– China Enters Currency War – Devalues Yuan By Most On Record (ZeroHedge, Aug 11, 2015):

Update: The Chinese currency complex is collapsing… 12 month NDFs just hit a new 5 year lows against the USD – biggest plunge since Lehman

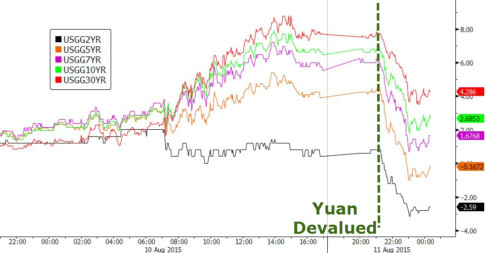

And Treasury yield stumble and have unwound Monday’s losses…

And then there’s this….

#China new loans 2x the size of Total Social Finance?! Do even THEY know what’s going on post PPT & LGV bail-out? pic.twitter.com/QCkLWiI5TA

— Wild Goose (@TrueSinews) August 11, 2015

* * *

As we detailed earlier…

Chinese stocks are holding on to modest losses in the pre-open as, just as we have been warning, the PBOC weakens the Yuan fix by the most on record.

As we first warned in March, and as became abundantly clear over the weekend when weaker than expected export data as well as the steepest decline in factory gate prices in six years underscored the extent to which the engine of global growth and trade has officially stalled, Beijing has no choice but to join the global currency wars, as the yuan’s dollar peg will ultimately prove to be too painful going forward. The renminbi has appreciated on a REER basis by double digits over the past 12 months, weighing heavily on already depressed exports. With multiple policy rate cuts having proven to be largely ineffective at resurrecting the flagging economy, the PBoC, despite the notion that this represents a “one-off”move, has been left with little choice. The bottom line: the danger posed by the country’s deepening economic slump now definitively outweighs the risk of accelerating capital outflows – especially after the latter moderated slightly in Q2.

As we noted over the weekend, “one can repeat that the PBOC will have to lower rates again until one is blue in the face (even as out of control soaring pork prices make it virtually impossible for the local authorities to ease any more), the realty is that Chinese QE is now inevitable. Why? Because while the government is already clearly buying stocks thereby validating the “other” transmission mechanism, the only thing the PBOC still hasn’t tried is to devalue the yuan. As global trade continues to disintegrate, and as a desperate China finally joins the global currency war, it will have no choice but to devalued next.”

Recall also what SocGen’s Albert Edwards said some five months ago:

We have long believed that China’s growth and deflation problems will necessitate a devaluation of the renminbi in a strong dollar environment. There is mounting evidence that this process may already be underway as the currency falls to a 28-month low against the dollar…

In the current deflationary environment the Chinese authorities simply can no longer tolerate the continued appreciation of their real exchange rate caused by the dollar link.

The 1.9% devaluation sends the Yuan to its weakest since April 2013. Gold is leaking lower as the offshore Renminbi collapses by the most since Oct 2011.

PBOC weakens Yuan fix by 1.9% – the most ever…

Offshore Renminbi is plunging..

Quite a shocking move, clearly aimed at regaining some competitiveness, one must wonder, given the lackluster response in stocks whether this will merely exacerbate capital outflows… though it does make one wonder who was buying yesterday ahead of the news…

Given The IMF’s delay decision, it seems that PBOC has decided maintaining a stable FX rate in the face of collapsing stock market is no longer in its best interest. Although the spin is already out…

- *PBOC SAYS YUAN EFFECTIVE FX RATE STRONGER THAN OTHER CURRENCIES

- *PBOC SAYS TODAY’S YUAN FIXING IS ONE-OFF ADJUSTMENT

- *CHINA TO KEEP YUAN STABLE AT REASONABLE, EQUILIBIRIUM LEVEL

- *PBOC SAYS YUAN EXCHANGE RATE DEVIATED FROM MARKET EXPECTATION

Officials say this is a one-off adjustment and we note that USDCNY has been trading 1t around 10 points cheap to the fix for 6 months.

