– Spain IS Greece After All: Here Are The Main Outstanding Items Following The Spanish Bailout (ZeroHedge, June 9, 2012):

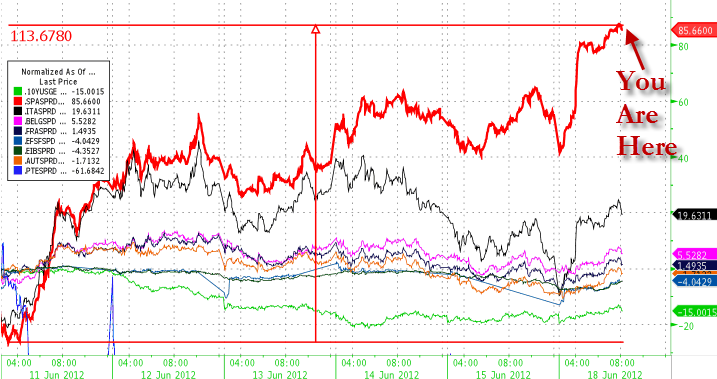

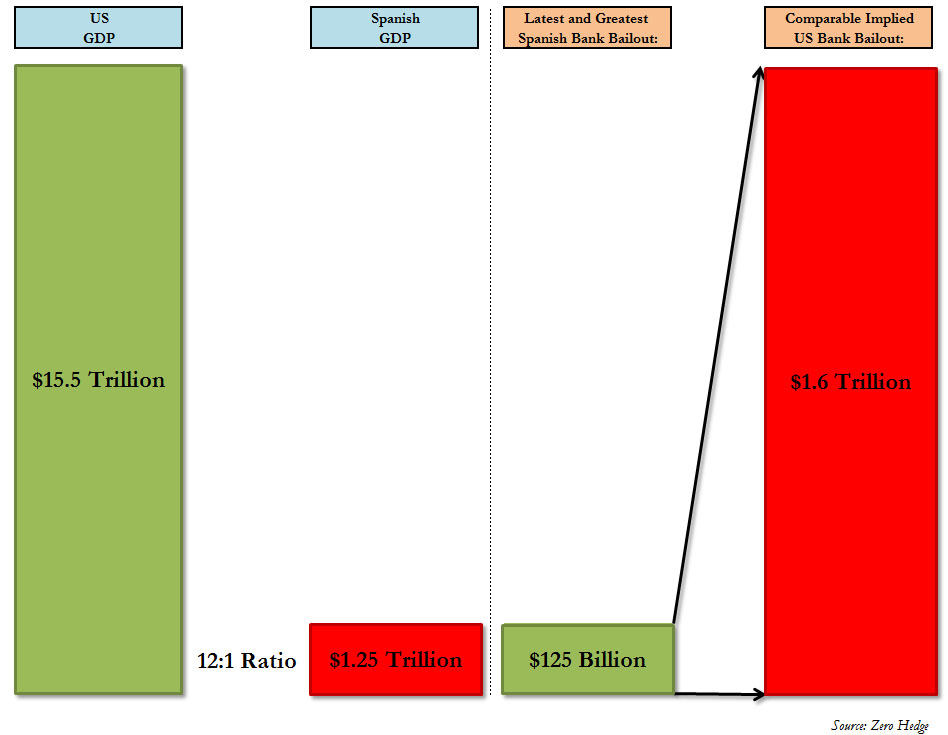

After two years of denials, we finally have the right answer: Spain IS Greece. Only much bigger (it is also the US, although while the US TARP was $700 billion or 5% of then GDP, the just announced Spanish tarp is 10% of Spanish GDP, so technically Spain is 2x the US). So now that the European bailout has moved from Greece, Ireland and Portugal on to the big one, Spain, here are the key outstanding questions.

