YouTube Added: 03.09.2012

Politics

U.S. Marines Headed To Libya To Reinforce Security

– Marines headed to Libya to reinforce security (AP, Sep 12, 2012):

WASHINGTON (AP) — When the Pentagon called out the Marines on Wednesday and dispatched them to Libya, it wasn’t the first wave of an invading force.

Instead, the 50 Marines are part of an elite rapid-response team and they were sent to assess and reinforce security in Libya in the aftermath of the attack in Benghazi that killed the U.S. ambassador there and three other Americans.

Known as a Fleet Antiterrorism Security Team, or FAST, the team’s role is to respond on short notice to terrorism threats and to bolster security at U.S. embassies. They operate worldwide, and the team that went is one of two that are based in Spain.

Euro, Stocks Climb As German Court Approves Bailout Funds

And the bailout party goes on (… until there is nohing left).

– Euro, Stocks Climb as German Court Approves Bailout Funds (Bloomberg, Sep 12, 2012)

Germany’s Bundesverfassungsgericht Decision On ESM: German Taxpayer Pillage Can Continue (But With EUR 190 Billion Cap)

– Karlsruhe Decision: German Taxpayer Pillage Can Continue (But With EUR190bn Cap) (ZeroHedge, Sep 12, 2012):

UPDATE: EURUSD unsure – but seems like ‘Unlimited’ ECB Bazooka’s trigger (ESM) is now capped at EUR190bn from Germany.The Kardinals of Karlsuhe kame through. As somewhat expected, they declined the complaint that, simply put – and among many other things, the ESM structure (i.e. German payments into it) stretches German constitutionality and can proceed to a broader vote next year – but basically – in a nutshell – there’s no coming back now. As expected there are conditions though – that the market seems perturbed by:

- *GERMAN COURT ALLOWS ESM RATIFICATION WITH CONDITIONS :13347Z US

- *GERMANY MUST SET CAP FOR LIABILITY UNDER ESM WEHEN RATIFYING

- *GERMANY MUST MAKE SURE ITS ESM SHARE IS CAPPED AT EU190 BLN

Limited ESM (primary market) vs Unlimited secondary bond market buying (OMT). Go figure it out

Germany Can Ratify ESM Fund With Conditions, Court Rules

– Germany Can Ratify ESM Fund With Conditions, Court Rules (Bloomberg, Sep 12, 2012):

Germany’s top constitutional court rejected efforts to block a permanent euro-area rescue fund, handing a victory to Chancellor Angela Merkel, who championed the 500 billion-euro ($645 billion) bailout facility.

The Federal Constitutional Court in Karlsruhe dismissed motions that sought to block the European Stability Mechanism, while ruling Germany’s 190 billion-euro contribution can’t be increased without legislative approval. The court said Germany can ratify the ESM if it includes binding caveats that it won’t be forced to assume higher liabilities without its consent.

“We are an important step closer to our goal of stabilizing the euro,” German Economy Minister and Vice Chancellor Philipp Roesler told reporters in Berlin after the ruling today. “It has always been the goal of this government” to establish a “clear limit and to include parliament in all important decisions.”

Read moreGermany Can Ratify ESM Fund With Conditions, Court Rules

Rajoy Says Spain May Not Need A Bail Out After All

– Rajoy Says Spain May Not Need A Bail Out After All (ZeroHedge, Sep 12, 2012):

Europe’s chicken or egg problem is about to strike with a vengeance. As a reminder, the biggest paradox of the recently conceived “make it up as you go along” bailout of Europe is that “in order to be saved, Spain (and Italy) must first be destroyed“. Sure enough, the markets have long since priced in the “saved” part with the Spanish 10 year sliding to multi-month lows, but in the process everyone forgot about the destruction. Because as has been made quite clear, secondary market bond buying will not be activated without a formal bailout request by a country, in essence admitting its insolvency, and handing over domestic fiscal and sovereign control to the IMF and other international entities. As a further reminder, many, Goldman Sachs especially, had hoped that Spain would request a bailout as soon as Friday. To wit: “With a large (and uncovered) redemption looming at the end of October (and under pressure from other Euro area governments), we expect Spain to move towards seeking support.” Alas, as we expected, this is now not going to happen, and the pricing in of the entire “saved” part will have to be unwound as Spain is forced to accept being “destroyed” first. To wit: “I don’t know if Spain needs to ask for it,” Rajoy told parliament in a debate session, referring to an international rescue for Spain.”And ironically the further the market prices in salvation, the more unrealistic a bailout request becomes. In the meantime Spain is running out of cash, and what has been a buying euphoria may well becoming a selling revulsion as the market realizes that without the ECB’s explicit bond buying support, there is no reason to buy the bonds of a country with 25% unemployment, a massive budget deficit, an imploding housing market, and insolvent banking system. But who cares about details in a centrally-planned world.

