1 of 3:

Source: YouTube

2 of 3:

Source: YouTube

3 of 3:

Source: YouTube

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

SACRAMENTO, Calif. (AP) — Federal water managers said Friday that they plan to cut off water, at least temporarily, to thousands of California farms as a result of the deepening drought gripping the state.

U.S. Bureau of Reclamation officials said parched reservoirs and patchy rainfall this year were forcing them to completely stop surface water deliveries for at least a three-week period beginning March 1. Authorities said they haven’t had to take such a drastic move for more than 15 years.

Read moreDrought to cut off federal water to California farms

Bloomberg has removed the article.

Feb. 19 (Bloomberg) — The collapse of the U.S. newspaper industry is accelerating as a deepening plunge in advertising forces publishers to consider curtailing print editions or shutting down altogether.

The Seattle Post-Intelligencer will shut down or appear only on the Internet if its parent company can’t find a buyer for it by March. The Tucson Citizen in Arizona will close if it can’t be sold. Denver’s Rocky Mountain News is up for sale, and Detroit’s two dailies cut their delivery schedule to three days a week.

“There’s going to be a lot of papers giving up days of the week that they publish editions and an acceleration of movement from print to digital publishing,” said Ken Doctor, an analyst at media consultant Outsell Inc. in Burlingame, California.

New York Times Co., Gannett Co. and McClatchy Co., which altogether own about 135 dailies, posted publishing ad revenue declines of more than 13 percent in 2008 and anticipate further drops this year. The publishers are selling assets and cutting at least 5,000 jobs amid the worst recession in more than 70 years.

Read moreNewspaper Industry’s Collapse Hastens; Shutdowns Loom

Added: 18. Februar 2009

Source: YouTube

The Harper government, under pressure to prevent the federal deficit from ballooning, is pressing ahead with an asset review that could lead to the sale or privatization of several well-known Crown corporations, including Canada Post, Via Rail, the Royal Canadian Mint and the agency that oversees security at Canada’s airports.

The Latvian parliament: The president will seek a fresh governing coalition (Photo: Latvian parliament)

The Latvian prime minister and his government have resigned amid growing political and economic strife in the Baltic country.

Prime Minister Ivars Godmanis submitted his resignation to the president, Valdis Zatlers, on Friday (20 February) afternoon after the two largest parties in the ruling four-party coalition demanded he step down.

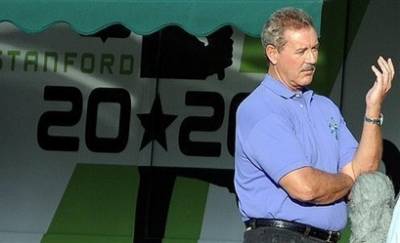

American authorities have been suspicious of Allen Stanford’s financial dealings for 15 years but only accelerated their investigation after the Bernard Madoff fraud was exposed, it was claimed today.

As investigators continued to hunt Mr Stanford and the $50 billion (£35 billion) of assets connected to him, a financial expert said that the Texan had been on “everybody’s radar” for more than a decade.

Related articles:

– FBI tracks down Texas financier in $8 billion fraud case (AP):

Stanford is not under arrest and is not in custody.

– Texas-Sized Fraud Spreads To 131 Countries (CBS News)

– Stanford lies low as clients count cost of fraud (Reuters)

The claim, made by the journalist and author Jeffrey Robinson, came as a link was made for the first time between the cricket impresario and a feared Mexican drugs cartel.

Read moreUS authorities had been investigating Allen Stanford for 15 years!

WASHINGTON — The Pentagon may have mishandled or even lost track of thousands of surplus machine guns, armored vehicles and other pieces of demilitarized equipment sold or provided to foreign governments, according to an internal audit.

Some of the equipment was given to unauthorized nations, jeopardizing U.S. national security, according to the report by the Defense Department’s inspector general.

The lax control over surplus items “increased the risk of providing foreign governments unauthorized property that could be used to threaten our national security,” the Feb. 13 report concluded. A copy of it was obtained Thursday.

– Czech leader attacks EU (Independent):

The Czech Republic President said the EU was undemocratic, elitist and reminiscent of Soviet-era Communist dictatorships in an attack which provoked an angry response from EU legislators.

– Binyamin Netanyahu to be Israel’s next Prime Minister (Times Online):

(I am sure Iran has raised the threat level to ‘blood’ red already.)

