See also:

– Death of ‘Soul of Capitalism:’ 20 reasons America has lost its soul and collapse is inevitable

The biggest collapse in world history is well on its way. The US dollar will not survive another major crisis.

The hottest investment now is the the dollar-carry trade:

– Hedge Funds’ ATM Moves From Tokyo to Washington:

“It’s the U.S.’s turn to flood the world with cheap funding and the risks of this going wrong are huge.”

“Now imagine what might happen if the world’s reserve currency became its most shorted. Carry trades are, after all, bets that the funding currency will weaken further or stay down for an extended period of time.”

The confidence game is over. (Thanks to the Federal Reserve and the US government.)

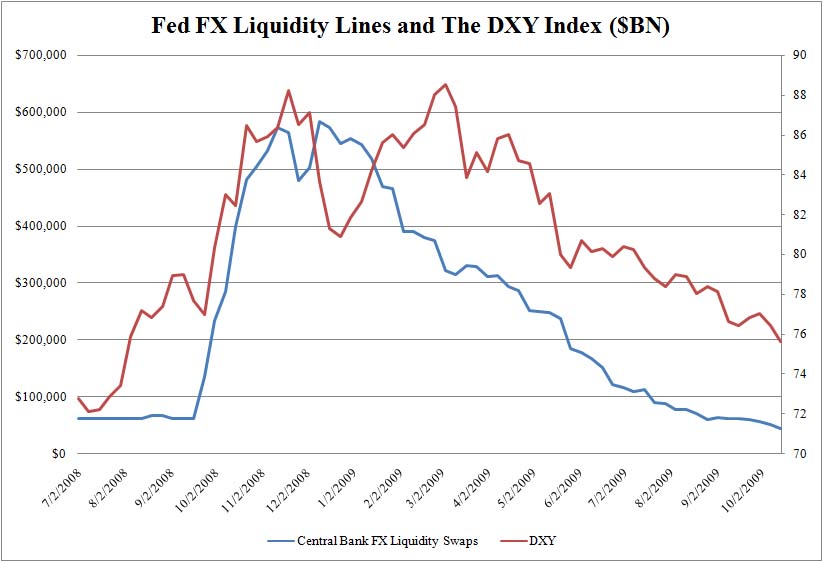

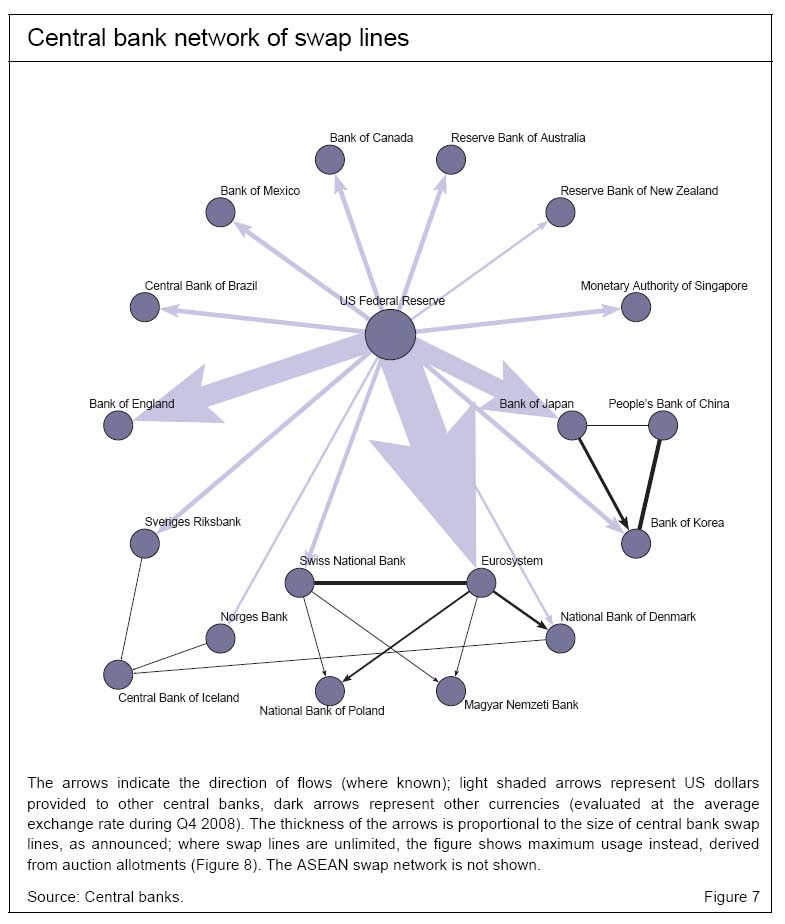

When the financial system almost imploded in the fall of 2008, one of the primary responses by the Federal Reserve was the issuance of an unprecedented amount of FX liquidity lines in the form of swaps to foreign Central Banks. The number went from practically zero to a peak of $582 billion on December 10, 2008. The number of swaps outstanding was almost directly correlated with the value of the dollar (much more on that shortly). A graphic representation of this can be seen below:

The topic of skyrocketing liquidity swaps was in fact the headline feature of one of the numerous grillings of the Chairman by the inimitable Alan Grayson as can be seen in the following video:

And while Bernanke was not very interested in getting caught up in providing actual explanations, the Bank of International Settlements just released a major paper titled “The US dollar shortage in global banking and the international policy response” which goes on to demonstrate just how it happened that Fed chief Ben Bernanke in essence bailed out the entire developed world, which was facing an unprecedented dollar shortage crisis due to the sudden implosion of FX swap lines and other mechanisms which until that point were critical in maintaining the dollar funding shortfall for virtually every foreign Central Bank.

