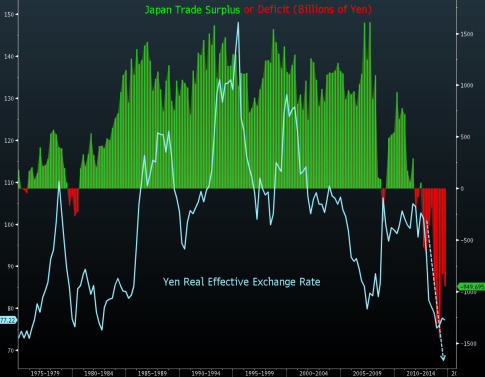

– How Japanese Hyperinflation Starts (In 1 Chart) (ZeroHedge, Oct 21, 2014):

The Japanese Yen’s real effective exchange rate (REER) has collapsed to the weakest since 1982, according to Mitsubishi UFJ Morgan Stanley Securities. Simply put, REER is a trade-weighted measure of Yen strength (or weakness) against, in this case, 59 trading partners; and as the nation posts an unprecedented 27th straight month of trade deficits [43rd straight month of Seasonally-adjusted trade deficits], Bloomberg reports MUFJ indicates “a structural shift” has taken place.

As a reminder, the Real Effective Exchange Rate (REER) is: