– Many baby seals dying of leukemia-linked disorder along California coast — Blamed for over 1/3 of recent deaths at San Francisco Bay rescue center (CHART) (ENENews, Aug 26, 2015)

Month: August 2015

Baby Sea Lions Are Dying

– Baby Sea Lions Are Dying (Mother Jones, Aug 26, 2015)

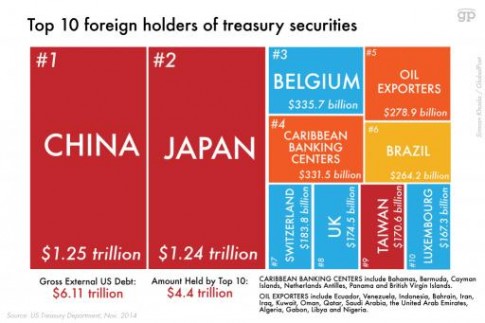

The Great Unwind, China Begins Dumping Treasuries

– The Great Unwind, China Begins Dumping Treasuries (Sprott Money):

charts from: http://www.globalpost.com/dispatch/news/regions/americas/united-states/150204/chart-us-foreign-debt

Behind the scenes is an event unfolding that has the market shaking in its boots. Yet you don’t hear this discussed by the mainstream media, let alone investment bankers.

The reason? It is an event that has been talked about throughout China’s rise to prominence. It has been pondered and feared by Western bankers and politicians. The event I am talking about is the dumping of US treasuries by China.

Oil Surges To $45 After Saudi Troops Invade Yemen

– Oil Surges To $45 After Saudi Troops Invade Yemen (ZeroHedge, Aug 28, 2015):

For the 3rd day in a row, crude oil prices are spiking as the short squeeze morphs into a war premium. Heberler reports that Saudi ground troops have entered Northern Yemen and seized control of two areas in the Saada province. WTI is now above $45…

As we noted previously, boots have been on the ground there (and tank tracks) since early July…

But, as Haberler reports, forces seize control of two areas in Yemen’s Saada province in the first actual ground offensive by The Saudis…

Putin To Get $3 Billion From US Taxpayers After Ukraine Bond Debacle

– Putin To Get $3 Billion From US Taxpayers After Ukraine Bond Debacle (ZeroHedge, Aug 28, 2015):

On Thursday, Ukraine struck a restructuring agreement on some $18 billion in Eurobonds with a group of creditors headed by Franklin Templeton. The deal calls for a 20% writedown and a reprofiling that includes a maturity extension of four years and an across-the-board 7.75% coupon. All told, Kiev should save around, let’s just call it $4 billion once everything is said and done (there are some miscellaneous loans and bonds that still have to be worked out).

That’s the good news.

The bad news is that Ukraine also owes $3 billion to Vladimir Putin.

Now obviously, owing Vladimir Putin $3 billion is not a situation one ever wants to find themselves in, but this particular case is exacerbated by the fact that Putin did not loan the money to Ukraine as we know it now, he loaned the money to a Ukraine that was governed by Russian-backed Viktor Yanukovych. Of course Yanukovych was run out of the country last year following a wave of John McCain-attended protests.

Read morePutin To Get $3 Billion From US Taxpayers After Ukraine Bond Debacle

“Total Capitulation” – Biggest Weekly Equity Outflow On Record

– “Total Capitulation” – Biggest Weekly Equity Outflow On Record (ZeroHedge, Aug 28, 2015):

If anyone was curious why the Fear and Greed index is at 13 (up from 5) despite the biggest 2-day surge in the Dow Jones ever, the answer is very simple: nobody believes the “broken market “any more, as confirmed by the biggest weekly equity outflow on record.

…

Nearly 1000 Rabbis Against Peace and Stability

– Rabbis Against Peace and Stability (Steve Lendman Blog):

by Stephen LendmanHundreds of US rabbis (nearly 1,000 as of August 27) signed an open letter – urging Congress to reject the Iran nuclear deal, reducing chances for greater Middle East war if approved, saying:“We, the undersigned rabbis, write as a unified voice across religious denominations to express our concerns with the proposed nuclear agreement with Iran.”“We have weighed the various implications of supporting – or opposing – this agreement. Together, we are deeply troubled by the proposed deal, and believe this agreement will harm the short-term and longterm interests of both the United States and our allies, particularly Israel.”