- *PBOC PROPOSES TO EXTEND CNY TRADING HOURS

- *CHINA PBOC SAYS TO STRENGTHEN MARKET ROLE IN YUAN FIXING

- *PBOC TO PROMOTE CONVERGED ONSHORE, OFFSHORE YUAN EXCHANGE RATE

- *PBOC SAYS TO CONVERGE ONSHORE, OFFSHORE YUAN EXCHANGE RATES

And the reaction in gold:

* * *

1.Why choosing the current time to improve quotation of the central parity of RMB against US dollar?

Currently, the international economic and financial conditions are very complex. The U.S. economy is recovering and markets are expecting at least one interest rate hike by the FOMC this year. As such, the U.S. dollar is strengthening, while the Euro and Japanese Yen are weakening. Emerging market and commodities currencies are facing downward pressure, and we are seeing increasing volatilities in international capital flow. This complex situation is posing new challenges. As China is maintaining a relatively large trade surplus, RMB’s real effective exchange rate is relatively strong, which is not entirely consistent with market expectation. Therefore, it is a good time to improve quotation of the RMB central parity to make it more consistent with the needs of market development.

Since the reform of the foreign exchange rate formation mechanism in 2005, the RMB central parity, which serves as the benchmark of China’s exchange rate, has played an important role in market expectation and stabilizing RMB exchange rate. Recently, however, the central parity of RMB has deviated from the market rate to a large extent and with a larger duration, which, to some extent, has undermined the market benchmark status and the authority of the central parity. Currently, the foreign exchange market is developing in a sound manner, and market participants are increasingly strengthening their pricing and risk management capacities. The market expectation of RMB exchange rate is diverging, and the preconditions for improving quotation of the RMB central parity are becoming mature. Improving the market makers’ quotation will help enhance the market-orientation of RMB central parity, enlarging the operation room of market rate and enabling the exchange rate to play a key role in adjusting foreign exchange demand and supply.

2.Why did the central parity of RMB against US dollar of 11 August change by nearly 2% compared to that of 10 August?

We noticed that the central parity of RMB against US dollar of 11 August changed(in the depreciation direction) by nearly 2% compared to that of 10 August. The following two factors may be relevent. First, after the improvement of the quotation of the RMB central parity, the market makers may quote by reference to the closing rate of the previous day and, therefore, the accumulated gap between the central parity and the market rate received a one-time correction. Second, a series of macro economic and financial data released recently made the market expectation diverge. Market makers paid more attention to the changes of market demand and supply. Compared with the closing rate of 6.2097 Yuan per dollar in the previous day, today’s central parity depreciated by about 200 bps. The market still needs some time to adapt. The PBC will monitor the market condition closely, stabilizing the market expectation and ensuring the improvement of the formation mechanism of the RMB central parity in an orderly manner.

3.RMB exchange rate reform: what’s next?

Next, the reform of RMB exchange rate formation mechanism will continued to be pushed forward with a market orientation. Market will play a bigger role in exchange rate determination to facilitate the balancing of international payments. Foreign exchange market development will be accelerated and foreign exchange products will be enriched. In addition, the PBC will push forward the opening-up of the foreign exchange market, extending FX trading hours, introducing qualified foreign institutions and promoting the formation of a single exchange rate in both on-shore and off-shore markets. Based on the developing condition of foreign exchange market and the macroeconomic and financial, the PBC will enhance the flexibility of RMB exchange rate in both directions and keep the exchange rate basically stable at an adaptive and equilibrium level, enabling the market rate to play its role environment, retiring from the routine FX intervention, and improving the managed floating exchange rate regime based on market demand and supply.

Currently, under the complex international economic and financial condition, we are seeing increasingly large and volatile cross-border capital flow. As such, the PBC and SAFE will strengthen the examination of banks’ FX transactions according to relevant laws and regulations, adopt effective measures to fight money laundering, terrorist financing and tax evasion activities, and improve the monitoring of suspicious cross-border capital flow. The PBC and SAFE will severely punish illegal FX transactions, including underground banks, and maintain a compliant and orderly capital flow.

