– Tales Of The Unexpected: Who Really Benefited From The Euro (Hint: NOT Germany) (ZeroHedge, Aug 18, 2012):

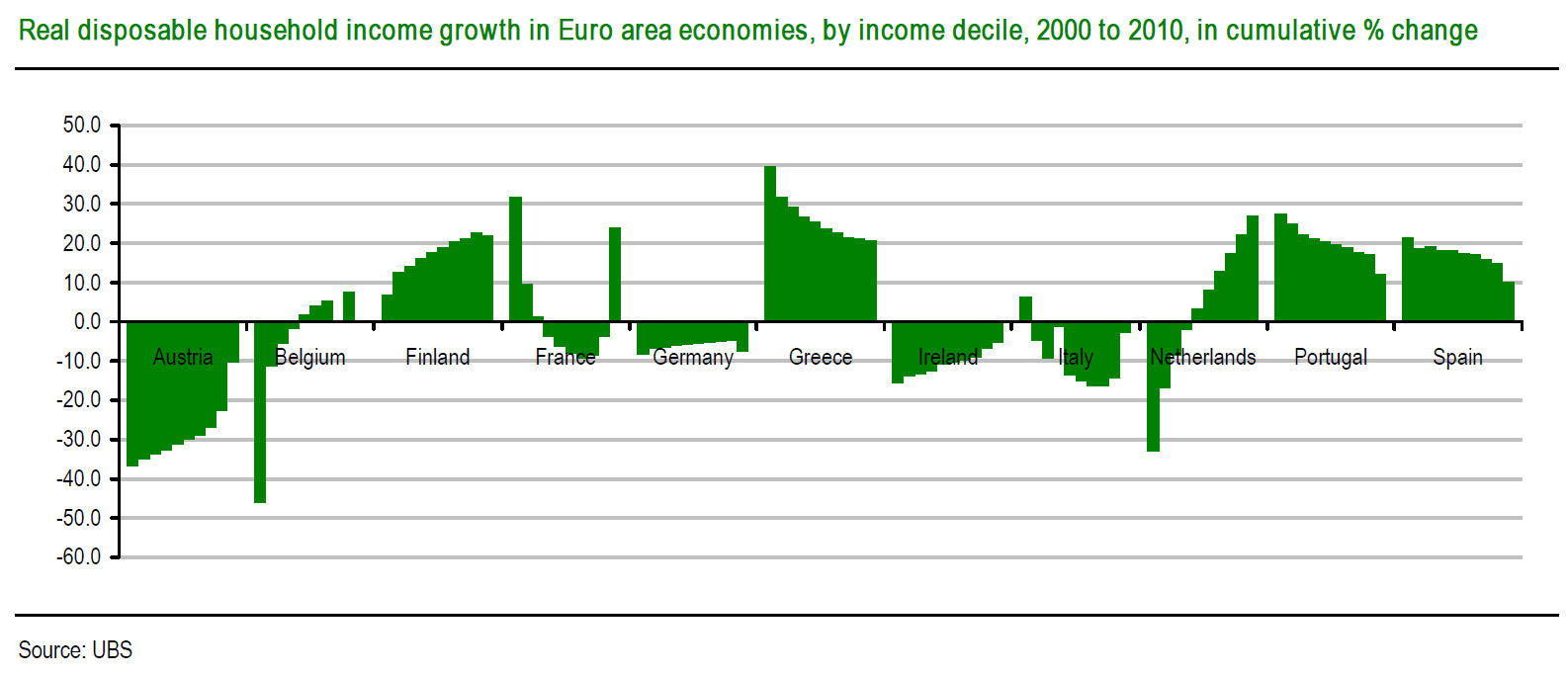

With austerity supposedly destroying standards of living (that no real austerity has actually been implemented is a different matter entirely) across Europe’s insolvent periphery, the only recourse said broke countries (here’s looking at you Mario Monti and Mariano Rajoy) have is to desperately attempt to shame those countries who have money such as Germany, Austria, Finland and the Netherlands, aka Europe’s AAA club, into shoveling more and more and more cash into the bottomless pit that are the PIIGS. After all, precisely this was the basis for the “hostage and extortion” strategy that Monti employed at the June 29 summit, and which has resulted in a surge in European stocks on hopes Germany will indeed bail everyone out. The reason for this is that, at least according to conventional wisdom, it was these countries that benefited the most from a decade of EUR-facilitated mercantilism, and exported inflation to their spendthrfit (and ‘debt-thrift’) southern neighbors. So it is only “fair” that these countries now give back a little (or a whole lot) back (just as it is only “fair” that Germany give a helping hand in Obama’s reelection chances, which as everyone knows would be negligible if the global capital markets were to tumble just before November if reality in Europe were to come back with a vengeance). Well, as virtually always happens, conventional wisdom is wrong, and as the following chart from UBS demonstrates, when one analyzes the only relevant metric that compares changes in standards of living across various income deciles- namely changes in real disposable household income – it is precisely the PIIGS that benefited, while countries such as Germany and Austria were left in the dust.