The BIS provides the following big picture perspective:

The funding difficulties which arose during the crisis are directly linked to the remarkable expansion in banks’ global balance sheets over the past decade. Reflecting in part the rapid pace of financial innovation, banks’ (particularly European banks’) foreign positions have surged since 2000, even when scaled by measures of underlying economic activity. As banks’ balance sheets grew, so did their appetite for foreign currency assets, notably US dollar-denominated claims on non-bank entities. These assets include retail and corporate lending, loans to hedge funds, and holdings of structured finance products based on US mortgages and other underlying assets. During the build-up, the low perceived risk (high ratings) of these instruments appeared to offer attractive return opportunities; during the crisis they became the main source of mark to market losses.

How exactly did this improper perception of funding risk manifest itself?

The accumulation of US dollar assets saddled banks with significant funding requirements, which they scrambled to meet during the crisis, particularly in the weeks following the Lehman bankruptcy. To better understand these financing needs, we break down banks’ assets and liabilities by currency to examine cross-currency funding, or the extent to which banks fund in one currency and invest in another. We find that, since 2000, the Japanese and the major European banking systems took on increasingly large net (assets minus liabilities) on-balance sheet positions in foreign currencies, particularly in US dollars. While the associated currency exposures were presumably hedged off-balance sheet, the build-up of net foreign currency positions exposed these banks to foreign currency funding risk, or the risk that their funding positions (FX swaps) could not be rolled over.

Once again, the specter of everyone (and in this case it really means everyone) doing the same trade: sound familiar? This is eerily similar to what happened to basis traders in late 2008 (nothing pretty) when the balance of the trade was so skewed to one side, that there was nobody willing or able to take the opposing side, leading to massive wipe outs for everyone who participated. It is also comparable to the situation prevalent in equity markets currently.

What is now unquestionable, and what will be made clear shortly, is that the dollar trade is precisely what the basis trade, or any other trade, would have ended up being for any and every Central Bank that had a funding mismatch in dollars after the Lehman bankruptcy (all of them), had the Federal Reserve not stepped in and become the lender of last resort to the entire world.

The Prehistory

How did it happen than in 8 short years virtually every bank would become reliant on the Fed’s wanton printing of dollars for their very survival?

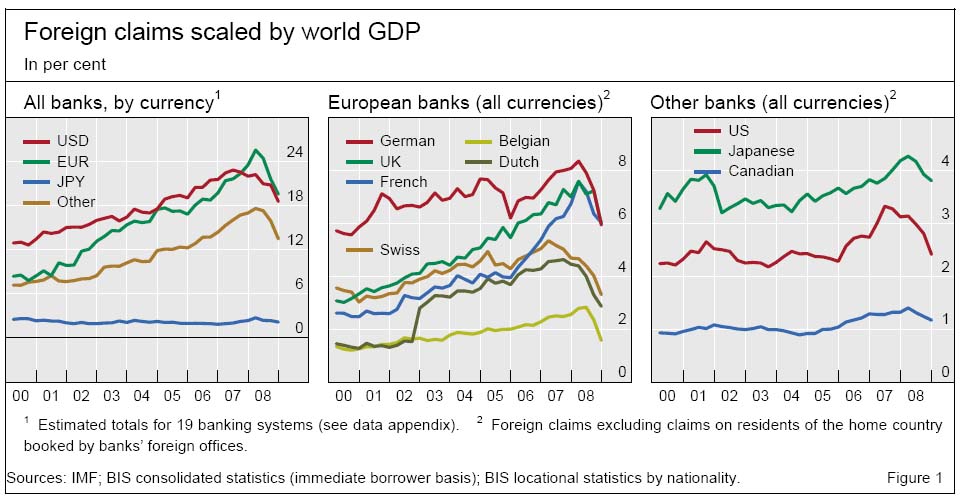

The origins of the US dollar shortage during the crisis are linked to the expansion since 2000 in banks’ international balance sheets. The outstanding stock of banks’ foreign claims grew from $10 trillion at the beginning of 2000 to $34 trillion by end-2007, a significant expansion even when scaled by global economic activity (Figure 1, left panel). The year-on-year growth in foreign claims approached 30% by mid-2007, up from around 10% in 2001. This acceleration took place during a period of financial innovation, which included the emergence of structured finance, the spread of “universal banking”, which combines commercial and investment banking and proprietary trading activities, and significant growth in the hedge fund industry to which banks offer prime brokerage and other services.

At the level of individual banking systems, the growth in European banks’ global positions is most noteworthy (Figure 1, centre panel). For example, Swiss banks’ foreign claims jumped from roughly five times Swiss nominal GDP in 2000 to more than seven times in mid-2007 (Table 1). Dutch, French, German and UK banks’ foreign claims expanded considerably as well. In contrast, Canadian, Japanese and US banks’ foreign claims grew in absolute terms over the same period, but did not significantly outpace the growth in domestic or world GDP (Figure 1, right panel). While much of the increase for some European banking systems reflected their greater intra-euro area lending following the introduction of the single currency in 1999, their estimated US dollar- (and other non-euro-) denominated positions accounted for more than half of the overall increase in their foreign assets between end-2000 and mid-2007.

Taking a step back: how do countries traditionally express long positions in dollars, and how does it happen that what by definition should be a hedge trade, could get so out of hand.

We first introduce concepts related to an internationally active bank’s investment and funding choices. Consider a bank that seeks to diversify internationally, or expand its presence in a specific market abroad. This bank will have to finance a particular portfolio of loans and securities, some of which are denominated in foreign currencies (eg a German bank’s investment in US dollar-denominated structured finance products). The bank can finance these foreign currency positions in several ways:

- The bank can borrow domestic currency, and convert it in a straight FX spot transaction to purchase the foreign asset in that currency.