1. Where will the money come from?

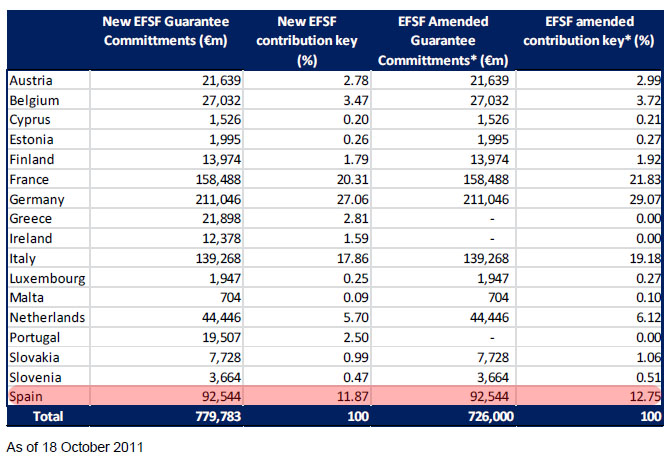

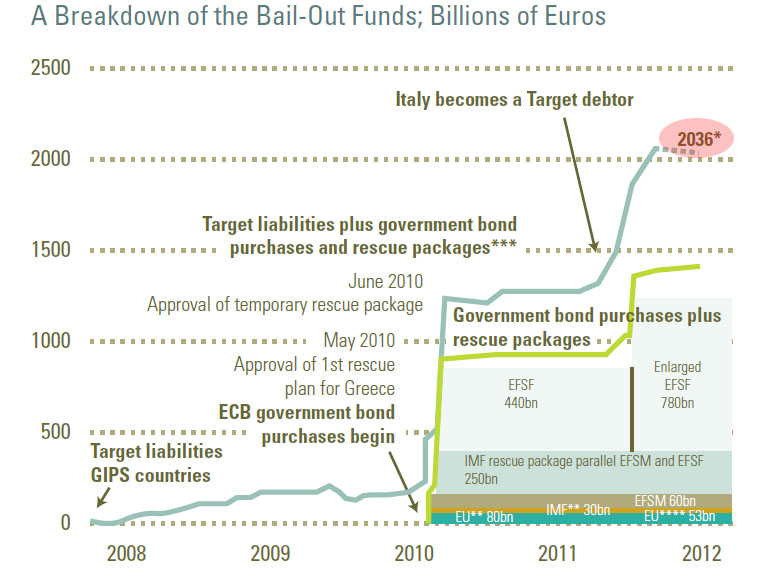

De Guindos, Schauble and the Eurogroup, all announced that the sole source of cash would be the ESM and/or the EFSF. The problem with this is that the ESM has yet to be ratified by Germany, whose parliament said previously it is sternly against allowing the ESM to fund a direct bank bailout, something which just happened. Thus, the successful German ESM ratification vote, whenever it comes, and which previously was taken for granted, now appears to be far more questionable.

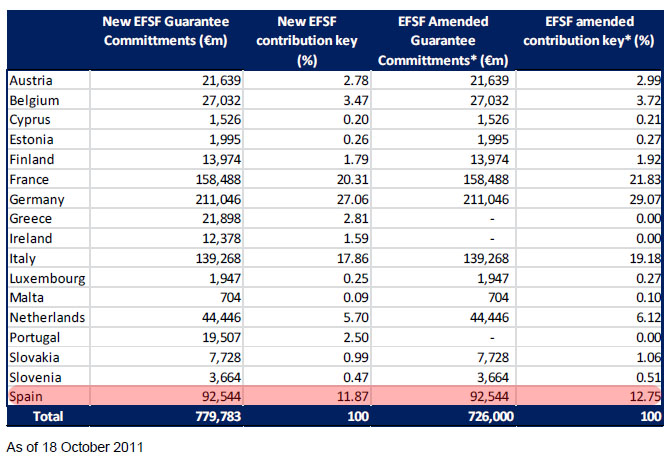

Which leaves the EFSF. The problem with the EFSF is that there is about €200 billion in dry powder. And this includes the Spanish quota of €93 billion, which we can only assume is now officially scrapped.

Which brings us to a bigger question: now that Spain is officially to be bailed out, what happens next. And by that we mean of course the big one: Italy. Recall that as we posted in Brussels… We Have A Problem, once the contagion spreads again to Italy, and that country also needs a bailout, it is game over. From the world’s biggest hedge fund Bridgewater:

Read moreSpain IS Greece After All: Here Are The Main Outstanding Items Following The Spanish Bailout