– Gold rises over $1000 on haven buying (Reuters):

NEW YORK/LONDON (Reuters) – Gold rose above $1,000 an ounce on Friday for the first time since March last year as nervous investors piled into the yellow metal to preserve wealth amid a tumbling stock market.

– Police documents linking New York governor Eliot Spitzer to prostitutes to be released (Telegraph):

A US federal judge ordered the release of documents from the investigation that linked former New York governor Eliot Spitzer to a prostitution ring.

– White House says world can’t delay on Iran (AP):

WASHINGTON — The White House says the international community must work together to urgently address Iran’s uranium enrichment activities.

– Iran has enough uranium ‘to build a nuclear bomb’ (Telegraph):

(Iran’s uranium is enriched at 3%, for a nuclear weapon Iran needs 95% enriched uranium. Still a looong way to go. I just saw a documentary (aired by a big German TV station) that for only $ 5 million you can get a suitcase nuke. Besides everything that Iran does is “perfectly legal” says Ron Paul.)

– Official: Pentagon report says Gitmo is humane (AP):

WASHINGTON (AP) — The Pentagon says the Guantanamo Bay prison meets the standard for humane treatment laid out in the Geneva Conventions, according to a report for President Barack Obama, who has ordered the terrorist detention center closed within a year.

– Former RNC director convicted in phone jamming case gets off without penalty (Raw Story)

– AP IMPACT: Jobless Hit With Bank Fees on Benefits (ABC News):

First, Arthur Santa-Maria called Bank of America to ask how to check the balance of his new unemployment benefits debit card. The bank charged him 50 cents. He chose not to complain. That would have cost another 50 cents. So he took out some of the money and then decided to pull out the rest. But that made two withdrawals on the same day, and that was $1.50.

– US bank stocks fall to 17-year low (Financial Times):

US banking shares hit their lowest level since 1992 on Thursday as fears mounted that the government would be forced to nationalise a key institution.

– No TARP Can Mend the Economy Now (International Forecaster):

The collapse we see in the distance will bring about social dislocation and Martial law.

– Russians Retrench as Crisis Evokes Memories of 1998 ‘Nightmare’ (Bloomberg)

– Qantas Rating Cut to Baa2 at Moody’s on Travel Plunge (Bloomberg):

Feb. 20 (Bloomberg) — Qantas Airways Ltd., Australia’s largest carrier, had its credit rating cut for the first time in more than 15 years by Moody’s Investors Service as the global recession hammers demand for air travel.

– Anglo American to shed 9,000 jobs (Financial Times)

– Newly Poor Swell Lines at Food Banks (New York Times):

MORRISTOWN, N.J. — Once a crutch for the most needy, food pantries have responded to the deepening recession by opening their doors to what Rosemary Gilmartin, who runs the Interfaith Food Pantry here, described as “the next layer of people” — a rapidly expanding roster of child-care workers, nurse’s aides, real estate agents and secretaries facing a financial crisis for the first time.

– Saab seeks bankruptcy protection in battle for survival (Times Online)

– Japan turns to ‘work-sharing’ to avoid layoffs (AP):

Work-sharing is the latest buzzword in Japan Inc. Proponents say it’s a good way to avoid American-style layoffs in a society that has long fostered lifetime employment. Toyota Motor Corp., Mazda Motor Corp., Toshiba Corp. and Fujitsu Inc., have all taken up some kind of work-sharing. Nissan Motor Co. and others are considering it.

– Highland Capital CDO Fund Is Insolvent, Wiping Out Investors (Bloomberg)

– Obama Picks Bilderberger for Health Secretary (Prison Planet):

Obama has picked a Bilderberger to be his choice for health secretary — Kansas Governor Kathleen Sebelius. Obama initially picked former Senate Democrat leader Tom Daschle for the position, but Daschle “withdrew because of personal tax issues,” in other words he didn’t bother to pay any taxes because minions of the elite are not required to do so, except for public relations reasons. (Obama has also given 10 key positions to members of the Trilateral Commission. Obama is a New World Order puppet.)

– GM shares hit 74-year low (AP)

– Berkshire stock hits 5-year low below $74000 (BusinessWeek)

– Sun-powered device converts CO2 into fuel (New Scientist):

Powered only by natural sunlight, an array of nanotubes is able to convert a mixture of carbon dioxide and water vapour into natural gas at unprecedented rates.

