– Puerto Rico – America’s Version of Greece? (ZeroHedge, Feb 15, 2014):

The Crisis Worsens

We previously discussed Puerto Rico in these pages in October of last year (see “Puerto Rico’s Debt Crisis – Another Domino Keels Over”). At the time, the public debt crisis looked increasingly worrisome – in fact, it seemed as though Puerto Rico would eventually have to apply for a federal bail-out, and if it failed to get one, it might have to restructure its debt (it actually cannot do that, see further below). Several months have now passed and the situation apparently hasn’t gotten better. Before we continue, allow us to point out though that noted contrarian Jeff Gundlach thinks that Puerto Rico will eventually be rescued – he believes that too many politicians have a vested interest in not letting anything bad happen:

“Municipal bonds are slightly overvalued, he said. Investors who are willing to tolerate volatility will get rewarded for the risk in Puerto Rico’s bonds. Too many politicians rely on votes tied to the stability of Puerto Rico to allow a crisis there, according to Gundlach. “Puerto Rico’s bonds are going to make it to the other side of the valley,” he said.”

(emphasis added)

We should point out to this that politicians don’t always get what they want, especially in the event of a debt crisis. The cost of rescuing Puerto Rico may be deemed too high, and the politicians with a vested interest are not the only ones needed to green-light rescue measures. In the event of a bailout, others will have to justify their support to their own constituents. With that out of the way, here is a fairly recent chart of the Barclay’s Puerto Rico municipal bond index:

Puerto Rico’s bonds continue to plummet – click to enlarge.

S&P has just downgraded Puerto Rico’s debt to junk, as reported here:

“The most recent blow to Puerto Rico’s economic reputation is yet another downgrade of its debt, this time to junk. S&P slashed the rating on Tuesday because, in a nutshell, the commonwealth is going to need a lot more money and that money isn’t going to get any easier to come by.

Although some initial reports indicate that investors are shrugging off the downgrade, the possibility of further downgrades by the other two major ratings agencies, Moody’s and Fitch (which both currently rate Puerto Rico a mere notch above junk), could spark a sell-off by institutional debt holders. That would make it even more difficult for the government to raise the cash it sorely needs.”

(emphasis added)

There has of course already been a lot of institutional selling in Puerto Rico’s debt, as the decline in its bond prices attests to. However, to the extent that the bonds are contained in investable indexes and other tracker products such as ETFs, future rating downgrades would of course provoke additional selling.

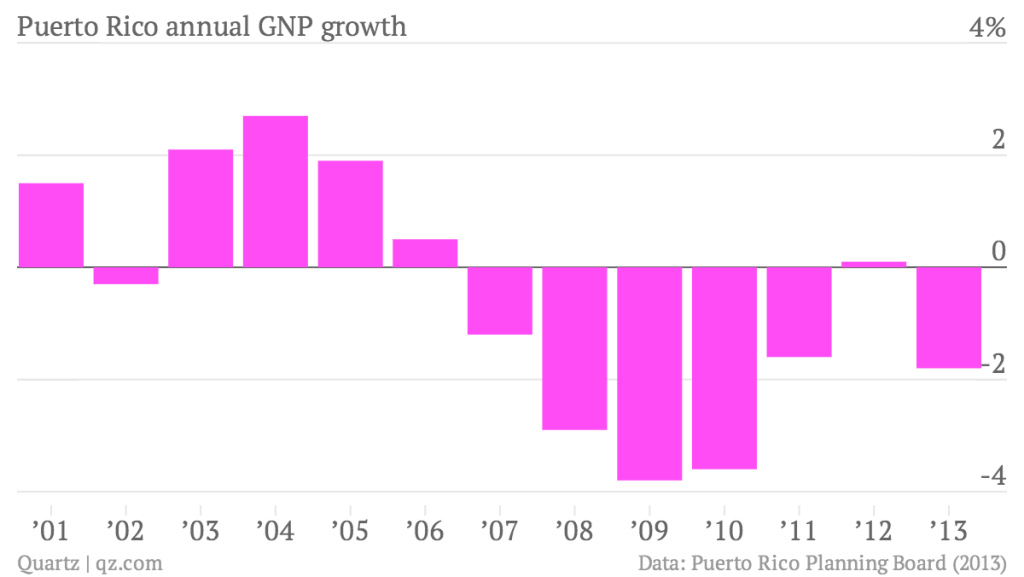

The economic backdrop meanwhile isn’t particularly encouraging:

Puerto Rico’s annual GDP growth – essentially the territory has been in a severe recession since 2007 – click to enlarge.