From Reuters:

Spain continues to study the price it will have to pay for seeking help from the European Central Bank’s bond-buying programme but improved market conditions may make aid unecessary, Prime Minister Mariano Rajoy said on Wednesday.

“I don’t know if Spain needs to ask for it,” Rajoy told parliament in a debate session, referring to an international rescue for Spain.

US Ambassador To Libya, Three Others, Killed (Video)

– US Ambassador To Libya, Three Others, Killed (ZeroHedge, Sep 12, 2012)

Yesterday it was the US embassy in Egypt which fell victim to rioting as angry protestors stormed the building and replaced the US flag with a black one. Today, the violence shifts to Libya where the US ambassador and three staffers was just killed after an attack over a US-produced filmed deemed insulting to Muslims. Perhaps it is time for the US to replace one “pro-democracy” regime with another. From Reuters: “The U.S. ambassador to Libya and three other embassy staff were killed in a rocket attack on their car, a Libyan official said, as they were rushed from a consular building stormed by militants denouncing a U.S.-made film insulting the Prophet Mohammad.” Number of US ambasadors to Libya killed under Gadaffi’s regime? Zero.

More:

The U.S. ambassador to Libya and three other embassy staff were killed in a rocket attack on their car, a Libyan official said, as they were rushed from a consular building stormed by militants denouncing a U.S.-made film insulting the Prophet Mohammad.

Read moreUS Ambassador To Libya, Three Others, Killed (Video)

Nigel Farage’s Berating Rebuttal Of Barosso’s ‘State-Of-The-Union’ Banalities (Video)

– Farage’s Berating Rebuttal Of Barosso’s ‘State-Of-The-Union’ Banalities (ZeroHedge, Sep 12, 2012):

MEP Nigel Farage provided a much-needed dose of reality to the peculiar pontifications of Barroso’s state of the union speech last night. Concerned at the fanaticism of Europe’s ever more concentrated power-base, summed up by his interpretation of Barroso’s call for a federal union of states (cue Darth Vader music): “while the nation state should continue to exist, it mustn’t have any democratic power,” the Englishman goes on to deride Mario Draghi’s unlimited money bazooka – though we suspect Farage’s belief that “money doesn’t grow on trees” will soon come into question day after day. Super Mario as much as implied that he “will fight to the last German taxpayer to keep the Mediterranean countries, that should never have been in the Euro, in there,” but for a sense of just how ludicrous things are becoming in the EU, this clip is important as he reminds us of Monti’s (monstrous Mario) recent statement that “nation-state democracy will bring down the European Union.” Farage fears this rumbling facade over a crisis could go on for a decade, we can only hope not – one way or another.

China And Russia Are Ruthlessly Cutting The Legs Out From Under The U.S. Dollar

– China And Russia Are Ruthlessly Cutting The Legs Out From Under The U.S. Dollar (Economic Collapse, Sep 10, 2012):

The mainstream media in the United States is almost totally ignoring one of the most important trends in global economics. This trend is going to cause the value of the U.S. dollar to fall dramatically and it is going to cause the cost of living in the United States to go way up. Right now, the U.S. dollar is the primary reserve currency of the world. Even though that status has been chipped away at in recent years, U.S. dollars still make up more than 60 percent of all foreign currency reserves in the world. Most international trade (including the buying and selling of oil) is conducted in U.S. dollars, and this gives the United States a tremendous economic advantage. Since so much trade is done in dollars, there is a constant demand for more dollars all over the globe from countries that need them for trading purposes. So the Federal Reserve is able to flood our financial system with dollars without it causing a tremendous amount of inflation because the rest of the world ends up soaking up a lot of those dollars. But now that is changing. China and Russia have been spearheading a movement to shift away from using the U.S. dollar in international trade. At the moment, the shift is happening gradually, but at some point a tipping point will come (for example if Saudi Arabia were to declare that it will no longer take U.S. dollars for oil) and the entire global financial system is going to change. When that tipping point comes the global demand for U.S. dollars is going to absolutely plummet and nightmarish inflation will come to the United States. If such a scenario sounds far out to you, then you have not been paying attention. In fact, China and Russia have been working very hard to move us toward exactly such a scenario.

