– Next “Subprime Crisis” Expands As Student Loan Defaults Hit $146 Billion, Highest Default Rate Level Since 1995 (ZeroHedge, Oct 1, 2013):

Almost exactly one year ago we wrote “The Next Subprime Crisis Is Here: Over $120 Billion In Federal Student Loans In Default” in which we took the latest (2009 three year cohort) loan default data on Federal Student Loans released by the Department of Education and applied it to the total amount of student loans outstanding, which back then was $914 billion. Yesterday, ED.gov provided its annual update – this time to the 2010 three year and 2011 two year cohorts – and to nobody’s major surprise, learned that things just got even worse. To wit: “The national two-year cohort default rate rose from 9.1 percent for FY 2010 to 10 percent for FY 2011. The three-year cohort default rate rose from 13.4 percent for FY 2009 to 14.7 percent for FY 2010.” Putting this in context, according to Bloombergdefaults have risen to the highest level since 1995. The irony that this is happening in the aftermath of Bernanke’s disastrous ZIRP policy is not lost on anyone.

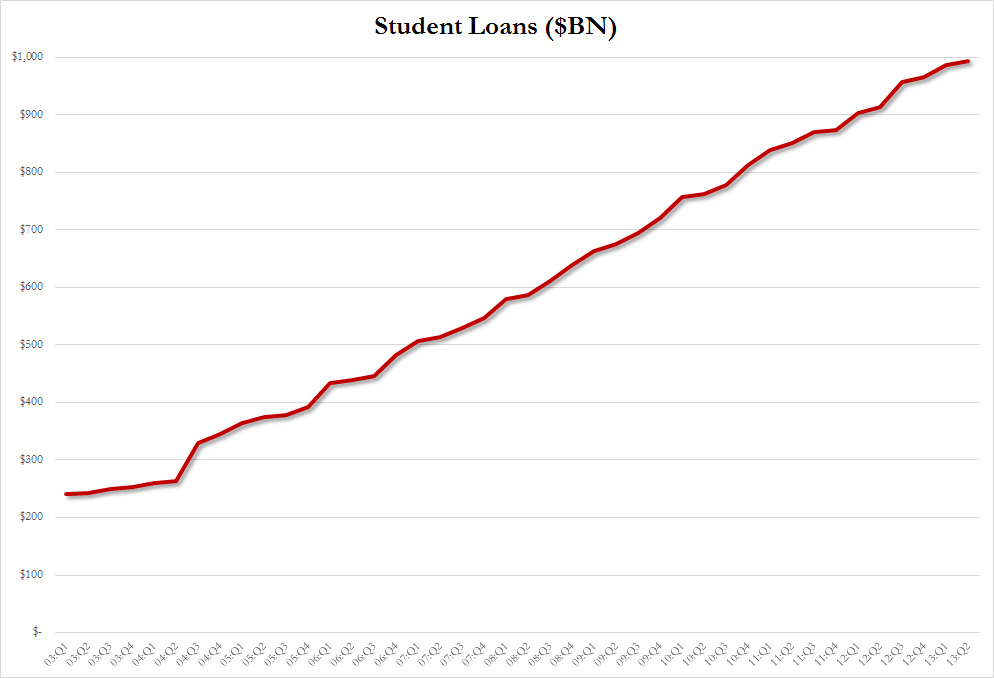

Quantifying this percentage, recall the NY Fed reported in its second quarter household credit update that the amount of total outstanding student loans has now risen to $994 billion, or $80 billion more in just one year:

… one can calculate that the current amount of non-performing loans originated in 2010 is now a whopping $146 billion (the full total amount of student loans owed is $1.2 trillion when including private loans from the likes of Sallie Mae – this sum surpasses all other kinds of consumer borrowing expect for mortgages). Unfortunately, as the economic situation has only deteriorated since then especially for student-age Americans, the real blended amount of student loans in default is almost certainly substantially higher as of this moment.

The Education Department had this commentary:

“The growing number of students who have defaulted on their federal student loans is troubling,” U.S. Secretary of Education Arne Duncan said. “The Department will continue to work with institutions and borrowers to ensure that student debt is affordable. We remain committed to building a shared partnership with states, local governments, institutions, and students—as well as the business, labor, and philanthropic leaders—to improve college affordability for millions of students and families.”

