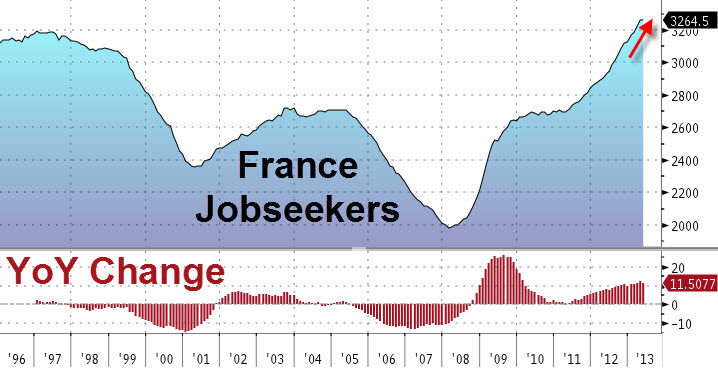

France Jobseekers Hit Another All-Time Record

– France Jobseekers Hit Another All-Time Record (ZeroHedge, June 26, 2013):

Despite the jump in French PMI (though still in contractionary region), the number of French Jobseekers rose once again (up 11.5% year-over-year) to a new all-time record. As the nation struggles with near Depression-era activity, it seems the green shoots that Draghi’s jawboning once again provided today remain a long way off in real-world land.

For Bonds, It’s A Lehman Repeat … The Liquidations Have Begun

– For Bonds, It’s A Lehman Repeat (ZeroHedge, June 25, 2013):

There is plenty of discussion of outflows but we though the following chart was perhaps the most insightful at why this drop is different from the last few year’s BTFD corrections. As we noted here, corporate bond managers have desperately avoided selling down their cash holdings (since they know dealer liquidity cannot support broad-based selling and its an over-crowded trade) and bid for hedges in CDS markets. But it seems, given the utter collapse in the advance-decline lines for high-yield and investment-grade bonds that the liquidations have begun. While the selling in high-yield bonds is on par with the Lehman liquidationlevels, it is the collapse in investment grade bond demand that is dramatic (and worse than Lehman). It’s not like we couldn’t see it coming at some point (here) and as we warned here, What Happens Next? Simply put, stocks cannot rally in a world of surging debt finance costs.Corporate Bond Advance-Decliners lines are as liquidation-based bad as during Lehman (worse in fact for IG)…

Do Not Panic!! This is orderly…

The current decline in the high yield market, now at 30 trading days, has been the fastest since the end of the 2008 recession, with yields widening 159 bp. Only the July – October 2011 market decline had a greater ultimate magnitude than the current period.

As we noted here:

Read moreFor Bonds, It’s A Lehman Repeat … The Liquidations Have Begun

Top Law Firm Weil, Gotshal & Manges Announces First Mass Layoffs In 82 Years

– Top Law Firm Weil, Gotshal & Manges Announces First Mass Layoffs in 82 Years (Liberty Blitzkrieg, June 24, 2013):

Nothing says economic recovery like one of the most profitable and prestigious law firms in the nation announcing mass layoffs for the first time in 82 years. Yep, four years after the so-called “recovery” began, things are so good that Weil, Gotshal & Manges has decided to cut 7% of its associates and slash annual compensation for 10% of its partners by hundreds of thousands of dollars. As the article below notes, there is still massive overcapacity in the legal profession and this announcement is likely to spark a wave of layoffs in the industry. Not to worry though, Blackstone will continue to place all cash bids on empty homes in Nevada and Arizona.

From the New York Times’ Dealbook:

One of the country’s most prestigious and profitable law firms is laying off a large number of lawyers and support staff, as well as reducing the pay of some of its partners, a surprising move that underscores the financial difficulties facing the legal profession.

Read moreTop Law Firm Weil, Gotshal & Manges Announces First Mass Layoffs In 82 Years

The 441 TRILLION Dollar Interest Rate Derivatives Time Bomb

– The 441 TRILLION Dollar Interest Rate Derivatives Time Bomb (Economic Collapse, June 24, 2013):

Do you want to know the primary reason why rapidly rising interest rates could take down the entire global financial system? Most people might think that it would be because the U.S. government would have to pay much more interest on the national debt. And yes, if the average rate of interest on U.S. government debt rose to just 6 percent (and it has actually been much higher in the past), the federal government would be paying out about a trillion dollars a year just in interest on the national debt. But that isn’t it. Nor does the primary reason have to do with the fact that rapidly rising interest rates would impose massive losses on bond investors. At this point, it is being projected that if U.S. bond yields rise by an average of 3 percentage points, it will cause investors to lose a trillion dollars. Yes, that is a 1 with 12 zeroes after it ($1,000,000,000,000). But that is not the number one danger posed by rapidly rising interest rates either. Rather, the number one reason why rapidly rising interest rates could cause the entire global financial system to crash is because there are more than 441 TRILLION dollars worth of interest rate derivatives sitting out there. This number comes directly from the Bank for International Settlements – the central bank of central banks. In other words, more than $441,000,000,000,000 has been bet on the movement of interest rates. Normally these bets do not cause a major problem because rates tend to move very slowly and the system stays balanced. But now rates are starting to skyrocket, and the sophisticated financial models used by derivatives traders do not account for this kind of movement.So what does all of this mean?

Read moreThe 441 TRILLION Dollar Interest Rate Derivatives Time Bomb

17 Signs That Most Americans Will Be Wiped Out By The Coming Economic Collapse

– Not Prepared: 17 Signs That Most Americans Will Be Wiped Out By The Coming Economic Collapse (Economic Collapse, June 24, 2013):

The vast majority of Americans are going to be absolutely blindsided by what is coming. They don’t understand how our financial system works, they don’t understand how vulnerable it is, and most of them blindly trust that our leaders know exactly what they are doing and that they will be able to fix our problems. As a result, most Americans are simply not prepared for the massive storm that is heading our way. Most American families are living paycheck to paycheck, most of them are not storing up emergency food and supplies, and only a very small percentage of them are buying gold and silver for investment purposes. They seem to have forgotten what happened back in 2008. When the financial markets crashed, millions of Americans lost their jobs. Because most of them were living on the financial edge, millions of them also lost their homes. Unfortunately, most Americans seem convinced that it will not happen again. Right now we seem to be living in a “hope bubble” and people have become very complacent. For a while there, being a “prepper” was very trendy, but now concern about a coming economic crisis seems to have subsided. What a tragic mistake. As I pointed out yesterday, our entire financial system is a giant Ponzi scheme, and there are already signs that our financial markets are about to implode once again. Those that have not made any preparations for what is coming are going to regret it bitterly.

The following are 17 signs that most Americans will be wiped out by the coming economic collapse…

Read more17 Signs That Most Americans Will Be Wiped Out By The Coming Economic Collapse