– What really happened in Beijing: Putin, Obama, Xi — and the back story the media won’t tell you (Salon, Nov 14, 2014):

Ukraine, Iran’s nukes, the price of oil: There are ties worthy of a Bourne film, if the media connected the dots

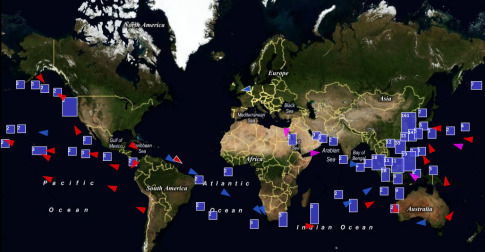

By way of events on the foreign side, the past few weeks start to resemble some once-in-a-while event in the heavens when everyone is supposed to go out and watch as the sun, moon and stars align. There are lots of things happening, and if we put them all together, the way Greek shepherds imagined constellations, a picture emerges. Time to draw the picture.