- It can also use FX swaps to convert its domestic currency liabilities into foreign currency and purchase the foreign assets.4

- Alternatively, the bank can borrow foreign currency, either from the interbank market, from non-bank market participants or from central banks.

The first option produces no subsequent foreign currency needs, but exposes the bank to currency risk, as the on-balance sheet mismatch between foreign currency assets and domestic currency liabilities remains unhedged. Our working assumption is that banks employ FX swaps and forwards to hedge any on-balance sheet currency mismatch. That is, a bank funding in domestic currency (option 1 or 2) is likely to do so as described in option 2. Importantly, the second leg of the swap in option 2 is not that different from funding a position through foreign currency borrowing in the first place (option 3): in both cases, the bank needs to “deliver” foreign currency when the contractual liability comes due.

There is much more to this congruity, however for those seeking the full story we refer them to the actual paper. The key issue is that over the years, banks managed to accumulate a substantial amount of funding risk as a result of positions set to take advantage of the Fed’s dollar destructive generosity:

Funding risk is inherently tied to stresses across the global balance sheet: mismatches between the maturity, currency and counterparty of assets and liabilities. Quantifying this risk requires measurement of banking activity on a consolidated basis, preferably at the level of the decision-making economic unit (ie individual banks). Data designed to identify vulnerabilities in banks’ funding patterns would ideally include, for both assets and liabilities, a complete breakdown of positions by currency, maturity and counterparty type, along with the relevant risk characteristics and off-balance sheet positions.

For a much more detailed analysis of dollar funding applicability we again refer readers to the original source, however in essence what the BIS did was to analyze the variance between domestic and foreign offices/balance sheets vis-a-vis domestic operations of various banks, and how dollar funding via FX swaps or otherwise was hedged on bank balance sheets, as well as funding maturity mismatch for dollar assets.

We use this dataset to investigate how banks fund their foreign currency investments, and to derive their funding requirements across currencies and counterparties. While not at the individual bank level, the advantages of these data are that they provide (i) the consolidated foreign assets and liabilities for each banking system, (ii) estimates of the gross and net positions by currency, and (iii) information on the sources of financing (ie interbank market, central banks and non-bank counterparties).

One of the key findings of the BIS paper is that the host countries of foreign banks have massive international operations, which traditionally are funded in the reserve currency – the dollar:

Looking at these data from the perspective of host countries shows just how large banks’ international operations really are. Table 2, where the column headings now indicate host countries, shows the gross and net international asset position of each country, and compares these to banks’ cross-border claims (here, including banks’ cross-border interoffice positions as well). The table distinguishes between positions booked by offices of “domestic” and “foreign” banks in each host country. In five countries (BE, CH, DE, JP and UK), banks’ cross-border positions accounted for almost half of that country’s external assets at end-2007, and as much as a quarter in five other countries (CA, ES, FR, IT and NL). The offices of foreign banks alone accounted for nearly 40% of the United Kingdom’s external assets. In contrast, positions booked by the home offices of domestic banks were much larger in the case of Belgium, Germany, Japan and Switzerland.