China and Russia are not the “buddies” of the United States. The truth is that they are both ruthless competitors of the United States and leaders from both nations have been calling for a new global currency for years.

They don’t like that the United States has a built-in advantage of having the reserve currency of the world, and over the past several years both countries have been busy making international agreements that seek to chip away at that advantage.

Just the other day, China and Germany agreed to start conducting an increasing amount of trade with each other in their own currencies.

Read moreChina And Russia Are Ruthlessly Cutting The Legs Out From Under The U.S. Dollar

UK Banks Could Be Shut Down Or Forced Into Bailouts By Brussels

– UK banks could be shut down or forced into bail-outs by Brussels (Telegraph, Sep 11, 2012):

Banks in London could be shut down or forced into taxpayer-funded bail-outs against the wishes of the British authorities under controversial “banking union” proposals from Brussels, it can be disclosed.

A panel of European officials would be given sweeping new powers to police the financial sector across the continent but also in the City of London.

They would be given “full decision making powers” to impose EU law and to arbitrate disputes between Britain and the eurozone over the risks posed by British banks, according to the proposals being tabled on Wednesday at the European Commission. Decisions taken by the powerful body would be automatically binding unless Britain was able to win the unlikely backing of a majority and overturn them.

Rulings by the panel could create huge costs for the British government and banks if they were ordered to bail out a struggling institution, contribute to cross-border bail-out funds, or allow the EU to rule over breaches of European law.

The moves stem from proposals for a eurozone “banking union”. The radical new EC blueprint for banking regulation at the EU level is focused on giving the European Central Bank new powers to supervise the eurozone’s banks, in order to shore up struggling financial institutions in southern European countries such as Spain.

South African Miners ‘Playing Dangerous Game’ As Tensions Rise Again

– South African Miners “Playing Dangerous Game” As Tensions Rise Again (ZeroHedge, Sep 11, 2012):

While it appears the mainstream media has forgotten about the ongoing drama in South Africa, the tensions are rising rather dramatically around the Marikana mines (owned by LonMin mining). As Al Jazeera reports, thousands of miners (along with wives and supporters) have defied an extended deadline (brokered by the government) and decide to remain on strike. The following clip provides some rather concerning color on what is occurring as Julius Malema, the expelled ANC leader, has already been charged with inciting violence – and is “playing a rather dangerous game.” He is calling for a national strike as he addresses the people: “they have been stealing this gold from you. Now it is your turn, you want your piece of the gold.” The tough reality is that as extraction costs rise (energy/depth) and now miners’ costs rise, then the end-product’s cost must rise, or – as Melema suggests – supply goes offline. Must see clip.

Jailed UBS Employee Gets $104 Million From IRS For Exposing Swiss Bank Account Holders

– Jailed UBS Employee Gets $104 Million From IRS For Exposing Swiss Bank Account Holders (ZeroHedge, Sep 11, 2012):

Just in case there wasn’t enough excitement and fury directed at Swiss bank account holders, which continue to dominate the presidential election “debate” above such mundane topics as the economy, or, say, reality, here comes the IRS, which as we noted yesterday collected $192 billion less than the government spent in the month of August alone, and have awarded Bradely Birkenfeld, a former UBS employee who in 2008 pleaded guilty to conspiracy to defraud the United States and was sentenced in 2009 to 40 months in prison, but received preferential whistleblower status after a prior arrangement to expose numerous Americans with Swiss bank accounts, has just been awarded $104 million.

From Reuters:

U.S. tax authorities have awarded $104 million to a whistleblower in a major tax fraud case against Swiss bank UBS AG that widened a government crackdown on Americans avoiding taxes in Switzerland, his lawyers said on Tuesday.

Bradley Birkenfeld, freed last month from prison, was not present at the news conference where his attorneys announced the reward made under an Internal Revenue Service whistleblower program that has come in for some criticism in Congress.

Birkenfeld had sought a large payout for his role in a tax-dodging case that resulted in early 2009 in UBS entering into a deferred prosecution agreement and paying $780 million in fines, penalties, interest and restitution.