From UBS:

If we look across the larger and longer established Euro membership we can see these two patterns being replicated according to country type. Each country shows the cumulative real disposable household income growth for each of its income deciles. The lowest income decile is to the left of each country’s selection, and the highest to the right.

Austria looks to be alarmingly weak – what this actually represents is very little change in nominal disposable income growth, coupled with inflation. Germany, Ireland, most of Italy and the French middle class all experience a decline in their standards of living. In most of these countries, the highest income groups do relatively well.

What stand out are Greece, Portugal and Spain. These economies have benefited from increased standards of living under the Euro (at least, until 2010), as nominal incomes have overcome inflation pressures. There has also been a concentration on improving the lot of the lower income groups in these societies.

Of particular note is the chart of France which is coming to every socialist and crony-capitalist country near you: the best off from the Eur “growth” phase are the bottom and top deciles. Everyone else, aka the middle class was substantially worse off. This pattern of class schism will be repeated in all other supposedly “egalitarian” countries as everyone becomes more and more “equal.”

So what are the implication of this novel reinterpretation of the winners and losers from the Euro, and what happens now that Germany will have sufficient ammo to deflect ongoing attempts by broke Italy, Spain et al to attempt shaming the country with allusions to World War II and other irrelevant allusions:

This chart unfortunately plays into the hands of the more nationally minded politicians of the Euro core. The argument can be made (and increasingly is being made) that periphery economies must simply accept the declines in living standards that their non-periphery counterparts have had to accept. Lower living standards in the sense of real disposable income implies either lower wages, or yet more fiscal austerity, or indeed both measures in combination. Why should Germany see its living standard decline to pay to maintain the Greek, Spanish or Portuguese living standard, when those standards rose by so much in the recent past? As a political sentiment it has a ready populist appeal.

… Someone occupying the bottom decile of French income distribution has twice the level of income of someone in the bottom decile of Greek income distribution in 2010. The income inequality between countries in the Euro area has been narrowed by the pattern of real disposable income growth (as a rule). In what is supposed to be a common enterprise, there is something disturbing about asking the poorest members of the poorest societies to become even poorer, in order to enhance the living standards of the richest societies. As the Italian Prime Minister has had occasion to point out, there may also be a natural limit to the extent to which such demands can be placed on poorer societies (or the poorest in societies) without creating a threat to civil order.

The problem is that this debate cuts both ways, using exactly the same argument. Why should one group of countries force another group of countries to accept lower living standards? This question could be asked by Germans of the Greeks (why should we see our taxes rise / disposable income fall to maintain your level of disposable income?). This question could be asked by the Greeks of the Germans (why should we see greater income inequality when we are already amongst the poorest in the Euro area, and suffer from a Germanocentric rather than a Helleno-centric monetary policy?). Both questions have a degree of validity. It does not make finding a solution any easier.

It gets worse:

The development of real disposable income growth across the Euro area adds an additional complication to the increasingly Byzantine Euro problem. Just like the Olympics, much of the attention is focused on the dynamic of speed. Looking at the growth of real incomes over the first few years of the Euro’s existence, it is hard to argue against the idea that the peripheral countries should be taking more pain now. Core countries have had to accept a decline in real living standards, and it seems unrealistic to expect them to finance an increase in living standards for others[ZH: Germany, are you reading this? Good].

When considering the static of income levels, however, the Euro has successfully engineered a slow move towards greater equality between nations, evidenced by the increase in real disposable income for the very lowest income groups in the Euro area. To reverse that achievement would seem to be perverse.

Politics and human nature means that the dynamic of growth rather than the static of income levels is likely to dominate policy makers’ discussions. It will not make for comfortable politics in the councils of Europe. Baron de Coubertin’s well known dictum from the first modern Olympics was “The most important thing… is not winning but taking part; the essential thing in life is not conquering, but fighting well”. The ideal is ideal, but it has a hollow ring if applied to the Euro. For most of the Euro countries if not all of them, taking part in the dysfunctional monetary union of the Euro at all was a bad decision in economic terms. Having signed up to the Euro’s irrevocable monetary union, the fact that living standards have fallen for some participating economies is likely to breed resentment and bitterness against those economies that have experienced an improvement in living standards.

All of the above simply means that the precarious European balance in which Germany quietly became the shamed underdog, responsible for funding its drunk, broke, and wayward neighbors because somehow it was its fault it benefited from their irresponsible spending ways, has just been shattered: now the opponents of the “convergence” theme have cold hard facts on their side, and we expect the above chart to make the front pages of most German papers in short order.

It also means that the political opposition to any acquiescence by Merkel to current and future Monti demands will now spike to intolerable levels, with dire consequences in national polls.

Finally, it also means that the entire precariously built-up European “Nash equilibrium” over the past 6 months was just dismantled. Courtesy of the facts.

We already knew September was going to be when the fun resumes (with August a scratch – just as expected). Now, we can hardly wait.