– China recalls more than 320000 doses of flawed rabies vaccine: official (Xinhua)

– Drinking two cups of coffee a day ‘cuts stroke risk by 20 per cent’ (Telegraph):

A study involving more than 80,000 women over a period of more than 20 years showed those who consumed several cups a day were much less likely to suffer a clot on the brain.

– Texans to shoot wild pigs from helicopters (Telegraph):

Texans may be allowed to take to the air in helicopters to gun down the millions of pigs that are running wild in the state’s countryside.

– Brian Eno: The well of freedom is running dry (Independent):

Nobody bothers about civil liberties until they’ve gone. As the old country song warns: “You don’t miss your water till your well runs dry.”

NEW YORK (AP) — The trustee in charge of untangling the mess left behind by Bernard Madoff told a packed auditorium Friday there was no indication the disgraced money manager had bought securities for his clients for over a decade.

“We have no evidence to indicate securities were purchased for customer accounts” in the past 13 years, said Irving Picard, the court-appointed trustee overseeing the liquidation of Bernard L. Madoff Investment Securities LLC. “This is a case where we’re going to be looking at cash in and cash out” — the definition of a Ponzi scheme.

The Constitution, gun ownership, gold ownership, home schooling, martial law, FEMA etc.

12 parts:

16. Februar 2009

Source: YouTube

With guests Ron Paul, Peter Schiff, Steve Moore, Lew Rockwell and Cody Willard from FOX.

6 parts:

February 19, 2009

Posted by Lew Rockwell

Source: Lew Rockwell

Texas financier Allen Stanford, pictured in 2008, who is alleged to have committed multibillion dollar fraud, has been located in Virginia, the FBI confirmed on Thursday. (AFP/File/Jewel Samad)

WASHINGTON – Texas financier R. Allen Stanford was tracked down Thursday in Virginia, where FBI agents served him with legal papers in a multibillion-dollar fraud case. FBI agents, acting at the request of the Securities and Exchange Commission, served Stanford papers in Fredericksburg, Va., said FBI spokesman Richard Kolko.

Stanford is not under arrest and is not in custody.

Related articles:

– Texas-Sized Fraud Spreads To 131 Countries (CBS News)

– Stanford lies low as clients count cost of fraud (Reuters)

– Stanford scandal ensnares Yankees’ Damon, Nady (FOXSports)

In a civil papers Tuesday, the SEC alleged Stanford and three of his companies committed an $8 billion fraud that lured investors with promises of improbable and unsubstantiated high returns on certificates of deposit and other investments.

Until regulators got help Thursday from the FBI, the SEC had not been able to find Stanford.

Read moreFBI tracks down Texas financier in $8 billion fraud case

CNBC’s Rick Santelli and the traders on the floor of the CBOE express outrage over the notion they may have to pay their neighbor’s mortgage, particularly if they bought far more house than they could actually afford, with Jason Roney, Sharmac Capital.

Last Update: Thurs. Feb. 19 2009

Source: CNBC

News broke last week that Rahm Emanuel, now White House chief of staff, lived rent-free for years in the home of Rep. Rosa De Lauro, D-Conn. — and failed to disclose the gift, as congressional ethics rules mandate. But this is only the tip of Emanuel’s previously undisclosed ethics problems.

One issue is the work Emanuel tossed the way of De Lauro’s husband. But the bigger one goes back to Emanuel’s days on the board of now-bankrupt mortgage giant Freddie Mac.

Emanuel is a multimillionaire, but lived for the last five years for free in the tony Capitol Hill townhouse owned by De Lauro and her husband, Democratic pollster Stan Greenberg.

Good as gold: investor demand for gold remains high Photo: EDDIE MULHOLLAND

Demand for the safe-haven asset rose by 29pc to $102bn (£72bn) last year, according to the World Gold Council.

The investment demand for gold, which includes gold exchange traded funds (ETFs), gold bars and gold coins, was 64pc higher in 2008 than 2007. Demand for bars and coins rose by 87pc over 2008.

Related article: In the economic downturn, gold shines ever brighter (Independent)

Billionaire Paul Allen is a Microsoft cofounder, the owner of the NFL’s Seattle Seahawks and the owner of the NBA’s Portland Trailblazers.