Some more on the Birkenfeld pro- then anti-tax evasion odyssey:

Read moreJailed UBS Employee Gets $104 Million From IRS For Exposing Swiss Bank Account Holders

Moody’s Warns Of 1 Notch Downgrade If A Bitterly Divided Congress Does Not Begin To Cooperate

– Moody’s Warns Of 1 Notch Downgrade If A Bitterly Divided Congress Does Not Begin To Cooperate (ZeroHedge, Sep 11, 2012):

13 months ago, in the aftermath of the debt ceiling fiasco, which we now know was a last minute compromise achieved almost entirely thanks to the market plunging to 2011 lows, S&P had the guts to downgrade the US. Moody’s did not. Now, it is Moody’s turn to fire up the threat cannon with a release in which it says that should the inevitable come to pass, i.e. should congressional negotiations not “lead to specific policies that produce a stabilization and then downward trend in the ratio of federal debt to GDP over the medium term” then “Moody’s would expect to lower the rating, probably to Aa1” or a one notch cut. Moody’s also warns that should a repeat of last year’s debt ceiling fiasco occur, it will also most likely cut the US. Of course, that the US/GDP has risen by about 8% since the last August fiasco has now been apparently forgotten by both S&P and Moodys. Sadly, continued deterioration in the US credit profile is inevitable, as every single aspect of modern day lives that is “better than its was 4 years ago” has been borrowed from the future. More importantly, with the S&P at multi year highs courtesy of Bernanke using monetary policy to replace the need for fiscal policy, Congress will see no need to act, and Moody’s warning will be completely ignored. This will continue until it no longer can.From Moody’s:

Budget negotiations during the 2013 Congressional legislative session will likely determine the direction of the US government’s Aaa rating and negative outlook, says Moody’s Investors Service in the report “Update of the Outlook for the US Government Debt Rating.”

If those negotiations lead to specific policies that produce a stabilization and then downward trend in the ratio of federal debt to GDP over the medium term, the rating will likely be affirmed and the outlook returned to stable, says Moody’s.

If those negotiations fail to produce such policies, however, Moody’s would expect to lower the rating, probably to Aa1.

Moody’s Says U.S. Faces Aaa Cut Without Budget Deal in 2013

– Moody’s Says U.S. Faces Aaa Cut Without Budget Deal in 2013 (Bloomberg, Sep 11, 2012):

Moody’s Investors Service said it may join Standard & Poor’s in downgrading the U.S.’s credit rating unless Congress next year reduces the percentage of debt- to-gross-domestic-product during budget negotiations.

The U.S. economy will probably tip into recession next year if lawmakers and President Barack Obama can’t break an impasse over the federal budget and if George W. Bush-era tax cuts expire in what’s become known as the “fiscal cliff,” according to a report by the nonpartisan Congressional Budget Office published on Aug. 22. The rating would likely be cut to Aa1 from Aaa if an agreement on the debt ratio isn’t reached, Moody’s said in a statement today.

Read moreMoody’s Says U.S. Faces Aaa Cut Without Budget Deal in 2013

U.S. Army Wants Tiny Suicidal Drone To Kill From 6 Miles Away

Thought the Army’s Raven drone was tiny? The Army now wants a new drone, called the Lethal Miniature Aerial Munition System, that’s weighs just just 5 pounds. And unlike the Raven, the so-called LMAMS will be armed and dangerous. Photo: U.S. Army

– Army Wants Tiny Suicidal Drone to Kill From 6 Miles Away (Wired, Sep 10, 2012):

Killer drones just keep getting smaller. The Army wants to know how prepared its defense-industry partners are to build what it calls a “Lethal Miniature Aerial Munition System.” It’s for when the Army needs someone dead from up to six miles away in 30 minutes or less.

How small will the new mini-drone be? The Army’s less concerned about size than it is about the drone’s weight, according to a recent pre-solicitation for businesses potentially interested in building the thing. The whole system — drone, warhead and launch device — has to weigh under five pounds. An operator should be able to carry the future Lethal Miniature Aerial Munition System, already given the acronym LMAMS in a backpack and be able to set it up to fly within two minutes.

Read moreU.S. Army Wants Tiny Suicidal Drone To Kill From 6 Miles Away

AND NOW … Kawasaki Mayor: ‘School Serves Radioactive Lunch For Educational Purpose’

– Kawasaki city mayor, “School serves radioactive lunch for educational purpose.” (Fukushima Diary, Sep 10, 2012):

Schools keep serving contaminated lunch for the students and they don’t even solve the problem.

(cf. Cesium from finished school lunch in Miyagi)Tokyo newspaper reported Abe, the city mayor of Kawasaki stated they serve radioactive school lunch for educational purpose. “Students need to know they live in danger by consuming radioactive school lunch.”