S&P 500 Suffers ‘Death Cross’ For First Time In 4 Years

Related info:

– SHEMITAH EXPOSED: Financial Crisis Planned For September 2015 (Video)

– S&P 500 Suffers ‘Death Cross’ For First Time In 4 Years (ZeroHedge, Aug 28, 2015):

This is the first time that the 50-day moving average crosses below the 200-day moving average since August 2011, creating the ominous-sounding “death cross.” The month following this ‘event’ has produced negative returns 80% of the time…

…

Cocaine Production Plummets After DEA Kicked Out Of Bolivia

– Cocaine Production Plummets After DEA Kicked Out Of Bolivia (Anti Media, Aug 27, 2015):

After the U.S. Drug Enforcement Agency (DEA) was kicked out of Bolivia, the country was able to drastically reduce the amount of coca (cocaine) produced within its borders. According to data released by the United Nations, cocaine production in the country declined by 11% in the past year, marking the fourth year in a row of steady decrease.

It was just seven years ago that the DEA left Bolivia — and only three years after that, progress was finally made. The strategy employed by the Bolivian government may be a surprise to many prohibitionists because it did not involve any strong-arm police state tactics. Instead, they worked to find alternative crops for farmers to grow that would actually make them more money.

Read moreCocaine Production Plummets After DEA Kicked Out Of Bolivia

Donald Trump Exposed

– The Donald Exposed (for starfcker and his Trumpeteers) (The Burning Platform, Aug 27, 2015):

It is pure idiocy to support a man simply because he is outspoken, or says popular things, or has mastered the art of titillation. Have you people forgotten Chris Christie??

- Some say “People are rallying behind him not because they agree with him, but merely because they find him to be the most truthful.” About … what truth?? The man vacillates between whatever “truth” is the most popular.

- Others think the guy is great because he’s rich … as if that’s a legitimate marker.

The Financial Times Calls for Ending Cash, Calls It A ‘Barbarous Relic’

H/t reader squodgy:

“Here it comes again…..incrementalisation…..”

* * *

As I’ve said before:

The people should resist a cashless society with everything they’ve got, …

… because next up are RFID microchip implants and if the people will allow THIS to happen, …

… then it is all over.

– The Financial Times Calls for Ending Cash, Calls it a “Barbarous Relic” (Liberty Blitzkrieg, Aug 27, 2015):

Earlier this week, as the financial world was mesmerized by a min-stock market crash, the Financial Times published a dastardly little piece of fascist propaganda.

There is no more egregious anti-liberty economic policy imaginable than banning cash. I covered this earlier in the year in the post, Martin Armstrong Reports on a Secret Meeting in London to Ban Cash. Here’s an excerpt:

At this point, anyone paying even the slightest bit of attention to the central planning economic totalitarians running the fraudulent global financial system is aware of the blatant push in the media to acclimate the masses to accepting a “cashless society.”

Read moreThe Financial Times Calls for Ending Cash, Calls It A ‘Barbarous Relic’

The Secret Meeting in London to End Cash

– The Secret Meeting in London to End Cash (Armstrong Economics, Aug 27, 2015):

I find it extremely perplexing that I have been the only one to report of the secret meeting in London. Kenneth Rogoff of Harvard University, and Willem Butler, the Chief Economist at Citigroup, will address the central banks to advocate the elimination of all cash to bring to fruition the day when you cannot buy or sell anything without government approval. When I googled the issue to see who else has picked it up, to my surprise, Armstrong Economics comes up first. Others are quoting me, and I even find it spreading as far as the Central Bank of Nigeria, but I have yet to find any reports on the meeting taking place in London, when my sources are direct.

