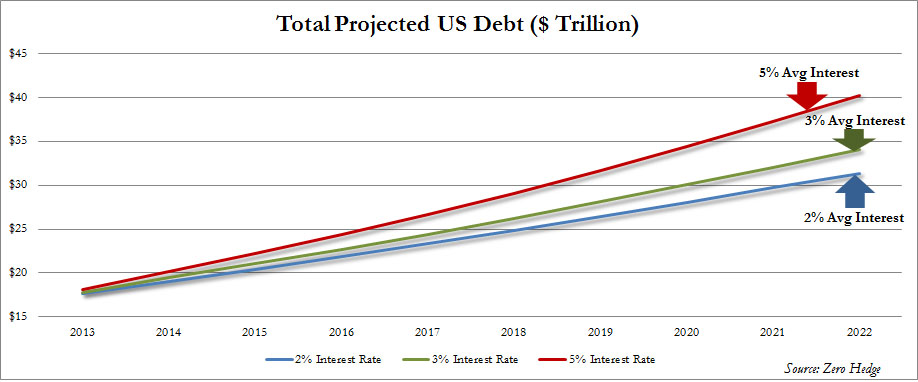

– “The Magic Of Compounding” – The Impact Of 1% Change In Rates On Total 2022 US Debt (ZeroHedge, Jan 6, 2013):

They say “be careful what you wish for”, and they are right. Because, in the neverending story of the American “recovery” which, sadly, never comes (although in its place we keep getting now semiannual iterations of Quantitative Easing), the one recurring theme we hear over and over and over is to wait for the great rotation out of bonds and into stocks. Well, fine. Let it come. The question is what then and what happens to the US economy when rates do, finally and so overdue (for all those sellside analysts and media who have been a broken record on the topic for the past 3 years), go up. To answer just that question, which in a country that is currently at 103% debt/GDP and which will be at 109% by the end of 2013, we have decided to ignore the CBO’s farcical models and come up with our own. Our model is painfully simple, and just to give our readers a hands on feel, we have opened up the excel file for everyone to tinker with (however, unlike the CBO, we do realize that when calculating average interest, one needs to have circular references enabled so please do that before you open the model).

Our assumptions are also painfully simple:

i) grow 2012 year end GDP of ~$16 trillion at what is now widely accepted as the ‘New Normal’ 1.5% growth rate (this can be easily adjusted in the model);

ii) assume the primary deficit is a conservative and generous 6% of GDP because America will never, repeat never, address the true cause of soaring deficits: i.e., spending, which will only grow in direct proportion with demographics but as we said, we are being generous (also adjustable), and

iii) sensitize for 3 interest rate scenarios: 2% blended cash interest; 3% blended cash interest and 5% blended cash interest.

And it is here that we get a reminder of a very key lesson, one that even the CBO admitted on Friday they had forgotten about, in what compounding truly looks like in a country that is far beyond the Reinhart-Rogoff critical threshold of 80% sovereign debt/GDP.

The bottom line: going from just 2% to 3% interest, will result in total 2022 debt rising from $31.4 trillion to $34.1 trillion; while “jumping” from 2% to just the long term historical average of 5%, would push total 2022 debt to increase by a whopping $9 trillion over the 2% interest rate base case to over $40 trillion in total debt!

Sadly, this is no “magic” – this is the reality that awaits the US.

And for those more curious about that other critical economic indicator, debt/GDP, the three scenarios result in the following 2022 debt/GDP ratios:

- 2% interest – 169%;

- 3% interest – 183.5%; and

- 5% interest – 217%, or just shy of where Japan is now.

Which reminds us: in the next few days we will recreate the same exercise for Japan’s ¥1 quadrillion in total sovereign debt, which will show why any more “exuberance” arising from Abe’s latest economic lunacy, will promptly send the country spiraling into that twilight zone where every dollar in tax revenue is used only to fund interest expense.

Once again, it is not our intention to predict what US GDP or debt/GDP will be in 2022: only the IMF can do that with decimal level precision, apparently, and not just with anyone, but Greece. The whole point is to show that when dealing with a debt trap lasting a decade, even the tiniest change in input conditions has profound implications on the final outcome. We invite readers to come up with their own wacky and wonderful projections of what the futures of the US may look like.

And that one should, indeed, be careful what one wishes for.

The results summarized for the three scenarios:

Total debt: 2013-2022.

Debt/GDP: 2013-2022:

The Zero Hedge open source model, for everyone to play around with, can be found here. Remember: don’t be a CBO, enable circs!

P.S. don’t even think of modelling a recession: everything Refs up then.

The problem is more complex than described. Until July, 2010, the US dollar was the World Reserve Currency. 100% of all international trades were completed in US dollars.

In July of 2010, Hugo Chavez introduced a new type of currency, an electronic currency, the Sucre. For members only of the South American Trade Alliance (12 nations, including Cuba), this currency translated the value of each nation’s currency automatically, without need to convert to any other currency before trading with each other. That was the beginning of the end for us. The World Reserve Currency status we held since WW2 has become obsolete. The South American Trade Alliance was small, but it’s impact has been dramatic.

Once they saw it work, China and Russia jumped into the game using electronic currency to translate the value of their own trades between each other, leaving the dollar out as well. November, 2010, they went online. We’ve lost 40% in foreign trade interactions over the past 18 months.

Since then, India, Japan, Brazil, Columbia, several nations in Africa and Turkey have joined with Russia and China. As of right now, 40% of the world GDP contributors no longer use the dollar……down from 100% TWO YEARS ago this month.

We are quickly losing our #1 economic standing while our leaders act as if this were still 1965, that we are still the #1 lender nation instead of the #1 debtor we have become. They don’t realize (or care) what is happening, they are very average and unimaginative.

The Fed has been floating the majority of our national debt since, because for the last 18+ plus months……….people are no longer buying our bonds or currency………they soon won’t need it. We are buying our own debt. We are becoming a Sick Man of Europe, and most people don’t realize it. As long as our currency stands, the FED can float our debt, once it falls………it will be huge.

Foreign investment is down dramatically since 2010. Go to USdebtclock.org, and you will see foreign investment is down to $5.5 billion……..In 2009, China alone held nearly that much US debt. We are keeping it going with chewing gum and rubber bands…..we are in deep trouble. This is the real world war, and we are quickly losing.

In my opinion, all bets are off when that happens.

Thanks for an interesting article.