Submitted by Mike Krieger of KAM LP

We are grateful to the Washington Post, The New York Times, Time Magazine and other great publications whose directors have attended our meetings and respected their promises of discretion for almost forty years. It would have been impossible for us to develop our plan for the world if we had been subjected to the lights of publicity during those years. But, the world is now more sophisticated and prepared to march towards a world government. The supranational sovereignty of an intellectual elite and world bankers is surely preferable to the national auto-determination practiced in past centuries.

– David Rockefeller

The interests behind the Bush Administration, such as the CFR, The Trilateral Commission — founded by Brzezinski for David Rockefeller — and the Bilderberger Group, have prepared for and are now moving to implement open world dictatorship within the next five years. They are not fighting against terrorists. They are fighting against citizens.

– Dr. Johannes B. Koeppl

Chancellor Angela Merkel said that Germany is ready to cede some sovereignty to strengthen the euro area and restore confidence in the common currency…“Germany sees the need in this context to show the markets and the world public that the euro will remain together, that the euro must be defended, but also that we are prepared to give up a little bit of national sovereignty,” Merkel said. Germany wants a strong EU and a euro “of 17 member states that is just as strong and inspires confidence on international markets.”

– Bloomberg article November 16, 2011 http://www.bloomberg.com/news/2011-11-16/merkel-says-germany-ready-to-ce…

Three Card Monti

Just like the con (confidence) game Three Card Monte through which people have been swindled out of their hard earned money in alleyways and street corners all over the world for half a millennium, the previously sovereign nations of Greece and Italy have now officially been placed into the receivership of “technocratic governments” and are now in the final phase of their looting. It truly is sad to watch these proud nations whose histories form the very core of Western civilization be taken down one by one but what is even more nauseating is watching the corporate media pundits, Wall Street analysts and financial experts cheer the news because it is ostensibly “good for markets.” First of all, it doesn’t take a genius to see that the people that screw up the most get promoted and advanced in the Western world’s current political/economic structure. The primary reason for this is that there is a very serious agenda of TPTB and that consists on using crisis to consolidate power in a one-world government, headed by a global central bank that issues a global fiat currency. People have been saying this on the fringe for decades and have been called conspiracy theorists the whole time but if you look at how things are progressing today you’d have to be asleep to not notice that the guys in charge are completely and totally determined to bring this sick, twisted dream into place. That is why the agenda moves forward despite the repeated, desperate cries of the citizenry for them to stop.

Let’s take a look at Mario Monti, the “soft” dictator that has been thrust upon the people of Italy by TPTB. He is a member of the Bilderberg Group, he is the European Chairman of the Trilateral Commission (a think tank founded by David Rockefeller in 1973, see quote at the top) and is international advisor to none other than Goldman Sachs. This guy was put into place by design. Anyone in Italy that thinks they achieved a victory in by ridding themselves of Berlusconi you better think again. You just got the biggest insider, crony financial terrorist around put in charge of your country without having a say in it. Even for someone like me that expects these things, I am amazed by how badly Italy was just screwed. Speaking of the unreported coup that just happened in Italy I will let my friend Jared Dillian of the Daily Dirtnap add his two cents. From his piece today:

So I read recently that Italy wasn’t going to have elections because of “market crisis” or something like that, and I am the last guy who should be writing about this, since I know very little about political systems in any European country, for example, how can you just announce or not announce an election? Aren’t these things on a schedule? So already I don’t know what I am talking about. But I am worried about Greece and Italy that have chosen not to have elections to choose their leaders, I am actually quite concerned about that. You can’t use “market crisis” as an excuse to not hold elections. Even if elections take time and are messy and (most importantly) don’t produce the desired result, it is a part of gosh darn democracy, and if they are going to suspend elections for this, then they can suspend elections for anything. Like, say, pretend Mario Monti is a closet dictator and they just put a guy in there who is never going to hold another election again.

So this is a bad precedent.

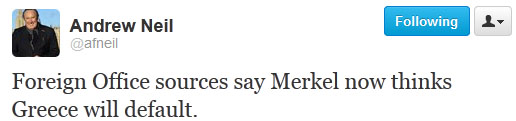

This is way worse than a bad precedent but well said my friend. Oh and another thing. If you are looking at the gold market and wondering why it is so weak stop wondering. In my opinion, all you have to look at is Mario “three card” Monti (credit to Gerald Celente for that name). If I were anyone in Italy that cared I would be checking the gold in the vault every single day. I have zero doubt that Monti is letting the country’s treasure out the back door by the ton in the name of “global stability” and ECB bond purchases. The backroom deals that are happening right now at the expense of the people of Italy have got to be completely off the charts. As I have said many times before, the reason Europe doesn’t announce a solution is because there is no solution. They also know that the minute they announce massive monetization gold and silver will go no offer and the gig will be up. This is also why the FED hasn’t announced QE3 despite their desire to do so. So the strategy is to announce nothing, sell sovereign gold behind the scenes and perform all sorts of market manipulations behind closed doors. While the sheep in most nations will be completely unaware until way after the looting is over and then they are left with chaos and then a real dictator, the leaders of nations of China, Russia and others know exactly what is happening and will happily take Italy’s gold (and whatever Greece hasn’t already sold without telling anyone). I love how leaders keep coming out with stuff like “we need to stop freedom of speech and we need to manipulate markets and we need to take your sovereignty away to create confidence.” The worst part is people actually fall for this crap! On what planet does robbing someone, taking their freedom away and saying you and your children will be slaves forever inspire confidence?

Read moreMike Krieger of KAM LP Exposes Mario ‘Three Card’ Monti