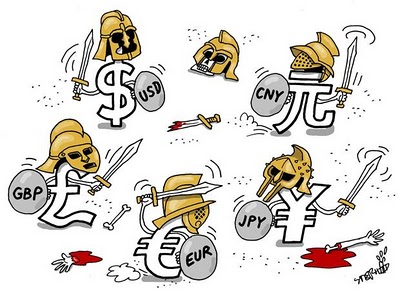

– China “Loses Battle Over Yuan”, And Now The Global Currency War Begins (ZeroHedge, Aug 11, 2015):

Almost exactly seven months ago, on January 15, the Swiss National Bank shocked the world when it admitted defeat in a long-standing war to keep the Swiss Franc artificially weak, and after a desperate 3 year-long gamble, which included loading up the SNB’s balance sheet with enough EUR-denominated garbage to almost equal the Swiss GDP, it finally gave up and on one cold, shocking January morning the EURCHF imploded, crushing countless carry-trade surfers.

Fast forward to the morning of August 11 when in a virtually identical stunner, the PBOC itself admitted defeat in the currency battle, only unlike the SNB, the Chinese central bank had struggled to keep the Yuan propped up, at the cost of nearly $1 billion in daily foreign reserve outflows, which as this website noted first months ago, also included the dumping of a record amount of US government treasurys.

And with global trade crashing, Chinese exports tumbling, and China having nothing to show for its USD peg besides a propped and manipulated stock “market” which has become the laughing stock around the globe, at the cost of even more reserve outflows, it no longer made any sense for China to avoid the currency wars and so, first thing this morning China admitted that, as Market News summarized, the “PBOC lost Battle Over Yuan.”

That’s only part of the story though, because as MNI also adds, the real, global currency war is only just starting.

And now that China is openly exporting deflation, and is eager to risk massive capital outflows, the global currency war just entered its final phase, one where the global race to the bottom is every central bank’s stated goal. Well, except for one: the Federal Reserve. We give Yellen a few months (especially if she indeed does hike rates) before the US too is back to ZIRP, maybe NIRP and certainly monetizing even more things that are not nailed down.

Here are some additional views from Market News that summarize what just happened in China:

China PBOC Loses Battle Over Yuan; War Continues

The People’s Bank of China said Tuesday that the yuan will from now on better reflect market forces, but the central bank is unlikely to tolerate sustained depreciation so long as it feels it needs to maintain financial stability and avoid spooking capital flows.

The near-2% depreciation engineered via the central parity fixing on Tuesday was described by the PBOC as a “one-off revision.” The yuan’s real effective exchange rate has risen nearly 15% over the past year and the central bank said it wanted to correct this deviation. Tuesday’s depreciation was presented as a reform step designed to improve the central parity fixing mechanism.

But the fixing rate, and the bank’s explanation, rocked regional markets as investors sold off on concerns that China will now competitively devalue the yuan to help prop up its flagging economy. Domestic asset prices also weakened because a weaker yuan risks worsening capital outflows, leading to tighter onshore monetary conditions and possibly destabilizing the financial system.

A person familiar with exchange rate policy accepted that the move increases depreciation speculation but said the authority will continue to stabilize the yuan.

“The yuan may keep falling as the market needs time to understand but the central bank will keep the exchange rate stable because it is in China’s interest to do so,” he said.

Another person stressed the market reforms imbedded in Tuesday’s statement and said “we cannot simply understand the yuan central parity from this depreciation angle.” Tuesday’s announcement comes ahead of an International Monetary Fund decision later this year on whether to include the yuan in the basket used to value its Special Drawing Right.

Traders in the interbank market noted big dollar sales by large institutions at around 6.3000 on Tuesday morning and suggested these banks could be acting on the quiet orders of the PBOC.

“It’s the PBOC’s invisible hand — it looks like this is the first line of defense now,” said a trader with one of the Big Four state banks. Another trader said the PBOC may step up intervention for now, but said the longer-term outlook is for a more market-oriented — and presumably weaker — yuan.

The central bank has kept the yuan stable for months in a quiet peg to the U.S. dollar precisely because of its concerns about capital flows and the need to maintain financial system stability.

It has faced mounting pressure from within the bureaucracy to allow the yuan to weaken to help support the export sector, MNI reported last week. July’s dismal trade report — showing an 8.3% y/y plunge in exports — made the PBOC’s ongoing resistance to depreciation untenable.

The new method for fixing the morning central parity rate does promise greater input from market forces. The PBOC instructed market makers that their central parity quotes “should refer to the closing rate of the inter-bank foreign exchange market on the previous day, in conjunction with demand and supply condition in the foreign exchange market and exchange rate movements of the major currencies.”

But those bids will still be calculated by the PBOC for publication by the bank at 0915, giving the bank considerable scope to manage the exchange rate according to China’s economic needs.

The PBOC may have lost the battle on the State Council, but it will continue fighting the war to maintain currency stability, particularly in the run-up to a Federal Reserve meeting next month which many now expect will result in the first increase in the federal funds rate in nine years.

All of the above, incidentally, was explained in our post from March 6 titled “How Beijing Is Responding To A Soaring Dollar, And Why QE In China Is Now Inevitable“

Greedy gut talking heads are speaking about potential deflation…….

One equated China to Japan in 1989, Chinese economy is going down….

Those of us reading this site have seen this coming for months.

Isn’t truth amazing? No matter how much the talking heads and websites lie, it is implacable……..

Just saw Mercedes is building cars here and shipping them to China to sell……in this market, does that make sense? Interesting story….glad to see something being MFG in the US once again, they are using the old Hummer MFG site….

If China does indeed follow the QE game, they might be a little late, the dominoes are falling……