– Trump: “The Country Is Headed For A Massive Recession; It’s A Terrible Time To Invest In Stocks”:

Donald Trump continued to streamroll over all conventional narratives when during a massive 96-minute interview with the Washington Post on Thursday which was released today, in which he talked candidly about his aggressive style of campaigning and offered new details about what he would do as president, he said that economic conditions are so perilous that the country is headed for a “very massive recession” and that “it’s a terrible time right now” to invest in the stock market, which, the traditionally cheerful WaPo said embraces “a distinctly gloomy view of the economy that counters mainstream economic forecasts.”

Unfortunately, his “gloomy view” is supported by such events as the record surge in gun violence and deadly shootings in Chicago, where the locals also do not ascribe to the WaPo’s rosy take on events, and instead blame the economy and the lack of jobs for the ongoing social collapse in the windy city.

In any case, Trump dismissed concern that his comments, which the WaPo said “are exceedingly unusual, if not unprecedented, for a major party front-runner”, which is precisely Trump’s style, “could potentially affect financial markets.”

“It’s irresponsible. It’s baffling that he would do this and also substantively wrong. There is no recession in sight.” -Doug Holtz-Eakin

— Robert Costa (@costareports) April 2, 2016

As the WaPo adds, “over the course of the discussion, the candidate made clear that he would govern in the same nontraditional way that he has campaigned, tossing aside decades of American policy and custom in favor of a new, Trumpian approach to the world.”

In his first 100 days, Trump said, he would cut taxes, “renegotiate trade deals and renegotiate military deals,” including altering the U.S. role in the North Atlantic Treaty Organization.

This is what he said:

“I think we’re sitting on an economic bubble. A financial bubble… We’re not at 5 percent unemployment. We’re at a number that’s probably into the 20s if you look at the real number. That was a number that was devised, statistically devised to make politicians – and in particular presidents – look good. And I wouldn’t be getting the kind of massive crowds that I’m getting if the number was a real number.”

“I’m talking about a bubble where you go into a very massive recession. Hopefully not worse than that, but a very massive recession. Look, we have money that’s so cheap right now. And if I want to borrow money, I can borrow all the money I want. But I’m rich… If somebody is a great, wonderful person, going to employ lots of people, a really talented businessperson, wants to borrow money, but they’re not rich? They have no chance…

Is it a good time to invest now? “Oh, I think it’s a terrible time right now… because the dollar’s so strong… You have – think of it – you have cheap money that nobody can get unless you’re rich. You have the regulators are running the banks. Not the guys that are being paid $50 million a year to run the banks. I mean, when you look at many of your friends that are running banks that are being paid $40 and $50 million, yeah, they’re not running the banks. The regulators are running the banks. You have a situation where you have an inflated stock market. It started to deflate, but then it went back up again. Usually that’s a bad sign. That’s a sign of things to come.”

“Part of the reason it’s precarious is because we are being ripped so badly by other countries. We are being ripped so badly by China. It just never ends. Nobody’s ever going to stop it. And the reason they’re not going to stop it is one of two. They’re either living in a world of the make-believe, or they’re totally controlled by their lobbyists and their special interests. Meaning people that want it to continue. Because what China, what Mexico, what Japan – I don’t want to name too many countries, because I actually do business in a lot of these countries – but what these countries are doing to us is unbelievable. They are draining our jobs. They are draining our money.”

“I can fix it. I can fix it pretty quickly…I would do a tax cut. You have to do a tax cut. Because we’re the highest-taxed nation in the world. But I would start…I would immediately start renegotiating our trade deals with Mexico, China, Japan and all of these countries that are just absolutely destroying us. “

Below are some of the annotated highlights of his bearish take on the economy via the WaPo.

Trump has for months contended that the U.S. economy is in trouble because of what he sees as an overvalued stock market, but his view has grown more pessimistic of late and he is now bearish on investing, to the point of warning Americans against doing so.

“I think we’re sitting on an economic bubble. A financial bubble,” Trump said. He made clear that he was not specifying a sector of the economy but the economy at large and asserted that more bullish forecasts were based on skewed employment numbers and an inflated stock market.

“First of all, we’re not at 5 percent unemployment. We’re at a number that’s probably into the twenties if you look at the real number,” Trump said. “That was a number that was devised, statistically devised to make politicians — and, in particular, presidents — look good. And I wouldn’t be getting the kind of massive crowds that I’m getting if the number was a real number.”

Trump said, “it’s precarious times. Part of the reason it’s precarious is because we are being ripped so badly by other countries. We are being ripped so badly by China. It just never ends. Nobody’s ever going to stop it. And the reason they’re not going to stop it is one of two. They’re either living in a world of the make-believe, or they’re totally controlled by their lobbyists and their special interests.”