And, thanks to the stimulus bill President Obama signed this week, he’s also about to be as much as a billion dollars richer.

Here’s how:

Not clear how a corporate tax benefit would be passed through to Paul’s personal tax payments? A reader informs us:

Read moreObama Stimulus Saves Microsoft Billionaire Hundreds Of Millions

Weeks of battling between regulators in Brussels and some of the biggest players in the huge $60,000bn credit derivatives industry ended on Thursday when the industry agreed to clear most EU-based credit default swap contracts in Europe.

And Greenspan should know, since he is one of the people mainly responsible for this mess.

Don’t miss: Mass Retail Closings: About 220,000 stores may close this year

Former Chairman of the Federal Reserve Alan Greenspan testifies before the House Oversight and Government Reform Committee on Capitol Hill in Washington October 23, 2008. REUTERS/Kevin Lamarque

NEW YORK (Reuters) – Former U.S. Federal Reserve Chairman Alan Greenspan said on Tuesday the current global recession will “surely be the longest and deepest” since the 1930s and more government rescue funds are needed to stabilize the U.S. financial system.

Joaquin Almunia, EU’s economic commissioner, said Brussels is ready to co-ordinate a pan-EU response to contain the crisis before matters get out of hand.

“I share with the Austrian authorities their concern about the situation of these economies. Everybody shares their concern about the risks involved. We are extremely concerned about the difficulties with the Ukrainian government,” he said.

Read moreEU mulls action as Ukraine crumble triggers contagion fears for Europe

Dubai got a bailout from Abu Dhabi, or else it would have already collapsed. Now not only Dubai, but the entire region is collapsing.

DUBAI, United Arab Emirates — The world’s economic shadows caught up with Employee No. 861 at the lip of a construction site on Dubai’s desert outskirts.

The foreman tapped on the dump truck’s window and broke the news: The project was slowing and fewer workers were needed. Muhammad Munir Bahadar’s next paycheque would be his last.

Such scenes have been repeated in millions of variations from corner offices to factory lines as the global economic landslide rumbles on.

Don’t miss:

– Dubai will soon be looking like a ghost town

– Once Booming Dubai Goes Bust

But in places such as Dubai — built on imported labourers who banked on the promise of steady construction jobs — there is a distinct brand of desperation: A rising number of low-wage foreign workers, like Bahadar, have become stranded with neither the chance to leave nor the immediate prospect to resume work.

“We are the ghosts of the financial crisis,” said the 36-year-old Pakistani, fingering the expired work site ID that he keeps in his wallet. “It has killed us, but we still roam the streets.”

Bahadar now gets by with some small savings and what he can borrow from fellow Pakistanis who still have their jobs. Bahadar’s last remittance to his family back home came from his last cheque in December.

About 220,000 stores may close this year in America, says our guest, retail consultant Howard Davidowitz of Davidowitz & Associates.

As more Americans save and spend less, it’s clear there’s too much retail space. Just visit Web site deadmalls.com and track retail’s growing body count. And luxury retailers? They’re on “life support,” Davidowitz says.

Among the brandname stores Davidowitz says are in trouble:

Don’t miss: Gerald Celente: The Collapse of 2009; The Greatest Depression

Read moreMass Retail Closings: About 220,000 stores may close this year

The U.K. is in ‘unbelievable’ bad shape:

– Britain’s AAA credit rating threatened by scale of bank bail-out

– Bank of England wants to print more money

– Britain faces £100bn cut in spending according to ‘Bankrupt Britain’ report

– Alistair Darling on BBC’s Newsnight:

“The problem was that last October the banking system was facing imminent collapse,” he said. “We had no alternative but to intervene quickly.We had a matter of days and then hours to stop the entire banking system collapsing. Since then many other countries have done the same thing. The alternative was to let HBOS go down and last October [at such a critical point] the damage would not have stopped there.”

– ‘This is the worst recession for over 100 years’:

‘Surpassing even the Great Depression of the 1930s’

Ed Balls, the PM’s closest ally, warns that downturn is ferocious and says impact will last 15 years

– Jim Rogers: ‘Sell any sterling you might have; It’s finished’

– Jim Rogers: Now it’s time to emigrate, says investment guru

Prepare yourself! Do not rely on your government and the Bank of England.