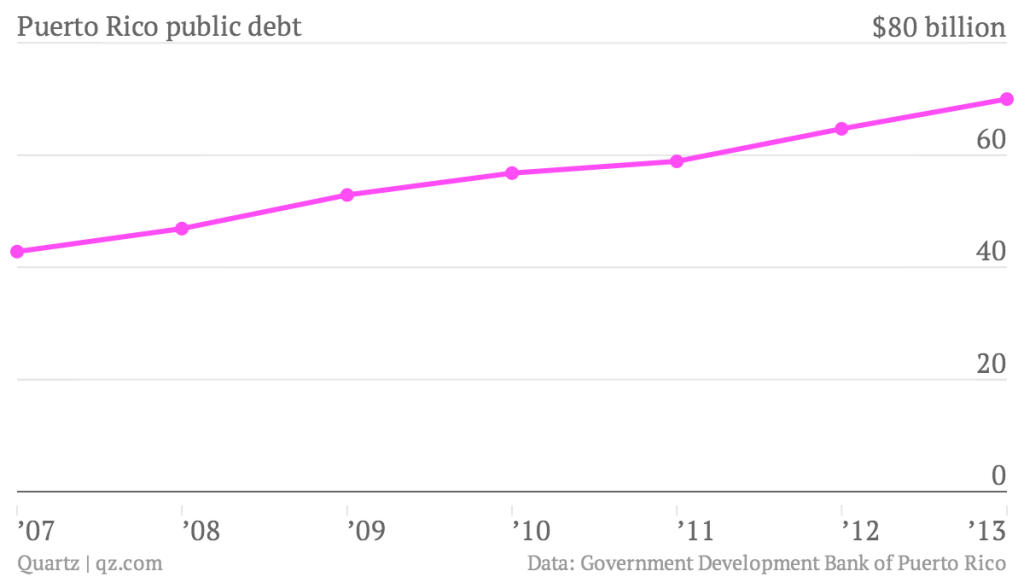

Total public debt since 2007. The public debt-to-GDP ratio is almost at 100% by now – click to enlarge.

On the Skids

According to a recent article in the NYT, Puerto Rico has a set of problems that reminds us a bit of Greece in several respects. Specifically, the persistence of the economic slump, the high unemployment rate, the incredible size of the public debtberg relative to the population, and an accelerating exodus of said population as it no longer sees a future for itself in the territory. The new governor has even jokingly wondered whether it was really such a good idea to take the job:

“Puerto Rico’s slow-motion economic crisis skidded to a new low last week when both Standard & Poor’s and Moody’s downgraded its debt to junk status, brushing aside a series of austerity measures taken by the new governor, including increasing taxes and rebalancing pensions. But that is only the latest in a sharp decline leading to widespread fears about Puerto Rico’s future.

In the past eight years, Puerto Rico’s ticker tape of woes has stretched unabated: $70 billion in debt, a 15.4 percent unemployment rate, a soaring cost of living, pervasive crime, crumbling schools and a worrisome exodus of professionals and middle-class Puerto Ricans who have moved to places like Florida and Texas.

The situation has grown so dire that this tropical island, known for its breathtaking beaches, salsero vibe and tax breaks, is now mentioned in the same breath as Detroit, with one significant difference. Puerto Rico, a United States territory of 3.6 million people that is treated in large part like a state, cannot declare bankruptcy.

From bottom to top, Puerto Ricans are watching it unfold with a mixture of disbelief and stoicism. Alejandro García Padilla, who was elected Puerto Rico’s governor by a sliver of a margin in 2012, said that after he began to wade deeply into the island’s economic and social quagmire, his fight-or-flight instincts kicked into high gear.

“I thought about asking for a recount,” Mr. García Padilla, 42, said with a grin during a recent interview in La Fortaleza, the 500-year-old government residence, recalling, among other things, the $2.2 billion deficit. “But now it’s too late.”

(emphasis added)

Puerto Rico cannot declare bankruptcy, but that doesn’t actually matter. It can still go bankrupt anyway, with or without a ‘declaration’. We’re actually not sure what this is supposed to mean in practice. Does it mean that servicing its debt takes precedence over all other government expenditures? In that case one could envisage a hypothetical future in which the only remnant of its government will be a band of armed tax collectors.

Similar to Greece, the measures taken to lower the deficit have probably made the deficit ultimately worse by destroying large swathes of the small business sector:

“A sense of pessimism pervades on the island. Streets are lined with empty storefronts in San Juan and in smaller cities like Mayagüez;small businesses, hit hard by high electricity, water and tax bills and hurt by drops in sales, have closed and stayed closed.

Schools sit shuttered either because of disrepair or because of a dwindling number of students. In this typically convivial capital, communities have erected gates and bars to help thwart carjackers and home invaders. Illegal drugs, including high-level narco-trafficking, are one of the few growth industries.”

(emphasis added)

Evidently, the government has taken the euro area approach to dealing with excessive government debt. This is to say, instead of concentrating on cutting its spending, it has raised the fiscal burden on businesses, many of which cannot continue to operate given the new impositions. This in turn lowers tax revenues, as many formerly tax paying establishments no longer exist. The predictable effect on the public debt is that it keeps growing.