“I’m pessimistic,” Trump said. “Unless changes are made. Changes could be made.” By Trump, for instance: “I can fix it. I can fix it pretty quickly.” Trump firmly believes that a turnaround on trade would be the necessary beginning of a solution to any looming recession.

He mentions the Trans-Pacific Partnership as one pact he would immediately seek to renegotiate, putting him at odds with congressional Republicans who supported giving the president fast-track trade authority last year.

Coupled with his push on trade would be a “very big tax cut,” which Trump unveiled last September. That proposal increases taxes on the “very rich” but reduces taxes for most taxpayers and would cut the corporate tax rate to 15 percent. To woo companies back to the United States, he would offer an incentive of a deeply discounted rate and would no longer allow corporations to defer taxes on income earned overseas.

* * *

The Washington Post was displeased by Trump’s pessimistic view, which it said “runs counter to that of most economists, whose rough consensus is that the U.S. economy has about a 20 percent chance of slipping into recession this year largely because growth remains weak across the world, according to a Wall Street Journal survey of economists in March.”

Most economists aren’t overly worried about an imminent downturn because job creation remains strong, workers are starting to see their wages grow and the Federal Reserve remains cautious about shifting away from the low-interest-rate stance that has helped stimulate the economy.

Cheerful economists promptly chimed in to defend the economy:

“It’s irresponsible. It’s baffling that he would do this and also substantively wrong. There is no recession in sight.” -Doug Holtz-Eakin

— Robert Costa (@costareports) April 2, 2016

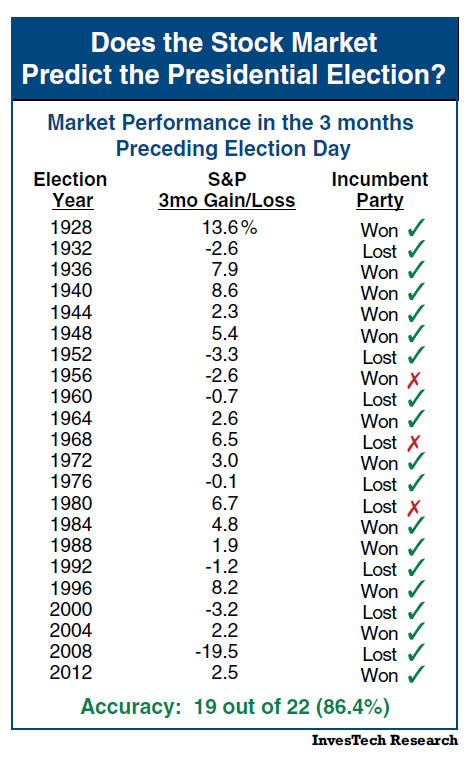

Of course, whether Trump is right or not with his warning about the economy and the market, only time will tell, although as we reported in mid-January, Trump is certainly hoping for a market crash. The reason is that historically, the market performance in the three months leading up to a Presidential Election has displayed an uncanny ability to forecast who will win the White House… the incumbent party or the challenger. Since 1928, there have been 22 Presidential Elections. In 14 of them, the S&P 500 climbed during the three months preceding election day. The incumbent President or party won in 12 of those 14 instances. However, in 7 of the 8 elections where the S&P 500 fell over that three month period, the incumbent party lost.

In other words, if Trump wants to win he would certainly benefit from a major drop in the S&P in the all important September to November period. That is, assuming he gets the nomination.

* * *

Of note also was Trump’s insistence that he would be able to get rid of the nation’s more than $19 trillion national debt: “We’re not a rich country. We’re a debtor nation. We’ve got to get rid of – I talked about bubble. We’ve got to get rid of the $19 trillion in debt.” How long would that take? “Well, I would say over a period of eight years.”

This is how he says he would do it: “I’m renegotiating all of our deals, the big trade deals that we’re doing so badly on. With China, $505 billion this year in trade.” He said that economic growth he foresees as a consequence of renegotiated deals would enable the United States to pay down the debt.

But Trump’s most interesting comment had nothing to do with economics – it was his admission that everyone close to him — family, friends, Republican leaders — have been urging him to tone down his attacks and reach out to former rivals, both to reassure wary voters and to begin the difficult process of unifying a party in which many have sworn to never back him. Trump does not intend to take the advice. He said such overtures are “overrated.” “I think the first thing I have to do is win,” he said. “Winning solves a lot of problems. And I have two people left”: his two remaining Republican rivals, Sen. Ted Cruz of Texas and Ohio Gov. John Kasich.

Bob Woodward summarizes his take of the Trump interview

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

Quite frightening…..

http://www.thecommonsenseshow.com/2016/04/02/soros-is-telling-you-that-if-you-want-to-save-your-life-savings-buy-gold-now/?utm_source=rss&utm_medium=rss&utm_campaign=soros-is-telling-you-that-if-you-want-to-save-your-life-savings-buy-gold-now