– Deutsche Bank: “We’ve Created A Global Debt Monster” (ZeroHedge, Feb 3, 2014):

Two observations on the latest thoughts by Jim Reid (DB’s best strategist by orders of magnitude):

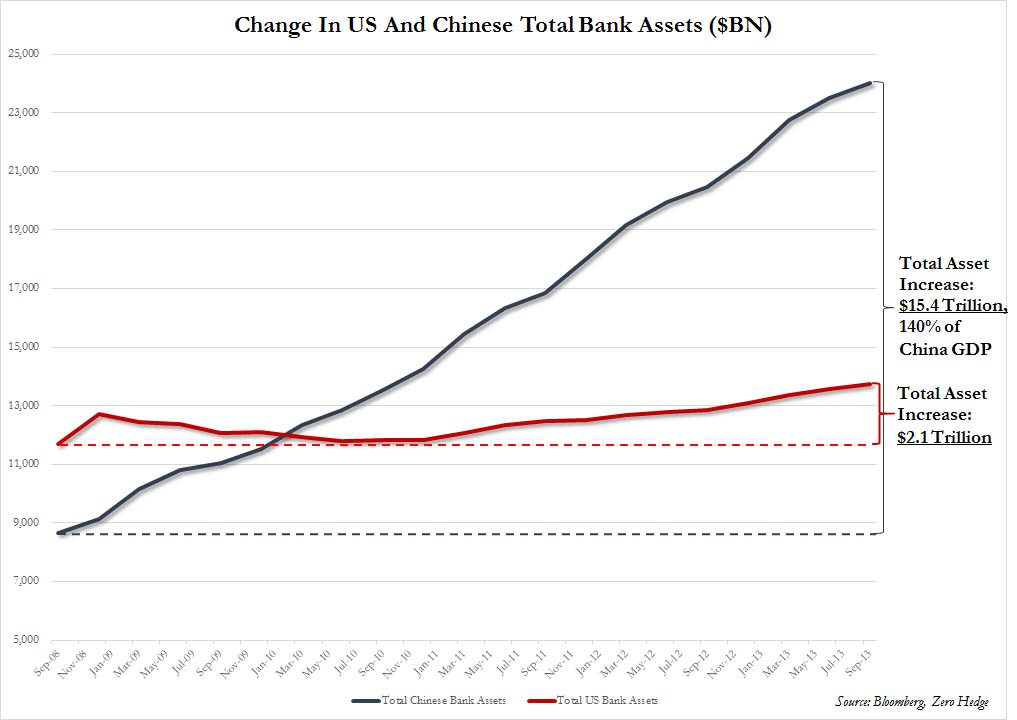

- He is far more concerned by what is going on in China than any of the other noise around the world. And rightfully so. As we first showed a few months ago, the money creation in China puts what all the other global central banks do to shame. Any slowdown in this credit creation and the wheels have no choice but to fall off, which also explains why even the tiniest default in this $9 trillion economy will be bailed out as it would risk an outright “flow” collapse.

- The Fed came, saw, and after realizing the mess it created with tapering – which can never be priced in now that the market is terminally addicted to the Fed’s liquidity injections – will soon do what we have said since the May 2013 “taper tantrum” would happen – untaper, and resume bailing out everyone.

Full note from Reid:

From all the stories that broke while I was away the most fascinating surely revolves around the Chinese Trust product that in the end wasn’t allowed to be at the mercy of market forces. For me it’s a microcosm of the fragility still present in global financial markets that a $9.0 trillion dollar economy – that will be the biggestin the world within the time frame of most of our careers – struggles to allow a $500 million investment product to default without there being market fears of it igniting panic in financial markets. This has now been a theme for the best part of 10-15 years in global financial markets particularly in the developed world but more recently the EM world since the GFC. We’ve created a global debt monster that’s now so big and so crucial to the workings of the financial system and economy that defaults have been increasingly minimised by uber aggressive policy responses. It’s arguably too late to change course now without huge consequences. This cycle perhaps started with very easy policy after the 97/98 EM crises thus kick starting the exponential rise in leverage across the globe. Since then we saw big corporates saved in the early 00s, financials towards the end of the decade and most recently Sovereigns bailed out. It’s been many, many years since free markets decided the fate of debt markets and bail-outs have generally had to get bigger and bigger.

This sounds negative but the reality is that for us it means that central banks have little option but to keep high levels of support for markets for as far as the eye can see and defaults will stay artificially low. As such we remain bullish for 2014. However it’s largely because we think the authorities are trapped for now rather than because the global financial system is healing rapidly. So as well as EM being very important for 2014, we continue to think the Fed taper pace is also very important. If the US economy was the only one in the world then maybe they could slowly taper without major consequences. However the world is fixated with US monetary policy and huge flows have traded off the back of QE and ZIRP so it does matter. We have suspicions that the Fed may have to be appreciative of the global beast they’ve helped create as the year progresses.

In other words: bullish… because the system will continue to collapse and need more bailouts. The Bizarro world Bernanke created truly is an exciting place.

It cannot continue forever. No currency will be worth anything. This article is absurd. Everything comes to an end……this is a finite universe.