In other words, the response to the bursting of the student loan bubble, is to entice even more young people into the low-yield debt trap by “keeping debt affordable”, which in turn will lead to college tuitions rising even higher, forcing students to take out, and default on, even more loans, and so on until this latest debt bubble can no longer be swept under the rug.

Things get even worse when broken down by for-profit institutions. “For-profit institutions continue to have the highest average two- and three-year cohort default rates at 13.6 percent and 21.8 percent, respectively. Public institutions followed at 9.6 percent for the two-year rate and 13 percent for the three-year rate. Private non-profit institutions had the lowest rates at 5.2 percent for the two-year rate and 8.2 percent for the three-year rate.”

In other words, more than one in five loans used to fund a for-profit education, which would be most of those that lead to actual jobs, will never be repaid to Uncle Sam, and the ultimate payer will be you, dear taxpayer, when the student loan bailout time comes.

In the meantime, ED.gov, which may or may not be down today, has announced its interim solution – pursuing sanctions against schools that have default rates of 25% or more for three consecutive years.

Certain schools are subject to sanctions for having two-year default rates of 25 percent or more for three consecutive years, or over 40 percent for one year. As a result, these schools will face the loss of eligibility in federal student aid programs unless they bring successful appeals. Please click here for more information about possible sanctions: http://www2.ed.gov/offices/OSFAP/defaultmanagement/cdr2yr.html

In other words, according to the government it is the school’s fault that students are levering up en masse, when the real sanctions should be targeting the Federal Reserve and its easy money policy which while working miracles for PE firms, hedge funds and Primary Dealers in their pursuit of the Fed-funded “wealth effect” is backfiring when ordinary American students try to take advantage of zero cost money in their pursuit of the American Dream Nightmare.

Finally, as Bloomberg reports citing Rory O’Sullivan, of the Young Invincibles nonprofit group, “Our generation is behind in the economic recovery and not recovering as fast as we need to,” said O’Sullivan, whose group represents the interests of people ages 18 to 34. “It’s financial disaster for borrowers. Defaults can dramatically affect their credit rating and make it harder to borrow in the future.”

No need to worry though: remember that as the Fed has shown over the past five years, the only policy the US has in order to “fix” the unprecedented borrowing binge by everyone, is to force everyone into even more debt. And since monetarism is now a religion, all one needs is a little faith that all this will one day end well.

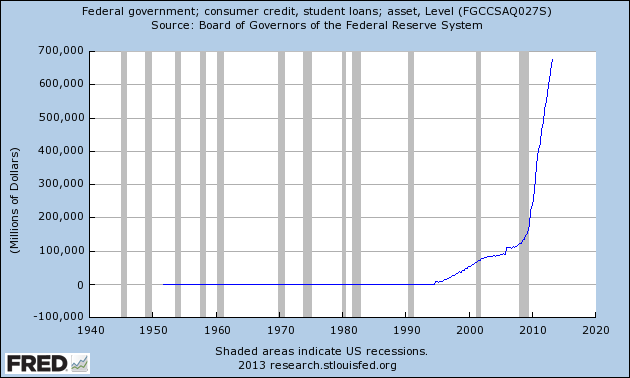

Finally, for those seeking some early humor, here is a chart straight from the St. Louis Fed showing the full history of Federal student loans.

One cannot default on student loans. Just like taxes, they cannot be ignored or evaded. Just like taxes, the fines and fees will continue to grow into huge numbers………the persons who made these contracts can never avoid paying them. Bankruptcy is no way out, either.

All they will get are higher costs and find themselves deeper in debt. In the UK, they just doubled the rates going back 15 years, and are selling them on Wall Street. The US will probably follow suit.

Greedy Guts will like to invest in deals like these……there is no way a person can escape paying. If they die, the debt goes to their heirs. Win Win for the Greedy Guts…..and they seem to get everything these days.

Regardless of the dilemma of millions who have gone into debt to get decent jobs only to find there aren’t any……student loans have to be paid.

End of story. No defaults allowed, not even death works.