On 9/4/2012, Abe, the city mayor of Kawasaki city held a regular press conference. Kawasaki is located between Tokyo, and Yokohama, which is the second biggest city in Japan. Kawasaki city has the 8th biggest population in Japan.

Although they measured 9.1 Bq/Kg of cesium from frozen tangerine, and 1.6 Bq/Kg from canned apples, they keep serving them for school lunch since this April.

About this matter, Abe commented like this below,“????????????????????????????”

<Translate>

It’s important for children to know that they live in danger.

<End>He emphasized they serve radioactive lunch for educational purpose.

Read moreAND NOW … Kawasaki Mayor: ‘School Serves Radioactive Lunch For Educational Purpose’

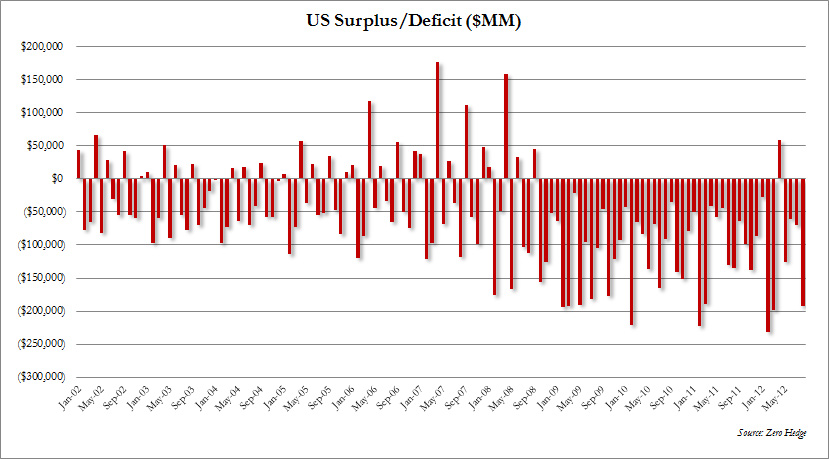

US August Budget Deficit Soars To $192 Billion, $1.17 Trillion In Fiscal 2012

– US August Budget Deficit Soars To $192 Billion, $1.17 Trillion In Fiscal 2012 (ZeroHedge, Sep 10, 2012):

While the official number from the FMS is not out yet, according to an advance look by the CBO, the August deficit soared from a modest $70 billion to a whopping $192 billion, the highest August deficit in history, and coming at a time when traditionally the US Treasury does not generate substantial deficits. It also means that “that” $59 billion budget surplus in April, coming after 42 straight months of deficits, and which surprised so many, was just as we suspected, nothing but a play on the temporal mismatch between treasury receipts and outlays. Most importantly, with one month left in the fiscal year, a month which, too, will likely come well above last year’s $63 billion, the US has now spent $1.165 trillion more than it has received via various taxes. Finally so much for the year over year improvement: at $1.23 trillion deficit in the LTM period, this is only 3.2% less than the August 2011 LTM deficit which was $1.27 trillion, despite nearly 2 million more workers employed (at least according to the BLS) and generating tax revenue. Expect the US to end Fiscal 2012 with a total deficit of well over $1.2 trillion, which in turn means that the average burn rate of $100 billion in new debt issuance each month, will continue into the indefinite future.

As a reminder…

French Government Gets Whacked, Even The Left Is Angry, And BILDERBERG Hollande Gets Slapped In The Face

Flashback:

– Francois Hollande Is Another Bilderberg Stooge (Video)

– The French Government Gets Whacked, Even The Left Is Angry, And Hollande Gets Slapped In The Face (ZeroHedge, Sep 10, 2012):

France is mired in a stagnating economy. The private sector is under pressure, auto manufacturing is heading into a depression. Unemployment hit a 13-year high of 10.2%, leaving over 3 million people out of work. Youth unemployment of 22.7%, bad as it is, belies the catastrophic jobs situation for young people in ghetto-like enclaves, such as the northern suburbs of Paris. The “solution”—fabricating 150,000 jobs for the young at taxpayers’ expense—has been tried before, with little success. Gasoline and diesel prices are hovering near record highs. So there are a lot of very unhappy campers.

In a BVA poll, 55% of the respondents were dissatisfied with President François Hollande’s efforts to tackle the economic crisis. By comparison, only 31% were dissatisfied with Nicolas Sarkozy in 2007 at the end of his honeymoon. Devastatingly, for a socialist: 57% believed that he didn’t distribute the “efforts” equitably—same as Sarkozy, the president of the rich.