Royal Bank of Scotland and Lloyds TSB, the two banks bailed out by the Government, are to add between £1 trillion and £1.5 trillion to the public debt, the equivalent of between 70 and 100 per cent of GDP, the Office for National Statistics indicated this morning.

Britain’s public sector net debt is already a record high, hitting 47.8 per cent of GDP in January, official figures show. This is the highest level of debt recorded since the ONS started recording data in 1993.

Read moreBailed-out banks to add £1.5 trillion to public debt

The U.S. is so broke, that it can’t even afford sending a football team to Afghanistan:

– Glenn Beck: United States Debt Obligations Exceed World GDP

– Federal obligations exceed world GDP

The U.S. economy is about to experience a total collapse, because now the financial crisis is hitting the real economy.

The retailers will collapse, which will be much, much worse that the subprime mortgage crisis. The bond bubble will burst. The dollar will be destroyed. The U.S. will default on its debt. The Greatest Depression is coming.

The ‘surge’, with the extra US forces in Afghanistan expected to rise to 30,000, was required to ‘stabilise a deteriorating situation’ said Barack Obama

A grim picture of spiralling violence and a disintegrating society has emerged in Afghanistan in a confidential Nato report, just as Barack Obama vowed to send 17,000 extra American troops to the country in an attempt to stem a tide of insurgency.

Direct attacks on the increasingly precarious Afghan government more than doubled last year, while there was a 50 per cent increase in kidnappings and assassinations. Fatalities among Western forces, including British, went up by 35 per cent while the civilian death toll climbed by 46 per cent, more than the UN had estimated. Violent attacks were up by a third and roadside bombings, the most lethal source of Western casualties, by a quarter. There was also a 67 per cent rise in attacks on aircraft from the ground, a source of concern to Nato which depends hugely on air power in the conflict.

The document, prepared by the Pentagon on behalf of the US-led International Security Assistance Force (Isaf) in Afghanistan and seen by The Independent, also reveal how swathes of the country have slipped out of the control of President Hamid Karzai’s government. According to a poll taken towards the end of last year, a third of the population stated that the Taliban had more influence in their locality.

– Brzezinski: US Recession Could Lead to Riots (U.S. News & World Report):

And if we don’t get some sort of voluntary National Solidarity Fund, at some point there’ll be such political pressure that Congress will start getting in the act, there’s going to be growing conflict between the classes and if people are unemployed and really hurting, hell, there could be even riots.

– Kabul on the edge (Stars and Stripes):

“People are saying that for six or seven years we have all these international troops, but everything is getting worse … security, the economy, everything. So they think America must be supporting the Taliban.”

– Russian navy accused of sinking Chinese cargo ship (Telegraph):

The New Star was pursued out of port in Nakhodka in the Siberian Far East on Sunday by a Russian naval vessel which believed it was involved in smuggling. The pursuing ship fired at least 500 rounds, forcing it to turn back to port, but it sank on the way.

– California Lawmakers Approve Tax Increases to Close $42 Billion Budget Gap (Bloomberg):

A $13 billion tax increase passed….

– Rising debt may overwhelm Barack Obama’s effort to rescue the economy (Times Online):

President Obama was hit with another wave of grim financial news yesterday, amid signs that his Administration is in danger of being overwhelmed by the scale of the economic crisis.

– Pentagon issues performance pay and bonuses averaging 8.35 percent (GovExec.com):

Nearly all of the employees in the Defense Department’s new personnel system were rewarded for their job performance in their first paychecks of 2009, with the average pay raise and bonus totaling 8.35 percent.

– Feb. could be worst month yet for jobless claims (AP):

WASHINGTON – February is shaping up to be another brutal month of job losses: The number of laid-off workers receiving unemployment benefits hit an all-time high of nearly 5 million, and new jobless claims are at levels not seen since the early 1980s.

– Stock Decline Hits Depression Levels (BusinessWeek):

During the darkest 10 years of the Great Depression, from September 1929 to September 1939, the stock market dropped roughly 50%, adjusted for inflation. With today’s drop in the stock market, the U.S. has now matched that unfortunate milestone.

