– The Italian Job: How Borrowing And Printing Lead To An Economic Dead End (David Stockman’s Contra Corner, Aug 21, 2014):

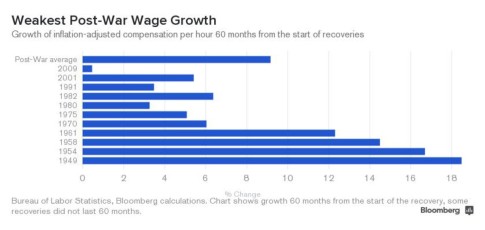

Earlier this week Bloomberg published a devastating chart showing real hourly wage growth for the first 60 months of every cycle going back to 1949. The 11 cycle average gain was 9% and the largest was 19% a half century back.

Fast forward to the 60 months of ZIRP and QE since the Great Recession officially ended in June 2009, however, and you get a drastically different picture: Real hourly wages have risen by just 0.5%, and in the great scheme of things that’s a rounding error.

Surely the above chart is also flat-out proof that massive money printing doesn’t work. After all, reflating wages, jobs and incomes is what the monetary politburo claims it’s all about. Indeed, the Fed has insouciantly cast a blind eye to the massive bubbles building everywhere in the financial system, and has kept money market rates relentlessly at zero for six years running on the grounds that it is not yet done “stimulating” the labor market.

So why does this abysmally failed and dangerous experiment continue unabated—as Yellen will undoubtedly confirm at Jackson Hole? Self-evidently, it is irresistibly convenient to both Wall Street and Washington. The former gorges on a massive diet of carry trade gambling windfalls thanks to ZIRP and the Greenspan/Bernanke/Yellen “put”; and the latter gets a fiscal get-out-of-jail-free card owing to the Fed’s massive repression of interest rates. Indeed, with the public debt now topping $17.7 trillion, the implicit (and fraudulent) debt service relief from current ultra-low interest rates amounts to upwards of $500 billion per year.

Read moreThe Italian Job: How Borrowing And Printing Lead To An Economic Dead End