Related info:

– Another Non-Russian, Non-Oligarch, Non-Billionaire, Non-Tax Evader Speaks Up: ‘I Went To Sleep Friday A Rich Man, I Woke Up Poor’

– TOTAL ECONOMIC COLLAPSE AWAITS CYPRUS – Caught In The Cyprus Crossfire: Small Businesses Suddenly With Zero Cash

– Have The Russians Already Quietly Withdrawn All Their Cash From Cyprus? … YES!!!

– And Scene: Big Cypriot Depositors Facing Complete Wipe Out (ZeroHedge, March 29, 2013):

9.9%? 30%? 60%? 80%? Nope – according to the latest from Reuters, the cash-on-cash return to all uninsured depositors in the healthy, i.e., only remaining big Cyprus bank, will be a big, fat doughnut.In what appears to be drastically worse than many had hoped (and expected), uninsured depositors in Cyprus’ largest bank stand to get no actual cash back from their initial deposit as the plan (expected to be announced tomorrow) is:

- 22.5% of the previous cash deposit gone forever (pure haircut)

- 40% of the previous cash deposit will receive interest (but will never be repaid),

- and the remaining 37.5% of the previous cash deposit will be swapped into equity into the bank (a completely worthless bank that is of course.)

So, theoretically this is 62.5% haircut but once everyone decides to ‘sell’ their shares to reconstitute some cash then we would imagine it will be far greater. Furthermore, at what valuation will the 37.5% equity be allocated (we suspect a rather aggressive mark-up to ‘market’ clearing levels).

Critically though, there is no cash. None. If you had EUR150,000 in the bank last week (net of insured deposits which may well be impaired before all is said and done) you now have EUR0,000 to draw on! But will earn interest on EUR60,000 (though we do not know at what rate); and own EUR56,250 worth of Bank of Cyprus shares (the same bank that will experience the slow-burn leak of capital controlled outflows).

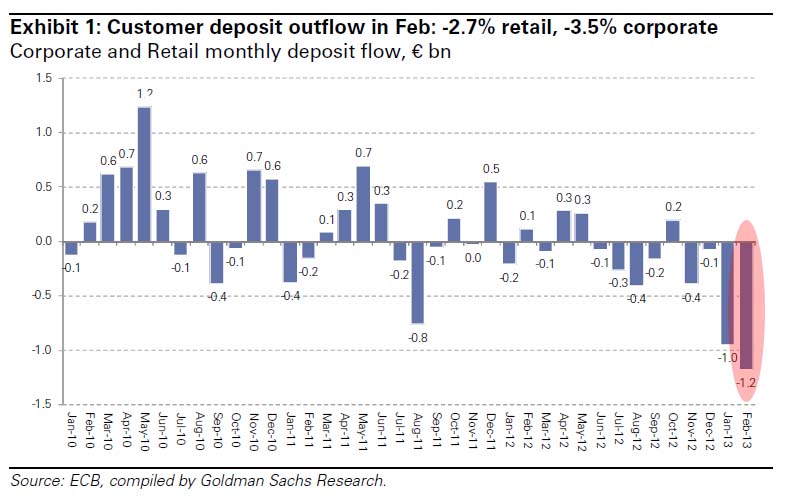

It seems, just as we warned, that the deposit outflow leakage that we discussed did indeed weaken the situation of the large banks significantly.

As Reuters adds, the toughening of the terms will send a clear signal that the bailout means the end of Cyprus as a hub for offshore finance and could accelerate economic decline on the island and bring steeper job losses.

– Big depositors in Cyprus to lose far more than feared (Reuters, March 29, 2013):

Big depositors in Cyprus’s largest bank stand to lose far more than initially feared under a European Union rescue package to save the island from bankruptcy, a source with direct knowledge of the terms said on Friday.

Read moreCyprus: Why Big Depositors Are Facing A Complete Wipe Out