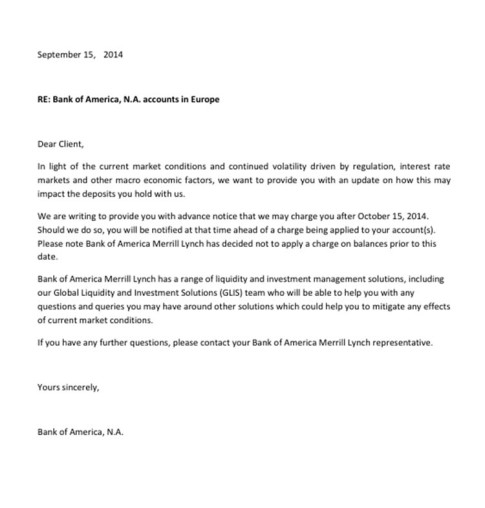

– Gold Tumbles To 2014 Lows As China Unveils Anti-Rigging Benchmark (ZeroHedge, Sep 18, 2014):

With a Fed hinting at exit strategies, gold has tumbled to 2014 lows (and almost in the red year-to-date) as traders apparently forget Japan, China, and European central banks continue to (or are set to) print more money into the global reflation trade. It appears that as the West continues to sell ‘paper’ gold, the East remains enamnored as the PBOC announced this morning:

- *CHINA TO FORM SHANGHAI GOLD BENCHMARK, PBOC GOVERNOR SAYS

- *PBOC CHIEF ZHOU: GOLD MARKET IMPORTANT PART OF FINANCIAL MARKET

- *SHANGHAI GOLD MARKET HAS TO AVOID SYSTEMIC RISK: PBOC’S ZHOU

Furthermore, traders have noted physical buying interest continues in the Asian region as premiums rise in China and India.

As Bloomberg reports, PBOC’s Zhou says Chinese gold market is crucial:

Read moreGold Tumbles To 2014 Lows As China Unveils Anti-Rigging Benchmark