* * *

It is unclear what the potential losses for hedging/trading vehicles will be in the ‘most stable carry currency’ but as we noted in April 2014, TRF losses would be the 10s of billions…

The total size of the carry trade is hard to estimate although even just looking at some of the onshore CNY positions accumulated, DB Asia FX strategist Perry Kojodjojo estimates that corporate USD/CNY short positions are around $500bn. The size of the carry trade and the fact that China saw significant capital outflows during the last period of substantial Renminbi depreciation in the summer of 2012 has led to concerns over what this might mean for both the Chinese economy and financial markets as well as broader global financial implications.

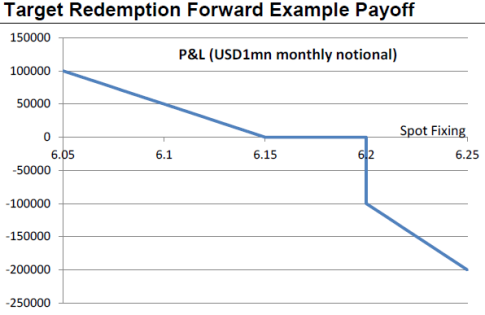

Morgan Stanley believes that one such carry-trade structured product that will be the “pressure point” for this – should the Yuan continue to depreciate – is the Target Redemption Forward (TRF) which has a payoff that looks as follows…

While this is just an example of a product payoff matrix to the holder, the broader point is that the USD/CNH market has a particular level (or range of potential levels) at which three factors can create non-linear price action. These are:

1. Losses on TRF products will (on average) crystallize if USD/CNH goes above a certain level. This has implications for holders of TRF products, who are mostly corporates;

2. The hedging needs of writers of TRF products (banks) mean that there is a point of maximum vega for banks in USD/CNH. Below this level banks need to sell USD/CNH vol; above this level banks need to buy USD/CNH vol;

3. The delta-hedging needs of banks are complex. As we approach the average strike (the 6.15 in the theoretical point of Exhibit 1), banks need to buy spot USD/CNH. Above this point but below the European Knock-in (EKI) (i.e., between 6.15 and 6.20 in Exhibit 1), banks need to sell spot. Then above the EKI, banks don’t need to do anything in spot.

From internal Morgan Stanley data, we estimate that the point of maximum vega is somewhere in the range of 6.15-6.20, and that the 6.15-6.20 in Exhibit 1 is reasonably indicative of the average strikes and EKIs in the market.

In other words, so long as the TRF products remain in place (i.e., are not closed out) and we remain below the maximum vega point (somewhere between 6.15 and 6.20), there is natural selling pressure by banks in USD/CNH vol. When we get above that level, there is natural vol buying pressure.

Of course, in the scenario that USD/CNH keeps trading higher and goes above the average EKI level, the removal of spot selling flow by banks and the need to buy vol means the topside move may accelerate.

Simply put, if the CNY keeps going (whether by PBOC hand or a break of the virtuous cycle above), then things get ugly fast…

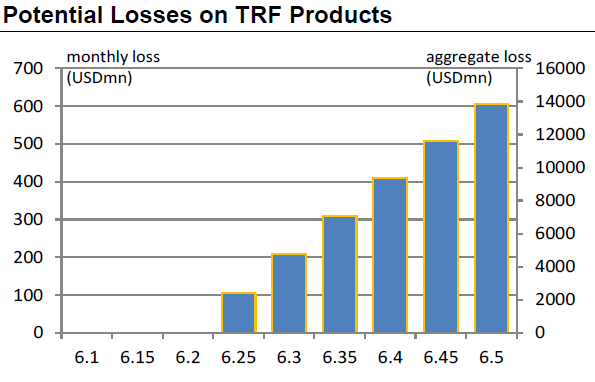

How Much Is at Stake?

