Since institutional memories are short, it is time to remind readers that it was the threat, and subsequent reality, of China overheating in the spring and summer of 2011 (when record high food prices sent the entire North African region in a state of coordinated revolt and gradually moved far east), when even the Great firewall of China could not block news of frequent break outs of localized violence from hungry and angry mobs, that halted and broke the spine of the great reflation trade then (and yes, 2013 has so far been a carbon copy replica of 2011 as we summarized in “It’s Deja Vu, All Over Again: This Time Is… Completely The Same“).

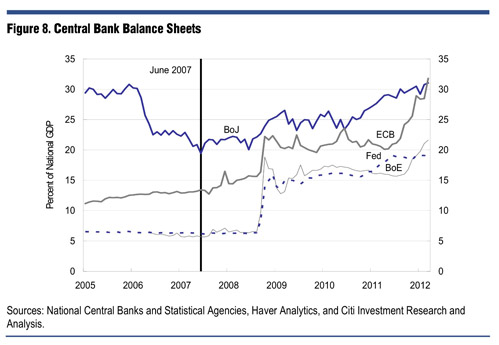

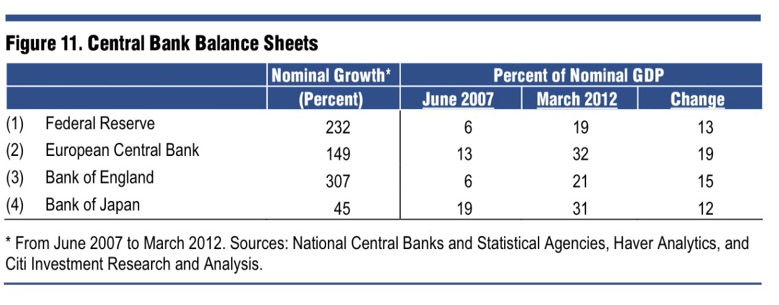

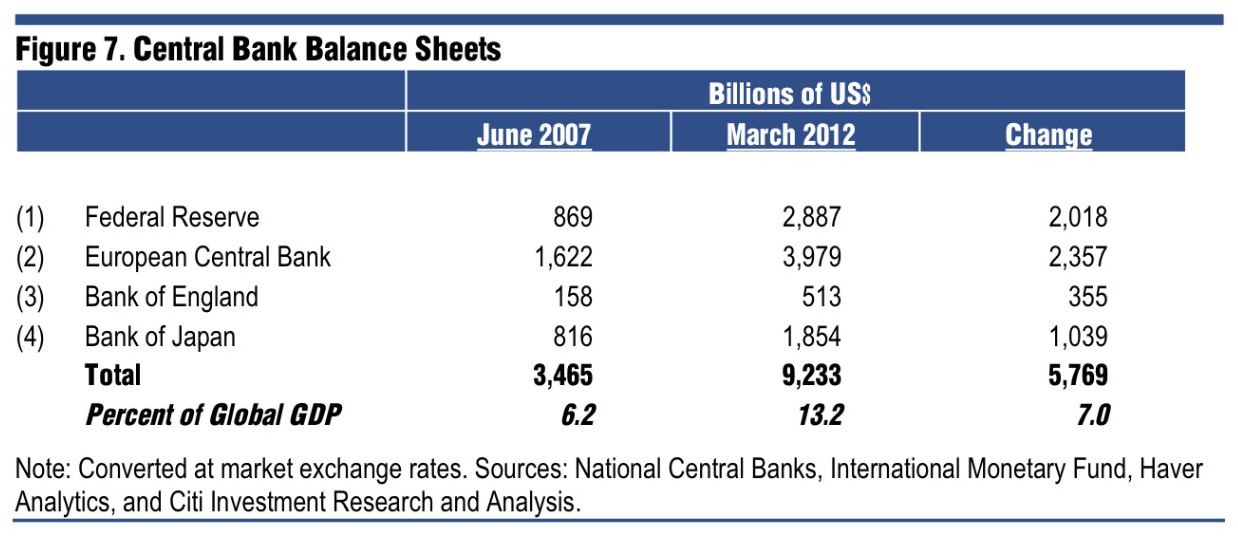

Furthermore, as only Zero Hedge forecast back in mid-2012, when ever other commentator was shouting over the rooftops that an RRR or interest rate cut out of Beijing was imminent, the PBOC would be the last to stimulate the market with monetary easing as it was well-aware that an entire developed world reflating at the same time would hit none other than China the fastest as the hot money flew straight into Shanghai. Just as it did in 2011. So instead China proceeded to engage in a series of daily reverse repos, or ultra-short term liquidity injections that prevented the advent of wholesale inflation: after all the Fed, the BOJ, the ECB and soon, the BOE, were doing it for them. And the last thing the country with the highest allotment of CPI, or book inflation, to food and energy can afford, is to let foreign central banks dictate its price level. After all, it has more than enough of its own.

Well, the Chinese New Year celebration is now over, the Year of the Snake is here, and those following the Shanghai Composite have lots to hiss about, as two out of two trading days have printed in the red. But a far bigger concern to not only those long the SHCOMP, but the “Great Reflation Trade – ver. 2013″, is that just as two years ago, China appears set to pull out first, as once again inflation rears its ugly head. And where the PBOC goes, everyone else grudgingly has to follow: after all without China there is no marginal growth driver to the world economy.

End result: China’s reverse repos, or liquidity providing operations, have ended after month of daily injections, and the first outright repo, or liquidity draining operation, just took place after eight months of dormancy.

From the WSJ:

Chinese authorities took a step to ease potential inflationary pressures Tuesday by using a key mechanism for the first time in eight months.

The move by the central bank to withdraw cash from the banking system is a reversal after months of pumping cash in. That cash flood was meant to reduce borrowing costs for businesses as the economy slowed last year—but recent data has shown growth picking up, along with the main determinants of inflation: housing and food prices.

Read moreThe Reflation Party Is Ending As China Withdraws Market Liquidity For First Time In Eight Months