Austerity always seems to mean ‘austerity for everyone except government’. However, that is a formula that cannot possibly work, as it amounts to slaying the goose that lays the golden eggs. The result is a never-ending tale of woe:

“Puerto Rico, about 1,000 miles from Miami, has long been poor. Its per capita income is around $15,200, half that of Mississippi, the poorest state. Thirty-seven percent of all households receive food stamps; in Mississippi, the total is 22 percent.

But the extended recession has hit the middle-class hardest of all, economists said. Jobs are still scarce, pension benefits for some are shrinking and budgets continue to tighten. Even many people with paychecks have chosen simply to parlay their United States citizenship into a new life on the mainland.

Puerto Rico’s drop in population has far outpaced that of American states. In 2011 and 2012, the population fell by nearly 1 percent, according to census figures. From July 2012 to July 2013, it declined again by 1 percent, or about 36,000 people. That is more than seven times the drop in West Virginia, the state with the steepest population losses.”

(emphasis added)

The shrinking population is obviously a significant problem as well – it means that the burden of the government’s debt is borne by fewer and fewer citizens, who must fear that even more hardship will be imposed on them. This in turn is likely to accelerate the exodus.

And indeed, the enormous costs businesses face in Puerto Rico are inter alia a direct result of government running major industries – running them into the ground, that is. Citing the example of a struggling small business owner the NYT writes:

“But his expenses mounted, including $600 a month in power bills, more than double what consumers pay on the mainland. The sky-high cost is a consequence of Puerto Rico’s inefficient government-run monopoly on electricity and its 67 percent dependency on petroleum for electric power. Other utilities are exorbitant, too. Last year, water rates rose 60 percent in a bid to help cut the state-run water company’s debt. “

(emphasis added)

Obviously letting the government run electricity and water utilities was a bad idea, as it always is. Such publicly-owned monopoly industries usually provide ample opportunities for graft and political cronyism (see Greece as a pertinent example) and it was probably no different in Puerto Rico. Here are a few of the things the new governor has done to bring the deficit down:

“Vowing not to lay off any more workers, he raised taxes sharply to provide much-needed revenue and moved aggressively to promote incentives to entice wealthy investors, like the hedge fund billionaire John Paulson, who has invested in an exclusive beach resort and condo complex.”

(emphasis added)

The workers he didn’t want to lay off are of course government employees. In other words, net consumers of the wealth others produce (government doesn’t produce anything of value – if it were, it would not need to obtain its revenue by coercion).

And if at the same time, he moved to ‘entice billionaires’ like John Paulson to invest, he obviously has to get tax revenue from someone other than billionaires. The ‘sharply raised taxes’ have have thus hit small business and the middle class the hardest. Some of the tax impositions are so bizarre as to defy belief:

“His tax increases have hit some businesses hard, which could pose a further drag on the economy. Among the many taxes he initiated, the governor raised the corporate tax rate to a maximum of 39 percent.Last year, the economy continued on a slide. “The new administration has a bookkeeping mentality as opposed to an economic development mentality,” said Pedro Pierluisi, Puerto Rico’s nonvoting representative in Congress and a political opponent of the governor. “Here you find Puerto Rico with an underlying economic problem charging its corporations — its job creators — 39 percent. Hello!”

Perhaps the most maligned is the new lucrative gross receipts tax, which some owners of small- and medium-size businesses say threatens to put them out of business. Because of the way the tax is structured, it affects companies with less than a 5 percent net profit margin. This means that many food-related companies, like supermarkets, and new businesses, are hit hardest. The smaller the margin, the higher the tax.

Some stores are paying an effective tax rate of 130 percent, said Manuel Reyes Alfonso, the vice president of a trade association that represents the food industry. If the tax is not revised, some will be forced to shut down and others will have to raise prices, he said. “It is absurd,” said Mr. Reyes Alfonso. “It’s like selling the car to buy gas.”

(emphasis added)

A 130% tax rate? Yes, that is going to work out for sure. The lower one’s profit margins the more tax one is forced to pay? We wonder who came up with this stroke of governmental genius.

Conclusion

Frankly, it is a complete mystery to us how a small territory enjoying all the advantages of being part of the US while remaining largely self-administered, sporting an inviting climate and endowed with great natural beauty, could ever be so insanely mismanaged that it ends up with an unbearable debt burden and an economy that seems caught in an unending downward spiral. It must have taken a real effort to bugger such excellent starting conditions up.

The global crisis that began in 2007/8 has unmasked many unsustainable economic dispositions. Unfortunately, the proper conclusions have still not been arrived at, as evidenced by the fact that the same old Keynesian recipes that have failed over and over again are being implemented on an even grander scale. One must not be misled by the claims of ‘austerity’ being imposed, as this has evidently little bearing on government spending as such, but is rather an attempt to squeeze more blood out of an already shriveled turnip, namely what remains of the private sector. Puerto Rico seems – at least so far – not any different in that respect.