– Greenwald: U.S. Is Bound By Treaty to Prosecute Torture Crimes (Crooks and Liars)

– SEC Uncovers Ponzi Scheme Targeting Deaf Investors (CNBC)

– Benefits neglected for civil retirees (USA Today):

State and local governments have set aside virtually no money to pay $1 trillion or more in medical benefits for retired civil servants, a USA TODAY survey found. With bills coming due as Baby Boomers start to retire, states, cities, school districts and other governments may be forced to raise taxes, cut benefits or both — a task made especially difficult in an economic downturn.

– Foreign firms and investors flee from wounded Celtic Tiger (Guardian):

Brussels lumped Ireland together with Greece and Latvia yesterday on a hit list of countries with “excessive” government deficits, in the latest blow to the pride of the economy once envied across Europe and dubbed the Celtic Tiger.

– Nicolas Sarkozy announces 2.65 bn euro in aid in bid to avert French unrest (Telegraph):

His speech came as violence in the French island of Guadeloupe put pressure on him to avert unrest on the mainland.

– Anger over Labour’s ‘secret plan to push up council taxes’ (Daily Mail):

Labour was last night accused of secretly plotting to raise extra cash from millions of households with a nationwide council tax revaluation. The Government has quietly renewed a multi-million pound deal with one of Britain’s leading property websites to access details of sale prices and floorplans of tens of thousands of homes.

– UK overshoots borrowing target (Financial Times):

… in the 12 months to the end of January 2009, tax revenues have been so weak that borrowing has already exceeded the pre-Budget report forecast and reached £79.3bn. For the past two months, the degree to which the government’s finances have been in deficit over the most recent year of data has deteriorated by £10bn a month.

– UK public finances deteriorate dramatically (Telegraph):

The UK’s public finances deteriorated dramatically in January as the Government’s bank bail-out boosted debt levels and tax revenues dropped sharply.

– Civil servants to benefit from £26 million bonuses (Telegraph)

– Brown leads global drive to close down tax havens (Independent):

Britain is leading moves to end the privileged status of tax havens as part of a planned “global new deal” to tackle the international recession. (Can’t hide from the New World Order.)

– EU fights plan to ring-fence British banks’ toxic assets (Guardian)

– Banks agree to European CDS clearer (Financial Times):

Weeks of battling between regulators in Brussels and some of the biggest players in the huge $60,000bn credit derivatives industry ended on Thursday when the industry agreed to clear most EU-based credit default swap contracts in Europe.

– Brown calls on world to strike ‘grand bargain’ to solve economic crisis (Times Online)

– Venezuela Takes Over Local Bank Owned by Stanford (Bloomberg)

– BNP Paribas, Axa Post Losses After Financial Markets Tumble (Bloomberg):

BNP Paribas, the biggest French bank, had a 1.37 billion- euro ($1.72 billion) fourth-quarter loss…

Axa, Europe’s second-largest insurer, had a deficit of 1.24 billion euros in the second half…

– Bank of Japan Widens Asset-Purchase Program to Ease Credit Woes (Bloomberg)

– Germany ready to help eurozone members (Financial Times):

Germany signalled that it would support emergency action to protect the eurozone if one of its 16 member-states found itself in such serious difficulties that it could not refinance its debt.

– China Feasts on Miners as ‘Bank of Last Resort’ (Bloomberg):

“China has turned out to be the bank of last resort,” said Glyn Lawcock, head of resources research at UBS AG in Sydney. “China is a net importer of copper, bauxite, alumina, nickel, zircon, uranium. China is looking for ways to secure supply of these raw materials.” (Excellent investment strategy, because commodities will go through the roof.)

– World Bank president Zoellick urges EU to help east Europe (Financial Times):

– European banks warn of more job cuts (Guardian):

Mainland European banks today warned of a worsening economic environment throughout this year as they confirmed they had plunged into the red in the final quarter of 2008 and warned of thousands of job losses to come.

– US Sen. Kerry goes to Gaza Strip, avoids Hamas (AP)

– Geronimo’s kin sue Skull and Bones over remains (AP):

HARTFORD, Conn. – Geronimo’s descendants have sued Skull and Bones the secret society at Yale University linked to presidents and other powerful figures claiming that its members stole the remains of the legendary Apache leader decades ago and have kept them ever since.

– What a mess! Experts ponder space junk problem (AP):

VIENNA – Think of it as a galactic garbage dump. With a recent satellite collision still fresh on minds, participants at a meeting in the Austrian capital this week are discussing ways to deal with space debris — junk that is clogging up the orbit around the Earth.