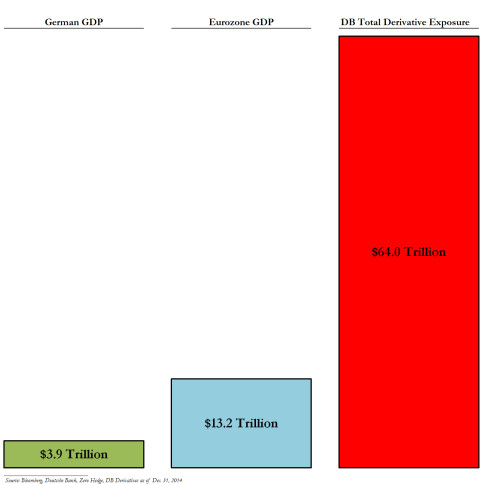

“Absolutely rock solid?” …

… like the molten granite found below the foundations of the Twin Towers?

– Deutsche Bank Selling Resumes After CEO Assures Employees Bank Is “Absolutely Rock Solid”:

Yesterday’s desperate scramble by Deutsche Bank to comfort markets about its liquidity position worked, for about three hours. And then, the bank which really should just keep its mouth shut, did the opposite and reminded an already panicked market just how “serious” things are, in the parlance of Jean-Claude Junkcer, when in an internal memo, the CEO assured his workers that:

- DEUTSCHE BANK CEO: CAP STRENGTH, RISK POSITIONS ’ROCK SOLID’

That was the good news. The bad news:

- DEUTSCHE BANK TO INFORM STAFF IN COMING WEEKS ABOUT COST CUTS

Here is the full note released from DB CEO Cryan:

Dear Colleagues,

When I first became your colleague and Co-CEO seven months ago, I promised to increase communication from the Management Board to you. I made clear that when we had something to communicate, I wanted you to hear about it first from us. That is why I am writing to you today.

Last week, at one of our scheduled off-sites, the Management Board talked about progress on our strategy, and how recent market volatility and forecasts for slowing economic growth might impact our clients and us. Volatility in the fourth quarter impacted the earnings of most major banks, especially those in Europe, and clients may ask you about how the market-wide volatility is impacting Deutsche Bank.

You can tell them that Deutsche Bank remains absolutely rock-solid, given our strong capital and risk position. On Monday, we took advantage of this strength to reassure the market of our capacity and commitment to pay coupons to investors who hold our Additional Tier 1 capital. This type of instrument has been the subject of recent market concern.

The market also expressed some concern about the adequacy of our legal provisions but I don’t share that concern. We will almost certainly have to add to our legal provisions this year but this is already accounted for in our financial plan.

The Management Board also discussed its vision for the bank. For us, a vision defines our aspiration for the bank, and what we want it to be. It’s important because it creates clarity of purpose and unites all of us in achieving common and worthy goals.

Our vision is to be a trusted and successful bank. We aim to deliver financial solutions, technology, products and services that exceed our clients’ expectations. We want to be the most respected financial services provider across all customer segments in Germany, our vital and strong home market; the number one bank for our corporate, institutional and fiduciary clients in Europe; and the best foreign bank in the United States and Asia.

We are achieving our vision in a number of ways, including:

First, we are investing in hiring more people in Equity Sales and Research to serve our clients’ needs and to regain our leadership in the equities markets.

Second, we are investing in bringing on board some talented senior bankers into Corporate & Investment Banking.

Third, we are investing in client-facing technology, particularly in our retail banking and asset management businesses.

Finally, I am personally investing time to resolve successfully and speedily open regulatory and legal cases. I want to remove the uncertainty among staff and in the market that these cases cause. A small group of senior people, led by me, will focus on this. For everyone else, we ask you to continue to focus on our clients and on the implementation of our strategy.

In the weeks ahead, my colleagues on the Management Board will update you on a number of topics, including customer focus, the work we’re doing on costs, and our priorities for developing employees. We want to make transparent where we are in our strategic efforts. This will add to accountability and help track progress.

We want to hear from you too. What are clients telling you? How do you think we should build a better Deutsche Bank? As ever, please contact me directly via the feedback tool on our intranet.

On behalf of the entire Management Board, thank you for your ongoing hard work. Let’s all work together to support this vision.

Yours sincerely,

John Cryan

Or, said otherwise, “Deutsche Bank is fine.”

However, with numerous analogies being made between the German bank with the soaring default risk and Lehman or at least Bear, that may have been the absolutely worst thing for the bank to note at a time when the market is perfectly happy to interpret any assurance of ongoing solvency and viability as a desperate attempt to boost confidence, and resume selling the stock and buying even more default protection, which is what it has done, and as of last check DB stock just turned negative in German trading.

Whenever we are getting the next full blown financial crisis and economic collapse, we are only months away from WW3.

WW3 will start at the end of July, beginning of August (= grain harvest time in the area of one of the best and accurate seers ever), but in the months before that we should see a financial collapse, hyperinflation, revolution and civil war.

Hyperinflation, Paris burning, the Pope fleeing the Vatican, a lot of new taxes are the signs to watch, which will just occur shortly before WW3.

All of this has been planned for us by TPTB.

Ever since this Rothschild puppet and Bilderberg bastard left Deutsche I’ve put it on my watchlist: