– The Great Unwind, China Begins Dumping Treasuries (Sprott Money):

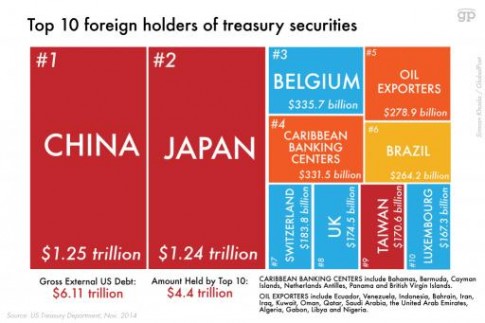

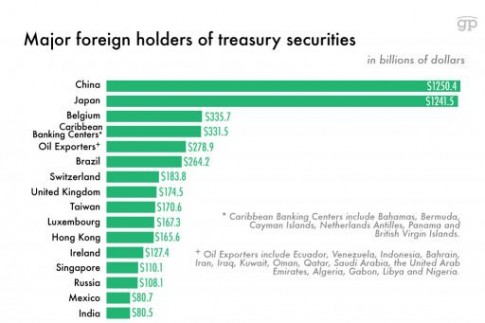

charts from: http://www.globalpost.com/dispatch/news/regions/americas/united-states/150204/chart-us-foreign-debt

Behind the scenes is an event unfolding that has the market shaking in its boots. Yet you don’t hear this discussed by the mainstream media, let alone investment bankers.

The reason? It is an event that has been talked about throughout China’s rise to prominence. It has been pondered and feared by Western bankers and politicians. The event I am talking about is the dumping of US treasuries by China.

It is common knowledge, that China has been propping up Western economies over the last decade and longer, it is common knowledge that China has the ability to wipe out the US dollar in one quick motion, by dumping their treasuries on the market.

What is not common knowledge are the recent events that have unfolded behind the scenes in which China has begun this very process.

On August 11th, China unexpectedly devalued the Yuan. This came as a shock to the markets, which saw the currency rapidly plummet by 4% and would have continued to do so if not for the extreme intervention of the Chinese Plunge Protection Team.

Since that time, they have been actively and directly engaging in the Forex markets, where they have propped-up the Yuan and artificially maintained their fix with the US dollar.

How did they do this you ask? By selling US treasuries. That’s right, it is being reported, that in the past two weeks alone, China has sold over $106 billion worth of treasuries! But this isn’t all, since the start of this year, China has sold an additional $107 billion worth of treasuries!

You read that correctly, not only is China accelerating their dumping of US treasuries, they have hyper-accelerated this process in the last two weeks, dumping almost as much as an entire year’s worth of US treasuries.

Yet, why haven’t treasuries collapsed under this huge influx of supply on the market? This is the true question that you have to ask and is not being answered. Who is buying up this huge influx of supply?

Remember, this is a period of time when the world is facing renewed uncertainty and is already awash with fiat dollars. The first and only likely candidate that comes to mind is the FED.

It is highly likely that the FED has been monetizing their own treasuries, in an act that is akin to paying off a credit card with a credit card.

As the situation in China continues to move into the realm of a full-blown crisis, you have to wonder how much more of their massive stockpile of treasuries are they willing to dump on the market? Likewise, how much more can the FED handle before the market wakes up and sees this Ponzi scheme for what it is?

Loretta Mester, Cleveland Fed President just announced we are at full employment, and that a rate increase is sustainable. She did admit a stronger dollar is “disinflation”. What a total idiot! Just saw her on Bloomberg……..a fool.

Fischer, another FED president was featured on CNBC….Says its too early to estimate this so-called interest rate in September. He said to put the rate hike “back on the table”, claiming the labor market growth “was impressive.”

VIX is over 28 and climbing in last 30 minutes…….that is pretty powerful……The US markets are controlled by a few individuals running funds worth hundreds of millions…They are pumping oil like crazy, regardless global demand has dropped to a crawl.

They are calling the emerging market collapse “a tantrum.” The greedy guts want QE 4……admitting China is “a huge problem” with at least a 3% decline, (at a -1.1% GDP?) China is “unwinding.” These are the talking greedy gut heads……

Bloomberg: “Extraordinary volatility…” the only fact I have heard. I normally do not heed the talking heads on these two channels, but am taking note of the spin. It is all crap…..The US economy is not in recovery, we are not at full employment……93.8 million working age Americans are suffering long term unemployment out of a pool of slightly over 200 million working age citizens. That is close to 50% unemployment……and these clowns say it is at 5%……

They have even changed the graphs to deny the reality of falling value……it is unbelievable. I cannot listen to any more…….Media has become the message; but I don’t see how the reality of a collapsing global economy can be denied forever……….

If the powers that be are this afraid, we are in deep trouble. Denying truth on every level has reached epic proportions…..How can this be sustained? It is insanity.

The FED bought most of the bad mortgage backed securities in 2008, bailed out the banks, fed the wrongdoers billions…..They have pumped trillions of empty dollars into the pockets of the same people who destroyed the world economy……They did give a billion for people to buy cars, remember?

If the FED is buying our treasuries, we are in deep trouble…..we are losing value on a global scale very quickly.

This is all one big game. Whatever happens, there will be just one winner, the banksters. Our irrelevance is rapidly getting obvious, and the theorists are so immersed in trying to explain what has never been a truly predictable science other than the classic simple (Supply v Demand) graph, that they cannot see the express train of deliberate manipulation and destruction for swathes of the population.

http://dailyreckoning.com/this-market-is-a-wheelbarrow-of-dynamite-waiting-to-blow/

I think the market crash, followed by the immediate recovery, is like a fart, advising the goods are on the way.

Great site, Stanley.

Thanks