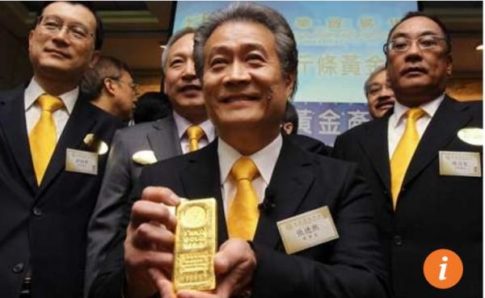

A 2011 file photo of honorary permanent president Haywood Cheung Tak-hay

of the Chinese Gold & Silver Exchange Society (centre) while conducting duties

as then president. Photo: Edward Wong

– Hong Kong Is Building The Biggest Gold Vault And Trading Hub In The World:

Less than a week after the official launch of the Chinese Yuan-denominated gold fix on the Shanghai Gold Exchange, a historic move which represents “an ambitious step to exert more control over the pricing of the metal and boost its influence in the global bullion market” and which will gradually transform the market of paper gold trading, in the process shifting the global trading hub from west (London) to east (China), overnight Hong Kong’s Chinese Gold and Silver Exchange (CGSE) Society revealed plans to do something similar for physical gold when it announced plans for what may end up being the biggest gold vault in the world.

As reported initially by SCMP, the Hong Kong gold exchange has teamed up with the world’s biggest bank by both assets and market cap, China’s Industrial and Commercial Bank of China (ICBC) to launch gold trading services in the Qianhai free trade zone in September, providing custodial and physical settlement service targeted at commercial users and precious metals traders, according to the exchange head.

Haywood Cheung Tak-hay, the honorary permanent president of the 105-year-old Chinese Gold and Silver Exchange Society, said theexchange has teamed up with ICBC to use its gold vault in Qianhai as a temporary bonded warehouse for Hong Kong traders and manufacturers to store their gold.

The plan is to replace this temporary facility with a massive, HK$1 billion permanent gold vault facility, including a bonded warehouse, trading floor and related offices areas in Qianhai: that would make it among the largest if not the biggest gold vault and trading hub in the world. The project will take two years before completion, according to Cheung.“ICBC is the largest of 15 gold importers authorised in mainland China. It is the largest bank in the mainland and has an international branch network which could provide bank clearing and settlement services.” It also appears to have an acute interest in the yellow metal.

Cited by SCMP, Cheung said that “ICBC’s Macau branch also handles gold import and export services. Teaming up with ICBC would connect Hong Kong, Macau, Qianhai and Shenzhen as a gold trading hub,” he added.

The new “hub” would capture not only the paper but physical trading as well – as gold storage across – in the wealthiest Pacific Rim countries where the world’s biggest demand for gold is currently to be found.

The Chinese Gold and Silver Exchange Society partnered with the Shanghai international gold board last year to provide gold trading and custodial services. Twenty-one Hong Kong financial companies are authorised to trade gold in Shanghai.

The official reason behind the proposed Qianhai facility is to benefit Hongkongers, as it will enable trade in Shanghai and physical settlement in Qianhai. The service is believed to be particularly useful to jewellery manufacturers with operations in Shenzhen. It will also be possible for large dealers to ship their bullion from Shanghai to Qianhai.

“The development of the gold industry will speed up the physical delivery process of gold trading in Hong Kong, Shanghai and Qianhai. Of China’s 3,000 gold-jewellery manufacturers, 70 per cent have factories in Shenzhen, The bonded warehouse in Qianhai, which is next to Shenzhen, would make it much easier for them to access gold when needed,” he said.

Currently, jewellery manufacturers must transport gold from Hong Kong and Shanghai to their factories in Shenzhen, in what can be a lengthy process.

The new facility will also allow China’s uber wealthy, should they decide they no longer feel “comfortable” storing their millions of gold in Shanghai, to gradually shift it to Hong Kong.

At the same, SCMP reports that the Hong Kong Exchanges and Clearing, which scrapped its gold contract last year owing to low trading volume, is planning to relaunch gold futures trading, according to Chief Executive Charles Li Xiaojia, although a launch date has not been announced.

Cheung said he was not worried about competition from HKEx.

It remans to be seen how successful the new hub will be or whether it will even be completed as scheduled, however one thing is increasingly clear: as the rest of the (developed) world is increasingly exiting the gold trading, bonding, custody and vaulting business, the interest in China, already the world’s largest importer of gold, has never been higher. One still wonders how long before China’s serial bubble obsession, which moved from housing, to stocks, to bonds, to commodities and back to housing all in under two years, resets its attention on gold – the same gold which with the help of soaring Chinese demand in mid-2011 saw the price of the yellow metal soar to all time highs just shy of $2000.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP