The Japan stock market celebrates quantitative easing, also being called the nuclear option.

– Shocking Bank Of Japan Trick And QE Boosting Treat Sends Futures To Record High (ZeroHedge, Oct 31, 2014):

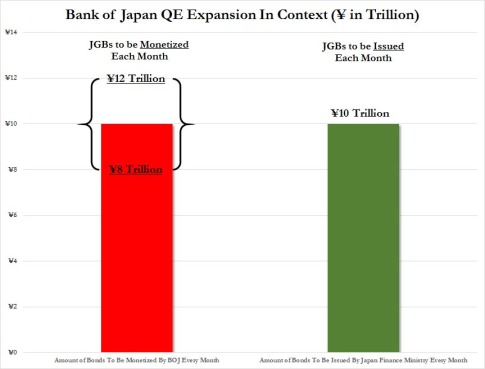

Two days ago, when QE ended and knowing that the market is vastly overstimating the likelihood of a full-blown ECB public debt QE, we tweeted the following: “It’s all up to the BOJ now.” Little did we know how right we would be just 48 hours later. Because as previously reported, the reason why this morning futures are about to surpass record highs is because while the rest of the world was sleeping, the BOJ shocked the world with a decision to boost QE, announcing it would monetize JPY80 trillion in JGBs, up from the JPY60-70 trillion currently and expand the universe of eligible for monetization securities. A decision which will forever be known in FX folklore as the great Halloween Yen-long massacre.

…

– Nikkei Futures Halted Limit Up (+1100) As USDJPY Tops 112 (ZeroHedge, Oct 31, 2014):

Bwuahahahaha… Nikkei futures halted limit up – over 1100 points post-BoJ (+1400 post-FOMC) as USDJPY tops 112 (up 4 handles post-FOMC) to its highest since Jan 2008.

…

– Bank of Japan Reaction Context: Nikkei 225 Is Up 1000 Points In 7 Hours (ZeroHedge, Oct 31, 2014):

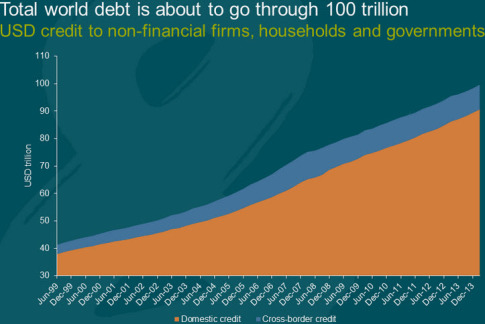

ou know the world’s financial markets have become farce when the broad Nikkei 225 stock market of Japan rises 1000 points in 7 hours… The meme that stock ‘markets’ move on fundamentals not central bank liquidity is officially dead. Let that sink in for a moment…

…