– Quantitative Easing Worked For The Weimar Republic For A Little While Too (Economic Collapse, Sep 22, 2013):

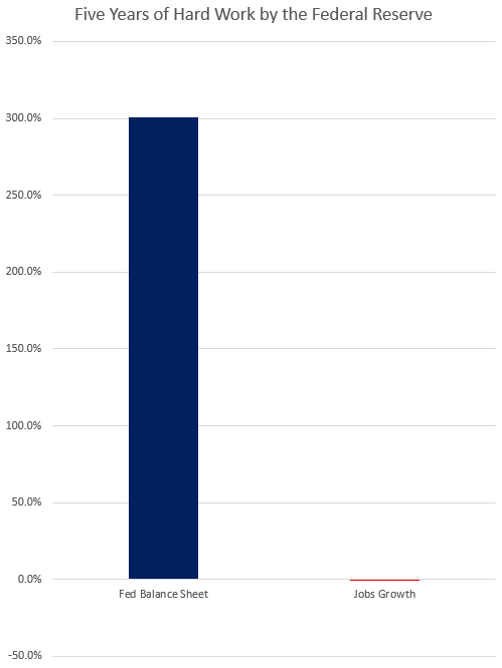

There is a reason why every fiat currency in the history of the world has eventually failed. At some point, those issuing fiat currencies always find themselves giving in to the temptation to wildly print more money. Sometimes, the motivation for doing this is good. When an economy is really struggling, those that have been entrusted with the management of that economy can easily fall for the lie that things would be better if people just had “more money”. Today, the Federal Reserve finds itself faced with a scenario that is very similar to what the Weimar Republic was facing nearly 100 years ago. Like the Weimar Republic, the U.S. economy is also struggling and like the Weimar Republic, the U.S. government is absolutely drowning in debt. Unfortunately, the Federal Reserve has decided to adopt the same solution that the Weimar Republic chose. The Federal Reserve is recklessly printing money out of thin air, and in the short-term some positive things have come out of it. But quantitative easing worked for the Weimar Republic for a little while too. At first, more money caused economic activity to increase and unemployment was low. But all of that money printing destroyed faith in German currency and in the German financial system and ultimately Germany experienced an economic meltdown that the world is still talking about today. This is the path that the Federal Reserve is taking America down, but most Americans have absolutely no idea what is happening.

It is really easy to start printing money, but it is incredibly hard to stop. Like any addict, the Fed is promising that they can quit at any time, but this month they refused to even start tapering their money printing a little bit. The behavior of the Fed is so shameful that even CNBC is comparing it to a drug addict at this point:

Read moreQuantitative Easing Worked For The Weimar Republic For A Little While Too