– Who’s Next? Italy’s Monte Paschi Admits To Billions In Deposit Outflows (ZeroHedge, March 30, 2013):

It appears, given news from Italy today, that European depositors are increasingly coming to the realization that deposits in their local bank are not ‘safe’ places to put their spare cash, but are in fact loans to extremely leveraged businesses. In a somewhat wishy-washy, ‘hide-the-truth’-like statement on Monte dei Paschi’s website, the CEO admits to, “the withdrawal of several billion in deposits.” Of course, the reasons why these depositors withdrew their capital from the oldest bank in the world will never be known though of course he blames it on “reputational damage” from their derivative cheating scandal. Apparently the fact that this happened to come about six week after said scandal and the bank’s third bailout, and that the prior two bailouts did not result in such an outflow of unsecured liabilities (at least not to the public’s knowledge), was lost on the senior management, as was lost that a far greater catalyst may have been the slightly more troubling events in Cyprus in the second half of March. Unsurprisingly, as Reuters notes, the CEO declined to give a forecast on the level of deposits at the end of the first quarter of 2013; no wonder given the bank just doubled its expectations for bad loans and the ‘Cypriot Solution’ dangling over uninsured depositor hordes.

Customers’ deposits at Italian bank Monte dei Paschi fell by “a few billion euros” … the bank said in a document posted on its web site on Saturday.

…

But it has yet to make clear what impact the scandal itself had on its first quarter results.

“The illicit nature of the derivatives trades and their consequence on the bank’s assets exposed the bank to reputational damage that was immediately translated into…the withdrawal of a few billion euros in deposits,” the bank said in a document for shareholders attending its April 29 meeting.

…

But he declined to give a forecast on the level of deposits at the end of the first quarter of 2013 or to indicate the outlook for net interest income and loan loss provisions.

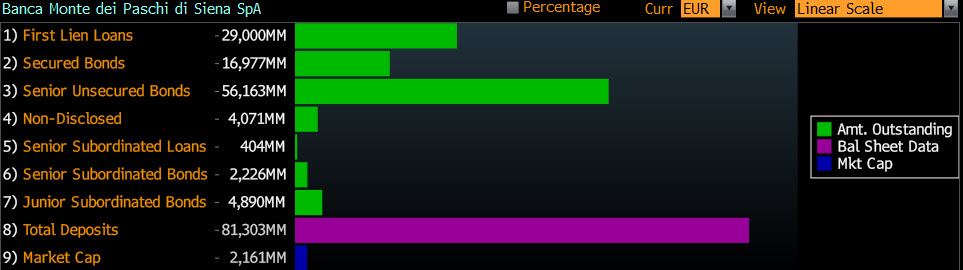

A quick glance at BMPS’ capital structure shows that there isn’t a whole lot (read: almost any) of impairable securities below the unsecured liability (i.e., deposit) level. It is also obvious that when the bad debt impairment begins and depositors start getting whacked at least senior bonds, which should be pari passu, will feel the pain too as per the Diesel-BOOM doctrine, although we doubt this particular case of pain sharing will bring much comfort to any and all uninsured depositors in the oldest bank in the world.