– Carpe Diem, Quam Minimum Credula Postero (ZeroHedge, Sep 3, 2012):

Via Mark J. Grant, author of Out of the Box,(Latin)

“Seize the day, put no trust in tomorrow.”

Tomorrow, September 4, 2012 will be a defining moment. Mr. Draghi will release to the European Central Banks his plan to save the Continent. The plan will get leaked, no doubt, and the consternation will begin throughout Europe. Today the German Economy Minister went public and announced that he supports Weidmann, the head of the German Central Bank, in his opposition to the European Central Bank’s plans to buy debt of Eurozone countries with high borrowing costs, saying that they could not replace economic reforms. I think we may all read this as Frau Merkel’s position as well as Herr Roesler does not speak without approval. The stage is now set for battle.

“A good soldier in an enemy’s country should everywhere and at all times be on the alert. It has been one of the rules of my life, and if I have lived to wear grey hairs it is because I have observed it.”

-Sir Arthur Conan Doyle, The Adventures of Gerard

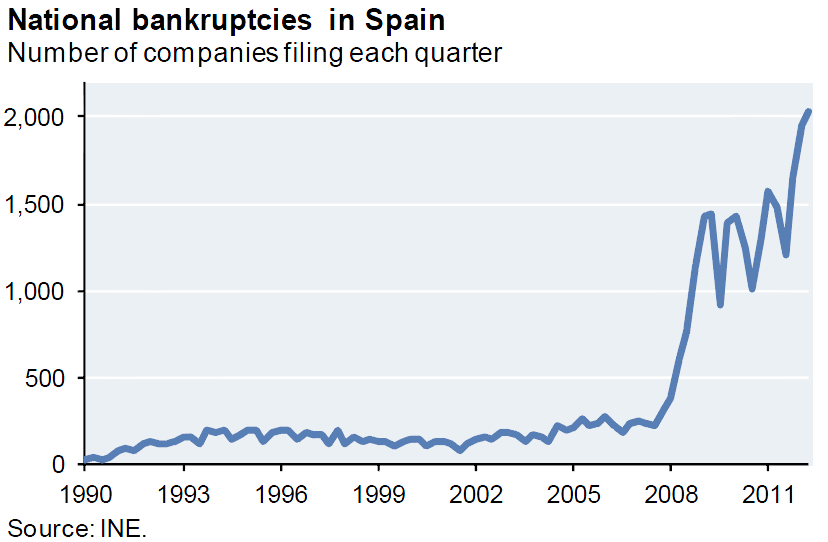

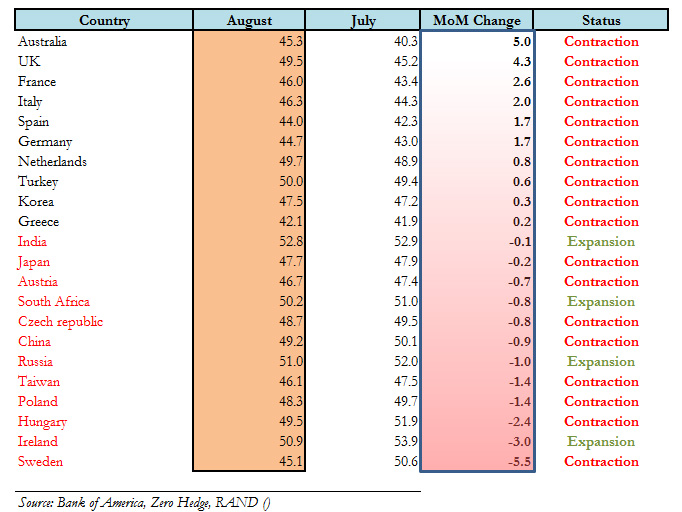

Spain wants the ECB to buy their debt without limit. France, Greece, Portugal, Italy and Cypress are lined up with Spain. The “have nots” are demanding divine intervention; the “haves” are not willing to tithe or to provide the necessary “indulgence” to send Madrid into Heaven. It is not the Barbarians but Martin Luther at the gate and I expect rancor and the spitting of Hell-fire. The Draghi plan, whatever it is going to be, will cause a very serious division of the faithful in Europe and I expect quite a fight. Spain and perhaps Italy are waiting on the plan before lining up for hand-outs and the trouble in Europe keeps escalating. Over the weekend the largest mortgage lender in France had to be bailed out and I expect the cost to be between $40-50 billion. In Spain Bankia had to be rescued and besides the initial payment of $5-6 billion you may expect a $30-40 billion injection required. In Italy the oldest bank in the world, Monte Paschi, turned to the nation to get bailed out in the last few days. The events may be isolated but a pattern is beginning to develop and the amount of money required will send shell-shocks through the national budgets of a number of countries in Europe.

“Once more unto the breach, dear friends, once more…”

-William Shakespeare, Henry V

The Battle Of Frankfurt

Read moreCarpe Diem, Quam Minimum Credula Postero