Flashback:

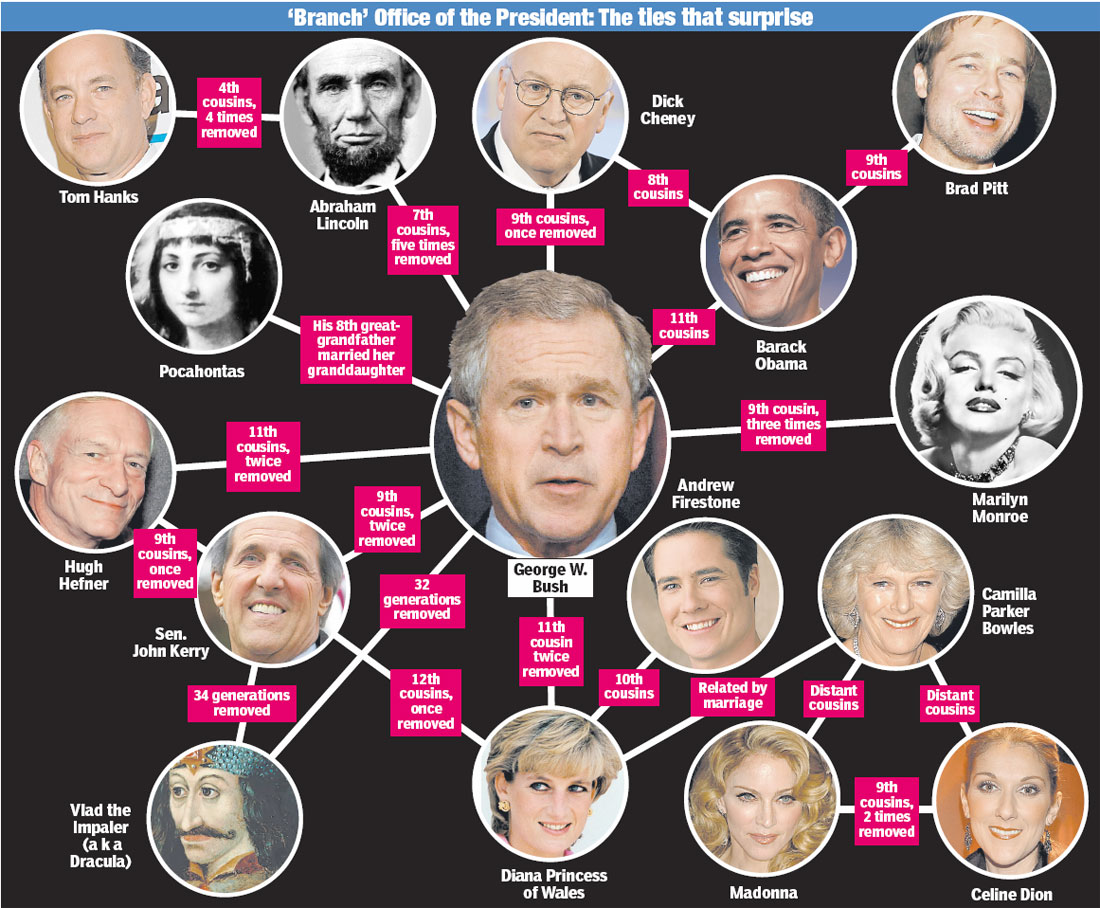

– Prince Charles Says His Ancestry Can Be Traced Back To Vlad The Impaler, The Inspiration For Dracula:

The last thing I expected was for Prince Charles to crack a joke about being descended from Dracula.

But when I spoke to him for my new TV show Wild Carpathia, he told me he can trace his ancestry back, through his great-grandmother Queen Mary, to the half-brother of Vlad the Impaler, the inspiration for Dracula. Prince Charles seemed quite amused by his dark lineage.

– Europe’s Luxury Home Bubble: People Are Dying To Own Dracula’s Castle (ZeroHedge, May 12, 2014):

With 560,000 visitors a year, Dracula’s Castle may not be the ideal seclusion spot for the uber-wealthy European real estate magnate, but, as the realtor notes “n the right hands it has the potential to generate far more revenue than we could ever imagine,” – we suspect followed by an echoing ‘mwuahahahahaha’. Construction on Bran Castle (for it’s not actually Vlad The Impaler’s residence of old but he was imprisoned there briefly) began in 1377 and as HuffPo notes, the 57-room manor on 22 acres has been on the market several times in recent years, with investors at one point hoping to get $135 million. As the firm running the castle noted, “If someone comes in with a reasonable offer, we will seriously entertain the idea.” We suspect people will be dying to buy this and with rates so low, it won’t bleed you dry either...

But it doesn’t look so scary…

Actually more bond villain than blood-sucker…

Not so sunny courtyard…

Inside is a little more spooky

Wardrobes are full…

And a spacious living room…

The property comes with a long list of previous owners: everyone from Saxons to Hungarians to Teutonic knights. And although the facilities may not be exactly state-of-the-art (the plumbing is reported to require some work), there’s no questioning the detachedness of the property. It stands on top of a hill, and is most definitely not overlooked by neighbours….

And yes, we all know that the bloodsucking vampire Count Dracula was a purely fictional character, invented by the British writer Bram Stoker, and made famous in films starring sharp-fanged Christopher Lee. But the fearsome real-life Vlad “The Impaler” Tepes famously operated in this area in the 15th century. Indeed, he is said to have been imprisoned in Bran Castle for a couple of months. On top of which, Transylvanian legend and folklore are full of characters called strigoi. These ghostly beings leave their corporeal bodies when darkness falls and roam the surrounding valleys searching for sleeping villagers to terrify….

There’s enough land to build a small hotel, he adds. “And we’re also installing a glass elevator that will lead to a tunnel in the mountain, with a light show featuring Dracula and the whole history of the place.

“That’s why we’d like whoever buys the castle to continue running it as a tourist destination. This isn’t just a national monument, it’s the largest and most significant attraction in Romania.”