Nazis’ Gold Train Is Said to Have Been Found in Poland

– Nazis’ Gold Train Is Said to Have Been Found in Poland (RINF, Aug 27, 2015):

On 27 August, Polish Radio announced that two people have presented evidence that they have discovered Nazi Germany’s legendary “Gold Train,” containing art and that’s especially “laden with precious metals,” and that the pair are demanding a 10% cut of its value, for finding this nearly 200-yard-long train, in a hidden mountain tunnel in the Polish town of Walzbrych, formerly the German town of Waldenburg. Nazis had constructed the tunnel in 1943, to hide valuables from Soviet forces, in the event that Germany might lose the war.

Read moreNazis’ Gold Train Is Said to Have Been Found in Poland

Fabricated Pentagon Reports On ISIS

H/t reader squodgy:

“Where the hell is John Connor when you need him?”

– Fabricated Pentagon Reports on ISIS (ZeroHedge, Aug 27, 2015):

By Steven J. Lendman

The Black Standard or the Black Banner is the official flag used by ISIS in the Middle East.America’s “war on terror” is a complete hoax. It’s a war OF terror on humanity. Washington actively recruits their fighters along with other takfiri elements.

Official US claims about wanting to degrade and defeat ISIS are a complete fabrication. Washington actively recruits their fighters along with other takfiri elements – as foot soldiers for endless wars of aggression against nations targeted for regime change.

China’s economic woes extend far beyond its stock market

H/t reader M.G.:

“Here is a voice of sanity in the midst of the happy horseshit about the great revival of the markets:”

– China’s economic woes extend far beyond its stock market (Guardian, Aug 27, 2015):

The Chinese government’s heavy handed efforts to contain recent stock market volatility – the latest move prohibits short-selling and sales by major shareholders – have seriously damaged its credibility. But China’s policy failures should come as no surprise. Policymakers there are far from the first to mismanage financial markets, currencies, and trade. Many European governments, for example, suffered humiliating losses defending currencies that were misaligned in the early 1990s.

Still, China’s economy remains a source of significant uncertainty. Indeed, although the performance of China’s stock market and that of its real economy has not been closely correlated, a major slowdown is under way. That is a serious concern, occupying finance ministries, central banks, trading desks, and importers and exporters worldwide.

…

Six ways China has tried to remedy economic slowdown and shares slide

H/t reader M.G.:

“If this isn’t a recipe for disaster, I don’t know what is…..”

– Six ways China has tried to remedy economic slowdown and shares slide (Guardian, Aug 25, 2015):

Governments can pull many levers to influence the behaviour of households, businesses and investors – Beijing has opted for half a dozen

China has tried to reboot its economy for the last year after it became obvious that a slowdown in early 2014 was turning into a steady decline in growth. Governments can pull many levers to influence the behaviour of households, businesses and investors. Here are the six main ones Beijing has used.

Cutting interest rates

The cut on Tuesday is the fifth since November and brings interest rates in the country down to 4.86% – an all-time low after having averaged 6.36% between 1996 and last year. The People’s Bank of China shaved another 0.25 percentage points off the borrowing and deposit rates to spur bank lending and encourage savers to spend the cash rather than earn a declining return on their money.

Read moreSix ways China has tried to remedy economic slowdown and shares slide

Trump’s Deck Of Jewish Cards (Video)

25.08.2015

It’s Official: China Confirms It Has Begun Liquidating Treasuries, Warns Washington

– It’s Official: China Confirms It Has Begun Liquidating Treasuries, Warns Washington (ZeroHedge, Aug 27, 2015):

As Bloomberg reports, “China has cut its holdings of U.S. Treasuries this month to raise dollars needed to support the yuan in the wake of a shock devaluation two weeks ago, according to people familiar with the matter. Channels for such transactions include China selling directly, as well as through agents in Belgium and Switzerland, said one of the people, who declined to be identified as the information isn’t public. China has communicated with U.S. authorities about the sales.”