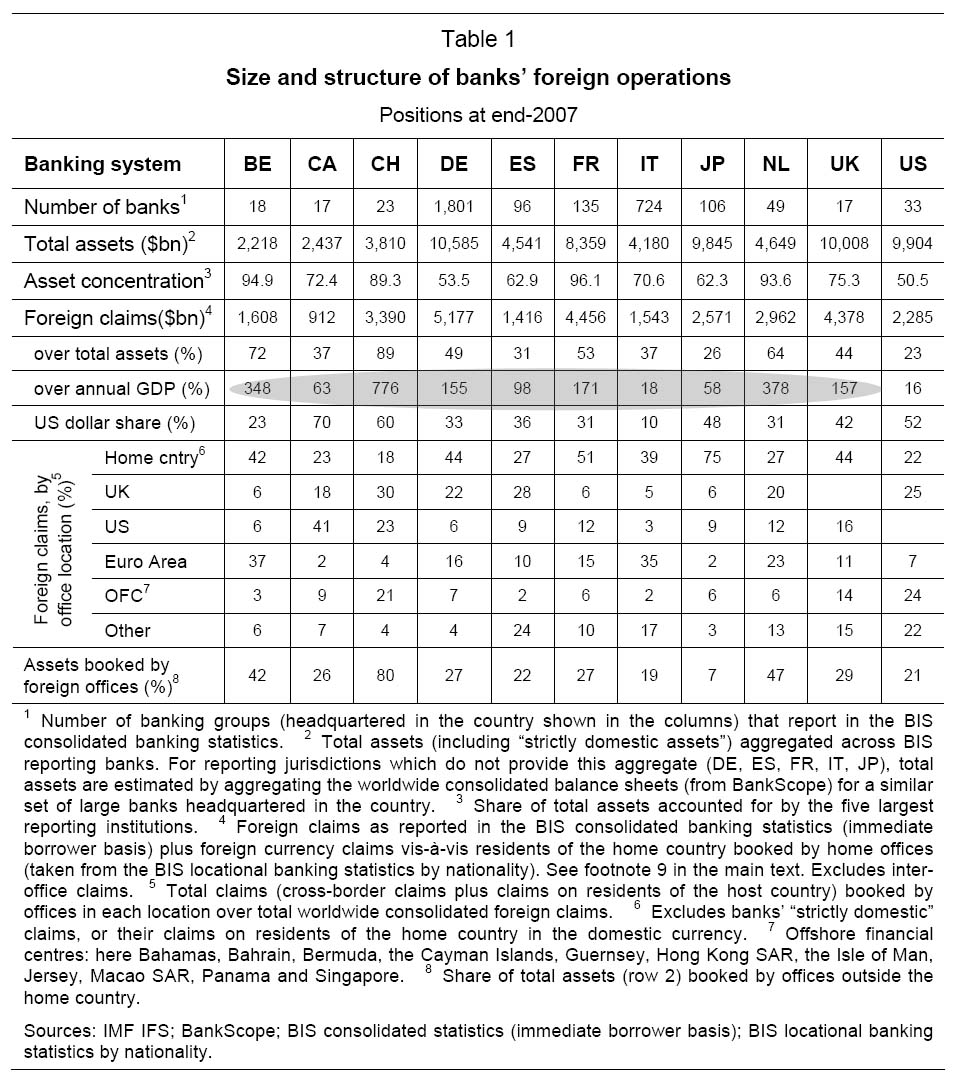

What is notable from the above table is just how massive foreign banks’ USD-funded positions are, especially when viewed from the perspective of various GDP numbers. The 6 countries that make up the core of the Eurozone all have foreign dollar denominated claims which are well over 100% of their respective GDPs! These countries took on an amount of Dollar exposure that would take on a country’s entire GDP to fund and then some. And the fact that they have done so with the complicity of the Federal Reserve is staggering and a clarion call for a global risk regulator which is distinctly separate from the US Fed, which prompted this intractable risk taking in the first place.

As for how this funding mismatch manifests itself in practice, the BIS had this insight:

