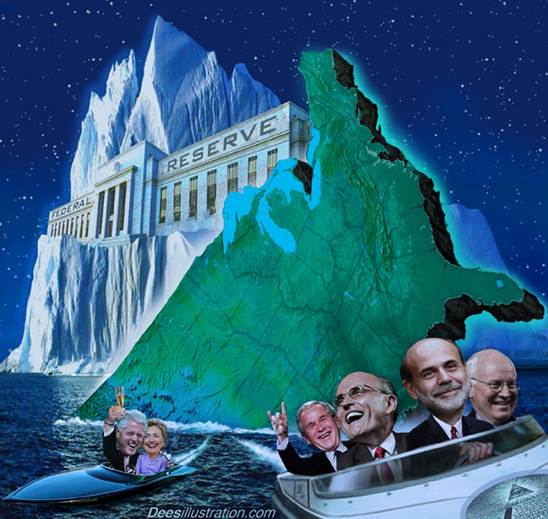

The Financial Crisis Inquiry Commission is releasing its report Thursday.

The New York Times has a preview of the report, which shows that the Commission will slam the right people for causing the financial crisis.

Barry Ritholtz gives a good summary of the Times’ article:

The many causal factors highlighted in the FCIC report:

• Alan Greenspan’s malfeasance — his refusal to perform his regulatory duties because he did not believe in them — allowed the credit bubble to expand, driving housing prices to dangerously unsustainable levels; Greenspan’s advocacy for financial deregulation was a “pivotal failure to stem the flow of toxic mortgages” and “the prime example” of government negligence;

• Ben S. Bernanke failed to foresee the crisis;

• The Bush administration’s “inconsistent response” — saving Bear, but allowing Lehman to crater — “added to the uncertainty and panic in the financial markets.”

• Bush Treasury secretary Henry M. Paulson Jr. wrongly predicted in 2007 that subprime meltdown would be contained.

• The Clinton White House, including then Treasury Secretary Lawrence Summers, made a crucial error in “shielding over-the-counter derivatives from regulation [CFMA]. This was “a key turning point in the march toward the financial crisis.”

• Then NY Fed President, now Treasury secretary Timothy F. Geithner failed to “clamp down on excesses by Citigroup in the lead-up to the crisis;” Further, a month before Lehman’s collapse, Geithner was still in the dark about Lehman’s derivative exposure;

• Low interest rates brought about by the Fed after the 2001 recession “created increased risks” but were not chiefly to blame, according to the FCIC (I place some more weight on Ultra-low rates than they do);

• The financial sector spent $2.7 billion on lobbying from 1999 to 2008, while individuals and committees affiliated with the industry made more than $1 billion in campaign contributions. The impact of which an incestuous relationship between bankers and regulators, Congress and bankers, and classic regulatory capture by the industry.

• The credit-rating agencies “cogs in the wheel of financial destruction.”

• The Securities and Exchange Commission allowed the 5 biggest banks to ramp up their leverage, hold insufficient capital, and engage in risky practices.

• Leverage at the nation’s five largest investment banks was wildly excessive: They kept only $1 in capital to cover losses for about every $40 in assets;

• The Office of the Comptroller of the Currency along with the Office of Thrift Supervision, “federally pre-empted” (blocked) state regulators from reining in lending abuses;

• The report documents “questionable practices by mortgage lenders and careless betting by banks;”

• The report portrays the “bumbling incompetence among corporate chieftains” as to the risk and operations of their own firms:

-Citigroup executives admitting that they paid little attention to the risks associated with mortgage securities.

-AIG executives were blind to its $79 billion exposure to credit default swaps;

-Merrill Lynch top managers were surprised when mortgage investments suddenly resulted in billions of dollars in losses;

I certainly agree with all of these points.

It should be noted that leading banking analyst Chris Whalen – who I greatly respect – agrees with FCIC Commissioner Peter Wallison (co-director of the American Enterprise Institute’s program on financial policy studies) that Freddie and Fannie were a leading cause for the crisis. This is the minority view of the FCIC.

Many people – including me – have criticized the FCIC for seeming to sidestep the massive fraud which was a core cause of the crisis. However, the Commission has indicated that it will make criminal referrals. We’ll have to wait and see if the referrals are for big or small fish.

Submitted by George Washington on 01/26/2011 01:40 -0500

Source: ZeroHedge

1 thought on “Financial Crisis Inquiry Commission Slams Greenspan, Bernanke, Geithner, Paulson, Summers, SEC, Rating Agencies and Big Banks for Causing Crisis”