…

Media Blackout: Canada Plans To Dump Nuclear Waste Less Than Mile From US Border

– Media Blackout: Canada Plans To Dump Nuclear Waste Less Than Mile From US Border (ZeroHedge, Aug 27, 2015):

Over the last few years, the United States has not had the best track record with Deep Geologic Repositories (DGR) for nuclear waste. In February of 2014, the U.S.’ DGR, known as the Waste Isolation Pilot Plant (WIPP), had two separate incidents that compromised the integrity of the project by releasing airborne radioactive contamination. While most U.S. citizens were relatively unaffected by the events, our Canadian neighbors have proposed a plan to construct a DGR 0.6 miles from America’s largest source of fresh water, the Great Lakes — and the U.S. State Department is remaining relatively uninvolved.

Read moreMedia Blackout: Canada Plans To Dump Nuclear Waste Less Than Mile From US Border

What China’s Treasury Liquidation Means: $1 Trillion QE In Reverse

– What China’s Treasury Liquidation Means: $1 Trillion QE In Reverse (ZeroHedge, Aug 27, 2015):

The size of the epic RMB carry trade could be as high as $1.1 trillion. If China were to liquidate $1 trillion in reserves (i.e. USTs) in order to stabilize the yuan in the face of the carry unwind, it would effectively offset 60% of QE3 and put around 200 bps of upward pressure on 10Y yields. So in effect, China’s UST dumping is QE in reverse – and on a massive scale.

…

Yuan Strengthens Most Since March, China Unveils New Bailout Source After Rescue Fund Runs Out Of Fire-Power

– Yuan Strengthens Most Since March, China Unveils New Bailout Source After Rescue Fund Runs Out Of Fire-Power (ZeroHedge, Aug 27, 2015):

Update: China readies new bailout mechanism – pooling CNY2 Trillion of Pension funds for “investment”

A busy night in AsiaPac before China even opens. Vietnam had a failed bond auction, Japanese data was mixed (retail sales good, household spending bad, CPI just right), Moody’s downgrades China growth (surprise!), China re-blames US for global market rout, and then the big one hits – China’s bailout fund needs more money (applies for more loans from banks) – in other words – The PBOC just got a margin call. China margin debt balance fell for 8th straight day (although the short-selling balance picked up to 1-week highs). China unveiled some economic reforms – lifting tax exemption and foreign real estate investment rules. PBOC fixesds the Yuan 0.15% stronger – most since March, but even with last night’s epic intervention, SHCOMP looks set for its worst week since Lehman.

…

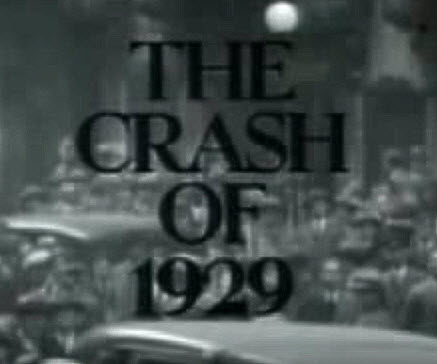

Remembering the Summer of 1929

– Remembering the Summer of 1929 (The Burning Platform, Aug 27, 2015)

Flashback:

Chinese Man Jumps From 17th Floor In First Stock Market Casualty

– Chinese Man Jumps From 17th Floor In First Stock Market Casualty (ZeroHedge, Aug 27, 2015):

It appears the collapse of China’s stock market has officially taken its first victim. While we have heard from desperate farmers who lost everything after realizing that making money in stocks is not easier than farmwork, RT reports that a 57-year-old man has allegedly committed suicide in Shenyang, the largest city in Liaoning Province, by jumping off the 17th floor of a building with a black briefcase “full of stock-related materials,” local press reported.

…

JPM Head Quant Warns Second Market Crash May Be Imminent: Violent Selling Could Return On Thursday

– JPM Head Quant Warns Second Market Crash May Be Imminent: Violent Selling Could Return On Thursday (ZeroHedge, Aug 27, 2015):

“Price insensitive” flows are starting to materialize, and our goal is to estimate their likely size and timing. These technical flows are determined by algorithms and risk limits, and can hence push the market away from fundamentals. The obvious risk is if these technical flows outsize fundamental buyers. In the current environment of low liquidity, they may cause a market crash such as the one we saw at the US market open on Mondaay”

…