– Greece, Portugal Debt Concerns Start to Infect Companies, Banks (Bloomberg):

Jan. 28 (Bloomberg) — Investor concern about the ability of Greece and Portugal to lower their budget deficits is starting to hurt the debt of national utility companies and banks.

The cost to insure Greek sovereign debt against default surged to a record today, spurring a rise in credit-default swaps on Hellenic Telecommunications Organization SA and National Bank of Greece SA. Swaps on Portugal Telecom SA and Energias de Portugal SA jumped as the perceived risk of holding their government debt rose.

“If you fear a Greek crisis then you should not only avoid government bonds but corporates as well,” said Philip Gisdakis, head of credit strategy at UniCredit SpA in Munich. “And if you fear Greece you should also fear Portugal and Spain.”

Chinese whispers drive up Greek yields

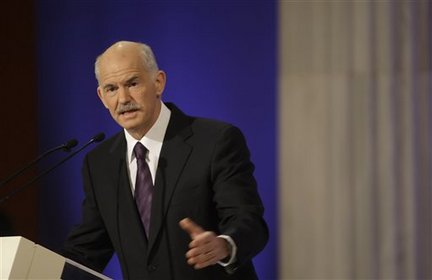

Greek Prime Minister George Papandreou speaks during an economic policy speech aimed to soothe international markets increasingly worried by the country’s ballooning public debt and budget deficit, in Athens. (AP)

(Financial Times) — Greece’s debt crisis returned to financial markets with a vengeance as agitated investors demanded the highest premiums to buy its government bonds since the launch of European monetary union over a decade ago.

The yield spread between 10-year Greek bonds and benchmark German Bunds widened dramatically on Wednesday, by almost 0.7 percentage points at one point, in what one trader called a “capitulation” to sellers worried about Greece’s ability to refinance its debt.

The mayhem unfolded after Greece denied it had given a mandate to Goldman Sachs, the US investment bank, to sell government debt to China. Greek 10-year bond yields closed at 6.70 per cent, 0.48 percentage points up on the day.

The Financial Times reported on Wednesday that Athens was wooing Beijing to buy up to €25bn of government bonds in a deal promoted by Goldman. China had not yet agreed to such a purchase, the FT said.

The government’s comments unsettled markets because of their implication that China, with $2,400bn in foreign exchange reserves, was not interested in increasing its exposure to sovereign Greek debt.

Experts, though, said that heavier Chinese purchases of Greek debt would be no less disturbing. For the eurozone, “a member country implicitly rescued by China would be an even worse signal than an IMF programme,” said Marco Annunziata, chief economist at Unicredit.

The Greek finance ministry said Athens wanted to diversify its sources of funds, and meetings with institutional investors would continue in Athens as well as the US and Asia.

Shares in Greek banks tumbled after Greece’s denial that it had mandated Goldman. The yield spread on Portuguese and Italian government bonds widened as traders fretted about other peripheral eurozone countries with high public debt and rising budget deficits.

George Papandreou, Greece’s premier, met the national central bank governor before flying to the World Economic Forum at Davos, where he planned to defend his government’s last-ditch efforts to rescue its public finances from collapse.

George Provopoulos, the bank governor, said: “I’m feeling more optimistic than before because the prime minister gave a message that he is determined to take immediate action on the stability plan.”

At the heart of Greece’s problems is a lack of confidence in its trustworthiness, a point the European Commission intends to address in coming weeks by proposing that Eurostat, the European Union’s statistical service, should be granted powers to audit national governments’ accounts.

28 Jan 2010 10:27am

By Tony Barber in Brussels, David Oakley in London and Kerin Hope in Athens

Source: The Financial Times