In their previous note, MS estimated that US$350 billion of TRF have been sold since the beginning of 2013. When we dig deeper, we think it is reasonable to assume that most of what was sold in 2013 has been knocked out (at the lower knock-outs), given the price action seen in 2013.Given that, and given what business we’ve done in 2014 calendar year to date, we think a reasonable estimate is that US$150 billion of product remains.

Taking that as a base case, we can then estimate the size of potential losses to holders of these products if USD/CNH keeps trading higher.

In round numbers, we estimate that for every 0.1 move in USD/CNH above the average EKI (which we have assumed here is 6.20), corporates will lose US$200 million a month. The real pain comes if USD/CNH stays above this level, as these losses will accrue every month until the contract expires. Given contracts are 24 months in tenor, this implies around US$4.8 billion in total losses for every 0.1 above the average EKI.

Deutsche Bank concludes…

Looking forward it’s possible that the PBOC is not attempting to actively engineer a sustained depreciation of the Renminbi but rather is attempting to increase the level of two-way volatility in the market to discourage the carry trade and also excessive capital inflows. In terms of the broad risk going forward the sheer scale of the challenge the PBOC has set out to tackle likely means they will have to move with restraint. This is certainly a story to watch…

As Morgan Stanley warns however, this has much broader implications for China…

The potential for US$4.8 billion in losses for every 0.1 above the average EKI could have significant implications for corporate China in its own right, as could the need to post collateral on positions even if the EKI level is not breached.

However, the real concern for corporate China is linked to broader credit issues. On that, it’s worth reiterating that the corporate sector in China is the most leveraged in the world. Further loss due to structured products would add further stress to corporates and potentially some of those might get funding from the shadow banking sector. Investment loss would weaken their balance sheets further and increase repayment risk of their debt.

In this regard, it would potentially cause investors to become more concerned about trust products if any of these corporates get involved in borrowing through trust products. In this regard, this would raise concerns among investors, given that there is already significant risk of credit defaults to happen in 2014.

Remember, as we noted previously, these potential losses are pure levered derivative losses… not some “well we are losing so let’s greatly rotate this bet to US equities” which means it has a real tightening impact on both collateral and liquidity around the world… yet again, as we noted previously, it appears the PBOC is trying to break the world’s most profitable and easy carry trade – which has created a massive real estate bubble in their nation (and that will have consequences).

* * *

As we noted then, and seems just as applicable now, The Bottom Line is the question of whether the PBOC’s engineering this CNY weakness is merely a strategy to increase volatility and thus deter carry-trade malevolence (in line with reform policies to tamp down bubbles) OR is it a more aggressive entry into the currency wars as China focuses on its trade (exports) and keeping the dream alive? (Or, one more thing, the former morphs into the latter as a vicious unwind ensues OR the market tests the PBOC’s willingness to break their momentum spirit).

Finally, putting aside speculative trader P&L losses, many of which are said to be of Japanese origin and thus will hardly enjoy much or any PBOC sympathies, here is CLSA’s Russel Napier on what the long-term fate of the Renminbi will be:

“Mercantilist alchemy transmutes China’s external surpluses into foreign exchange reserves and renminbi. But with capital outflows from China at record highs, those surpluses are only maintained due to its citizens’ foreign-currency borrowing. Bank-reserve and M2 growth are already near historical lows and are driving tighter monetary policy. This will lead to severe credit-quality issues and force the authorities to accept a credit crunch or opt for a major devaluation of the renminbi. They will do the latter; and despite five years of QE, the world will get deflation anyway.”

One now wonders how the Bank of Japan and The Bank of Korea will respond.. especially as protectionism rears it ugly head also…

- RTRS – CHINA TO RESUME 13 PCT VALUE ADDED TAX RATE ON FERTILISER IMPORTS AND SALES FROM SEPT 1 – GOVT

Charts: Bloomberg

Wasn’t that predicted on this site?

I am not surprised, is anyone else?

China will play financial games the greedy guts never thought of………they are truly ruthless…..not that western greedy guts are not.