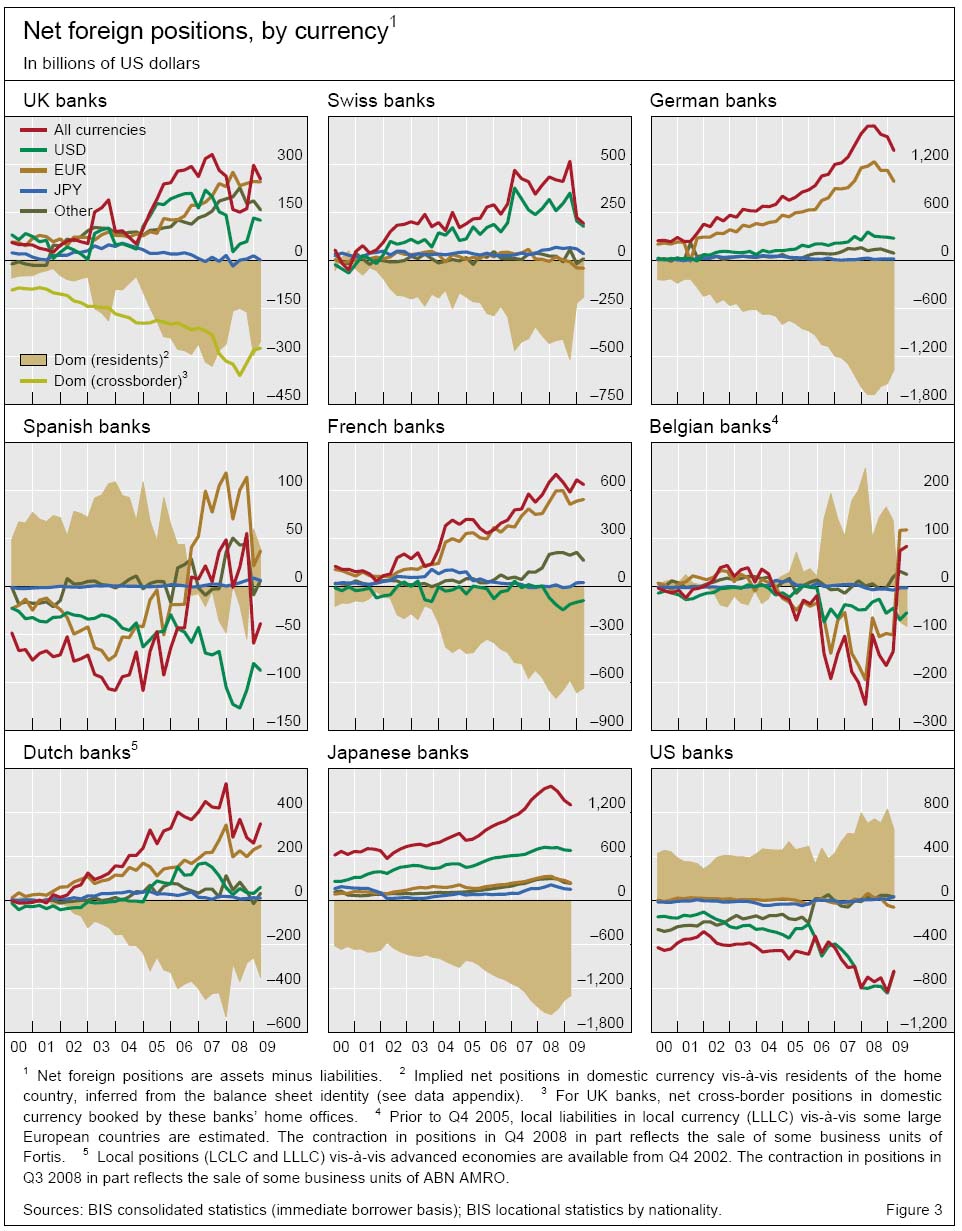

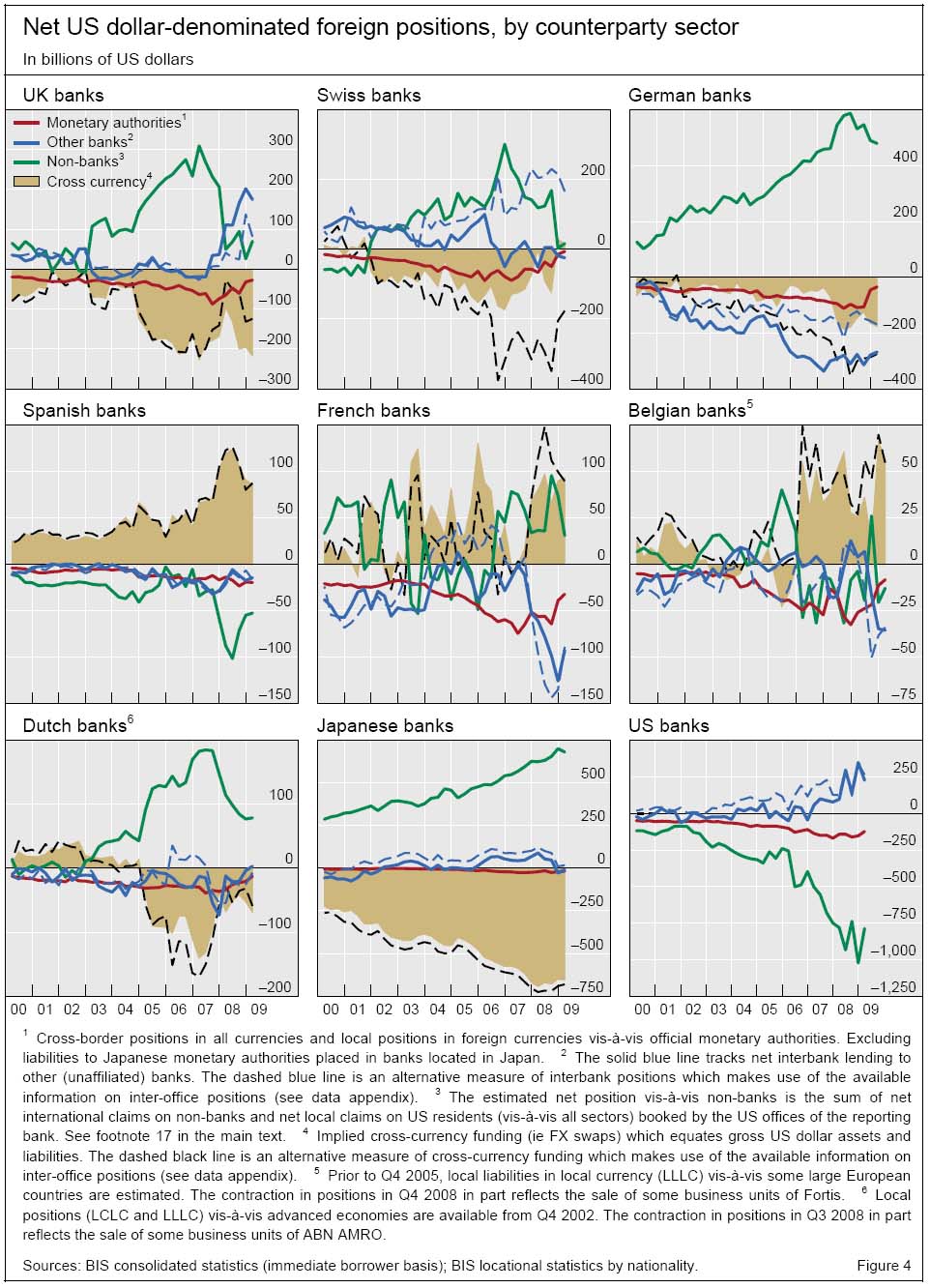

Foreign currency assets often exceed the extent of funding in the same currency. This is shown in Figure 3, where, in each panel, the lines indicate the overall net position (foreign assets minus liabilities) in each of the major currencies. If we assume that banks’ on-balance sheet open currency positions are small, these cross-currency net positions are a measure of banks’ reliance on FX swaps. Many banking systems maintain long positions in foreign currencies, where “long” (“short”) denotes a positive (negative) net position. These long foreign currency positions are mirrored in net borrowing in domestic currency from home country residents (recall equation (1)). UK banks, for example, borrowed (net) in sterling (some $550 billion in mid-2007, both cross-border and from UK residents) in order to finance their corresponding long positions in US dollars, euros and other foreign currencies. By mid-2007, their long US dollar positions stood at $200 billion, on an estimated $2 trillion in gross US dollar claims. Similarly, German and Swiss banks’ net US dollar books approached $300 billion by mid-2007, while that of Dutch banks surpassed $150 billion. In comparison, Belgian and French banks maintained a relatively neutral overall US dollar position prior to the crisis, while Spanish banks had borrowed US dollars to finance euro lending at home, at least until mid-2006.