The problem with voters is Hollande’s “inaction,” after some initial half-measures, such as the partial reinstatement of retirement at 60 and raising back-to-school aid for families. Now people “seriously doubt his ability to change things.” They believe that the government spends its time trying to “unravel Sarkozy’s legacy” and “sitting around in meetings,” rather than making decisions.

Bilderberg Hollande Defends 75% Tax Rate To A Disillusioned France

Flashback:

– Francois Hollande Is Another Bilderberg Stooge (Video)

– Embattled Hollande defends his 75% tax rate to a disillusioned France (Daily Mail, Sep 9, 2012):

Francois Hollande last night tried to justify his plans for multi-billion-pound tax rises to an increasingly disillusioned France.

The Socialist president, whose popularity has slumped, appeared on live television to convince the public his policies could help turn the country’s economy around.

During the 25-minute appearance, he unveiled plans for tax increases of ‘between 15 to 20 billion euros’ (£12billion to £16billion), targeting wealthy households, savings and firms.

The money raised will be used for public services, including thousands of new civil servant jobs.

He confirmed that ‘all earnings over one million euros will be taxed at 75 per cent’, adding: ‘It’s symbolic, it will show an example.’

Read moreBilderberg Hollande Defends 75% Tax Rate To A Disillusioned France

Germans Could Be Consigned To Serfdom To Save The Euro – ‘ESM Breaches German Law And EU Treaties’

The proposed rescue fund for Europe not only breaches German law and EU treaties but could condemn a generation

The euro currency sign in front of the European Central Bank headquarters in Frankfurt . Photograph: Alex Domanski/Reuters

– Germans could be consigned to serfdom to save the euro (Guardian, Sep 9, 2012):

Some commentators have taken to referring to this Wednesday as “the day that could make or break the common currency”, and they’re not far off the mark. On that day, Germany’s constitutional court will announce its verdict on the legality of the European Stability Mechanism, the permanent rescue fund for struggling eurozone countries. If implemented, the ESM’s share capital of €700bn would be provided by all 17 eurozone members in proportion to their economic size. Fourteen have so far ratified the treaty – Estonia, Italy and Germany are the only ones remaining.The German government has defended the ESM treaty, claiming it would fix Germany’s maximum liability at €190bn, and that the Bundestag would retain control over the grant of further assistance. Either German politicians have not read the treaty they have signed, or they do not understand its small print, for there is little in the document that supports their interpretation. Because the ESM is plainly unlawful.

For example, article 25(2) of the treaty states that members are jointly liable for any losses arising from loans made by the ESM. That means if one or more of the ESM members fail to meet their agreed financial contributions, the other members are liable for the shortfall. That situation is already a reality, because Greece and Portugal are unable to make any contribution.

George Soros Calls On Germany To Save Euro By Dropping Austerity Policies Or By Leaving Single Currency

From the article:

“In other words, Germany must lead or leave.”

Translation:

Germany must surrender and agree to be bankrupted, raped and pillaged … or leave.

Elite puppet financier …

– George Soros urges Germany to save euro (Guardian, Sep 9, 2012):

George Soros calls on Germany to save euro by dropping austerity policies or by leaving single currency

George Soros is calling on Germany to save the euro, either by abandoning its obsession with austerity policies – or itself leaving the single currency.”The difficulty is in convincing Germany that its current policies are leading to a prolonged depression, political and social conflicts, and an eventual break-up not only of the euro but also of the European Union,” he said in an article published in the New York Review of Books.

He warned that the split between creditor and debtor countries in the euro risked becoming permanent, with debtor nations condemned to low growth because they are forced to pay a high premium for access to credit. European union was liable to fall apart under the pressure, he added.

Soros singled out Germany as the country that should take responsibility for this “class divide” in the eurozone.

“In my judgment, the best course of action is to persuade Germany to choose between becoming a more benevolent leading nation, or leaving the euro. In other words, Germany must lead or leave.”

Judge Napolitano On The 2012 Election, Obamacare, And The Future Of Liberty (Video)

Description:

“Those of us who really yearn for a return to first principles, the natural law, the Constitution, a government that only has powers that we have consented it may have… are frustrated by the choice between Barack Obama and Mitt Romney,” says Judge Andrew Napolitano, author of the upcoming book “Theodore and Woodrow: How Two American Presidents Destroyed Your Constitutional Freedoms,” Fox Business contributor, and former host of “Freedom Watch.”