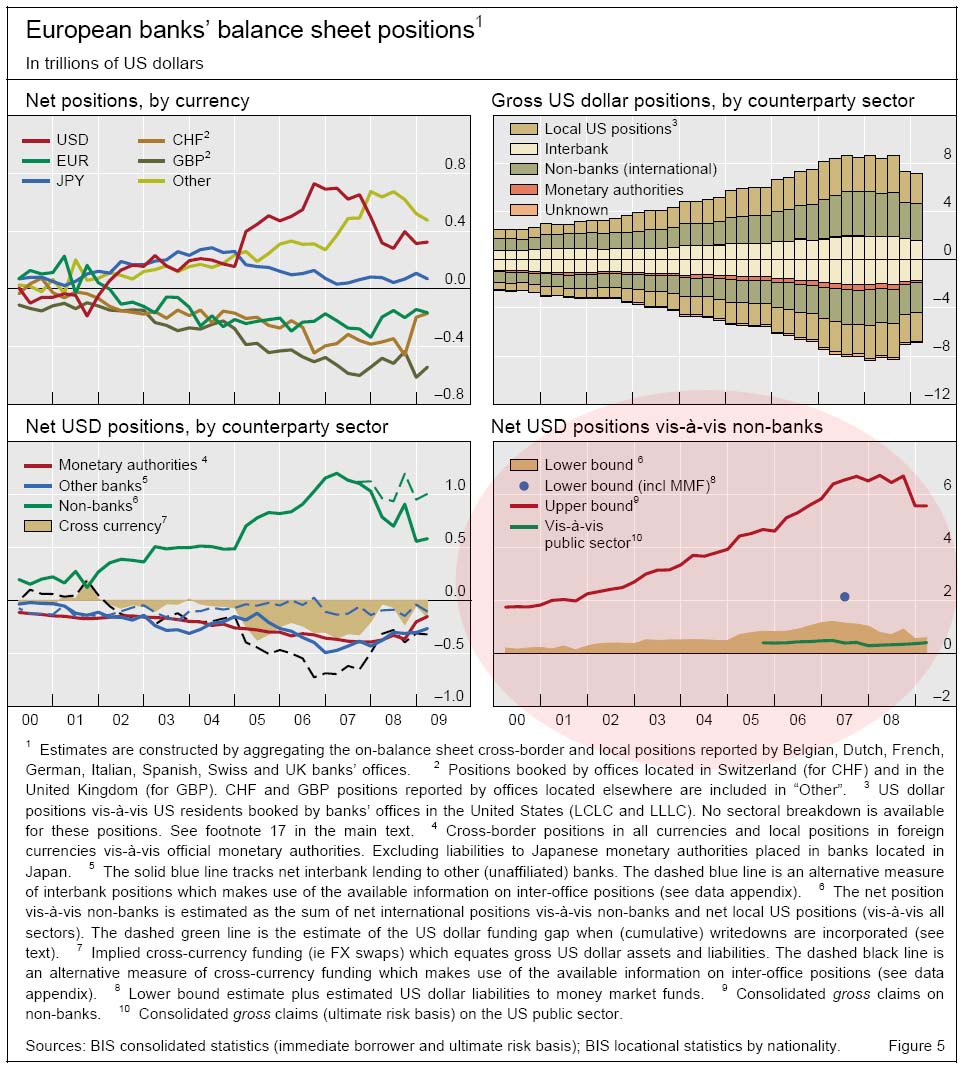

Taken together, Figures 2 and 3 thus show that several European banking systems expanded their long US dollar positions significantly since 2000, and funded them primarily by borrowing in their domestic currency from home country residents. This is consistent with European universal banks using their retail banking arms to fund the expansion of investment banking activities, which have a large dollar component and are concentrated in major financial centres. In aggregate, European banks’ combined long US dollar positions grew to roughly $700 billion by mid-2007 (Figure 5, top left panel), funded by short positions in sterling, euros and Swiss francs.15 As banks’ cross-currency funding grew, so did their hedging requirements and FX swap transactions, which are subject to funding risk when these contracts have to be rolled over.

And here comes the first estimate ever attempted at quantifying the Fed sponsored “Dollar Destructive” moral hazard: the upper bound of the total loss in the case of a major liquidity event occurring with the Fed’s complicit bailout on the table would amount to a staggering $6.5 trillion from a dollar duration funding mismatch alone! This is an astounding, unfathomable and untenable number. Yet it is likely the same now as it was at the onset of the Lehman crisis.

Taken together, these estimates suggest that European banks’ US dollar investments in nonbanks were subject to considerable funding risk at the onset of the crisis. The net US dollar book, aggregated across the major European banking systems, is portrayed in Figure 5 (bottom left panel), with the non-bank component tracked by the green line. By this measure, the major European banks’ US dollar funding gap had reached $1.0-1.2 trillion by mid-2007. Until the onset of the crisis, European banks had met this need by tapping the interbank market ($432 billion) and by borrowing from central banks ($386 billion), and used FX swaps ($315 billion) to convert (primarily) domestic currency funding into dollars. If we assume that these banks’ liabilities to money market funds (roughly $1 trillion, Baba et al (2009)) are also short-term liabilities, then the estimate of their US dollar funding gap in mid-2007 would be $2.0-2.2 trillion. Were all liabilities to non-banks treated as short-term funding, the upper-bound estimate would be $6.5 trillion (Figure 5, bottom right panel).

The Crisis

So what exactly was the chain of events that ended up with the Fed having to singlehandedly bailout the rest of the world?

The implied maturity transformation in Figure 5 became unsustainable as banks’ major sources of short-term funding turned out to be less stable than expected. Beginning in August 2007, heightened counterparty risk and liquidity concerns compromised short-term interbank funding (Taylor and Williams (2009)), visible in the rise of the blue line in the lower left panel. The related dislocations in FX swap markets made it even more expensive to obtain US dollars via currency swaps (Baba and Packer (2009a)), as European banks’ US dollar funding requirements exceeded other entities’ funding needs in other currencies.

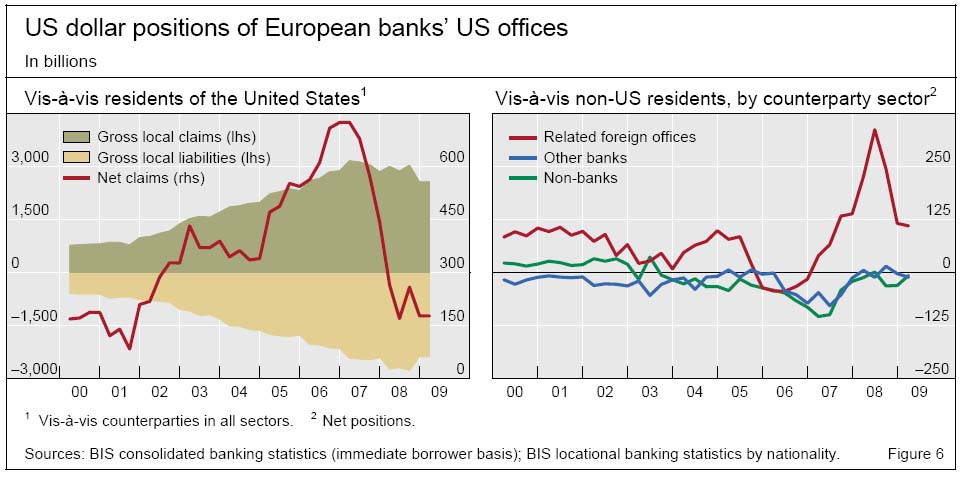

European banks’ funding difficulties were compounded by instability in the non-bank sources of funds as well. Money market funds, facing large redemptions following the failure of Lehman Brothers, withdrew from bank-issued paper, threatening a wholesale run on banks (Baba et al (2009)). Less abruptly, a portion of the US dollar foreign exchange reserves that central banks had placed with commercial banks was withdrawn during the course of the crisis. In particular, some monetary authorities in emerging markets reportedly withdrew placements in support of their own banking systems in need of US dollars.Market conditions during the crisis have made it difficult for banks to respond to these funding pressures by reducing their US dollar assets. While European banks held a sizeable share of their net US dollar investments as (liquid) US government securities (Figure 5, bottom right panel), other claims on non-bank entities – such as structured finance products – have been harder to sell into illiquid markets without realising large losses. Other factors also hampered deleveraging of US dollar assets: banks brought off-balance sheet vehicles back onto their balance sheets and prearranged credit commitments were drawn. Indeed, as shown in Figure 5 (top right panel), the estimated outstanding stock of European banks’ US dollar claims actually rose slightly (by $248 billion or 3%) between Q2 2007 and Q3 2008. It was not until the fourth quarter of 2008 that signs of deleveraging emerged.Banks reacted to the dollar shortage in various ways, supported by actions taken by central banks to alleviate the funding pressures. Prior to the collapse of Lehman Brothers (up to end-Q2 2008), European banks tapped funds in the United States; their local US dollar liabilities booked by their US offices, which included their borrowing from Federal Reserve facilities, grew by $329 billion (13%) between Q2 2007 and Q3 2008, while their local assets remained largely unchanged (Figure 6, left panel). This allowed European banks to channel funds out of the United States via inter-office transfers (right panel), presumably to help their head offices replace US dollar funding previously obtained from the market.

In a nutshell what happened is that short-term sources to sustain the massive dollar funding mismatch disappeared virtually overnight, and CBs were suddenly facing a toxic spiral of selling increasingly more worthless assets merely to satisfy currency funding needs in an environment where all of a sudden nobody was willing to provide FX swap lines. So what happens next…

The Fed Bails Out The World

No, that is not an overstatement: had the Fed not stepped in, the rest of the world (which optimistic pundits tend to forget exists in their bubble view of the US market as the one and only) would have simply collapsed as the $6.5 trillion dollar funding gap closed in on itself, causing a indiscriminate selling off of all dollar denominated assets. The implosion of the basis trade would have seemed like a picnic compared to what was about to ensue had the Fed not stepped in to perpetuate the Fiat banking way of life.

The severity of the US dollar shortage among banks outside the United States called for an international policy response. While European central banks adopted measures to alleviate banks’ funding pressures in their domestic currencies, they could not provide sufficient US dollar liquidity. Thus they entered into temporary reciprocal currency arrangements (swap lines) with the Federal Reserve in order to channel US dollars to banks in their respective jurisdictions (Figure 7). Swap lines with the ECB and the Swiss National Bank were announced as early as December 2007. Following the failure of Lehman Brothers in September 2008, however, the existing swap lines were doubled in size, and new lines were arranged with the Bank of Canada, the Bank of England and the Bank of Japan, bringing the swap lines total to $247 billion. As the funding disruptions spread to banks around the world, swap arrangements were extended across continents to central banks in Australia and New Zealand, Scandinavia, and several countries in Asia and Latin America, forming a global network (Figure 7). Various central banks also entered regional swap arrangements to distribute their respective currencies across borders.

And here is the chart that started off this article in more regional detail:

And it gets worse: the Fed’s printing press single handedly guaranteed the way of life for the UK, the Eurozone and Switzerland with unlimited funding! Whether the Fed was within its rights to bet the American way of life in order to mitigate the stupidity of Europe is a question best left to politicians. And politicians take note: the Fed’s actions were to the benefit of “banks around the world including those that have no US subsidiaries or insufficient eligible collateral to borrow directly from the Federal Reserve System.”

On 13 October 2008, the swap lines between the Federal Reserve and the Bank of England, the ECB and the Swiss National Bank became unlimited to accommodate any quantity of US dollar funding demanded. The swap lines provided these central banks with ammunition beyond their existing foreign exchange reserves (Obstfeld et al (2009)), which in mid-2007 amounted to [TD: a meager and very much underfunded] $294 billion for the euro area, Switzerland and the United Kingdom combined, an order of magnitude smaller than our lower-bound estimate of the US dollar funding gap.

In providing US dollars on a global scale, the Federal Reserve effectively engaged in international lending of last resort. The swap network can be understood as a mechanism by which the Federal Reserve extends loans, collateralised by foreign currencies, to other central banks, which in turn make these funds available through US dollar auctions in their respective jurisdictions. This made US dollar liquidity accessible to commercial banks around the world, including those that have no US subsidiaries or insufficient eligible collateral to borrow directly from the Federal Reserve System.The quantities of US dollars actually allotted through US dollar auctions in Europe provide an indication of European banks’ US dollar funding shortfall at any point in time (Figure 8). Most of the Federal Reserve’s international provision of US dollars was indeed channelled through central banks in Europe, consistent with the finding that the funding pressures were particularly acute among European banks. Once the swap lines became unlimited, the share provided through the Eurosystem, the Bank of England and the Swiss National Bank combined was 81% (15 October 2008), and it has remained in the range of 50-60% since December 2008.

Concluding observations

One angle of preliminary concluding remarks is provided by the cautiously worded prose of the BIS:

The recent financial crisis has highlighted just how little is known about the structure of banks’ international balance sheets and their interconnectedness. The globalisation of banking over the past decade and the increasing complexity of banks’ international positions have made it harder to construct measures of funding vulnerabilities that take into account currency and maturity mismatches… The analysis shows that between 2000 and mid-2007, the major European banking systems built up long US dollar positions vis-à-vis non-banks and funded them by interbank borrowing, borrowing from central banks and FX swaps. We argue that this greater transformation across counterparties in fact reflected greater maturity transformation across these banks’ balance sheets, exposing them to considerable funding risk. When heightened credit risk compromised sources of short-term funding during the crisis, the chronic US dollar funding needs became acute, particularly in the wake of the Lehman Brothers bankruptcy.

In contrast to many previous international financial crises, it was banks’ international exposures to other industrialised countries that deteriorated, and the global interbank and FX swap funding structure which seized up. The build-up of such stresses at the global level can only be identified by tracking the extent of cross-currency funding, and by implication, banks’ reliance on short-term interbank and FX swap positions. What pushed the system to the brink was not cross-currency funding per se, but rather too many large banks employing funding strategies in the same direction, the funding equivalent of a “crowded trade”. Only when examined at the aggregate level can such vulnerabilities be identified. By quantifying the US dollar overhang on non-US banks’ global balance sheets, this paper contributes to a better understanding of why the extraordinary international policy response was necessary, and why it took the form of a global network of central bank swap lines.

Why is this critical? We are now back at a time when the only gains in the stock market are at the expense of dollar destruction, with a concomittant funding for dollar denominated assets. In one short year since the collapse of Lehman we have gone back to the same dollar funding risk exposure as was on the books in these days before Dick Fuld’s empire unravelled. While whether or not the Federal Reserve stepped beyond its bounds in practically bailing out not just Goldman Sachs, but as this paper has proven, virtually the entire world, is not up to us to decide. However, a critical topic is: have we learned anything from the implications of an unprecedented dollar funding gap, which is likely back to record levels once again? What is obvious is that the Fed’s current policy of a weak dollar, contrary to its repeated lies otherwise, is simply enhancing the dollar funding moral hazard: and the breaking point will come sooner or later with disastrous consequences.

As the H.4.1 discloses weekly, the Fed’s liquidity swaps are now back to almost zero. This means that foreign Central Banks believe they have the FX swap and dollar maturity situation under control. They thought the same before Lehman blew up. And they were wrong. As the DXY continues tumbling ever lower to fresh 2009 lows, the trade de jour is once again the dollar funding one, although unlike before when the Yen was the carry currency of choice, this time it is the dollar itself, positioning banks for the double whammy of not just a dollar funding shock, but one coupled with a potential massive and historic short squeeze. If and when an exogenous event occurs, not even $6.5 trillion in Fed swap lines will be sufficient to bail out the world economy. It is time someone in Congress asks the Chairman all the pertinent questions that evolve from this analysis and how he is prepared to handle its next, much more vicious, and likely terminal, iteration.

Submitted by Tyler Durden on 10/19/2009 14:12 -0500

Source: ZeroHedge

Related information:

– Latin American leaders agree on new currency, sanction Honduras

– Russia ready to abandon US dollar in oil, gas trade with China

– Iran to drop US dollar from forex reserves

– Sumitomo Chief Strategist: US Dollar to Hit 50 Yen, Cease as Reserve Currency

– DOW at 10,000!!! Oh Wait, Make That 7,537

– Marc Faber on Bloomberg: Dollar decline and inflation – Oct. 14, 2009

– David Tice: Gold Heading to $3000 Unless America Hits the ‘Reset’ Button

– Jim Rogers: ‘I Am Quite Sure Gold Will Go Over $2000?, Dollar Will Lose Reserve Status

– US Dollar Reaches Breaking Point as Central Banks Shift Reserves

– Financial Times: US mantra of strong dollar loses its value

– The Federal Reserve buys Fannie Mae bonds; Timothy Geithner is a liar

– Gerald Celente on the demise of the US dollar: ‘The US is failing on it’s most basic level’

– Max Keiser on RT: ‘Dollar to be buried way before 2018?

Undeniably believe that which you stated. Your favorite justification seemed to be at the internet the simplest thing to understand of. I say to you, I definitely get annoyed while folks consider issues that they just don’t realize about. You managed to hit the nail upon the highest and outlined out the whole thing without having side-effects , other people could take a signal. Will likely be back to get more. Thanks